TradingProfessor10

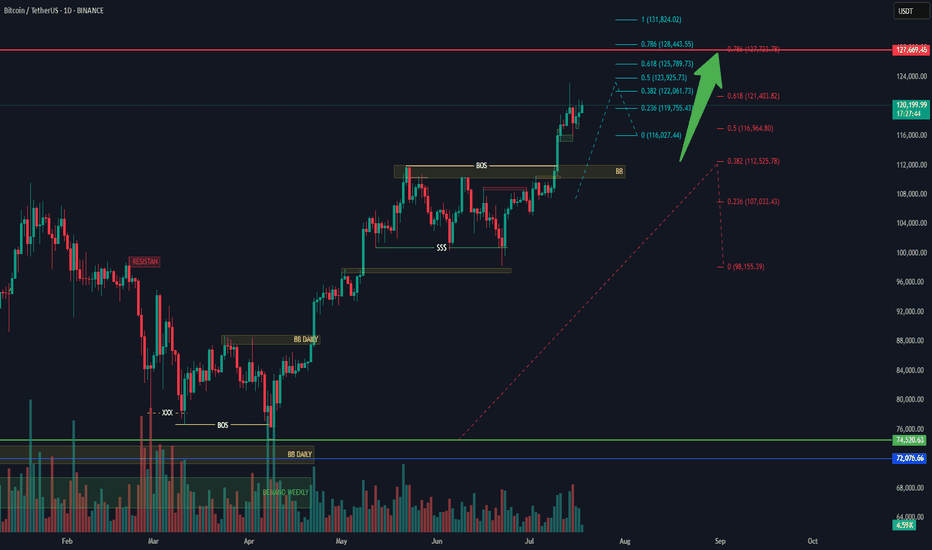

🧠 Key Observations (Smart Money Concepts - SMC Style) 🔄 Market Structure: MSS (Market Structure Shift): Price recently made a MSS after a BOS (Break of Structure), indicating a shift to bullish structure. BOS (Break of Structure): Seen on the move up from the demand zone. SSL (Sell-side Liquidity) taken before the recent bullish move — classic liquidity sweep...

Price has pulled back into the Bullish Order Block. A bounce from the 113K–111K zone is expected. Targeting next levels of imbalance and liquidity: TP1: 120,977 USDT TP2: 127,669 USDT TP3: 135,561 USDT

If it came to retrace its base point it go to its fib extension target

Symmetrical Triangle Correction – Elliott Wave Perspective The image depicts a Symmetrical Triangle Correction, a common corrective pattern in Elliott Wave Theory. This formation is typically observed during wave 4 or within a complex correction, and it signals consolidation before the next impulsive move. Structure: A symmetrical triangle is composed of five...

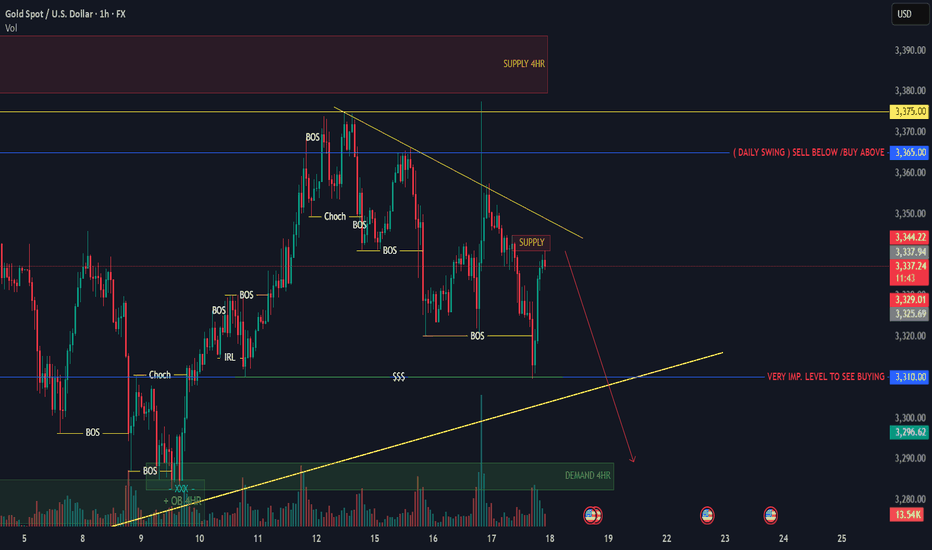

Possible Scenarios: 🔻 Bearish Bias (Primary Scenario) Price is currently reacting from the 30-min supply zone. Under the descending trendline, maintaining lower highs. If rejection confirms, we may see a move down toward the 3310 level, and possibly into the 4H Demand Zone. Price Levels: Daily Swing Decision Level: 3365 — Sell below / Buy above level. Current...