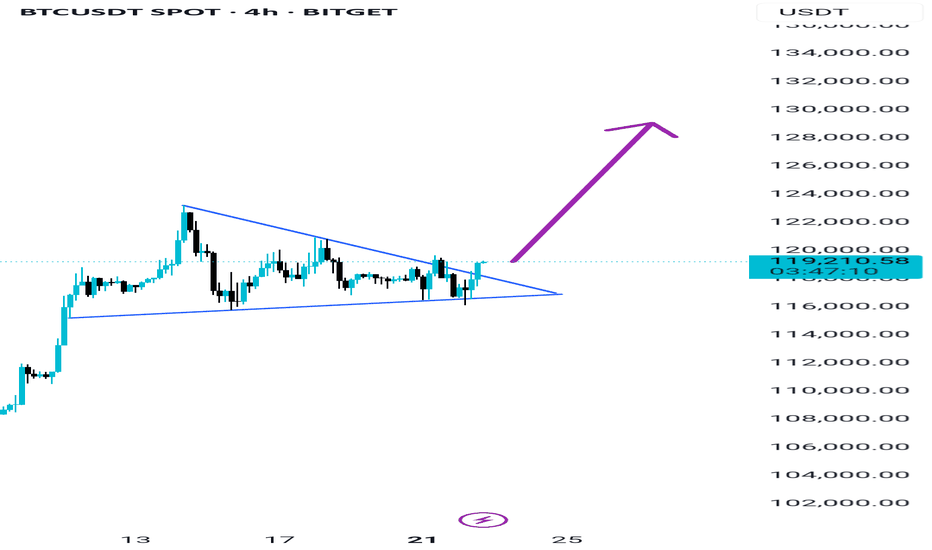

Breakout is done on 4H wait for retest and you can take long after confirmation TP 128K 130K For now

Now that Bitcoin dominance has officially broken its uptrend and started a confirmed downtrend — as the previous higher low has been taken out — the key thing to watch next is the 55–56% range. Once BTC dominance enters that zone, you may consider taking partial profits from altcoins if you'd like, as this area could trigger a bounce where dominance attempts a...

Bitcoin is currently holding the demand zone between $116K and $117K, which also aligns with the retest area of a previously broken trendline—making this zone quite strong. If BTC manages to close above $117.8K on lower timeframes, we could see the beginning of a new uptrend targeting around $130K. However, if this zone fails due to any unexpected news or events,...

It seems that Bitcoin dominance , after a long and exhausting uptrend, is finally showing signs of fatigue. The momentum appears to be fading, and a new downtrend has already begun. As you can observe, both the long-term and short-term trendlines have been broken on the daily timeframe, clearly indicating that Bitcoin dominance is shifting into a downtrend. So,...

Everyone seems to be ignoring the breakdown of the rising wedge on the weekly timeframe of USDT dominance. While many are clinging to small hopes of Bitcoin reaching new highs—some targeting $130K, others $150K—they’re overlooking a major pattern that could flip the entire game. Just think for a moment: if this pattern plays out and USDT dominance hits its...

Everyone is selling their altcoins out of fear after minor pumps, but they don’t realize that Bitcoin dominance is only retesting its supply zone. It has already broken its structure, indicating a shift into a downtrend. This retest is not a reversal—yet people are spreading fear among each other as if something major is about to happen. Many will miss what’s...

Just Trust the process BTC DOMINANCE last leg You can see here BTC Dominance already broked it's uptrend and started it's downtrend it is just taking a move up to retest. Soon you will see if after touching the black box area it breaks the structure on lower time frame get ready for huge Altseason 🚀 🚀 🚀 🚀 🚀 🚀 🚀 Don't worry it's just a pull back Only the...

Worried about Btc Dominance? Don't Worry i have a Good news Waiting for Altseason congratulations 🎊 Bitcoin Dominance (BTC.D) is showing signs of making one last upward push towards the key resistance zone between 64.60% to 65%. This area has historically acted as a strong barrier, and a rejection here could signal a significant shift in market...

Ignore the smaller Time frames guys let's see the bigger and better picture of where BTC can top this cycle As you can see i have shared the Monthly Chart of USDT Dominance. It's already broke the trendline support and rising channel on monthly. NOW we are heading to our targets of approx 1.91% and 1.5%. It seems like a joke today but yes it's possible. Ignore...

Bitcoin Dominance Peaked Finally 🚀 🚀 You can see in the image that Bitcoin Dominance is now Breaking its Bullish Structure, and clearly indicating that it's topped and Altseason is ready 40x to 50x gains are coming for you if you are still here surviving all the pain and Blood in past years and months. Congratulations to you. People will call you lucky but they...

The Final Level of Bitcoin Dominance: Where the Altcoin Season Begins Bitcoin Dominance (BTC.D) has long been a critical indicator in the crypto market — a gauge of how capital is distributed between Bitcoin and the rest of the altcoin market. Over the past months and years, we’ve watched Bitcoin's dominance fluctuate, often controlling the direction and...

- BTC Dominance Nearing 0.786 Fibonacci Level – Altseason on the Horizon? Bitcoin dominance, which measures BTC’s market cap relative to the total cryptocurrency market, is currently approaching a critical technical level — the 0.786 Fibonacci retracement, precisely around 66.20%. Historically, this level has acted as a strong resistance zone, often signaling...

Bitcoin's dominance has failed to establish a new high, suggesting a significant weakening and a lack of upward momentum. This failure strongly indicates that Bitcoin's dominance is poised for a reversal from this point, potentially initiating a new downtrend. Furthermore, a compelling bearish divergence is forming on Bitcoin's dominance on the weekly timeframe's...

Usdt dominance is finally topping out and going to start it's new downtrend And massive bull run in Bitcoin and your altcoins as well like i have discussed with you in my previous ideas you can check them out. But 3.7% support is now weak My potential targets for usdt dominance reveal is approx 2.7 and 2.5 range So plan accordingly don't exit too early and don't...

I'll Short BTC if I see it at 86k once again Too much weakness on 4h time frame But I'll use a tight stoploss there above the high My tp will be at 81000 or 80000 But at the end I'll definitely wait for the confirmations on the lower time frames because without confirmations it's total loss in trading. This trade is 1:10 risk to reward So it does not...

USDT Dominance is currently heading toward a key demand zone between 5.33 and 5.16, which could act as a strong support area. From this zone, we might witness a short-term bounce or upward movement. This could temporarily cause corrections in both Bitcoin and altcoins, so don't be alarmed—this is a healthy part of market behavior. After a possible slight move...

Bitcoin Dominance Is Very Close to a Downtrend – Altcoin Season Is Near Bitcoin dominance is likely to enter a downtrend soon—because no uptrend lasts forever. This shift may occur within just a few weeks. As you can see in our current Scenario1 , Bitcoin dominance might sweep its previous high and reverse from there. However, if a daily candle closes above...

BTC Price Action Analysis: Short-Term Correction Insight Bitcoin (BTC) is currently undergoing a short-term correction, likely heading towards the $78K zone to retest its demand area. This is a natural move in market structure, so there’s no need to panic. The retest of this level could provide the necessary momentum for a bounce back toward the upside, aligning...