1. Head of the European Central Bank (ECB) As of August 2025, Christine Lagarde is the President (head) of the European Central Bank (ECB). She is responsible for leading eurozone monetary policy, representing the ECB at global forums, and setting the tone for financial and economic policy across Europe. 2. Fundamental Drivers of the GER40 (DAX 40) The GER40, also...

1. Labor Market Data Average Hourly Earnings m/m: Actual: 0.3% Forecast: 0.3% Previous: 0.2% Interpretation: In-line with forecast and slightly above the prior period, indicating stable wage growth. This suggests inflationary pressures from labor costs remain steady, not accelerating unexpectedly. Non-Farm Employment Change: Actual: 73,000 Forecast:...

Departments Responsible for Each Economic Report Indicator Responsible Department/Source Average Hourly Earnings m/m U.S. Bureau of Labor Statistics (BLS), part of the Department of Labor Non-Farm Employment Change BLS (Establishment Survey) Unemployment Rate BLS (Household Survey) Final Manufacturing PMI S&P Global/Markit...

West Texas Intermediate (WTI) oil is a major benchmark for crude oil pricing, known for its high quality—being both light and sweet due to its low sulfur content and low density. WTI is sourced primarily from inland Texas and is the underlying commodity for oil futures traded on the New York Mercantile Exchange (NYMEX). The main physical delivery point is Cushing,...

BREAKOUT OF DESCENDING TRENDLINE COULD SEE 22$-24$ BlackBerry today is a Canadian technology company specializing in cybersecurity software and Internet of Things (IoT) services for enterprises and governments worldwide. Formerly renowned as a mobile device manufacturer, BlackBerry Limited (formerly Research In Motion, RIM) exited the smartphone business in 2016...

BREAKOUT OF DESCENDING TRENDLINE COULD SEE 22$-24$ BlackBerry today is a Canadian technology company specializing in cybersecurity software and Internet of Things (IoT) services for enterprises and governments worldwide. Formerly renowned as a mobile device manufacturer, BlackBerry Limited (formerly Research In Motion, RIM) exited the smartphone business in 2016...

The Federal Open Market Committee (FOMC) announced on July 30, 2025, that it will maintain the federal funds rate at the current target range of 4.25% to 4.50%. This keeps the rate unchanged from previous meetings, continuing a "wait-and-see" approach amid mixed economic signals. The decision was supported by a 9-2 vote. The committee highlighted that recent data...

The American Battery Technology Company (ABAT) is a U.S.-based battery materials and recycling company focused on domestic production of critical battery minerals, including lithium. It has received significant federal support and attention in recent years tied to strategic initiatives to boost domestic mining and manufacturing of battery materials. BlackRock has...

The latest U.S. economic data released on July 30, 2025 shows: ADP Non-Farm Employment Change: Actual increase of 104,000 jobs, significantly above the forecast of 77,000. This marks a strong rebound from the previous decline of -23,000 in June and indicates solid labor market momentum, particularly in services sectors like leisure/hospitality, financial...

EUR/USD Exchange Rate Current Rate: About 1.1525 Government Bond Yields U.S. 10-Year Treasury Yield: 4.328% Eurozone 10-Year Government Bond Yield: Last reported at 2.686% Economic Data Reports for Today U.S. Data: 1:15pm USD ADP Non-Farm Employment Change 82K -33K 1:30pm USD Advance GDP q/q 2.4% -0.5% USD Advance GDP Price Index...

The federal funds rate is the interest rate at which U.S. banks and credit unions lend their excess reserve balances to other banks overnight, usually on an uncollateralized basis. This rate is set as a target range by the Federal Open Market Committee (FOMC), which is the policymaking arm of the Federal Reserve. The current target range as of July 2025 is...

The federal funds rate is the interest rate at which U.S. banks and credit unions lend their excess reserve balances to other banks overnight, usually on an uncollateralized basis. This rate is set as a target range by the Federal Open Market Committee (FOMC), which is the policymaking arm of the Federal Reserve. The current target range as of July 2025 is...

