SineHeidari

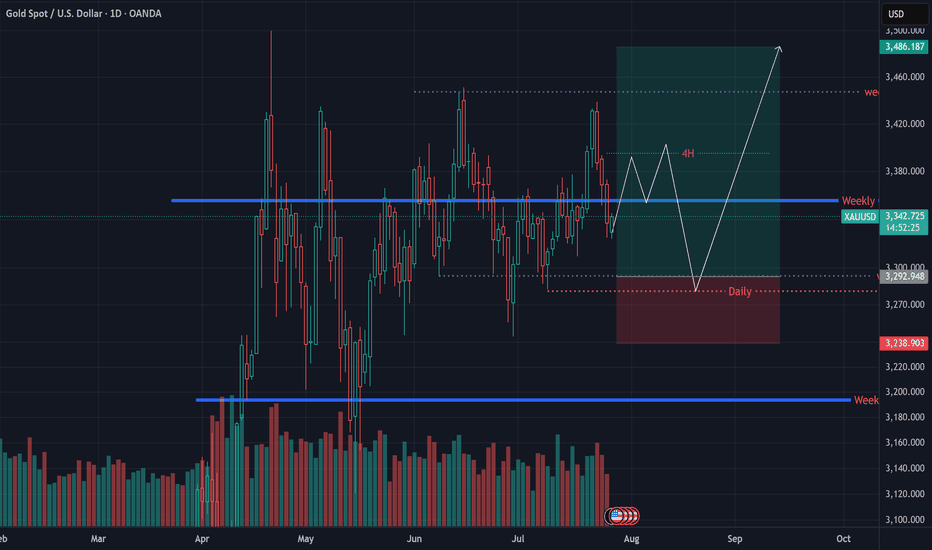

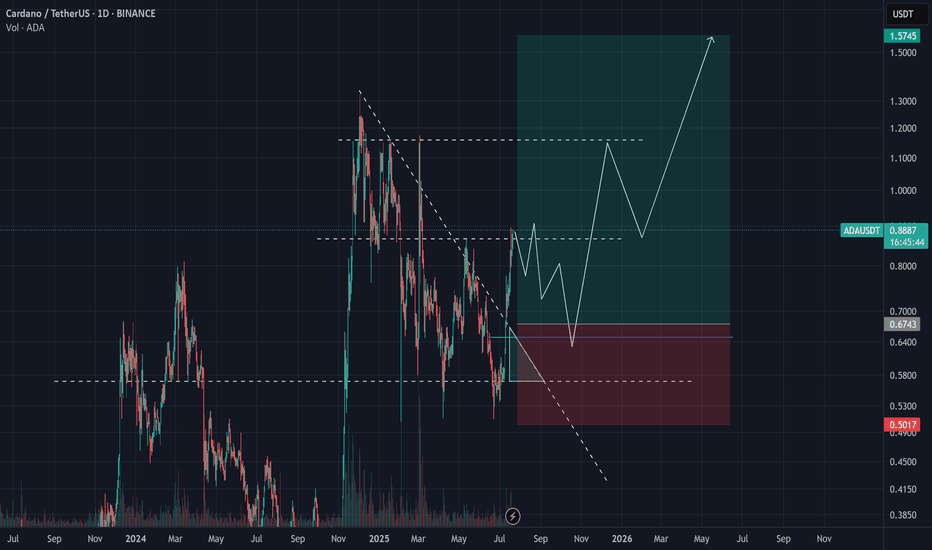

We’ve been waiting for gold to break above the 3400 level for quite some time. Despite multiple tests and deep wicks into this zone, I don’t expect the coming week to bring a fresh high for gold. With price compression between 3390 – 3400, I anticipate that the market will be selling gold this week. We should also expect a stop hunt on sellers before the...

Long-term outlook for Silver remains bullish, but over the past few weeks, early signs of a correction have started to appear. The break below $36 and inability to reclaim the previous high suggest sellers are slowly stepping in. My key liquidity zone sits between $33 – $34, and I believe a revisit of this area is needed before Silver can make a meaningful push...

After the prolonged downtrend in the US Dollar Index that started back in January, recent political developments seem to have had a short-term impact on its trajectory. I believe we could soon see a short-term correction in the dollar. However, after months of decline, this recovery won’t be straightforward — expect stop hunts targeting buyers before any...

