Stephanie_clark

FUNDAMENTAL ANALYSIS Attention Traders! The tides are turning in the gold market, and smart money is positioning for a decline. With the recent breakthrough EU-US tariff deal, global trade tensions are easing, systematically eroding gold's appeal as a safe-haven asset. This pivotal shift is creating a compelling selling opportunity. Risk-On Sentiment: The 15%...

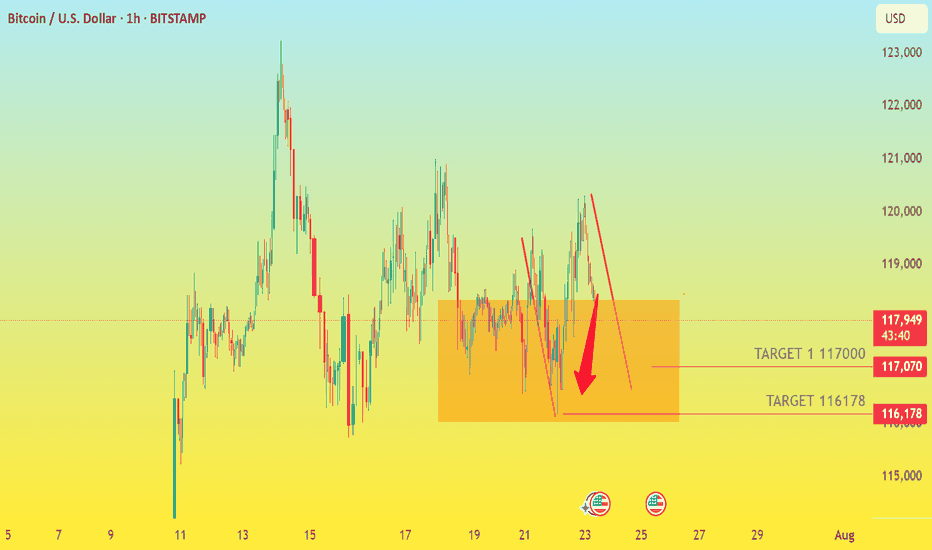

FUNDAMENTAL ANALYSIS ETF Outflows: Recent data shows significant outflows from US-listed spot Bitcoin ETFs. After a strong period of inflows, a $131.35 million outflow was observed on Monday, breaking a nearly three-week streak. This indicates a shift in institutional sentiment and a potential cooling of demand from these major players. Continued outflows could...

FUNDAMENTAL ANALYSIS With geopolitical tensions simmering and a weaker US Dollar providing tailwinds, the precious metal is setting its sights on the $3455 target and beyond. Our analysis indicates immediate resistance around $3426 - $3435, and a decisive break above this zone could ignite a powerful surge. The next key hurdle stands at $3445 - $3450, where a...

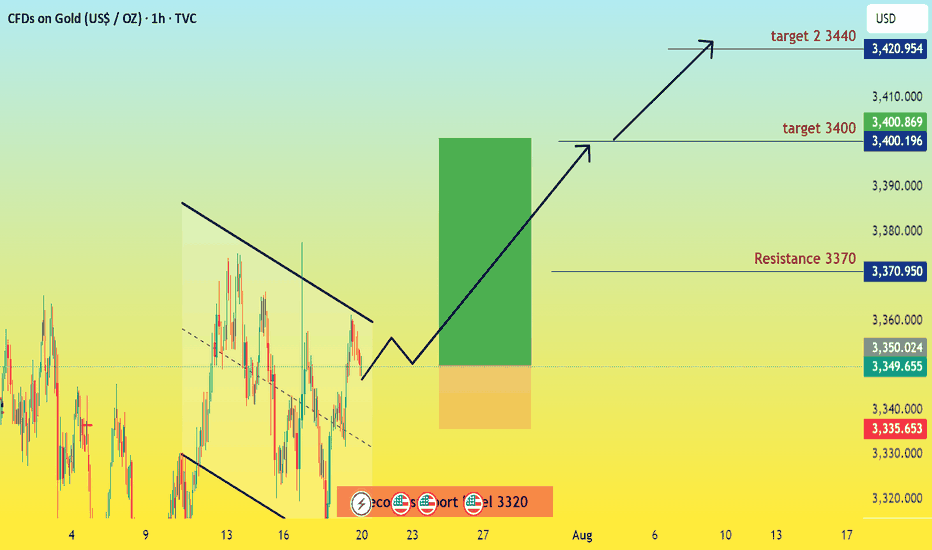

FUNDAMENTAL ANALYSIS "This week, the golden opportunity shines bright! With robust support at $3320 and our sights set on a $3340 target, we're giving strong buy signals. The path to profit is clear, but keep a keen eye on the $3370 resistance. Don't miss this strategic entry!

