The_Archi-tect

EssentialGreetings Traders, In today’s analysis of EURJPY, recent price action confirms the presence of bullish institutional order flow. As a result, we aim to align ourselves with this directional bias by seeking high-probability buying opportunities that target the long-term highs, where a significant liquidity pool resides. Key Observations: Weekly Timeframe...

Greetings Traders, In today’s analysis of USDCAD, recent price action confirms the presence of bearish institutional order flow. As a result, we aim to align ourselves with this directional bias by identifying strategic selling opportunities. Key Observations: Weekly Timeframe Insight: Last week's candle rebalanced a weekly Fair Value Gap (FVG), indicating...

Greetings Traders, In today’s analysis of NZDCHF, recent price action confirms the presence of bearish institutional order flow. As a result, we aim to align ourselves with this directional bias by identifying strategic selling opportunities. Key Observations on H4: Bearish Market Structure Shift: The H4 timeframe has recently confirmed a bearish shift in...

Greetings Traders, In today’s analysis of EURUSD, recent price action confirms the presence of bullish institutional order flow. As a result, we aim to align with this narrative by seeking high-probability buying opportunities at key institutional arrays. Higher Timeframe Context: On the weekly timeframe, last week’s candle retraced into a Re-Delivered...

Welcome back, traders! In today’s video, we’ll be conducting a Forex Weekly Outlook, analyzing multiple currency pairs from a top-down perspective—starting from the higher timeframes and working our way down to the lower timeframes. Pairs to focus on this Week: EURUSD USDCAD EURGBP EURJPY GBPCHF USDCHF NZDCHF EURNZD Our focus will be on identifying...

Greetings Traders, In today’s analysis of EURGBP, we observe that institutional order flow on the H4 timeframe has recently shifted bearish. This provides us with a clear directional bias to look for shorting opportunities in line with the prevailing higher timeframe trend. Higher Timeframe Context: On the weekly timeframe, price action is currently drawing...

Welcome back, traders! In today’s video, we’ll be conducting a Forex Weekly Outlook, analyzing multiple currency pairs from a top-down perspective—starting from the higher timeframes and working our way down to the lower timeframes. Pairs to focus on this Week: USDJPY AUDJPY CADJPY EURGBP GBPCHF USDCHF NZDCHF EURNZD Our focus will be on identifying...

