SupernaturalSpiritAnimal

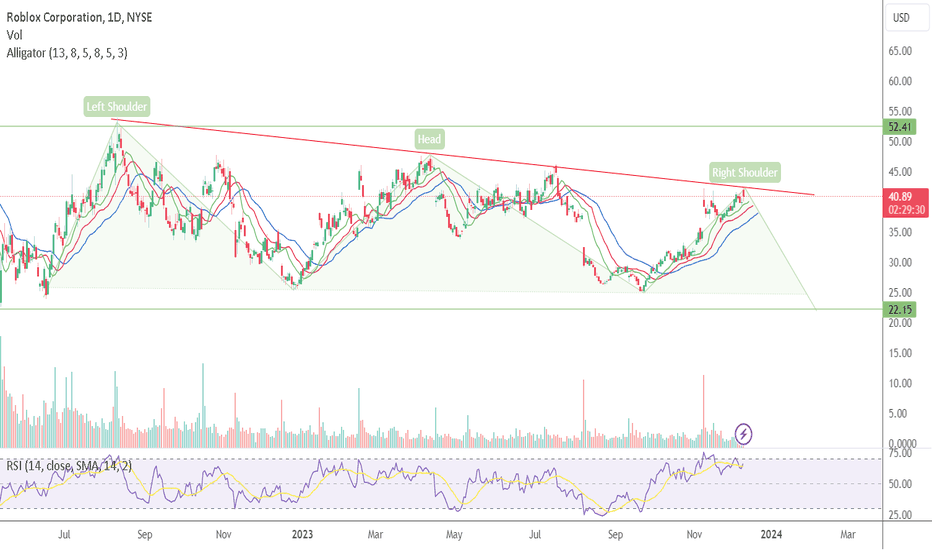

Looks like a possible buy zone incoming. April 25th earnings and future outlook could aid in a move higher going into July potentially filling the gap in the $40's.

The target area of Point D hit from my prior post a month or so ago. RSI is oversold, bearish crossover is occurring as well. I feel we will see a 10%+ pullback over the next several months.

We are breaking the neckline and continuing the bull trend. LFG, GOLD.

Broke support and could see a downfall to the $38 level.

Eanrings are supposed to be favorable. A bullish pennant set up in the works. A breakto the upside could be rewarding.

SPY heading higher, $520 area looks like it could be a major resistance area.

520/21 area then Thursday perhaps we get crushed to a 0.618 retracement.

Three drives to a low set up. If there is a bullish move up, we could see a retrace to 0.618.

Ovrbought, selling pressure may come into play resulting in gap fills. Potential pullbacks incoming.

Inverted H&S pattern identified on 15min. Perhaps, we see a gap fill by the end of Feb.

Upside potential for BIG LOTS after a double bottom and significantly oversold. Or, not.

Possibly getting pushed hire. Maybe CPI Data will contribute tomorrow. I do think there is a strong pullback in the future but I don't have a crystal ball.

Either we go up hard or we drop down to potentially $13 for the next major support area.

Potential Beairsh garlety in the making. If point D is broken there is strong resistance near $188/9.

Retail is dying, and KSS is bleeding. Red flags everywhere.

Consistent lower highs, maybe a $5 pullback at least? Negative EBITA increase YOY. 2019 -48,776, 2020 - 2021 -329, 2022 -412,180, 2023 -760,603. Goodwill has doubled, etc. RBLX is bleeding IMO.

If the JBLU case rules in favor of the Spirit merger, JBLU will be the 5th largest airline in the industry expanding its reach and flight offerings.

"Advertisers GFY, I hope that was clear." Met resistance and pulling back now. Maybe it stays in the channel and sees some lows.