Trading_Vista

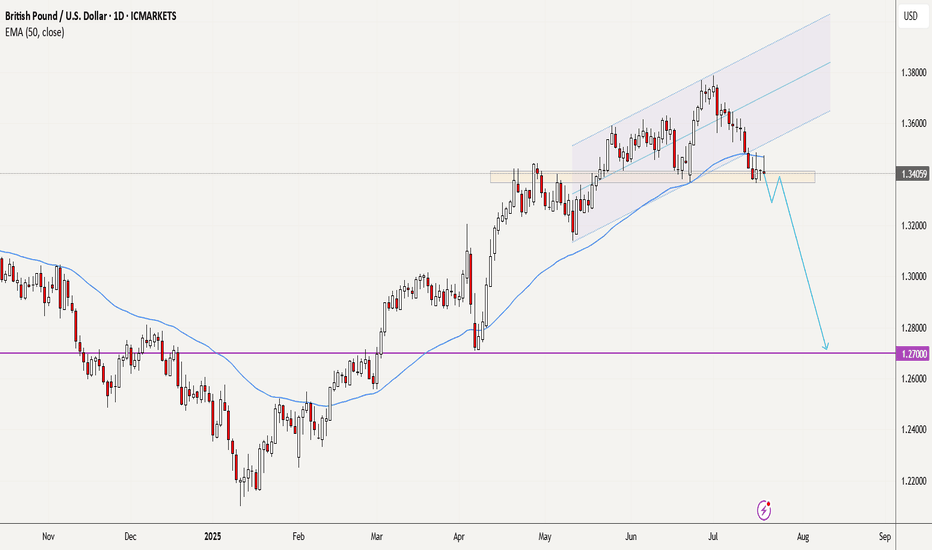

EssentialI have some questions here and no clear answers yet. For the moment, there is no trading idea here. 1) Is the USD going to be strong this week? - after scanning other USD pairs, the best I can say is "maybe". 2) Looking at GBPUSD, can we say it is bearish. - The uptrend does seem to be exhausting, but until this support is convincingly broken, it is still a...

Friday’s candle engulfed 2 previous days of price action. I interpret this as strongly bullish, especially since this happened in an already nicely bullish trend. However, the room to the upside it not unlimited - the ATH is at 175.421. We are likely to see sideways price action there due to some profit taking and maybe even some selling. IMO there are 2 possible...

It may be difficult to have a bearish bias on gold, but the chart is saying sell! After a prolonged bull run, you can see how price got rejected at $3,500. Subsequent bullish moves became weaker and weaker, you may even see a H&S pattern but more importantly the latest weaker bounce seems to indicate that the local support at 3272 may soon break. If this plays...

I am planning to short GBPCHF next week. A Head and shoulder pattern in an existing bearish move signifies a continuation. My trade will be executed on H1 time frame with confluence factors that support a bearish continuation. A break below the neck line and pull back followed by a strong bearish candle would be ideal. This is not a trade recommendation; it’s...

Going short is not the first thought when talking about BTCUSD, yet the 3 recent lower highs together with an "evening star" pattern are saying exactly that. Will you take this offer? What do you think? Comment below, share your thoughts and analysis!!

The area around 87.65 has been a solid resistance since early Feb. Time and again, price has been rejected there and recently the lows have become higher. The squeeze is on and I sense that another attempt to break out above will happen soon. Will it succeed? I have no idea, we never do. But if there is a breakout and then a retest, I'll take the trade and take...

It appears that the bearish move that began in April may have ended now. Price that mostly stayed under the 50ema has crossed over to the other side. The downward trendline has also been broken with price moving above it. We already have a higher high and higher low in place. Aggressive traders can take a long now, but I want to be more conservative these days. I...

I am seeing a 'pre-breakout buildup' on ETHUSD. Price is being carried by the 50ema for extended periods. The preceding trend before this sideways movement was bullish (so is bitcoin). There is a squeeze in progress, and we are seeing consistently higher lows. I see this PA as a high probability breakout potential in the next week or so.

My chart shows exactly what I am seeing and anticipating. What about you? What is your opinion? Please comment.

The support zone between 0.8890 and 0.8870 has been holding firm, while this pair has been making lower highs for the past couple of weeks. Price is now below the 50ema too. The most recent bounce from the zone looks rather weak and IMO a breakout to the downside may happen in the next few days. I see an initial target around 0.8730 with the potential to go much...

Inverse H&S formation. I prefer to see a break above the neckline and a retest.

You can go short near the upper trendline, but it's probably best to wait for the breakout to happen in the next few days. This is not a trade recommendation; it’s merely my own analysis. Trading carries a high level of risk so carefully managing your capital and risk is important. If you like my idea, please give a “boost” and follow me to get even more. ...

The area between 0.8434 and 0.8330 has been a strong support all year but got broken to the downside on 10 April. Since then, this pair gave several day trades as it pulled back to the zone (see my previous posts). As my daily chart shows, the recent retracement helped price to catch up to the 50ema and is now nicely below it. I will be monitoring price action...

You can see that JPY has becoming stronger over the last couple of days, and today it broke previous structure and broke above the recent low. If this continues, we will see the JPY crosses continue to head lower.

The daily candle has not yet closed but we could have an inside bar setup later today. Price is below the 200dma and the price action today seems indicative of a bearish breakout that could happen tomorrow. I am not advising jumping the gun, instead wait and see how it all plays out. This is not a trade recommendation; it’s merely my own analysis. Trading...

Will price retest the support/resistance zone one more time? That is what I am hoping for. Note that we have been seeing consistently lower highs. Price then broke below the zone, did one retest already and seems to be trying to retest it once again. I am looking for price to enter the zone and then give me some bearish evidence. Stop – above the zone 1st target...

Main trend – bearish. Pull back to nearest s/r level at 0.49850 has been completed. A lower high has now been formed. Price is below the 200dma. We are in all time low territory, so I will be targeting the 0.4700 round number and then evaluate again. This is not a trade recommendation; it’s merely my own analysis. Trading carries a high level of risk, so only...

A resistance area that turns into support usually creates high probability trades and that is what I see here. But we have NZD employment data release later today. I will stay patient and await the effect of that news release. You never know we could get this opportunity to go long even at that time. This is not a trade recommendation; it’s merely my own...