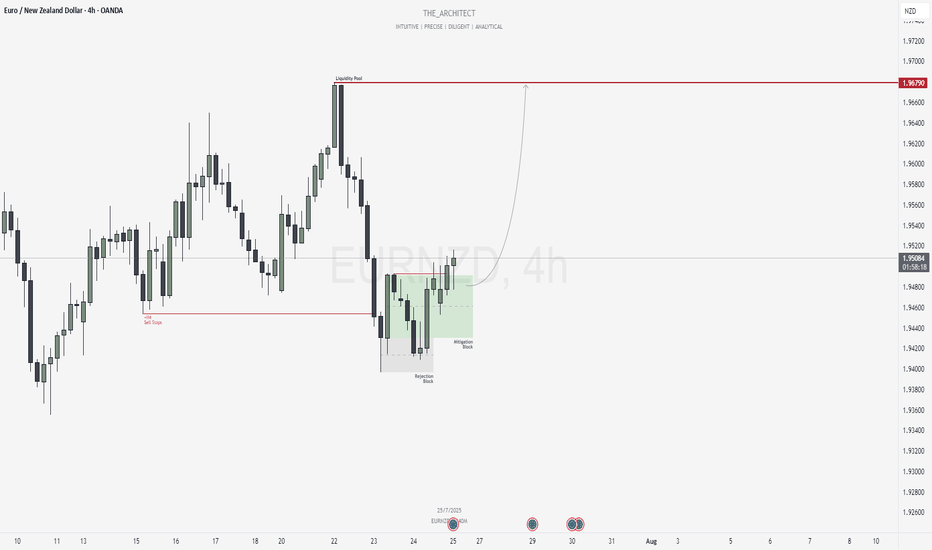

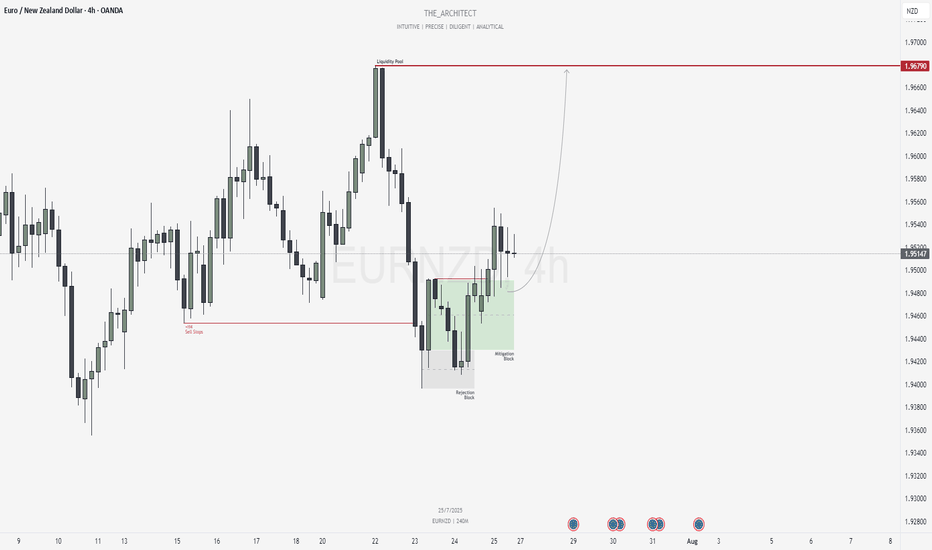

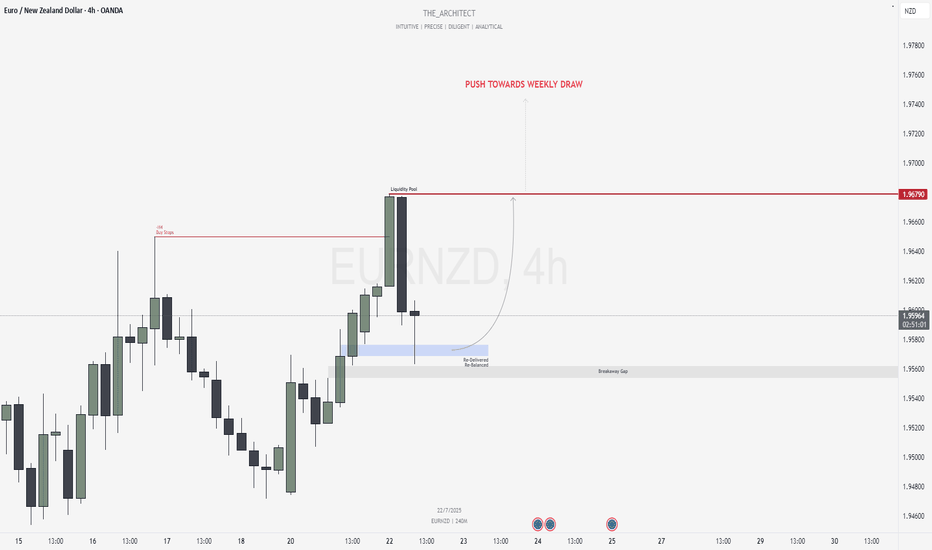

Greetings Traders, In today’s analysis of EURNZD, we observe that institutional order flow on the H4 timeframe has recently shifted bullish. This alignment now provides us with a clear bias to seek buying opportunities in line with the predominant higher timeframe trend. Higher Timeframe Context: The weekly timeframe is currently delivering bullish order flow....

