SharpCharts

Essential- Looks like 5 of V is unrolling. - Retested supported and bounced up. - Tremendous confluence found at $51. - Tight stoploss right below $45 In general, ALSN is a good company with good short-term outlook. { "info": { "close ": 46.19, "marketcap ($bil)": 6.25, "name": "allison transmission holdings, inc.", "sector":...

GS, arguably an over-valued stock, formed a divergence against MACD histogram, bouncing back from channel lower line and 78.6% fib level of latest rise. Stochastic lines also crossed over. Above hints gave me a short-term BUY recommendation for GS. SL: below 227 TP: 252-254

IBKR is a pretty solid stock quality wise with good earnings estimates expensively traded above 50 times of its earnings. At the moment, we can see hidden bullish divergences fully developed on all 3 indicators (RSI, MACD and Stoch). And the fact that RSI dipped really low to 30 levels and started showing signs of picking up is bullish. Last time it did this in...

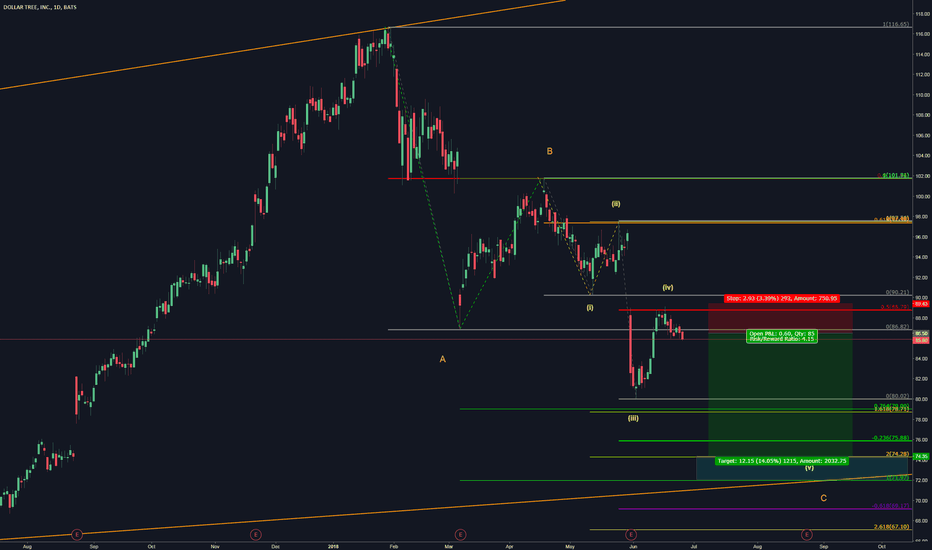

Seems like (v) of C is unrolling. Tight stoploss in place. R/R > 4.

CFG, a stock that has made consistently increasing earnings over the years, forms a low risk/reward opportunity for LONG. Here are the clues that supports the buy: - Divergences formed against RSI, MACD and Stoch. - Bounced from 50% Fib level from previous rise. - Has good form of a Elliott Wave count in which C of (4) of V has been completed. (5) of V is...

It's daring to short oil/engergy stocks lately, but here it comes an opportunity with low stoploss - HES. Reason r=for short (05/21): - Divergences RSI, MACD - Double top inside resistance region - End of 138.2% abc-like structure SL placed right above the highlighted region. TP can be safely set at POC of 56.

