Trade_with_Ray

Gold has broken into uncharted territory, printing a new ATH, reflecting ongoing global uncertainty and strong safe-haven demand. As per my analysis, bullish momentum is likely to continue today, supported by both technical and fundamental factors. 🔍 Technical Outlook: Structure: Strong bullish structure with consecutive higher highs and higher lows. Support...

💡 Bias: Sideways to Bearish 🔍 Technical Outlook: Gold is currently consolidating within a sideways-to-bearish structure, trading between the 3225 – 3245 resistance zone and the 3185 – 3180 support zone. 📌 Key Zones: 🔺 Resistance: 3225 – 3245 (Liquidity zone / Potential sell area) 🔻 Support: 3185 – 3180 (Liquidity zone / Potential bounce area) 🎯 Target...

Gold (XAUUSD) is displaying strong bullish momentum today, with price action indicating a potential rally toward the 3157 level. The metal has established a key demand zone between 3115 - 3125, from where buyers are likely to step in. 🔹 Trading Plan & Key Levels: ✅ Entry Zone: 3115 – 3125 📍 ✅ Bullish Targets: 3157 ➝ 3170 🎯 ✅ Invalidation: Below 3110 ❌ 🔹...

Gold (XAUUSD) remains firmly bid today, driven by geopolitical uncertainties, fueling safe-haven demand. The metal has surged from 3098 to 3114, with upside momentum suggesting further gains towards key resistance zones. 🔹 Technical Analysis: ✅ Trend Bias: Bullish 📊 ✅ Key Levels: Support: 3098 | 3085 Resistance: 3135 | 3142 ✅ Indicators: EMA: Price holding...

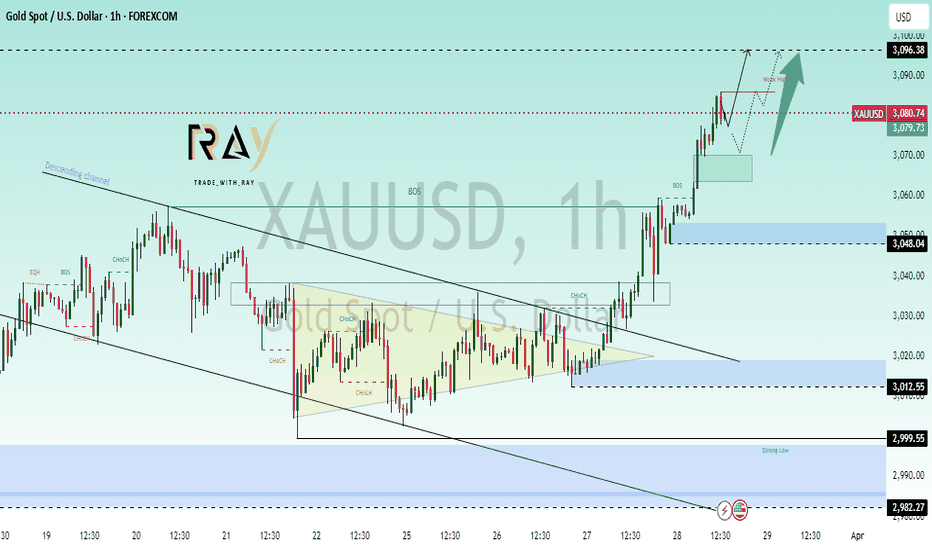

🔹 Market Outlook: Amid ongoing economic tensions and a brewing trade war, gold remains a safe-haven asset, pushing prices to new historic highs. 🔹 Technical Analysis: 📈 Elliott Wave Theory suggests a bullish continuation, with Gold expected to reach $3,096. 📊 Price is moving from $3,065 to $3,070, with key upside targets at $3,085 & $3,096. 🎯 Trading Plan: ✅...

🔹 Market Sentiment: Bullish ✅ 🔍 Technical Analysis: 📈 Trend: Gold remains in an upward trajectory, forming higher highs & higher lows. 📊 Key Indicators: EMA & Market Structure: Price holding above key EMAs signals continued bullish momentum. RSI: Trending towards overbought zone, confirming strong buying interest. Support & Resistance: Support: 3014 – 3021...

🔹 Market Sentiment: Sideways to Bullish 📈 🔹 Optimal Buying Zone: 3018 – 3024 🔹 Upside Targets: 3047 & 3056 🔍 Technical Analysis: 📊 Trend Outlook: Gold is consolidating but leaning bullish, respecting key support levels. 📈 Key Indicators: EMA & Market Structure: Price holding above key EMAs signals potential upside. RSI: Near neutral, allowing room for further...