Greetings Traders, In today’s video, I’ll be walking you through my end-of-week trade outlook, breaking down every setup I took throughout the week. This session is designed to offer insight into how I apply risk management, trading rules, and maintain psychological discipline in real-time market conditions. Whether you're struggling with emotional trading,...

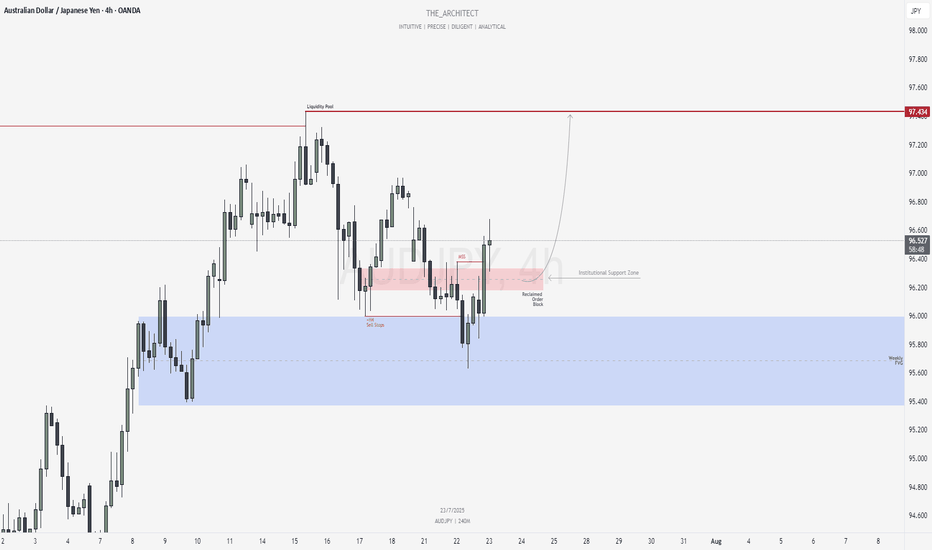

Greetings Traders, In today’s analysis of AUDJPY, we observe a recent bullish market structure shift (MSS), signaling potential for continued upward movement. With this in mind, we aim to capitalize on buying opportunities at key institutional points of interest to target higher premium prices. Higher Timeframe Context: The weekly timeframe maintains a clear...

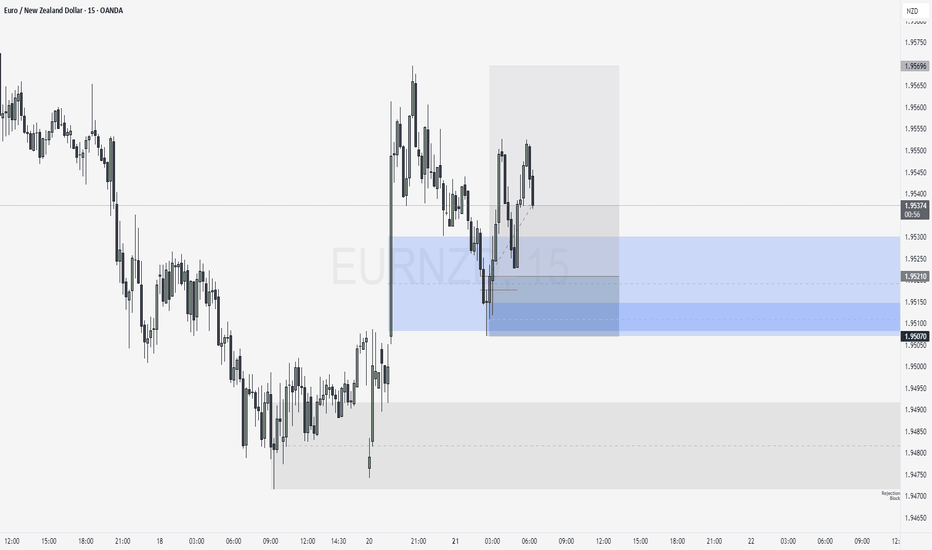

Greetings Traders, In today’s analysis of EURNZD, we identify that the current institutional order flow is bullish. With this bias in mind, we aim to capitalize on high-probability buying opportunities from key points of interest aligned with institutional behavior. Higher Timeframe Context: The weekly timeframe is showing a clear bullish narrative. This...

