Tealstreet

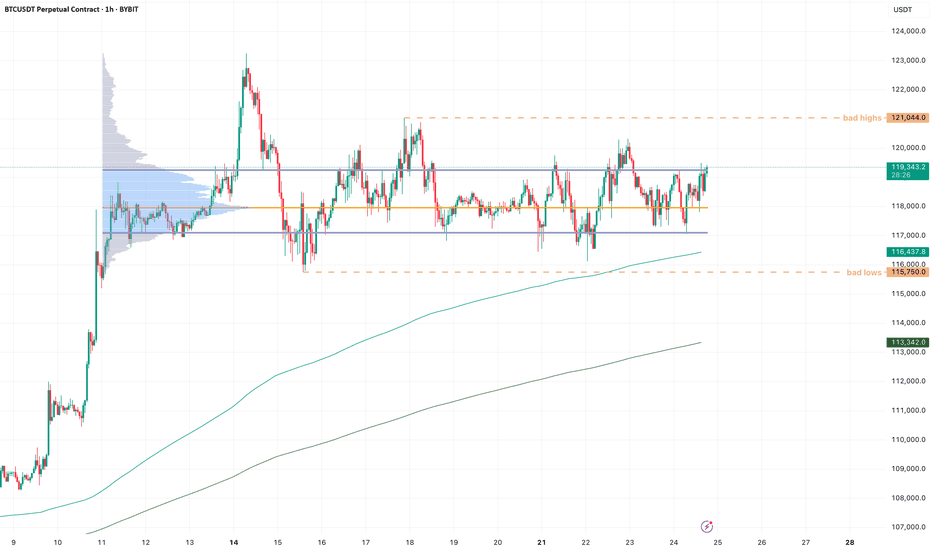

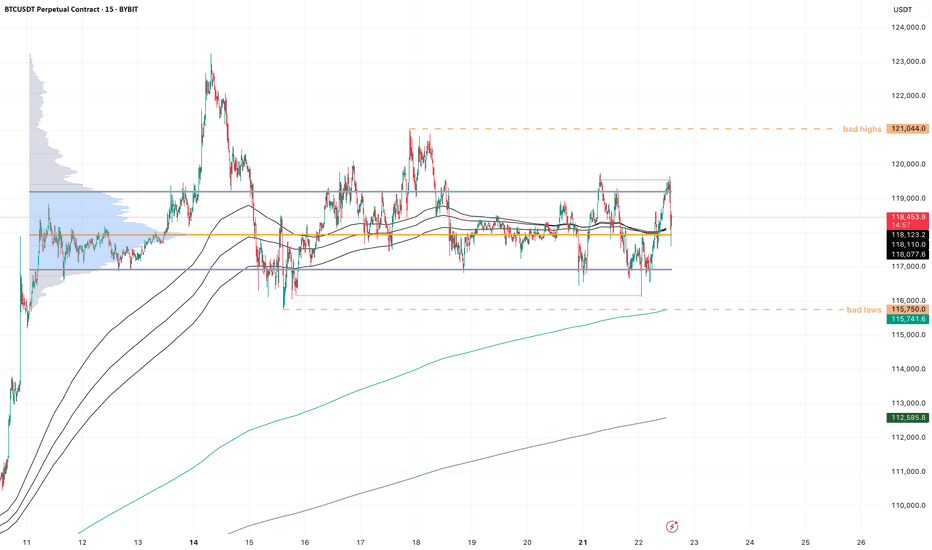

ExpertSome rotations I'm looking for BTC. Volatility is slowly cooling off, also noticeable in options premiums so I'm not expecting any big moves and mostly focussing on intraday moves. That doesn't mean we can't mark more htf POIs of course. 1. Clean up the bad lows we left yesterday, but protect the low from CME open this week. Gives a really nice setup and RR 2....

Hoping to get that internal sweep at 24; in any case I have a small feeling that this corrects a bit higher soon. Not gonna buy it here at local highs of course, it would be equal distance to first tp and stop, I don't like it. so either we sweep or come back into discount at least, or I buy on the s/r flip after taking out tp1. much more difficult to execute of course

Very nice imbalance on HYPE here, I think there are a few different things to keep an eye on, money to be made for sure. Technically an msb on H1, although again a strong rejection and only a very short time spent above the msb. But we can try a long on the retest in the green box, if we get it. Stop is below the low. Second long attempt is enter where we just...