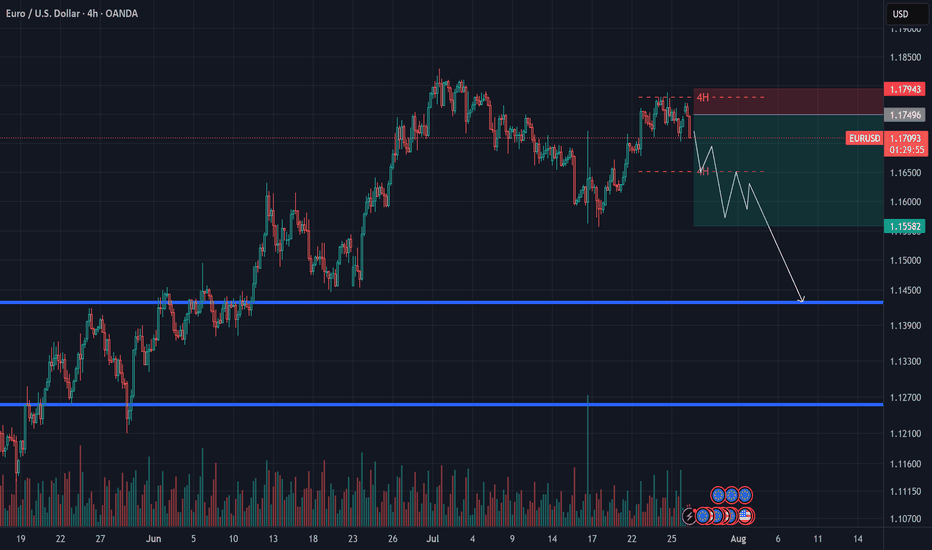

EUR followed our previous scenario to the letter. After hitting our take-profit level, price retraced right into our anticipated zone. With the current sideways price action and compression, I expect high volatility in the coming week. Bias remains bearish – I anticipate another break to the downside, with a likely move back to the previous swing low.

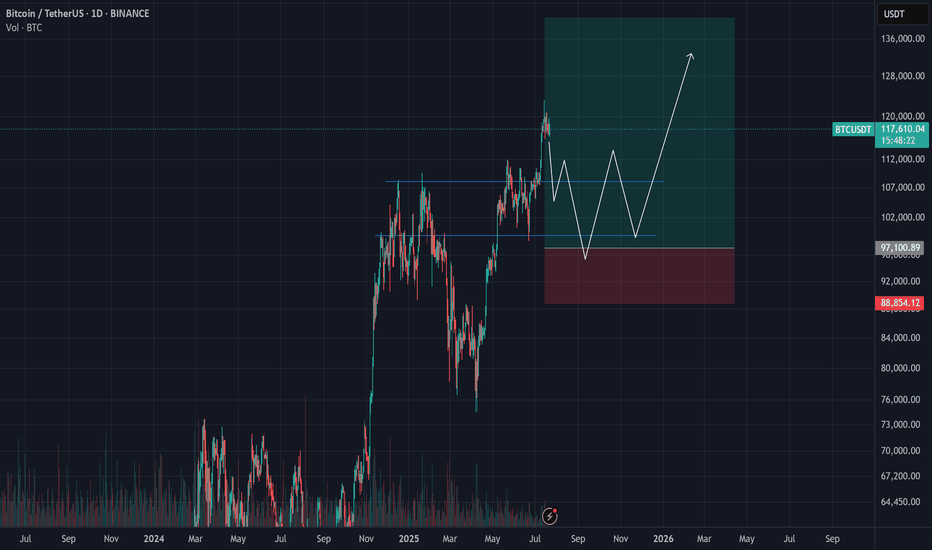

After consolidating between $120K and $116K for two weeks, last week Bitcoin broke below this range with a strong bearish candle. 📉 Part of the leftover liquidity has been swept, but the candle formations at the top indicate profit-taking by buyers and increasing selling pressure at higher levels. On the retracement toward the $118K zone, sellers still showed...