fundamental analysis Before Jerome Powell's pivotal speech, gold stood at 3387. Now, in a clear testament to market reaction and renewed confidence, it has surged to 3425! This immediate and significant upward movement confirms gold's role as the ultimate safe haven and a powerful inflation hedge in uncertain times. The Powell Effect: A Bullish Catalyst for...

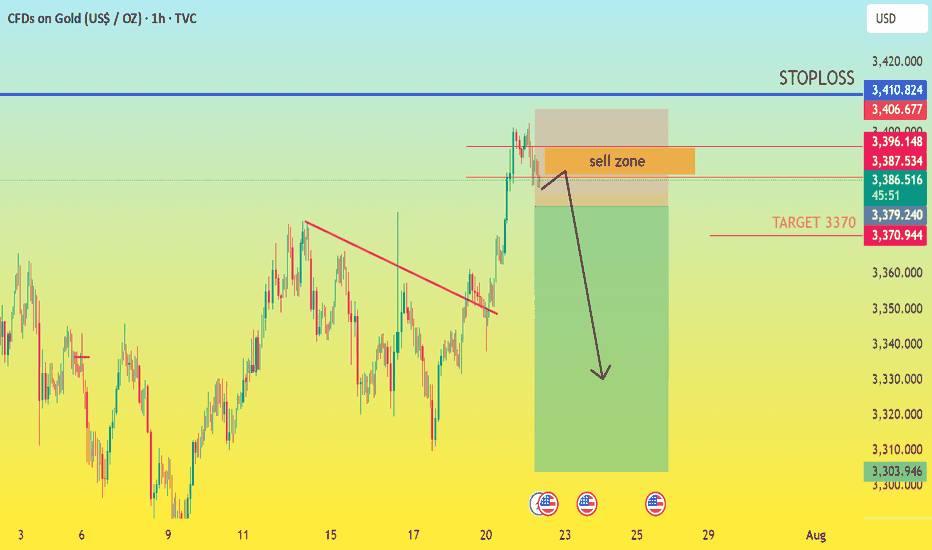

FUNDAMENTAL ANALYSIS Are you ready to capitalize on the impending short-term correction in Gold? XAUUSD is flashing clear sell signals from the 3390 to 3370 zone, setting the stage for a profitable bearish move. Don't miss this chance to ride the downward momentum! Here's why we anticipate Gold's descent to 3370: The Ceiling is Here: Key Resistance at...

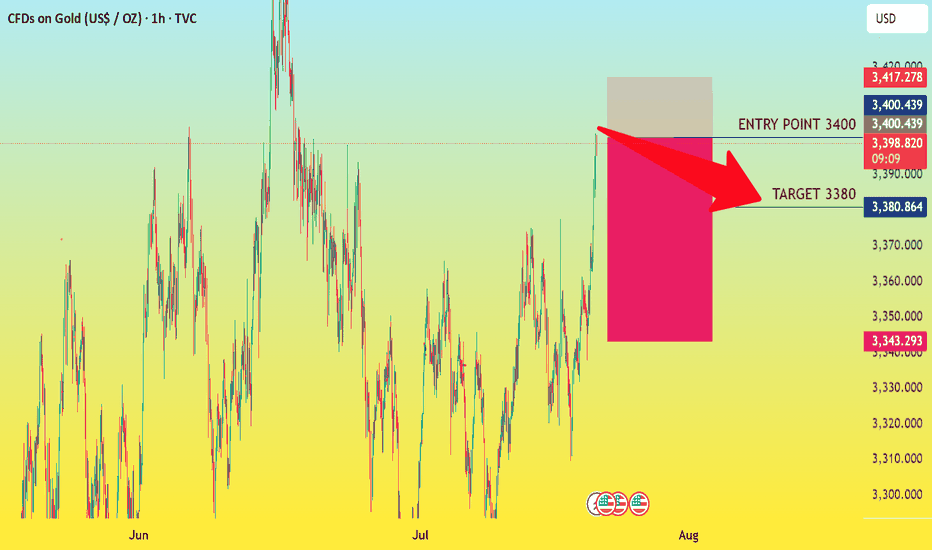

FUNDAMENTAL ANALYSIS After a monumental 500-pip bullish run this morning, gold now stands at $3400. This significant upward momentum presents a prime opportunity for a strategic reversal. We are issuing a SELL signal from $3400! Technical Resistance: After such a sharp bullish move, gold is likely to encounter significant technical resistance levels at or...