Looks like we got our downside first. Short update, but important level to watch is that 112k high from May this year. I longed on a ltf low hold, looking for a bounce into the highs of this sell-off cluster, then see what's what. Flow is still very heavy; I expect to get stopped on this but it's one of those setups I just have to take, or I kick myself tomorrow.

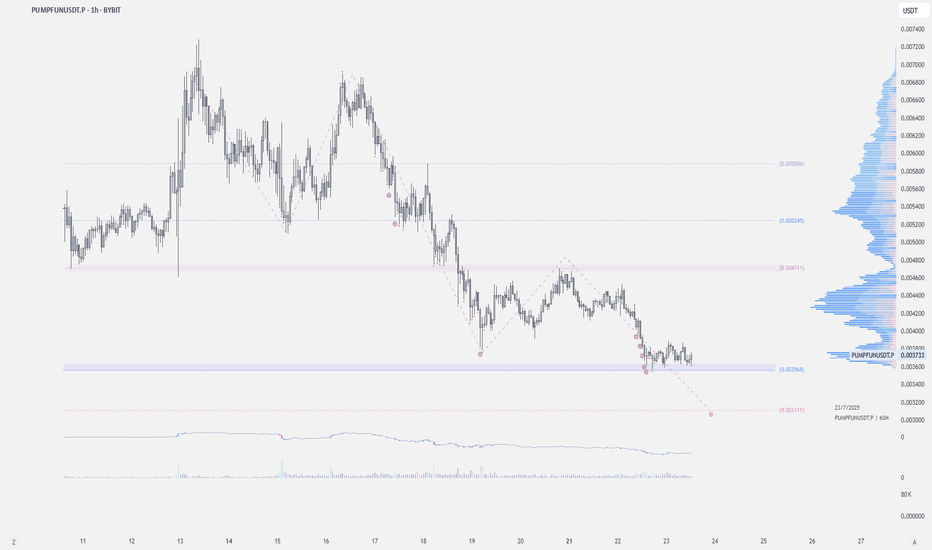

BYBIT:PUMPUSDT | 4h PUMPFUN is one of the few coins still holding support during the dump. It’s looking tempting here, but a drop to the 0.0021–0.0018 zone is still likely. Planning to long around 0.0021–0.0018 Targets: .0028-.0032 .0037-.0040 .0045-.0048

Bearish momentum is starting to stall here at the lows. New month, and we started it by cleaning up the previous month's bad lows. If we can hold here I'm looking for a trendline retest and VAL retest soon. Maybe we get one more sweep of the low, giving us a three drive pattern. Reclaim VAL then it's back to VAH, maybe take out all the bad highs. If we start...

CRYPTOCAP:BTC.D | 6h We're approaching the monthly close, and many are eyeing a potential breakdown in Bitcoin dominance — a key trigger for altcoin season. On the mid-term chart, BTC dominance held support at 60.43% and recently retested the 60.65% base. A sustained drop below 61.20% would favor altcoins. But if dominance accepts above 62%, it opens the door...

