We've just broken out of an accumulation phase and it looks primed to rip. Already retested support, so fingers crossed for now.

In the epic battle of memes for the next bull run, it seems the BNB backed meme token is primed for a good run. There are bullish patterns forming in multiple time frames and we can only sit back and enjoy the coming show. Very long on NYSE:CAT at the moment.

So far the $117k support seem to have held which is good news for the bulls. Now we should anticipate a reclaim of the $120Ks; this should form a pretty good double bottom for CRYPTOCAP:BTC to surge to $130Ks and more, of course.

Today's move seems like a bull trap, a healthy correction to GETTEX:87K before $100k should do it

This should fly once we clear this level; a retest of the trend line then breakout should be imminent.

$DOGEGOV just broke out of a resistance and should in fact go higher from higher. Expecting Elon Musk to shill this token in the coming days/weeks. It's Meme Season.

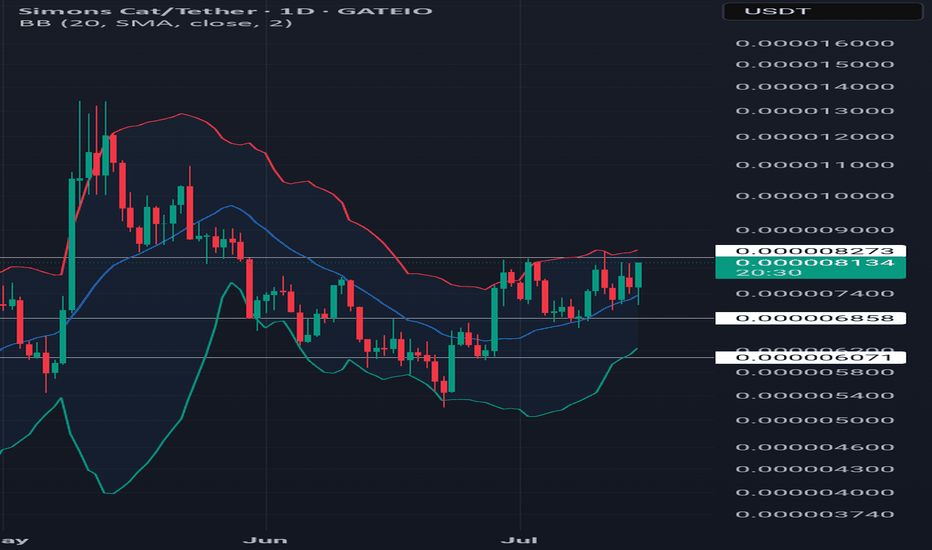

If we revisit previous lows, a good range to buy Simon's Cat would be at $0.00002543. Buy orders already placed here with leverage.

The direction CRYPTOCAP:BTC goes in the next few days is pivotal as to how the market would play out in Q1. On one hand, we could push for new highs thereby resuming the uptrend that started at $70k to $108k and on the other hand, we could head lower to the $80Ks; which is healthier as BTC.Dominance as well as USDT.Dominance would push higher for their final leg...

Bitcoin is currently trading at GETTEX:97K but with the head and shoulders pattern forming on the USDT. Dominance Chart (which trades in the opposite direction of CRYPTOCAP:BTC ); we should clear these levels and head to $100k+ for one Bitcoin. Once we clear this level, we should have more information.

This should be a potential double bottom on the 4-hour timeframe for the next leg up. Investing here with leverage, fingers crossed.

In the short term, the 95k resistance should hold causing CRYPTOCAP:BTC to head back down to the 90k support. A perfect double bottom should be formed here for the next pump to the $100k+

As before, volume is low. We should drop down to FWB:65K in order for this to be a healthy correction; then pump with better volume.

From the chart, the only disappointing thing is the low volume with which it is pumping with. I think we revisit 68k before lift off.

With a potential double bottom forming after today's daily close and with Bitcoin chasing the well awaited $70Ks, Simon's Cat might be the meme of the season. It has made a good run previously and this time, with an ever active community, listing on major exchanges should further drive up its price. Entered Long till Q1, fingers crossed.

Still following our use of the USDT Dominance Chart, we can see that the breakdown of the 5.3% resistance occurs as predicted. We should see all time highs for Bitcoin soon. Not a bad time to long your favourite coins; currently long on CATUSDT. Would post the chart next.

Bitcoin's trend for the next few days/weeks should depend on how this chart plays out at this particular level. A breakdown to the 4.61% USDT Market Dominance area should give us a pump to Bitcoin's all time highs. On the other hand, a move to the 6.39% zone should make us go back below 60k. Fingers crossed. Fun, exciting times ahead.

The answer can be seen from the USDT Dominance Chart, which trades in opposite direction to to every other coin ( as it shows that the market is either buying or selling at that particular time period). From this we should be able to guess the market's next move. From the chart, we should retest the resistance in a few days or weeks which should see Bitcoin go...

From this USDT. Dominance chart, whose upward move shows that more people are buying stables, we could see one final shake out of longs. We pamp in Uptober with this.