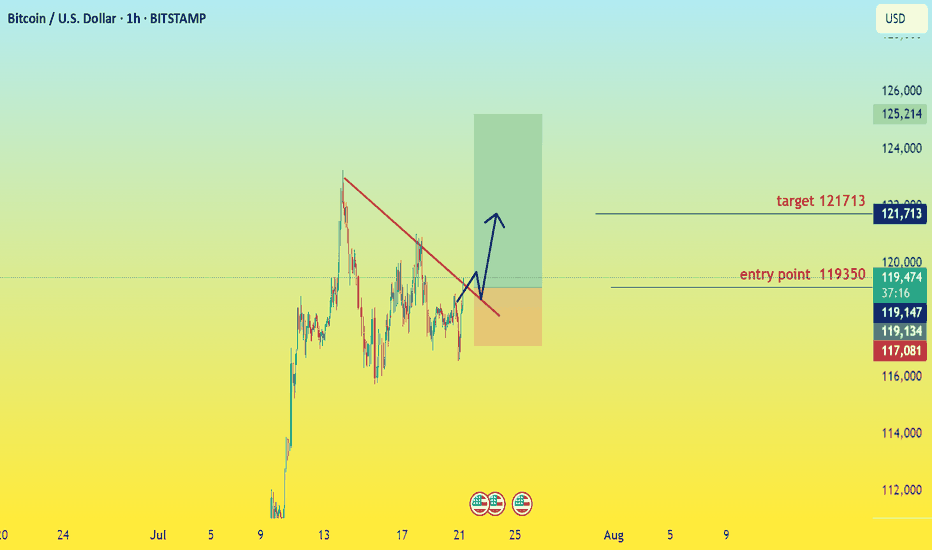

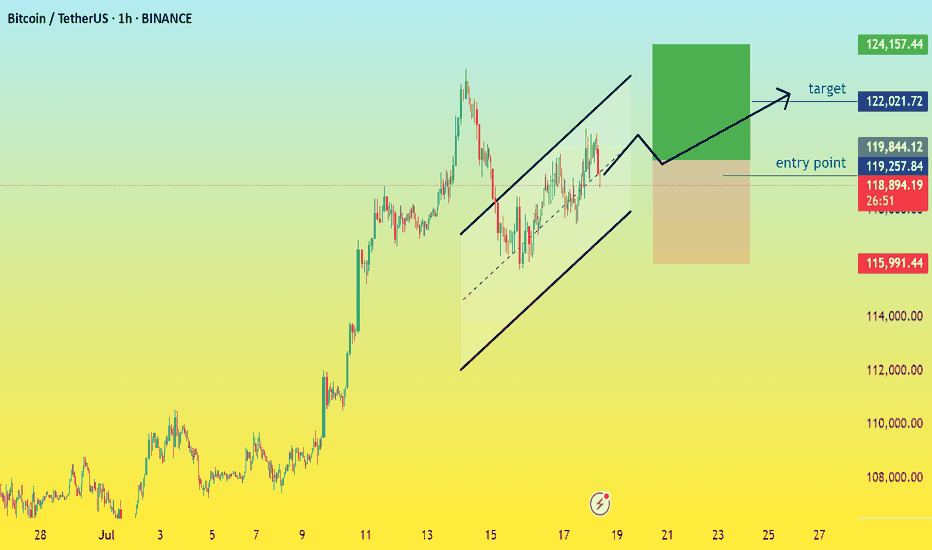

With Bitcoin currently trading at $119,425 and our buy signals extending confidently to $121,700, the landscape for BTC presents a compelling bullish narrative. The confluence of sustained institutional demand, evident in robust ETF inflows, and the ever-present scarcity driven by the recent halving, creates a powerful upward momentum. Furthermore, the maturing...

