IDX:INDF - VCP +) 1. Low risk entry point on a pivot level. 2. Volume dries up. 3. Price has been above the MA 50 > 150 > 200 4. Price is within 25% of its 52-week high. 5. Price is over 25% of its 52-week low. 6. The 200-day MA has been trending upwards for over a month. 7. The RS Rating is above 70 (71). EPS Growth: a. Quarterly QoQ: - b. Quarterly YoY:...

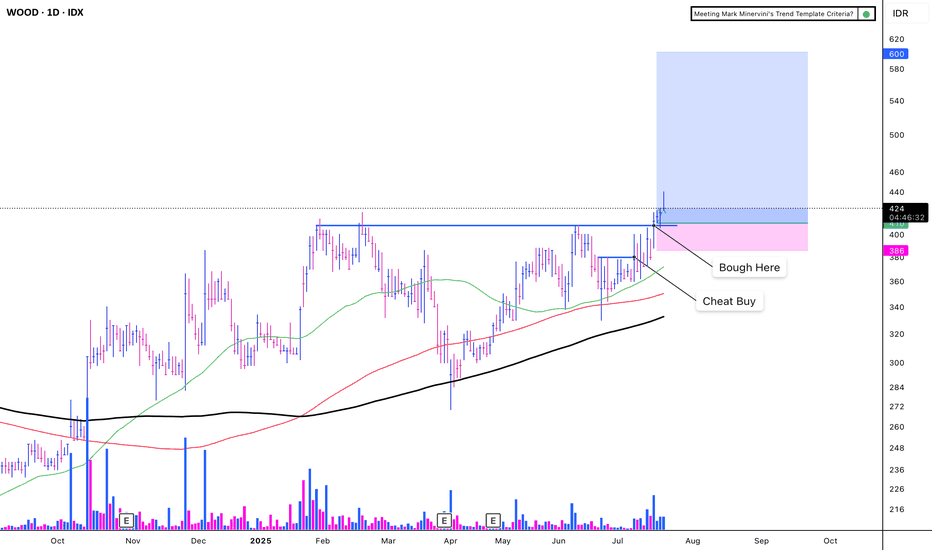

IDX:WOOD - CUP WITH HANDLE (+): 1. Low risk entry point 2. Volume dries up. 3. Price has been above the MA 50 for over 10 weeks, with values exceeding 150, 200, and 300. 4. Price is within 25% of its 52-week high. 5. Price is over 30% of its 52-week low. 6. The 200-day MA has been trending upwards for over a month. 7. The RS Rating is above 70 (85). 8. Carbon...

IDX:TAPG - VCP (+): 1. Low risk entry point on a pivot level. 2. Volume dries up. 3. Price has been above the MA 50 for over 10 weeks, with values exceeding 150, 200, and 300. 4. Price is within 25% of its 52-week high. 5. Price is over 30% of its 52-week low. 6. The 200-day MA has been trending upwards for over a month. 7. The RS Rating is above 70 (86). 8....

IDX:DKFT - POWER PLAY (+) 1. Low risk entry point on a pivot level. 2. Volume dries up. 3. Price has been above the MA 50 for over 10 weeks, with values exceeding 150, 200, and 300. 4. Price is within 25% of its 52-week high. 5. Price is over 30% of its 52-week low. 6. The 200-day MA has been trending upwards for over a month. 7. The RS Rating is above 70...

IDX:BNLI - VCP (+) 1. Low risk entry point on a pivot level. 2. Volume dries up. 3. Price has been above the MA 50 for over 10 weeks, with values exceeding 150, 200, and 300. 4. Price is within 25% of its 52-week high. 5. Price is over 30% of its 52-week low. 6. The 200-day MA has been trending upwards for over a month. 7. The RS Rating is above 70 (98). 8....

IDX:TRUK - VCP (+): 1. Low risk entry point on pivot level 2. Volume dries up 3. Price above MA 50 > 150 > 200 over 10 weeks 4. Price is within 25% of 52 weeks high 6. Price is over 30% of 52 weeks low 7. 200 day MA trending up over 1 month 8. RS Rating is over 70 (84) 9. Breakout with huge volume (-) 1. There is nothing good with the fundamental

IDX:JARR - VCP (+): 1. Low risk entry point on pivot level 2. Volume dries up 3. Price above MA 50 > 150 > 200 over 10 weeks 4. Price is within 25% of 52 weeks high 6. Price is over 30% of 52 weeks low 7. 200 day MA trending up over 1 month 8. RS Rating is over 70 (85) 9. EPS Growth: a. Quarterly QoQ: +56.12% b Quarrerly YoY: +255.56% b. TTM YoY: +208.21% c....