🔹 Market Sentiment: Strong bullish bias amid geopolitical tensions & FOMC event risk 🌍⚠️ 🔹 Key Levels: 🔸 Resistance Targets: 3055 🎯 | 3061 🚀 🔸 Support Zone: 3015 – 3018 🛑 📊 Technical Analysis: ✅ Trend: Bullish continuation 📈 ✅ Indicators: EMA & RSI confirm strong momentum 🔥 ✅ Key Zones: Demand area at 3015 – 3018 for potential long entries 🎯 ✅ Market Structure:...

🔹 Market Sentiment: Bullish bias amid geopolitical tensions 🌍🔥 🔹 Key Technical Levels: 🔸 Resistance: 3033-3040 📊 🔸 Support: 2999 – 3004 🛑 📊 Technical Analysis: ✅ Trend: Bullish momentum remains strong 📈 ✅ Indicators: EMA & RSI confirm upside strength 📊 ✅ Key Zones: Optimal long entries around 2999 – 3004 for a potential move toward 3033 🎯 ✅ Market Structure:...

🔍 Technical Analysis: 📉 Trend: Gold remains under bearish pressure, with price rejecting key resistance levels. 📊 Key Indicators: EMA & Market Structure: Price trading below key EMAs signals bearish momentum. RSI: Near overbought zone, indicating potential downside. Support & Resistance: Resistance: 2994 – 3005 (Sell Zone) Support: 2973 – 2956 (Bearish...

🔸 Market Sentiment: Gold remains sideways to bullish 📈, with key technical and fundamental factors shaping price action. 🔍 Technical Outlook: 📌 Buy Zone: $2,906 – $2,910 (Key support area) 🎯 Target 1: $2,930 (Resistance & liquidity zone) 🎯 Target 2: $2,939 (Major supply zone) 🔹 Key Indicators: ✅ EMA Support: Price holding above key moving averages ✅ RSI:...

🔻 Bearish Scenario: Gold is exhibiting a sideways-to-bearish structure today. A potential downside move is expected from the $2,899 - $2,904 resistance zone, with targets at $2,878. 📈 Retracement & Bullish Pullback: If price stabilizes near $2,899, we may see a temporary bullish move toward $2,910 before another bearish leg resumes. 🔍 Technical Analysis: 📉...

🔹 Market Outlook: Gold (XAUUSD) is exhibiting a sideways-to-bullish bias, with price action gradually strengthening from $2899 to $2901. Key upside targets are projected at $2929 and $2945. 🔹 Technical Analysis: ✅ Trend Bias: Bullish above $2899, confirming upside momentum 📊 ✅ Key Support Levels: $2899 / $2885 ✅ Key Resistance Levels: $2929 / $2945 ✅...

🔸 Market Outlook: Gold (XAUUSD) is exhibiting a sideways-to-bullish bias ahead of the NFP report, with price action fluctuating between $2900 - $2890 before potential upside movement. 📈 🔸 Key Technical Levels: ✅ Support: $2890 | $2882 ✅ Resistance: $2929 | $2936 🔸 Technical Analysis: 🔹 Trend: Mild bullish momentum above $2890. 🔹 Indicators: EMA 50 & 200: Price...

🔹 Technical Analysis: Gold is currently testing a strong resistance zone at $2929–$2931. A failure to break above this level could trigger a bearish retracement towards the key support levels at $2902–$2894. 📉 Bearish Confluence: Market Structure: Price showing signs of exhaustion near resistance. Indicators: RSI nearing overbought territory, potential for a...

🔹 Market Sentiment: Gold appears bearish today, but key technical signals indicate a potential reversal. 🔹 Technical Outlook: 📊 RSI (14): Oversold, forming a bullish divergence, signaling possible buying interest. 📉 Support Zone: $2853 – $2845 (Potential bearish continuation level). 📈 Resistance Levels: $2865 / $2878 (If bullish momentum builds). 🔍 Price Action:...

🔹 Technical Outlook: 📍 Bearish Structure: Gold is trading below the key pivot level, reinforcing a downside bias. 📍 Key Resistance (Sell Zone): $2896 – $2903 🛑 📍 Support Levels: First Target: $2878 🎯 Second Target: $2864 🏹 📍 Indicators & Price Action: ✅ Price is below the moving averages, confirming a bearish trend. ✅ RSI signals downside momentum, staying below...

📉 Technical Outlook: Gold remains under bearish pressure, with key downside levels at $2,930, $2,923, and $2,918. Price is trading below key EMAs, signaling continued weakness. RSI is showing bearish momentum, indicating further downside potential. ATR suggests moderate volatility, supporting a potential move lower. 🔹 Key Technical Levels: 📍 Resistance: 2945 |...