Gold is currently poised at 3349, eyeing a critical resistance level at 3380. A decisive break above this point would signal a significant bullish move. The ongoing geopolitical uncertainties globally are providing a strong safe-haven bid for gold, fueling its upward momentum. While a strengthening US Dollar could typically act as a headwind, current market...

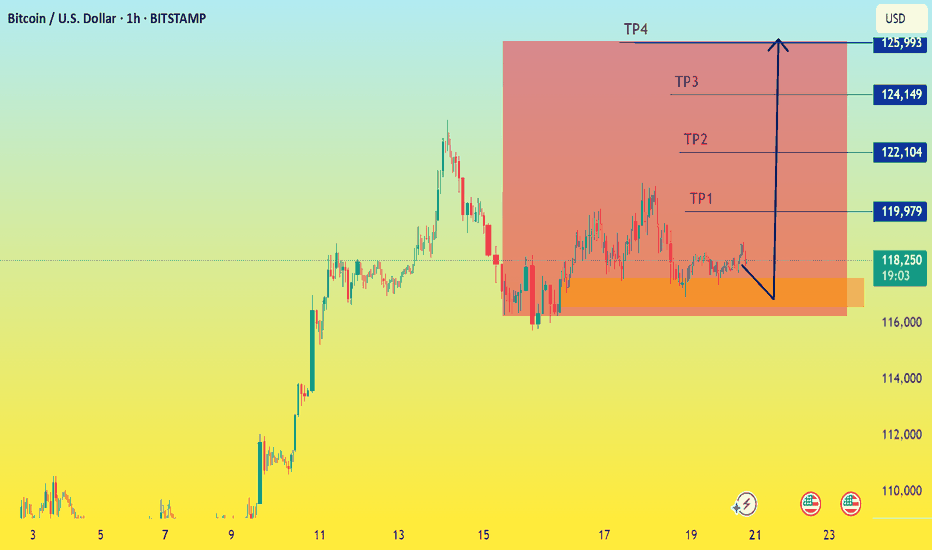

Bitcoin is currently trading at $118,209, demonstrating continued strong bullish momentum in the market. This aligns with broader market sentiment, which has seen significant institutional inflows, particularly through spot Bitcoin ETFs, driving BTC to new all-time highs in July 2025. The transformation of Bitcoin from a speculative asset to a macro asset, coupled...

FUNDAMENTAL ANALYSIS Bitcoin has a fixed supply cap of 21 million coins. Approximately every four years, the reward miners receive for verifying new blocks (and thus introducing new Bitcoin into circulation) is cut in half in an event known as "halving." The most recent halving occurred in April 2024, reducing the block reward from 6.25 BTC to 3.125 BTC. Why...