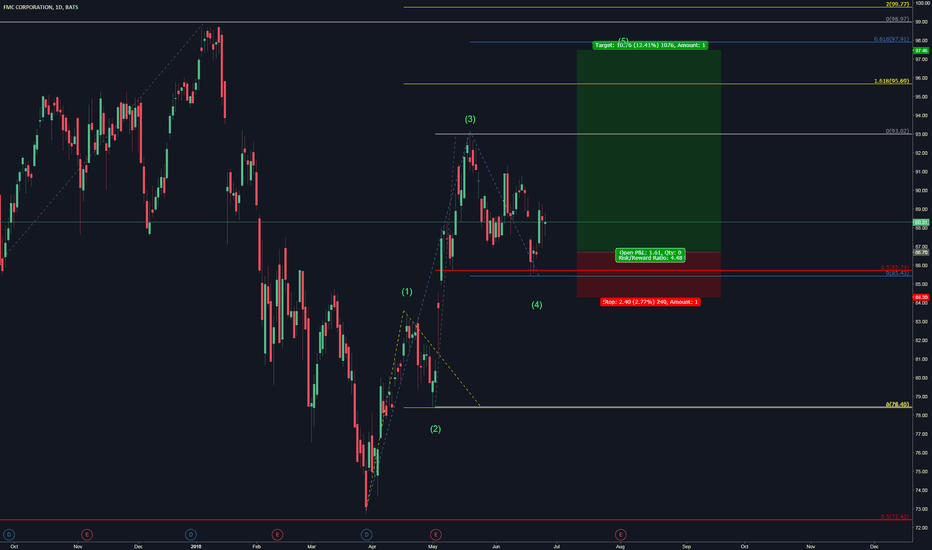

If this is not a perfect demonstration of Elliott Wave Theory, I don't know what else would be. - Wave 2 measures exactly 61.8% of wave 1 - Wave 3 is exactly at 161.8% of 1 - Wave 4 is exactly at 38.2% of wave 3. - Inside zigzag 4, c is exactly 123.6% of a. - Plus the yellow resistance box failed to break out. - Plus OBV was going no where when price moved from...

HRB will release after market close tomorrow with estimated earnings boasted at 5.22. This is a whopping 39.9% increase from 3.75 actual earnings last year. Just like last year, we can expect huge volality on Wed 06/13. TA wise, to the down side, HRB is hitting the daunting yellow trendline. It's also wandering inside the resistance yellow region which it...

FDC is a high quality stock. These indices are generated by my self-developed stocks valuation system. { "info": { "close ": 17.68, "marketcap ($bil)": 14.2, "name": "first data corporation", "sector": "miscellaneous", "industry": "business services", "country": "united states" }, "val": { ...

Pretty good quality stock at some what expensive price level. AKAM is currently at important price level. Here is my argument for long and short calls. LONG: - Consolidation right at important resistance level. Bears show no sign of strength. SHORT: - Consecutive Bearish Divergences. Decreasing momentum RSI & MACD as price moves higher. - Stayed inside big...

ABBV is a very high quality stock. It never missed an earnings estimate. Accordingly, my homebrew stock valuation system gives it pretty high scores quality-wise. "val2_k": 5, "val2_q": 8, "qual2_k": 60, "qual2_q": 51, "qual3_k": 59 TA wise, It does seem like ABBV is finishing wave 2 and starts making into 3 of (5) of III. Lots of long term...

FA wise, DIS is a solid stock which has beated earnings estimates the last 2 quarters. Its forecasts earnings also looks good and rising. Stockl is traded around 13-14 its current and forecasted earnings, which is not too bad in this expensive market. TA wise, DIS is wandering at the lower bound of a gigantic triangle where 5 subwaves can be clearly...

Intriguing behavior: - Same relationship found in yellow and orange waves: (3) = 161.8% of (1) (iii) = 161.8% of (i) (4) = 61.8% of (3) (iv) = 61.8% of (iii) - Both degrees violate traditional EWT in the same manner. - What currently in place: (v) = 123.6% of (i)+(ii)+(iii) Extrapolate this relationship to the higher degree: (5) --> 123.6% of (1)+(2)+(3) III...

Lots of folks including me got excited by the news of Micron's $10B share repurchase plan just later bursted into tears when both GS and JPM badmouthed about the stock. LOL If you love drama and/or comedy, you can't manage to miss checking reddit's /r/wsb. MU is the hottest topic there. OK. That was a lot of fun. But the last retracement from $63 down to $45 is...

05/29: Buy - Bullish divergence MACD - Bullish reaction at fib 76.4% and having abc form that looks like wave 2. Against: - Last red bar show less strength - RSI made lower highs lower lows Looking at quick small 10% gain with tight stop loss.

05/29: Short - Tweetzer formed at previous swing high. - Bearish Divergence: RSI and MACD - Stoch crossed down at range boundary region - Tempted to test gap around 50%-62.8%