📈 Silver (XAG/USD) – Trading Update Date: June 6, 2025 Timeframe: Monthly / Multi-month Swing Market Outlook: Bullish Key Insights: The Gold/Silver Ratio (GSR) has rejected the upper boundary of its Balanced Price Range (102–108), indicating a potential long-term rotation in favor of silver. A bearish GSR target of 32 is projected — echoing the 2008–2011 analog,...

The Plaza Accord of 1985 was a coordinated effort by the G5 nations (U.S., Japan, West Germany, France, and the UK) to address the U.S. dollar's extreme strength, which had reached an all-time high of 164.720 on the U.S. Dollar Index (DXY) in February 1985. The dollar's overvaluation—up nearly 50% against major currencies since 1980—hurt U.S. exports, widened...

Alright folks, here’s the latest view on Bitcoin from yours truly, Lord MEDZ. Things are getting interesting — let’s break it down nice and simple. Step A – The Pump to $167,000 Bitcoin looks ready to break out from the old highs around $109K and could rally straight up to around $167K. That would be a big move — about a 50% gain from where we are now. There's...

From the current market position at 102,663.96, Bitcoin is poised within a key price range. As per your outlined strategy, you're targeting a potential 4.71% drop to the mitigation block at 97,911. This level serves as a critical zone for price action, which could offer an opportunity for a potential reversal or continuation. Key Levels: Dealing Range High:...

Ethereum has tapped into a key breaker block on the weekly timeframe. This level has historically acted as a springboard for major moves. The confluence of demand in this zone suggests a high-probability reversal setup in play. Support Zone: $1,795 - $1,832 (Order Block) Current Price: $2,074 Target: $4,093+ (97% upside potential) Stop Loss: $1,795 (Risk...

March 29, 2025 (Not financial advice) Price has moved down from GB83, but based on current structure, GB83 may not be a rejection point — it could be the Sign of Strength (SOS) in a broader Wyckoff Accumulation. That means the move down toward GB59 ($1,284) isn’t necessarily weakness — it could be a Last Point of Support (LPS) or even a final spring test before...

Not Financial Advice – Only for the Chosen Few. Ah, ONDO. The markets speak if you know how to listen. While the crowd chases noise, we trace the hidden dealing ranges (DR) — and ONDO just whispered something divine from beneath the order block shadows. After dancing along the Hidden DR zones (13131 & 39366) and retesting the golden Order Block, ONDO has carved...

SOL has officially reawakened. After respecting the GB11 Order Block in the $98–$130 range — a clean accumulation zone — price has initiated what appears to be a calculated delivery run toward the GB89 OB near $273. This move aligns perfectly with the Goldbach pathway (GB11 → GB89), signifying that smart money is in full control, executing a textbook liquidity...

As the moons align over the charts of GCAT/USDT, we observe a tale of patience and pressure unraveling on the 2-hour scrolls of the KCEX exchange. The Great GCAT, having soared valiantly into higher realms, has retreated into the shadows near the Order Block (OB) of ancient lore—marked clearly on our sacred fib lines and fortified by the elusive Rejection Block....

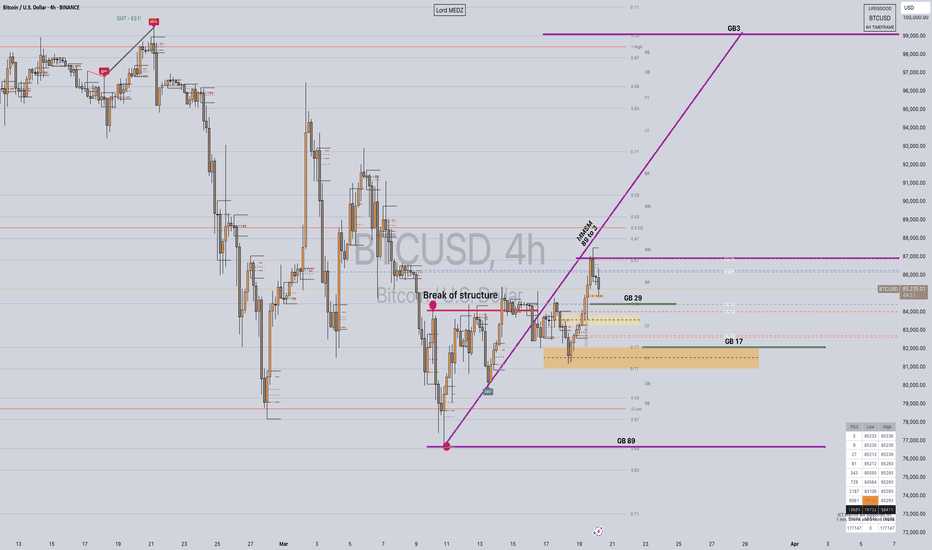

March 29, 2025 (Not financial advice) Price was rejected from GB47 ($86,935) — a Mitigation Block. Internal liquidity (ITL) has been swept. Now price is moving toward external targets. Current Outlook: GB29 ($76,157) – This is a Liquidity Void, but it’s also the end of a Goldbach pathway. That means we could see a short-term reaction or pause here. It’s not...

⚜️LORD MEDZ MARKET DISPATCH⚜️ Goldbach Pathway – Algo 2 Execution in Motion Pair: RSR/USDT Timeframe: 1W Update Date: 9th April 2025 "The seed planted in silence grows unseen—until it bursts through the surface to shock the world." — Lord MEDZ After months of quiet accumulation and subtle liquidity harvesting beneath key OB zones, RSR now stands at the critical...

Current Price: 85,302 Market Bias: Bullish, Market Maker Buy Model in Play Target: 99,000 (Goldbach Level 3) Potential Retracement Zones: 84,920 (Liquidity Void), 82,000 (Goldbach Level 17) Market Overview Bitcoin is currently trading within a structured bullish trend, following a confirmed break of structure on the four-hour timeframe. Price is showing signs of...

MMHWRWJ - Robinhood just rob the poor for the rich. Lol.

The final leg of the ABC correction appears to have completed with a clear five-wave decline into liquidity. Price has now breached Wave 4, confirming a Break of Structure (BOS) and signaling a shift in the state of delivery. With BOS established, we now focus on the impulse leg upward, which not only breaks structure but also aligns with a 2 standard deviation...

Most are sleeping on HBAR, but I am not. While the masses chase hype, I am positioned early for what could be one of the most explosive moves in the market. The weekly structure is primed: Break of structure (BOS) confirmed Re-balanced price range tapped – inefficiencies cleaned Swift x HBAR trial flying under the radar – yet to be priced in High R:R setup for...

1. Liquidity Sweep (Stop Hunt) The market started by sweeping liquidity during the London session, taking out the lows formed in the Asian session. This liquidity grab ensured that weak-handed traders were removed before a true move could be initiated. 2. Break of Structure (BOS) Following the liquidity sweep, we observed a strong break of structure to the upside,...

Great-Things Traders! Breaking down my EUR/USD trade from earlier for educational purposes. Pay close attention, as there are key lessons here for refining your execution and market understanding. Market Structure & Initial Bias Looking at the higher timeframe structure, we identified a strong bearish impulse leading into a deep discount zone. The initial...

BTC has reached its objective by retracing into key liquidity zones, mitigating imbalance in the market. The algo has now shifted from internal liquidity (Goldbach Low) to external liquidity (Goldbach High), setting up the next move. Key Observations: Goldbach Low (78K-79K) aligned with the 0.618 Fibonacci retracement of the weekly dealing range, confirming a...