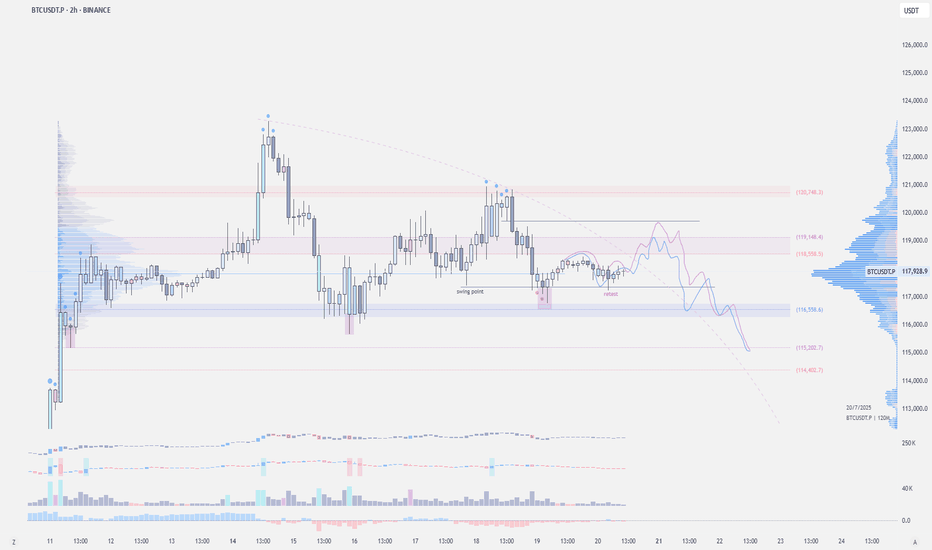

CRYPTOCAP:BTC | 2h We've got a swing point retest at 115.7k after the deviation at 114.6k For bullish continuation, holding above 117.3k-116.8k is key — any break below invalidates the setup. A clean break above the 120k resistance, I'm expecting we could finally tag 121k–122k (untested supply zone).

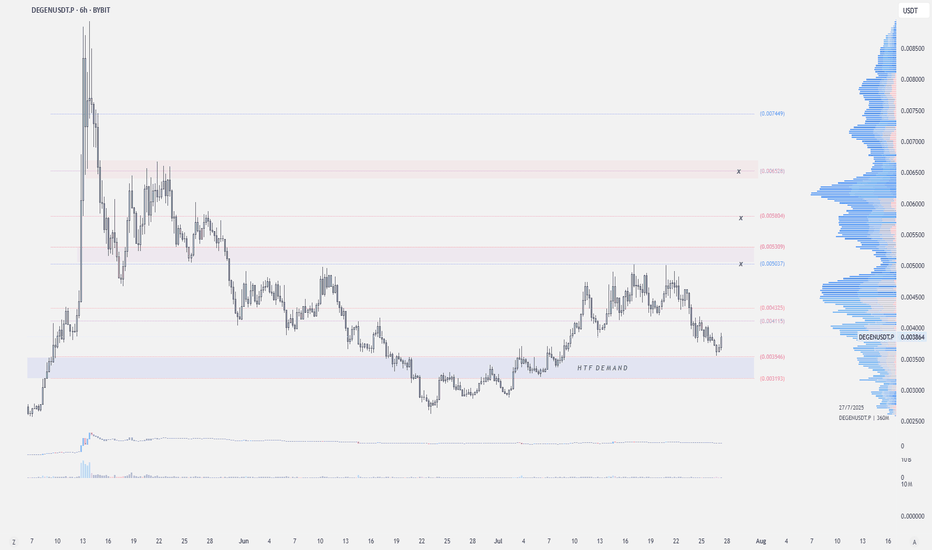

BYBIT:DEGENUSDT | 6h Price is holding this HTF demand Taking some long here .0038 DCA/Conservative Entry .0036-.0034 Stoploss: .0030 TPs: .0043-.0045 .0050-.0053 .0054-.0058

CRYPTOCAP:XRP | 1h Possible retest of $3.24–3.26 If we see rejection, I'll look to enter around $3.12–3.09, targeting $3.35–3.47 (previous value area). Stoploss set to $3.03-$3

Still pingponging between VAL and VAH, so there is not much to update on BTC. I think patience is key here, most of all don't chase moves but position at the extremes for opposite side, then you are much better placed for continuation moves. I never try to have much expectations, but there is a smol gut feeling that ETH puts in a new high locally (let's say...

BYBIT:PUMPUSDT | 1h It has dropped below its ICO price level $0.004, currently trading around $0.00373. The drop seems driven by airdrop anticipation and broader market cooldown. If they stagger the airdrop, it could be a bullish move—reducing supply shock and pushing platform engagement. Price looks to have bottomed, but still feels uncooked — we’d prefer to...

Compressing really hard here on BTC, look at: - volume range becoming very concentrated, clean pingpong between VAL and VAH - H4 trend compressing to almost a single point - you can see from the purple lines that only internal liquidity is being taken on both sides imo this sets us up for a potential fake out setup. There is so much liquidity on both sides in...