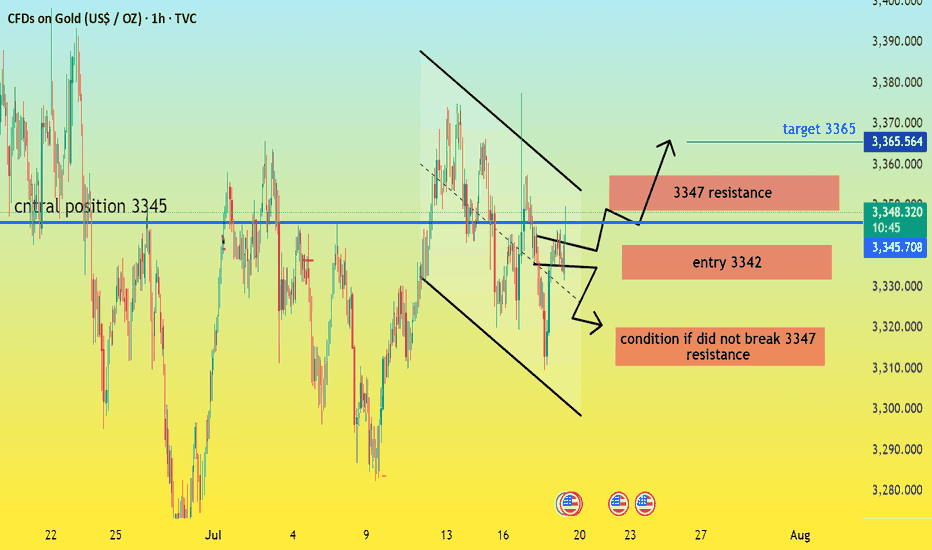

FUNDAMENTAL ANALYSIS entry 3342 target 3365 stop loss 3330

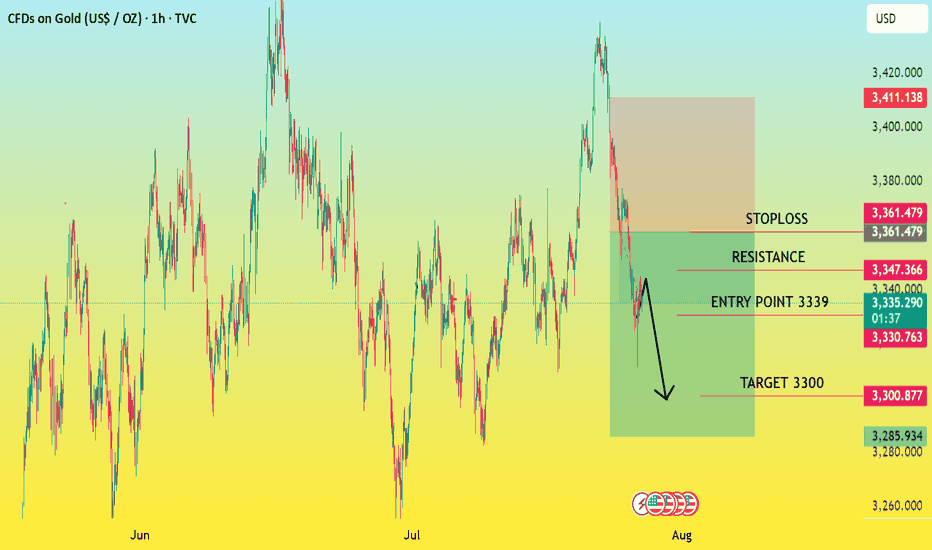

FUNDAMENTAL ANALYSIS entry 3332 target 3315 resistance 3339 stop loss 3342

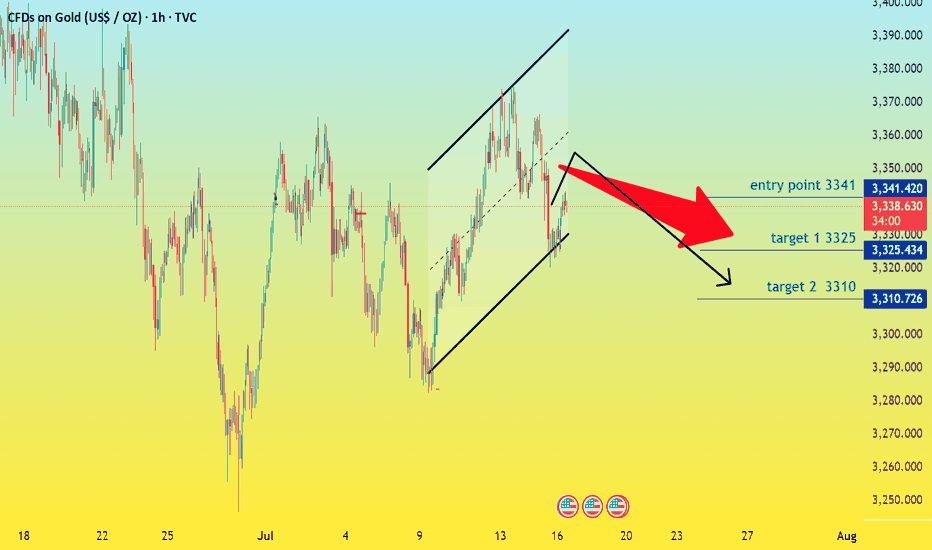

FUNDAMENTAL ANALYSIS Current Price: $3341 Target Range: $3310 - $3320 While gold has enjoyed a recent run-up, the technical landscape suggests that this upward momentum is encountering significant resistance. Multiple indicators point to a potential short-term pullback, offering a compelling selling opportunity for astute traders. Key Resistance Holds Strong:...