Last week, prior to Powell’s speech, we expected a move down to the $3280 area. While we anticipated a brief pullback to lighten liquidity around $3400 first, price instead dropped straight down without a bounce. ✅ The reaction at our level was spot-on, culminating in a weekly close above $3360 — very bullish. With liquidity around $3370 already cleared, we...

Gold enters a high-risk environment starting today. All eyes are on Jerome Powell's speech, which will signal whether the Fed remains firm on its hawkish stance or adopts a more dovish tone. 📈 That said, a broader look at the chart suggests the market has already aligned itself with the dominant trend. 🗓️ In addition to today’s speech, tariff-related news...

We’ve been tracking the yen for months and, since the beginning of the year, have signaled a potential appreciation in its value, largely based on the Bank of Japan’s policy stance. 📉 However, recent price action — particularly the return to prior levels — revealed a shift in Japan’s macroeconomic direction. 🇯🇵 Last week, we saw the first formal confirmations,...

This week, the EU is set to release key economic data, including GDP figures. Given the recent U.S. tariff pressure, there’s a strong chance that these numbers will come in weak — weighing further on the euro. 📉 After bouncing from the 1.15 level, EURUSD entered a corrective move, but even with extended consolidation, it failed to reach the previous high — a...

Silver appears to be losing momentum at the top, and for the first time in a while, we’ve seen a strong bearish daily candle, suggesting that sellers may be stepping in more seriously. 🌀 Previous pullbacks mostly looked like profit-taking, but this drop seems to be accompanied by actual selling pressure. Despite breaking the previous high over the past two...

Last week, we marked the 3320–3330 zone as a potential buy-entry area. However, mid-term order flow pushed price above 3400 before reaching that level. Toward the end of the week, a sell-off slightly weakened buyer confidence, and we now anticipate more cautious re-entries around the 3300–3290 region. 📈 The broader trend remains bullish for mid and long-term...

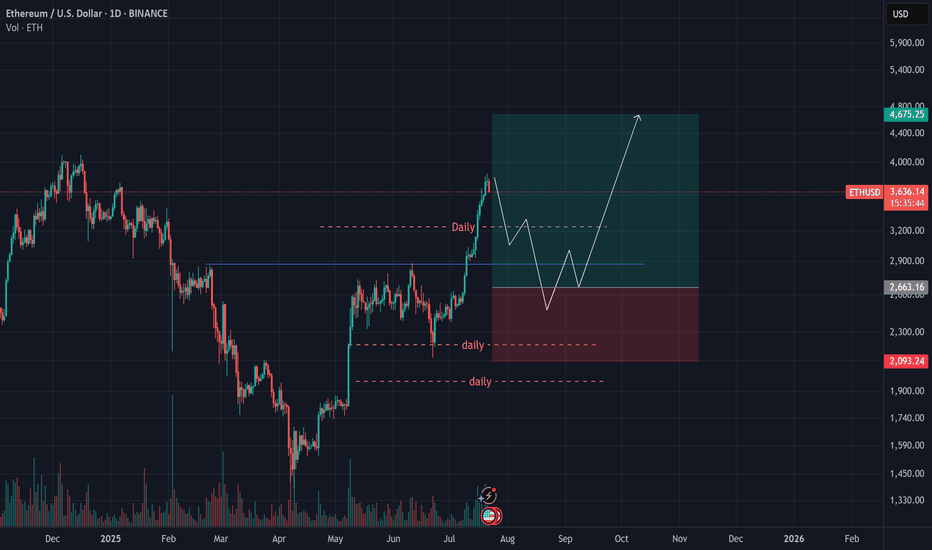

Ethereum has decisively broken through the key $3,000 level, pushing toward $4,000 with strong bullish momentum. 📉 While a short-term correction is likely in the coming weeks, ETH — much like Bitcoin — tends to attract increased investor interest with each dip. As such, a continued rally toward $5,000 by the end of September remains well within reach, given the...

We’ve previously discussed the significance of the $110,000 level — a zone where long-term holders typically take partial profits. After multiple pullbacks from that region, a new wave of short-term investors stepped in around $97,000, managing to push the price as high as $123,000. ⚠️ I know many traders are tracking Bitcoin dominance and expecting a correction...

