TechNerdOmar

PremiumNYSE:BA is showing an ascending triangle on the weekly that is about to break upwards, giving a target of 65% rise to $377. Our stop loss is based on the most recent swing low at $187.

I'm expecting a great 2021 for TSLA overall, regardless of what investors and traders decide. I've drawn a premature triangle representing the region between two levels which I believe are crucial support and likely resistance for the next month and a half. The resistance I based on multiple different Fibonacci extensions drawn out from multiple swings. The...

Due to popular demand, I've taken my first look at NYSE:NIO . Predicting the next move has proven difficult in this particular setting. In the following, I will list all the bullish and bearish factors I have seen in the chart. I will not consider fundamentals. Bullish : The thick ascending trend line looks like it will hold, especially that we are in a...

Today I decided to zoom out and look at the big picture. I was looking at the monthly chart of NASDAQ:TSLA . I noticed that the current month is a green 8 on the TD sell setup, which means that next month is going to be the reversal signal. I imagine the candle of February to be red or a bearish pin bar (shooting star). Before I dive into the analysis, I want to...

Square ( NYSE:SQ ) is a serious growth company and is certainly a long-term investment. I'm bullish on NYSE:SQ long term, but I believe especially today, the stock has presented us with an excellent buying opportunity. As usual, I don't talk fundamentals. I'm only looking at the chart from a technical analysis perspective. Sometimes, after a stock is running...

This is just a quick notice of a possible bullish momentum on ETHBTC . The move is not confirmed yet. Notice how the circled pattern repeated before. The first time it occurred in a bear market. This time it's occurring in a bull market. And as much as I would hate to see Ethereum steal some of the market cap of Bitcoin, this is merely a trade. In my opinion,...

Bitcoin ( BITSTAMP:BTCUSD ) has been one of the trickiest assets to forecast, until institutions hopped on, and now it's THE trickiest asset to forecast. So I will give my take on it and the factors I'm considering for my mid to long term analysis. I also give a short-term forecast. But since that can change very quickly, keep following this idea for updates. I...

EURONEXT:BN is showing signs that it has already bottomed out and on its way up. We have a relatively safe trade here. RSI divergence suggests a reversal of trend. It suggests that the low of 29 October 2020 at €46 is the lowest Danone will reach in the short- to mid-term (few months). An ascending triangle is showing upward momentum. This suggests a...

Today's impressive AMZN daily candle signals a breakout of a 4-month long triangle. Measuring the height of the triangle at its basis gives a target of $3886, that's 18% profit. Taking the stop loss a bit below the previous swing low at $3050 gives us a clean trade of 2:5 risk-reward ratio. The day hasn't closed yet but let's hope the green candle stays solid....

After one of the most unexpected years, I thought I should take a step back and look at macroeconomics a little bit, at one specific chart that I've been watching. That is the German Government 10-Year Bond Yield (DE10Y). I've been anticipating a signal in that chart that will indicate massive shift in global market trends and will bring us closer to the next...

I believe that on this week, the US stock market will open below its close of last Friday. I will list the signals that lead me to this prediction: As you can see, I'm analyzing the DXY chart. DXY has an inverse relation with the US stock market. Whenever, DXY rises, TVC:SPX drops. In the chart, we see a TD buy setup defined by the red 9 candle, a...

TSLA has reached the target we set last week, but that's not all. There are many factors that suggest we should not exit our longs, at least not completely. But before I list those factors, let me first clarify that I'm talking about leveraged longs, not stock. If you own shares in Tesla, then I would not advise selling them, even if the stock price went down 50%....

NYSE:LMND is the new and promising tech company in the insurance market. It's beyond promising; it's already a product with proven scalability and disruptive features to the aging insurance business model. Lemonade follows a creative insurance model. To understand this, consider the conventional insurance business model where companies are incentivized to NOT...

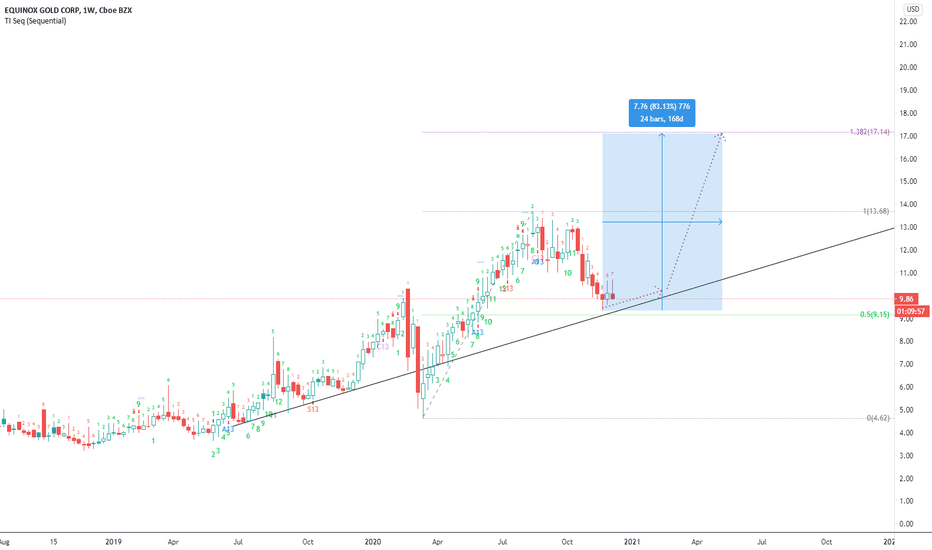

I believe Equinox Gold is valued much higher than current stock price, but I'm only following technical analysis here. This trend line has held for 18 months, and the swing gives indication for the volume of the coming upward momentum. I chose 1.382 of the previous swing to determine my target. I'm not confident about the target. I think time analysis will prove...

NYSE:CRK is showing signs of a new momentum upwards. On the weekly, we see higher and higher lows of RSI since May 2019. On the daily, we see a green 2 above a green 1 on the TI Sequential indicator. Six major reversals since June 2015. Judging from the timing of previous swings, I suspect this swing will take 43 days and reach a high of $7. That's 48% gain....

AAPL has confirmed a bullish trend on 1 Dec 2020 through three signals: 1. Breaking the downard arch (in red) starting on 2 Sep 2020. 2. printing a green 2 above a green 1 on the TD sequential indicator. 3. Launching off of the bottom of the blue channel. 4. The two arches (red and green) act like a triangle which was also broken upwards. To me, this is a very...

There is no doubt about the value of Tesla as a company. The proven value they provide is obvious: reducing EV manufacturing cost, making the best energy storage, launching self-driving, Tesla insurance, and more to come. However, regardless of fundamentals, this is a technical analysis that only considers the chart. That is generally my style. Today's green...

Time Fib plus a descending triangle plus some economics about commodity prices and the deflationary dollar for the next 2 years; all that says that copper is dropping by 43% from its current price at $2.5 per pound, reaching $1.42 by the end of 2022. This breaks the descending triangle downward setting a target of $0.83. It sounds crazy, but I'm simply looking at...