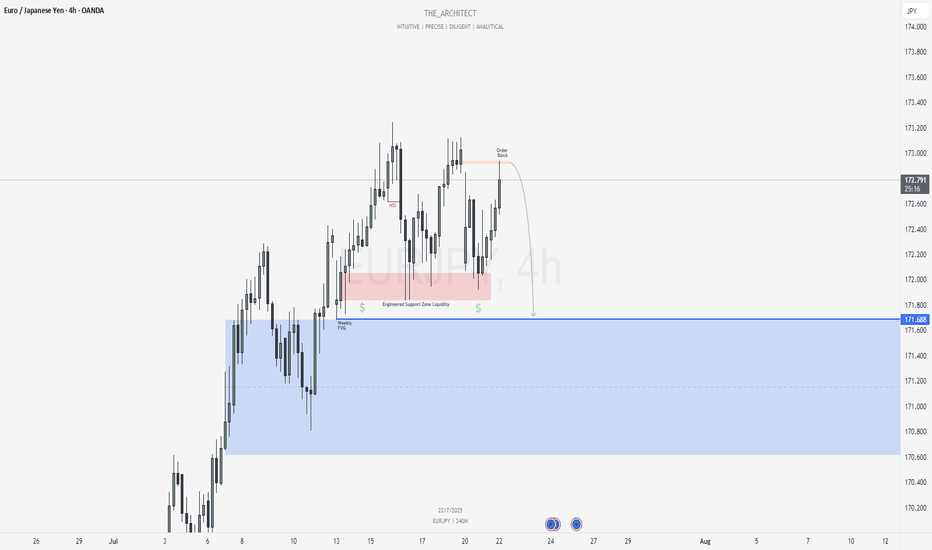

Greetings Traders, In today’s analysis of EURJPY, we observe that a Market Structure Shift (MSS) has recently occurred on the H4 timeframe, indicating a potential change in directional bias. This suggests that price may begin to draw toward the Weekly Fair Value Gap (FVG), presenting a favorable opportunity to align with bearish order flow. Higher Timeframe...

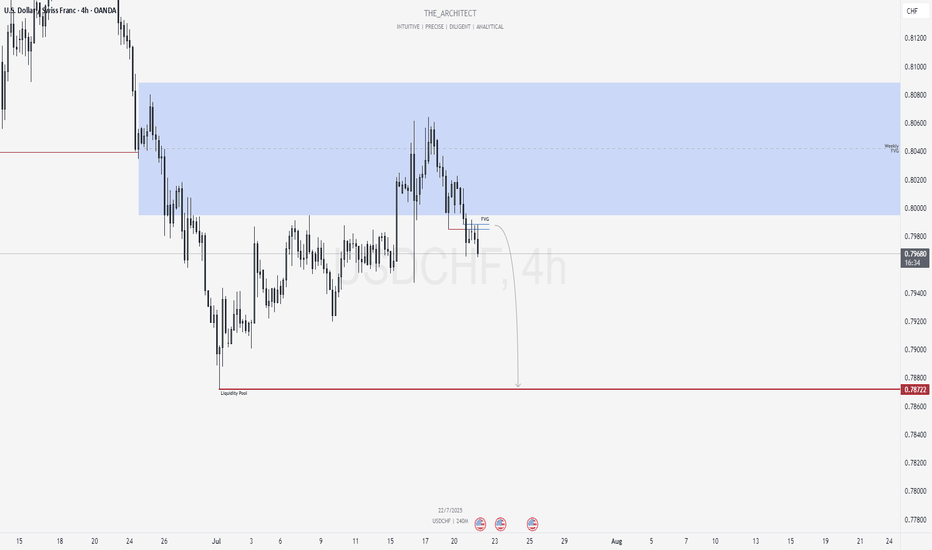

Greetings Traders, At present, USDCHF is exhibiting a clear shift in institutional order flow toward the bearish side. In response, we aim to align with this directional bias by identifying high-probability selling opportunities within premium price zones. Higher Timeframe Context: The weekly timeframe remains bearish, offering a macro-level bias. Price...