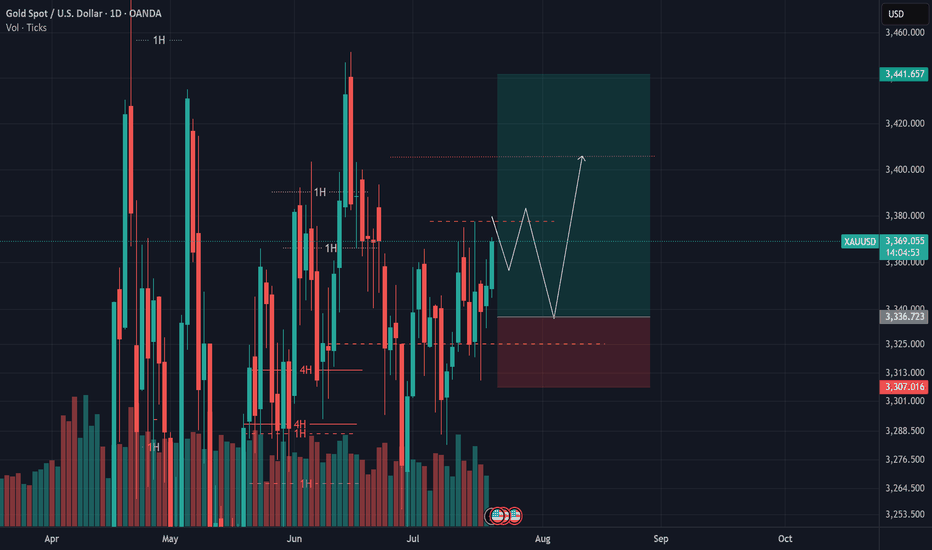

The breakout above the $0.80 level was a major technical milestone for Cardano. ✅ The price not only breached the resistance, but also confirmed it with a strong daily close — clearly signaling that sellers have lost control of the market. Now, we’re likely to see buyers step in and take over the trend. 🕒 For a more optimal and lower-risk entry, I suggest...

In our previous updates, we highlighted the 3350–3360 zone as a critical resistance that could trigger a pullback toward the 3200 level. 📉 Over the past week, price tested this zone multiple times, and each time we saw a sharp rejection of 400–500 pips. This behavior clearly indicates that liquidity has been absorbed in this area, and short sellers have likely...

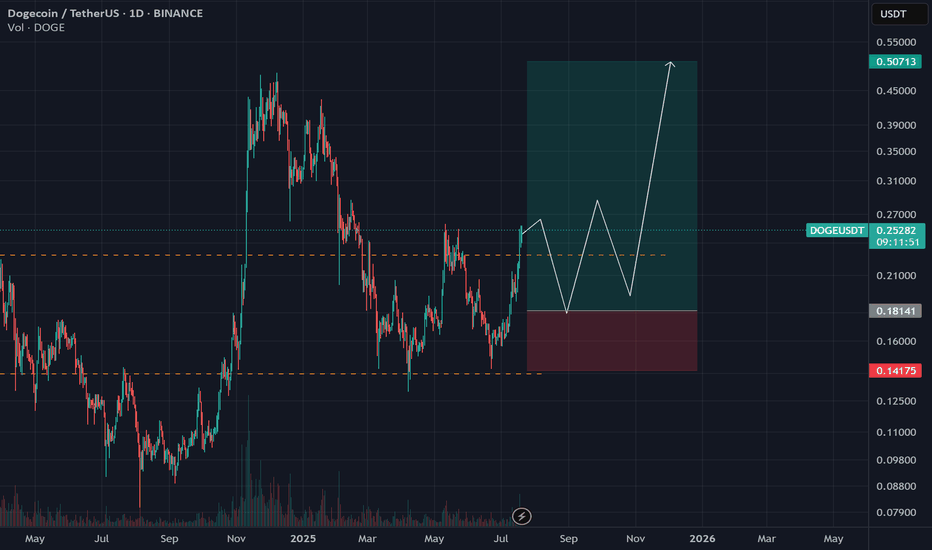

DOGE appears bearish long-term (Dec 2024 ATH: $0.48), but recent price action reveals bullish divergence. 🔑 Key Observations: 1️⃣ April 2025 "Weak Support" ($0.15): Low-volume consolidation → weak seller commitment. Swift breakout confirms this was a liquidity grab by bulls. 2️⃣ Bullish Momentum Acceleration: Minor resistance at $0.25 breached with 24%...