The federal funds rate is the interest rate at which U.S. banks and credit unions lend their excess reserve balances to other banks overnight, usually on an uncollateralized basis. This rate is set as a target range by the Federal Open Market Committee (FOMC), which is the policymaking arm of the Federal Reserve. The current target range as of July 2025 is...

U.S. Dollar Index (DXY) and US 10-Year Treasury Yield Dollar Index (DXY) — will reclaim 103-102 level if it crosses 100 mark currently is at 98.34 and faces immediate supply roof ,a make or break situation awaits dollar buyers . Over the past month, the Dollar Index has gained about 2%, although it is still down over 5% compared to a year ago. The recent uptick...

THE CURRENT PRICEACTION OF EURAUD IS WATCHED. EU10Y=2.689% ECB RATE 2.0% AU10Y= 4.348% RBA RATE =3.85% RATE AND BOND YIELD DIFFERENTIAL FAVOR AUD . The recent fluctuations in the EUR/AUD exchange rate are primarily driven by factors including: Monetary Policy and Interest Rate Differentials: Decisions and outlooks from the European Central Bank (ECB) and the...

Bank of Japan (BOJ) — July 28, 2025: Latest Overview Policy Rate and Recent Moves Short-term policy rate: Remains at 0.5%, the highest since 2008. Decision timing: This rate was set in January 2025 (up from 0.25%) and has been maintained Policy Outlook and Economic Backdrop Inflation: Tokyo's core CPI is running above the BOJ’s 2% target (2.9% YoY in July),...

The primary regulatory catalyst boosting XRP's bullish outlook in 2025 is the resolution of Ripple Labs' long-standing lawsuit with the U.S. Securities and Exchange Commission (SEC). In March 2025, Ripple settled the case by agreeing to pay a $50 million fine, and crucially, it was clarified that XRP is not considered a security in the context of secondary market...

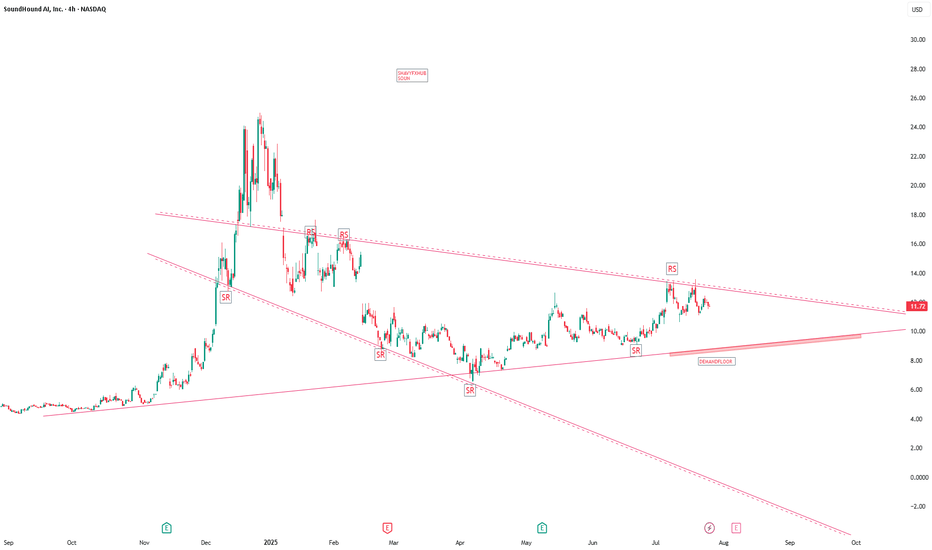

SoundHound AI — Company Overview and Latest Developments (July 2025) What Is SoundHound AI? SoundHound AI, Inc. (Nasdaq: SOUN) is a leading voice artificial intelligence (AI) company headquartered in Santa Clara, California. Founded in 2005 by Stanford graduates, it has evolved from music recognition app Midomi (later rebranded SoundHound) to a global innovator in...