IDX:PSAB - CUP WITH HANDLE (+): 1. Low risk entry point on pivot level 2. Volume dries up 3. Price above MA 50 > 150 > 200 over 10 weeks 4. Price is within 25% of 52 weeks high 6. Price is over 30% of 52 weeks low 7. 200 day MA trending up over 1 month 8. RS Rating is over 70 (92) 9. EPS Growth: a. Quarterly QoQ: +47.80% b. Quarterly YoY: +436.36% b. TTM YoY:...

IDX:SAME - VCP (+): 1. Low risk entry point on pivot level 2. Volume dries up 3. Price above MA 50 > 150 > 200 over 10 weeks 4. Price is within 25% of 52 weeks high 6. Price is over 30% of 52 weeks low 7. 200 day MA trending up over 1 month 8. RS Rating is over 70 (80) 9. 9. EPS Growth: a. Quarterly QoQ: +852.30% b. Quarterly YoY: +570.99% b. TTM YoY: -3.34% c....

IDX:MFIN - VCP (+): 1. Low risk entry point on pivot level 2. Volume dries up 3. Price above MA 50 > 150 > 200 over 10 weeks 4. Price is within 25% of 52 weeks high 6. Price is over 30% of 52 weeks low 7. 200 day MA trending up over 1 month 8. RS Rating is over 70 (95) 9. EPS Growth: a. Quarterly QoQ: +22.24% b Quarrerly YoY: +185.92% b. TTM YoY: +22.24% c....

IDX:TAPG VCP (+): 1. Low risk entry point on pivot level 2. Volume dries up 3. Price above MA 50 > 150 > 200 over 10 weeks 4. Price is within 25% of 52 weeks high 6. Price is over 30% of 52 weeks low 7. 200 day MA trending up over 1 month 8. RS Rating is over 70 (84) 9. Biggest net income +197.70% on Q4 2024 vs Q4 2023 (-) 1. Breakout with huge volume but...

IDX:NICL VCP (+): 1. Low risk entry point on pivot level 2. Volume dries up 3. Price above MA 50 > 150 > 200 over 10 weeks 4. Price is within 25% of 52 weeks high 6. Price is over 30% of 52 weeks low 7. 200 day MA trending up over 1 month 8. RS Rating is over 70 (93) 9. EPS Growth: a. Quarterly QoQ: +45.05% b. TTM YoY: +872.03% c. Annual YoY: +1,029.03% (-) 1....

IDX:MUTU - 3 Weeks Tight (+): 1. Low risk entry point when stock pause 2. Volume significantly drop on week 2, and huge volume on week 1 3. Price above MA 50 > 150 > 200 over 10 weeks 4. Price is within 25% of 52 weeks high 6. Price is over 30% of 52 weeks low 7. 200 day MA trending up over 1 month 8. RS Rating is over 70 (90) 9. High volume on breakout (-) 1....

IDX:MLPL - Low Cheat (+): 1. Very Low risk entry point on pivot level 2. Volume dries up 3. Price above MA 50 > 150 > 200 over 10 weeks 4. Price is over 30% of 52 weeks low 5. 200 day MA trending up over 1 month 6. RS Rating is over 70 (93) 7. VCP characteristic 10. Price breakout with huge volume (-) 1. Price is below 25% of 52 weeks high Try to Adding with...

IDX:WIRG (+): 1. Very Low risk entry point on pivot level 2. Volume dries up 3. Price above MA 50 > 150 > 200 over 10 weeks 4. Price is within 25% of 52 weeks high 6. Price is over 30% of 52 weeks low 7. 200 day MA trending up over 1 month 8. RS Rating is over 70 (84) 9. Additional aspect about AI sentiment 10. Price breakout with huge volume (-) 1. I am not...

ELIT - LOW CHEAT (+): 1. Low risk entry point 2. Volume dries up 3. Price above MA 50 > 150 > 200 over 10 weeks 4. Price is within 25% of 52 weeks high 6. Price is over 30% of 52 weeks low 7. 200 day MA trending up over 1 month 8. RS Rating is over 70 (82) 9. Stock build VCP Characteristic Try to Adding with some basic fundamental about EPS growth: a. Quarterly...

IDX:ALDO (CUP WITH HANDLE) 28-10-2024 (+): 1. Low risk entry point, first time the stock showing it’s buying point 2. Volume dries up on handle 3. Stock showing it’s strength while market is corrected 4. Price above MA 50 > 150 > 200 over 10 weeks 5. Price is within 25% of 52 weeks high 6. Price is over 30% of 52 weeks low 7. 200 day MA trending up over 1...

IDX:PBID (3C) 14-10-2024 (+): 1. Low risk entry point 2. Volume dries up 3. Price above MA 50 > 150 > 200 over 10 weeks 4. Price is within 25% of 52 weeks high 5. Price is over 30% of 52 weeks low 6. 200 day MA trending up over 1 month 7. RS Rating is over 70 (86) (-): 1. Not really in Stage 2-a uptrend 2. No big volume on the breakout