THEOGFX

XAU/USD Tests Supply Zone – Watching 3365 for Bullish Continuation Gold is climbing amid global uncertainty and U.S. tariff concerns ahead of the July 9 deadline. But strong resistance is still in play. The price is now testing the 1H–2H supply zone and has pushed past the pivot (3347–3352). A clear 4H close above 3365 will confirm bullish continuation. Until...

This analysis examines the Ethereum/US Dollar 1-day chart from Binance, focusing on a potential bullish continuation as of July 22, 2025. The chart indicates a recent upward movement following a consolidation phase, with the price approaching a key resistance at $4,090.81. As a reader, I’d want to grasp the context: the 1-hour and 2-hour support zone around...

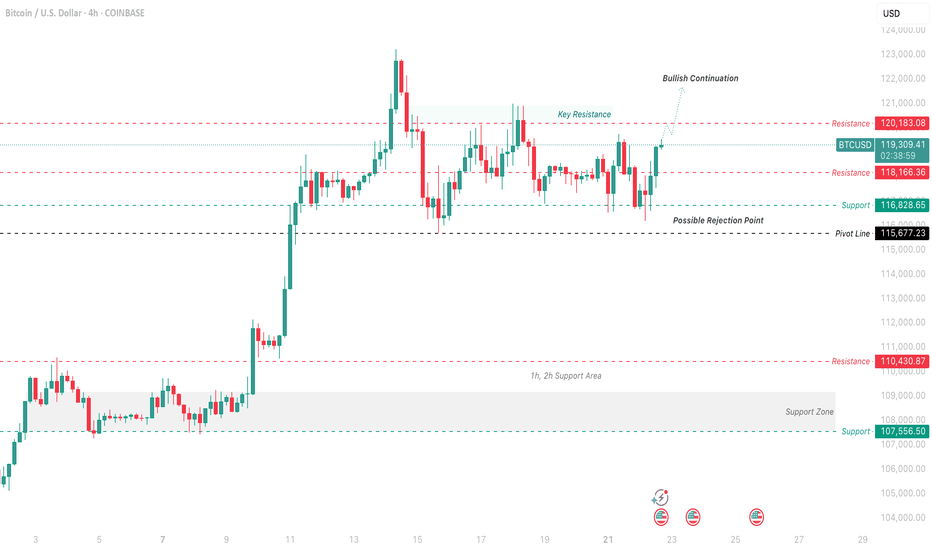

This analysis focuses on the Bitcoin/US Dollar 4-hour chart from Coinbase, highlighting a potential bullish continuation based on recent price action as of July 22, 2025. The chart shows a strong upward trend with a recent pullback, suggesting a possible rejection point near the pivot line at $115,672.23. Putting myself in the reader’s shoes, I’d want to...

With the CPI data released at 2.7%, gold’s bearish momentum is confirmed below the Pivot Line of 3,357.953 USD. The market reaction suggests no immediate Fed rate cuts, supporting downward pressure. Expect a move toward Support at 3,307.665 USD and the Support Zone around 3,264.120 USD. A close above 3,357.953 USD on a 1H or 4H candle could indicate a bullish...

XAU/USD Below Pivot, Eyes on 3352 for Bullish Clarity Gold remains pressured under the 3347 pivot and the 3352 resistance, aligning with the 1h–2h supply zone. Despite brief upside attempts, price action still struggles to gain bullish momentum. A clear 4H close above 3352 is essential to confirm any bullish shift toward 3365. Until then, the sentiment stays...