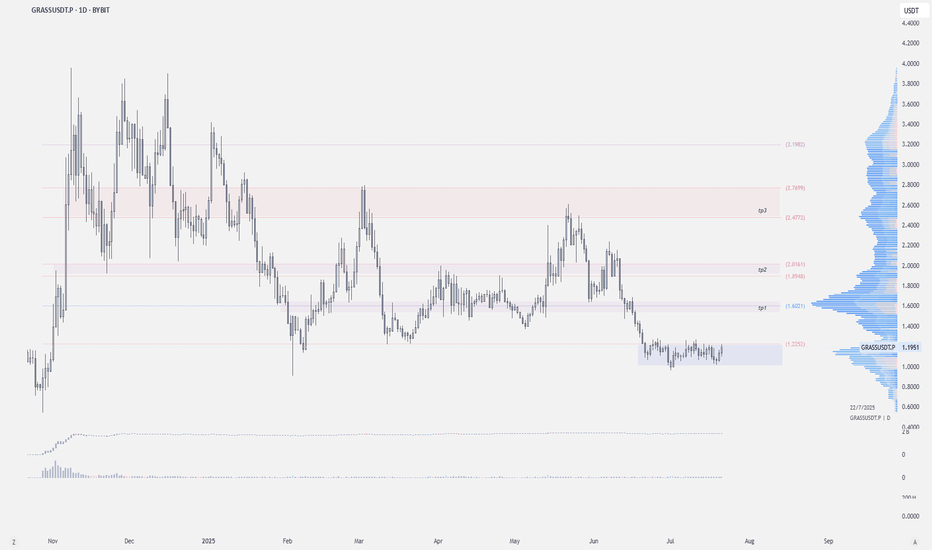

BYBIT:GRASSUSDT | 1D Consolidating within this range, setting up for a potential breakout. We can long this so long as we trade above 1.14 (equilibrium) Stoploss: Below 1.05 TPs: 1.32 to 1.40 (scalp) 1.62 to 1.67 1.84 to $2

BINANCE:BANANAS31USDT | 1h Price is trying to breakout from consolidation. If we can break .0077 resistance, we could see it retesting .0084-.0088 (initial target) Entry: .0074-.0070 Stoploss just below .0066 TPs: .0084-.0088 .0089-.0092 .0097-.0103

BYBIT:MOGUSDT | 1h MOG is one of the top ETH beta play. Downtrend has broken on lower time frame, we need to see $1.60-1.56 hold here. Acceptance above 1.62 resistance signals momentum and is ready to continue higher toward 1.68-1.74 zone, next resistance is around 1.80-$2

CRYPTOCAP:BTC | 2h Possible LTF setup: We got the 2h swing point retest. If base support holds, I’m looking for a potential move back to 119k — possibly even a gap fill to 119.7k before taking out the local lows.

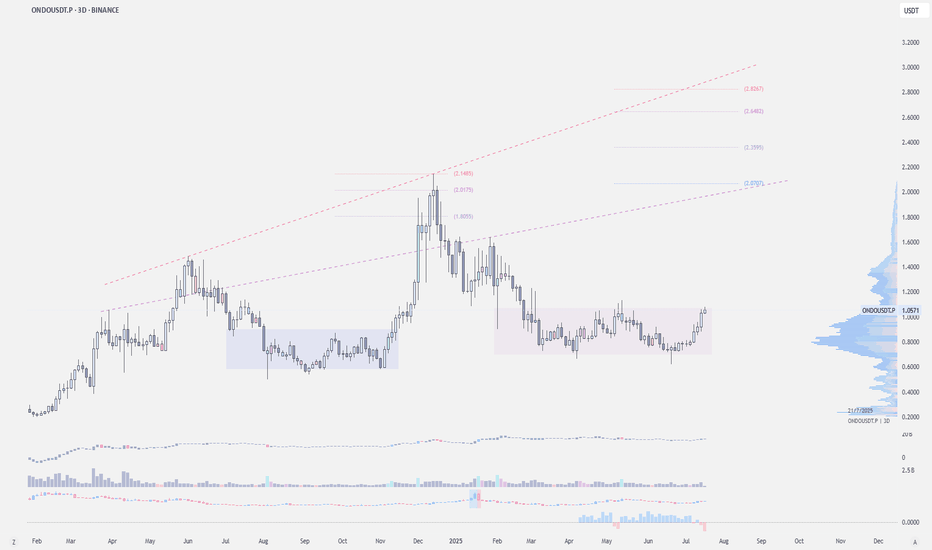

BYBIT:ONDOUSDT is showing one of the cleanest structures among altcoins right now — attempting to breakout from its accumulation. We have a strong recovery off the local bottom, reclaiming $1 and showing signs of strength. Could retest $2 or even higher till $2.8 Catalysts: — U.S. crypto legislation highlights @OndoFinance as institutional-grade — BNB Chain...