Strateg_

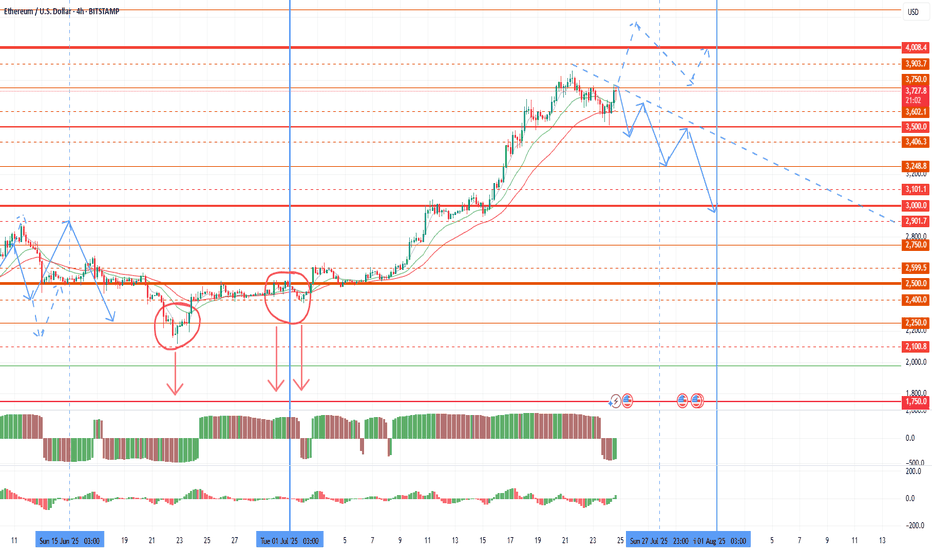

PremiumToday I want to review the market and give a warning on further purchases. Since the last review, as expected, volatility in the market began to grow with a flat of about 2500 on ether until the half-year change. The growth of the euro and oil gave rise to a 4k retest in the new half of the year. However, the half-year has opened below 2,500, which is a technical...

The market remains extremely sluggish in the seasonal flat, but there is a possibility of increased volatility this week and next. In this regard, I would like to consider the market situation and the likely prospects. First of all, in the medium term, the probability of a flat of about 100k for bitcoin and 2500 for ether prevails until the opening of the new...

And so a difficult week is behind us, with overcoming the middle of the quarter. Against the background of positive factors, the week and the second half of the quarter opened above 2500, which provides market support and reduces the potential for decline. However, we have only come to a temporary consolidation of the market and it is too early to talk about a...

According to porto, the picture resembles alpine, the goal is also to try to take the level of 1.5 with the opening of the second half of the quarter higher, which will create the ground for a stable trend immediately to 2.5. The main medium-term goal is the range of 2.5-3.5, where large volumes of purchases were previously left. I would like to note that the...

Today, the market looks very optimistic. The week on air opened above 2500, which compensates for sales on a weekly schedule. You can continue to keep working on fantokens to maintain growth in a row. In the absence of a significant market drawdown, an additional wave of purchases of up to 70-100% from current levels is likely. Binance also continues to support...

To date, the market has shown itself quite positively, but, as I wrote earlier, it will be possible to talk about a trend change only after the opening of the second half of the quarter. The first half is so far only a pullback and retest of the broken key levels in the first quarter. Today and tomorrow we are passing an important bifurcation point. At the moment,...

Since in the second half of the week there was an opportunity for the ether to take higher levels, I want to consider the events for the coming days in more detail. At the moment, the growth target is the test test of 2100-2150, then either the range will be broken, in which case a stable trend towards the test of 2250 can be expected on Saturday. If it fails to...

Large-cap coins showed growth yesterday following the tops, and memcoin bullying is subsiding today, followed by a high probability of bullying in the remaining altcoin market. I expect the main day of growth tomorrow until Sunday afternoon, then the probability of a major pullback prevails until the middle of the new week. Today, fio, which I considered for work...

At the end of last week, I recommended keeping KOMA memcoin in mind as having a very high growth potential, as it is only at the development stage. Against the background of a new wave of growth in the second half of this week, we can expect much stronger growth. The minimum goal is to consolidate above the key level of 0.05, which will open the possibility of...

To date, the market has reached the buying period of the second half of the week, which I outlined earlier. Against the background of extremely negative statistics for the United States over the past week and a half, ether sales were successfully repaid yesterday at the next bifurcation point, and purchases with an attempt to gain a foothold above 2100 will...

Against the background of the current market situation, when the seasonal growth cycle is over and most large-cap coins will be prone to flat with a fall along with the tops, and weak projects are awaiting a new announcement of the assignment of a monitoring tag, there are few interesting tools for speculators except for the most oversold coins on the market. In...

To date, the crypt has been given a number of positive factors and the basis for a very stormy weekend. Binance monitoring did not give a new assignment of the tag, which was immediately responded to by pivx, which I recommended for work. I think the holidays in China had an impact. In the new rules for assigning the binance tag, it obviously means the first...

In the coming days, against the background of the beginning pullback in the market, oversold coins from the delisting announcement may become very interesting for speculators, since for strong altcoins that have shown good growth this month, the probability of falling within the rollback prevails, and the threat of assigning the monitoring tag in the second half...

Yesterday, an attempt was made to turn the weekly candle into a bullish one and change the trend. The momentum is very volatile with a local breakout, breakdown of the previously formed trend line and resistance of 0.035. These are signals for an attempt to continue the trend. Within the framework of the bullish market sentiment of this week, a reversal of the...

The seasonal growth cycle is ending this week. For most of the market, the sales cycle begins on Sunday. In the new week, we can still expect pumps for the turn of the month for individual coins. From Sunday to Tuesday, the probability of a market drawdown prevails as part of a pullback on the current weekly candle and shadow rendering for the new week. For coins...

Along with the pda and vin, alpaca may show good growth in the upcoming bullish cycle. This month, the token was not included in the delisting announcement, and an active set of positions began because it is in an extremely oversold position. Previously, many signals were left with attempts to return to 0.15, and this month there is a possibility of working out...

VIB is preparing a new growth momentum today. As I wrote in previous reviews, finding a token below the 0.035 level is appropriate when the ether is below 1500, even if there is a monitoring tag. At the moment, the breakdown is more likely caused by panic sales on tag assignment. However, the assignment of the tag was obviously already worked out by the price when...

As I wrote earlier, April is the most powerful seasonal growth period in the first half of the year. The first half of the month was under selling pressure against the background of the continuation of the trend of the previous month and quarter, but as we approach the middle of the month, the activity of buyers is likely to begin to increase and from the second...