Welcome back, traders! In today’s video, we’ll be conducting a Forex Weekly Outlook, analyzing multiple currency pairs from a top-down perspective—starting from the higher timeframes and working our way down to the lower timeframes. Pairs to focus on this Week: EURUSD USDJPY AUDJPY CADJPY EURJPY GBPCHF USDCHF NZDCHF EURNZD Our focus will be on identifying...

Welcome back, traders! In today’s video, we’ll be conducting a Forex Weekly Outlook, analyzing multiple currency pairs from a top-down perspective—starting from the higher timeframes and working our way down to the lower timeframes. Currency Pairs: EURUSD USDCAD AUDUSD EURGBP EURJPY GBPCHF USDCHF NZDCHF NZDUSD EURNZD Our focus will be on identifying...

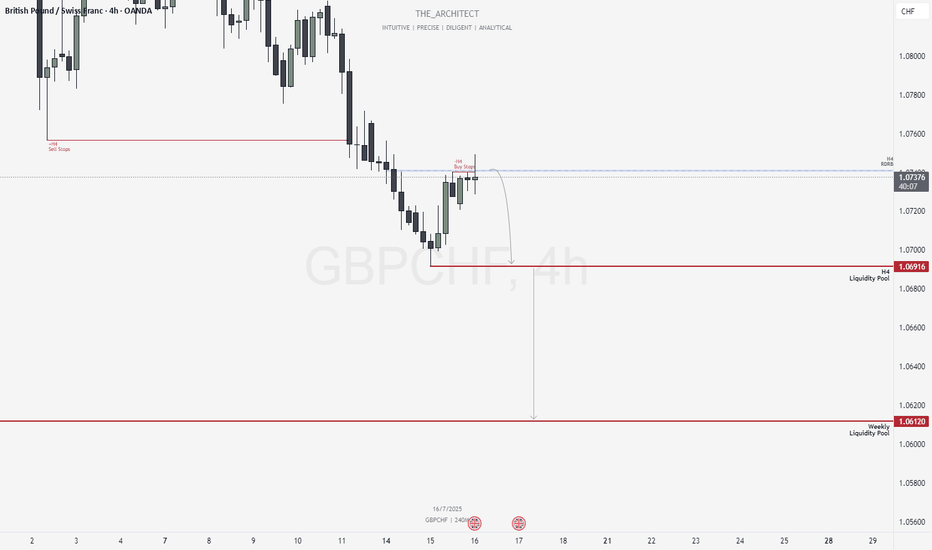

Greetings Traders, In today’s analysis of GBPCHF, we observe that the institutional order flow is currently bearish, and as such, we aim to align with this bias by identifying selling opportunities from key institutional resistance zones. Higher Timeframe Context: Weekly TF: The weekly timeframe, which serves as our macro bias, is firmly bearish. This...

Greetings Traders, In today’s analysis of EURNZD, we observe that the market is currently operating within bullish institutional order flow. It is therefore essential that we align our bias with this narrative by focusing on buying opportunities. Market Context: Higher Timeframe Alignment: The weekly timeframe is showing a bullish draw on liquidity, and...

Greetings Traders, In today’s analysis of USDCHF, we observe that the H4 timeframe is currently delivering bullish institutional order flow. As a result, our directional bias is aligned with seeking buying opportunities that reflect this bullish momentum. Market Context: Higher Timeframe Objective: The current draw on liquidity is aimed at a Weekly Fair...