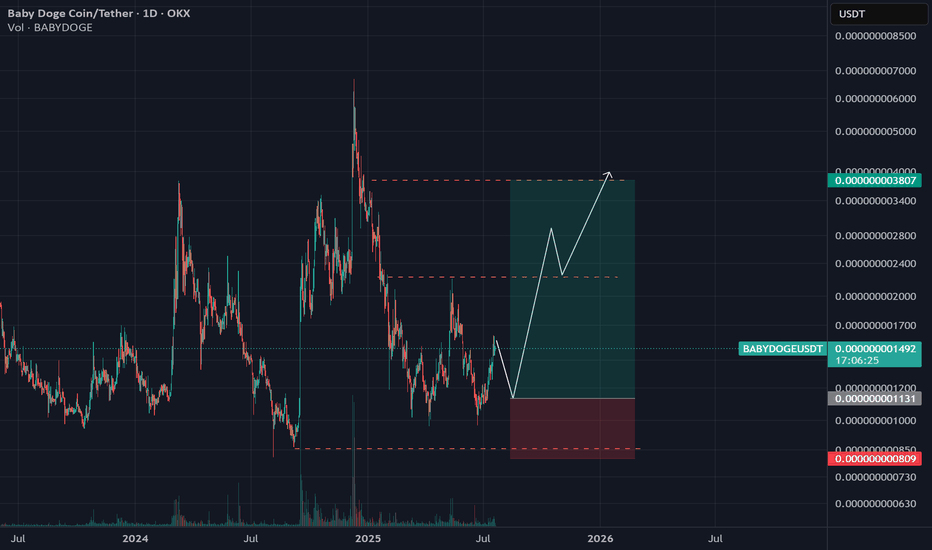

1️⃣ After the December 2023 downtrend, BabyDoge found strong support at the **0.38 Fibonacci retracement level**. 2️⃣ Despite expectations of breaking previous lows, **buyers actively defended this zone**, gradually weakening seller momentum through extended consolidation. **Current Outlook:** • Price action suggests accumulation near the **12 support...

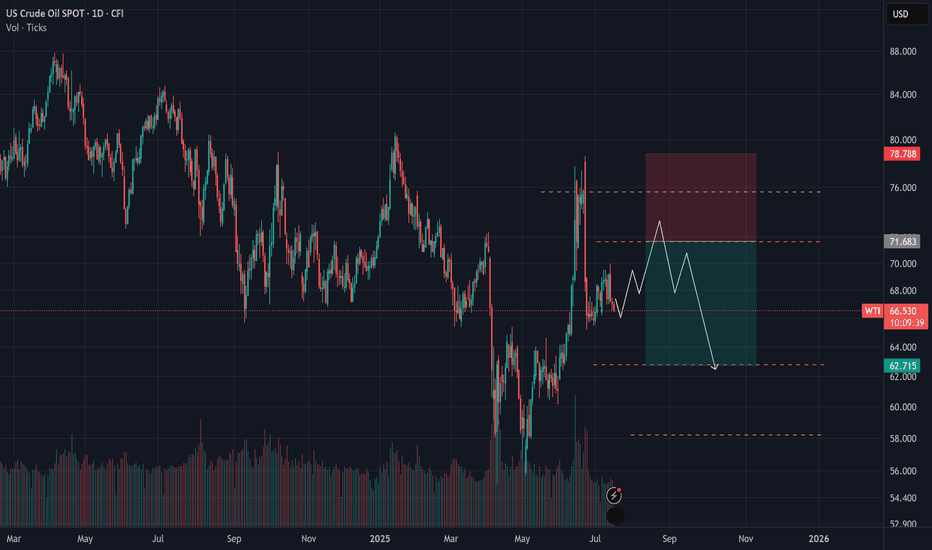

Following recent Middle East tensions, WTI crude oil briefly surged to around $77. However, the price quickly retraced back to its previous range and seems to have resumed its prior downward trajectory — characterized by a gradual bearish slope. 🔍 It’s important to remember that before the geopolitical events, analysts were eyeing the $52 level as a potential...