SohailChaudhary

Higher Highs (HH) & Higher Lows (HL): The pattern of higher highs and higher lows is an indication of an uptrend, showing that the buying momentum is strong. Entry: Place a buy stop order just above the recent higher high (HH). This allows you to enter the trade if the price continues moving upward, confirming the bullish momentum.

Range Breakout: The pair has been trading within a range, and the breakout from this range signals potential bullish momentum. A breakout indicates that the price is ready to move out of its consolidation phase, with buyers now in control. Trendline Breakout: The price breaking above a key trendline further confirms a shift from a bearish or neutral market...

Higher Highs (HH) & Higher Lows (HL): The pattern of higher highs and higher lows is an indication of an uptrend, showing that the buying momentum is strong. Entry: Place a buy stop order just above the recent higher high (HH). This allows you to enter the trade if the price continues moving upward, confirming the bullish momentum.

The first higher high after a downtrend indicates a potential trend reversal to the upside. It shows that buyers are starting to regain control, signaling the possibility of a new bullish trend. Trendline Break: A break above a significant trendline further confirms the shift in sentiment from bearish to bullish. The trendline break signifies that selling...

Higher Highs (HH) & Higher Lows (HL): The pattern of higher highs and higher lows is an indication of an uptrend, showing that the buying momentum is strong. Entry: Place a buy stop order just above the recent higher high (HH). This allows you to enter the trade if the price continues moving upward, confirming the bullish momentum.

The tool watches for a strong upward move (called the flagpole). Then it looks for a small pullback or sideways move (called the flag).

The tool watches for a strong upward move (called the flagpole). Then it looks for a small pullback or sideways move (called the flag).

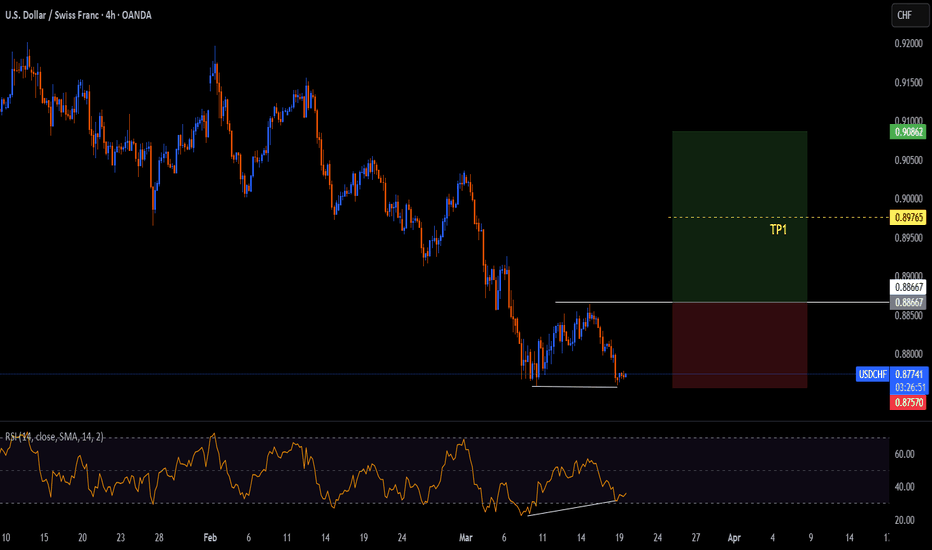

RSI indicates Bullish Divergence. Trendline Break: A break above a significant downtrend line signals a shift in market sentiment from bearish to bullish. This is a key technical signal that buyers are starting to gain control.

LTC/USDT Bullish Weekly Setup: Timeframe: Weekly Trend: Bullish Entry: 70.88 Target: $130+ Stop Loss: 49.77 Litecoin (LTC) has been showing a consistent uptrend on the weekly timeframe, with the price forming higher highs and higher lows

Range Breakout: The pair has been trading within a range, and the breakout from this range signals potential bullish momentum. A breakout indicates that the price is ready to move out of its consolidation phase, with buyers now in control. Trendline Breakout: The price breaking above a key trendline further confirms a shift from a bearish or neutral market...

RSI indicates Bullish Divergence. Which means that at any time the market trend can change to HH and HL.

RSI indicates Bullish Divergence. Which means that at any time the market trend can change to HH and HL.

RSI indicates Bullish Divergence. Which means that at any time the market trend can change to HH and HL.

RSI indicates Bullish Divergence. Trendline Break: A break above a significant downtrend line signals a shift in market sentiment from bearish to bullish. This is a key technical signal that buyers are starting to gain control.

Range Breakout: The pair has been trading within a range, and the breakout from this range signals potential bullish momentum. A breakout indicates that the price is ready to move out of its consolidation phase, with buyers now in control. Trendline Breakout: The price breaking above a key trendline further confirms a shift from a bearish or neutral market...

RSI indicates Bullish Divergence. Trendline Break: A break above a significant downtrend line signals a shift in market sentiment from bearish to bullish. This is a key technical signal that buyers are starting to gain control.

1) A symmetrical triangle breakout 2) previous trend break Order type : Buy Stop EP : 2728.30 SL : 2583.68 TP : 2872

Range Breakout: The pair has been trading within a range, and the breakout from this range signals potential bullish momentum. A breakout indicates that the price is ready to move out of its consolidation phase, with buyers now in control. RSI Bullish Divergence: The Relative Strength Index (RSI) indicates a bullish divergence, meaning while the price was making...