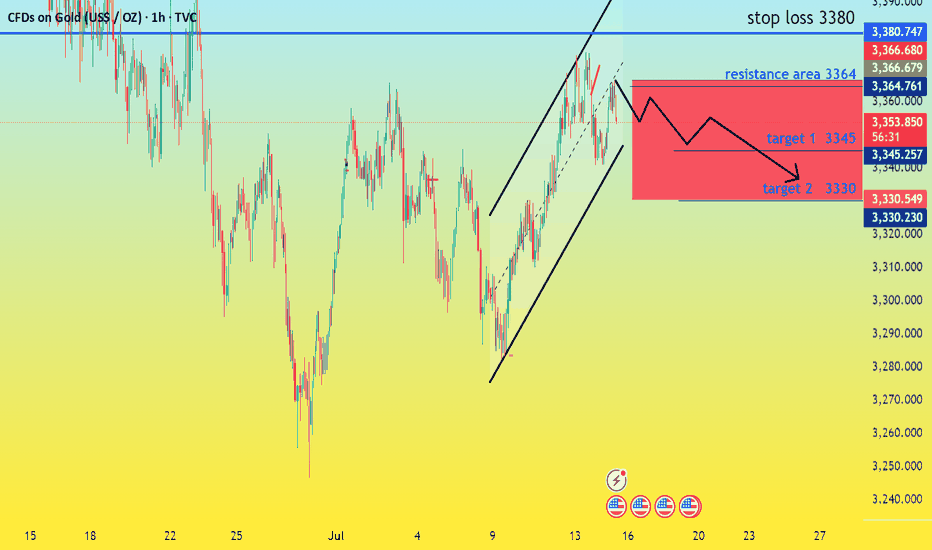

FUNDAMENTAL ANALYSIS With Gold currently trading at 3357, we're at a pivotal moment. The confluence of heightened geopolitical tensions and recent decisive US government actions – including renewed tariff threats and evolving monetary policy signals – is creating a clear trajectory. Analysis indicates a compelling opportunity to initiate aggressive sell signals,...

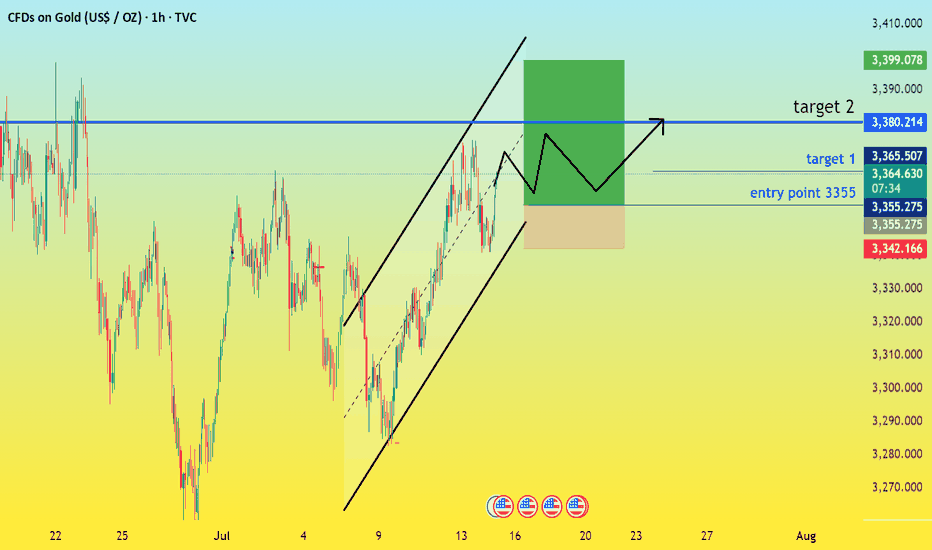

FUMDAMEMTAL ANALYSIS Key Drivers for the Bullish Outlook: Strong Technical Support and Breakout Potential: Recent price action indicates a robust underlying strength. Gold has demonstrated resilience around the $3331-$3335 zone, which is acting as a strong demand area. Furthermore, a "Break of Structure" (BOS) above $3340 has been confirmed, signaling bullish...

Fundamental analysis the Gold surged to approximately $3,360 per ounce on Monday, extending its bullish run for a fourth consecutive session. This upward momentum was primarily driven by President Trump's latest tariff announcements, which ignited a flight to safety among investors, bolstering demand for the precious metal. Trump's communications to the EU and...

FUNDAMENTAL ANALYSIS Entry Point 3357 Target 1 3347 Target 2 3337 Stop Loss 3367 this is not financial advice