Tealstreet

ExpertCRYPTOCAP:DOGE | 1D Currently retesting the 0.25 resistance. If we break through, a push to 0.27 is likely. Expect a minor pullback to the 0.23–0.22 region before a potential full move toward 0.30 region

BINANCE:JUPUSDT | 1D Entry: .53 to .50 Stoploss: .477 (prev low) Initial target .57–.60, if we get a strong rejection here, take full profit and look to re-enter on a retest around .47–.45 TPs: .57-.60 .67-.72 .82-.90

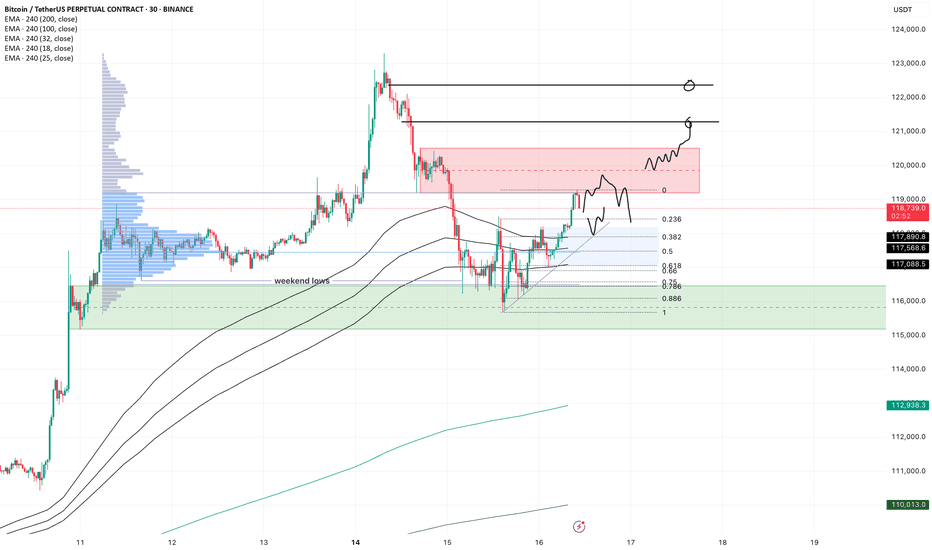

A lot of volatility, which is nice for trading either way. The high we set on Monday morning gave a very strong rejection, but in the end we simply took out the weekend lows, then reclaimed and are now grinding higher into the imbalance we left. Price is now coming into the first resistance, so we watch for either a reversal or see if price keeps grinding...

CRYPTOCAP:BTC | 1h We're establishing a new value area here Looking at a potential ltf setup: If 116.5k holds as base support, targeting a move toward 120.5k–121.4k (immediate supply zone) Similar to past price action, we might see a few pushes before breaking through ltf supply.

KUCOIN:HYPEUSDT | 4h Price just tapped the channel on its first test — expecting a minor pullback to the $47.5–$45.3 area (short term). Key support to hold now is $45–43 for potential continuation toward $57–60 zone.

If you zoom out on H4, you see that SOL just didn't take the highs there, creating bad highs with our current high. I'm looking at this little range, hoping we get another small pullback into the fvg on m5, where we can have a clean long into those highs. I kept the stop rather tight, because the lows are bad lows as well, so it's possible we get stopped, but...

BINANCE:PENGUUSDT | 4h Price is now trading above previous resistance. If this level holds as new base support, we could see a retest of the 0.028–0.032 zone Key local support to hold: 0.0175–0.014 Possible TPs: .0218-.0233 (scalp) .0262-.0282 .0295-.0326

MEXC:SPXUSDT | 4h Price is now trading above its previous resistance 1.40 We may fill the gap around 1.39s, but this one looks solid so long as we stay above 1.36 Local Support: 1.40-1.38 TPs: 1.54 to 1.58 1.67 to 1.72 1.86 to 1.92

KUCOIN:HYPEUSDT | 8h We're seeing a short-term distribution forming on the daily chart. Price has now tested the supply zone around $42 three times and is struggling to break through. There's local demand in the $34.5–$34 area, where I expect a reaction, in confluent with vwap. However, if price keeps getting rejected at $37–38, a move back to $30 is...

I'm taking profit on the long here, nice weekend pump. For me low 109s is the inflection point, I rather take profit here and start the week fresh. See previous BTC post for a more zoomed out version and higher timeframe levels, nothing has changed.

Made a composite profile of that little range we had last week. We took out the lower npoc, then took out the higher npoc and the internal equal highs (which was the only short I see for now) I'm looking for 107.2-3 to get a bullish reaction, long from there into a clean-up of the 112k highs. If the July 2nd lows don't hold, I'd look for the 101k npoc, or...

$PLUME | 6h You can risk at current price or wait for a rejection at vwap, and enter on pullback Might tag .12–.125 first, possible pullback into .105-.094 Stoploss just below .082 TPs: .12 to .125 .132 to .138 .154 to .163

BINANCE:AIXBTUSDT | 4h Valid retest of previous LTF swing point. Potential trendline break out Ltf demand: .13 to .125 Stoploss: just below .118 TPs: .142 to .149 .158 to .165 .176 to .182

BYBIT:GRASSUSDT | 6h Entry: $1.02 to .98 Conservative entry/dca level: .97 to .95 Stoploss .90 TPs: 1.12 to 1.20 1.36 to 1.42 1.46 to 1.54

BYBIT:DRIFTUSDT | 2D On the 2-day chart, there's a double bottom forming. Key support: .40 to .38 Local resistance: .44 Long Entry: .42 to .38 Stoploss: .32 TPs: .50 to .54 .72 to .87 1.02 to 1.14 @rebel

MEXC:LAUNCHCOINUSDT | 6h Entry: .122 (cmp) to .105 Stoploss: set below .086 TPs: .147 to .165 .172 to .186 .213 to .238

BINANCE:TNSRUSDT | 4h Entry: .114 (cmp) DCA level : .11 to .107 Stoploss: just below .10 TPs: .132 to .137 .148 to .154 .157 to .162

CRYPTOCAP:BTC | 6h Bitcoin is compressing below its all-time high, with 108k as the local resistance that must be reclaimed for a bullish continuation to retest the highs. I expect the price to clear some poor highs around 108.8k–109.6k before taking out the bad lows around 106.3k-105.4k As long as we hold above 104k , I believe we’re in a strong position...