Stephenlks

Facebook might break above a 60 min downtrend line at support. If it can break above it then Facebook is likely to change trend in the short term and move higher.

NVDA is correcting to a support area in the 60 min chart. We could draw a downtrend line connecting the prices. If NVDA breaks above this downtrend line then it could go higher.

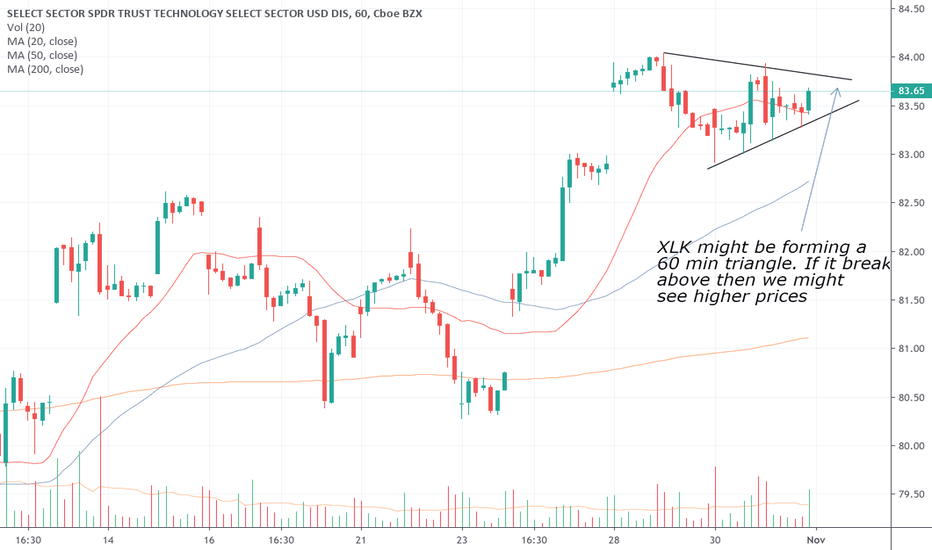

A breakout above the 60 min triangle will help to send the tech sector higher. This will be good for tech stocks.

Nvidia broke out of a weekly ascending triangle. Target of this pattern is around $260.

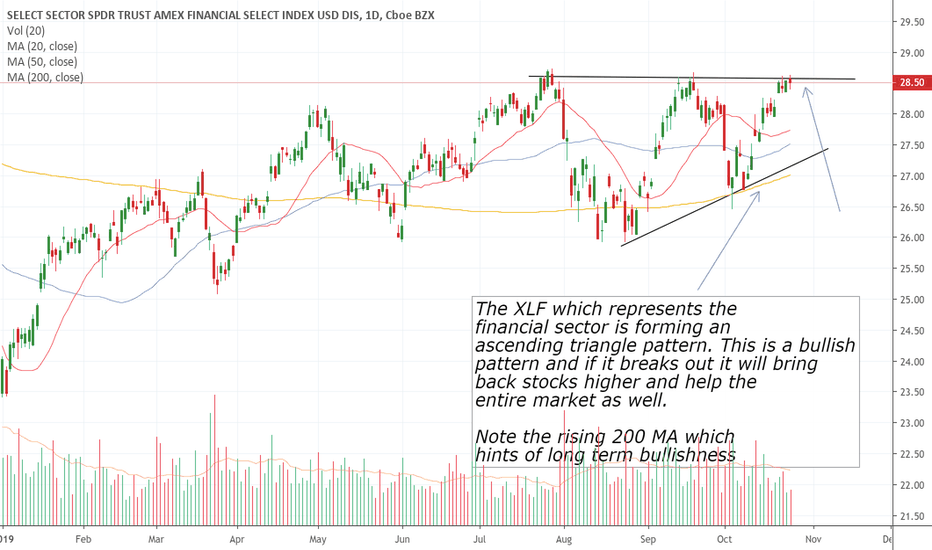

When you see the SPY forming a bullish ascending triangle that is great! But when you also see the XLF forming an ascending triangle, you know that the likelihood of the market going higher is good.

Silver prices recently broke out of a daily ascending triangle as well as a downtrend line. I believe that as long as Silver stays above the lower trend line in the ascending triangle, it could move higher.

The SPY which is the ETF the tracks the S&P 500 is forming a large ascending triangle. Note the rising 200 day moving average as well. This points to bullishness and if SPY can breakout of this pattern we will be looking at higher prices for the US market.

The Singapore STI just broke a downtrendline in the daily chart and still struggling to stay above it. It might meet the rising 200 MA and bounce higher.

The Dow has broken out of a long and wide consolidation box. This is usually a very good thing. With ample support at 21080 area and also the psychological area of 21000, the Dow is healthy and looks set to move higher in the future.