TrendTao

Essential🔮 Nightly AMEX:SPY / SP:SPX Scenarios for August 6, 2025 🔮 🌍 Market‑Moving News 🌍 🪙 Citi Lifts Gold Price Forecast Amid Global Uncertainty Citi raised its short-term gold outlook to $3,500/oz, citing surging safe-haven demand driven by trade instability, softening labor metrics, and heightened geopolitical risk. Risk premiums and volatility remain...

🔮 Nightly AMEX:SPY / SP:SPX Scenarios for August 5, 2025 🔮 🌍 Market‑Moving News 🌍 🔹 PBOC Moves Prompt FX Backlash On August 5, 2019, China’s central bank allowed the yuan to depreciate over 2% to its lowest level since 2008. That same day, the U.S. Treasury officially designated China as a currency manipulator, citing the PBOC’s moves as retaliation for...

🔮 Weekly AMEX:SPY / SP:SPX Scenarios for August 4–8, 2025 🔮 🌍 Market-Moving News 🌍 📦 U.S. Tariffs Finalized as August 7 Deadline Nears President Trump’s administration confirmed newly finalized tariff rates—ranging from 10% to over 40%—on dozens of countries, set to take effect starting August 7. The announcement has heightened global trade uncertainty and...

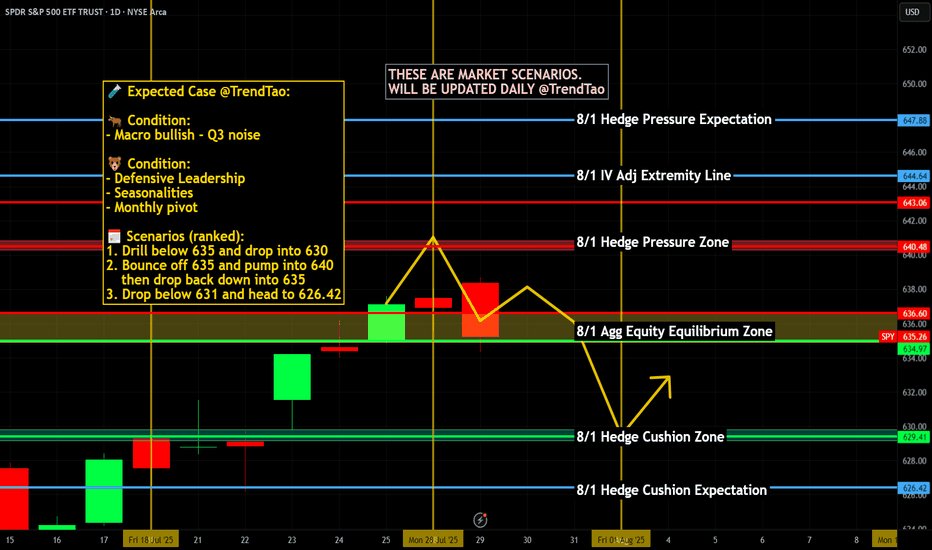

🔮 Nightly AMEX:SPY / SP:SPX Scenarios for August 1, 2025 🔮 🌍 Market-Moving News 🌍 📦 U.S. Imposes New Tariffs as Deadline Passes Fresh tariffs rolled out on August 1 hitting major exporters: 25% on Indian goods, 20% on Taiwan, 19% on Thailand, and 15% on South Korea. Canadas tariff elevated to 35%, though Mexico got extra negotiation time. Global equity...

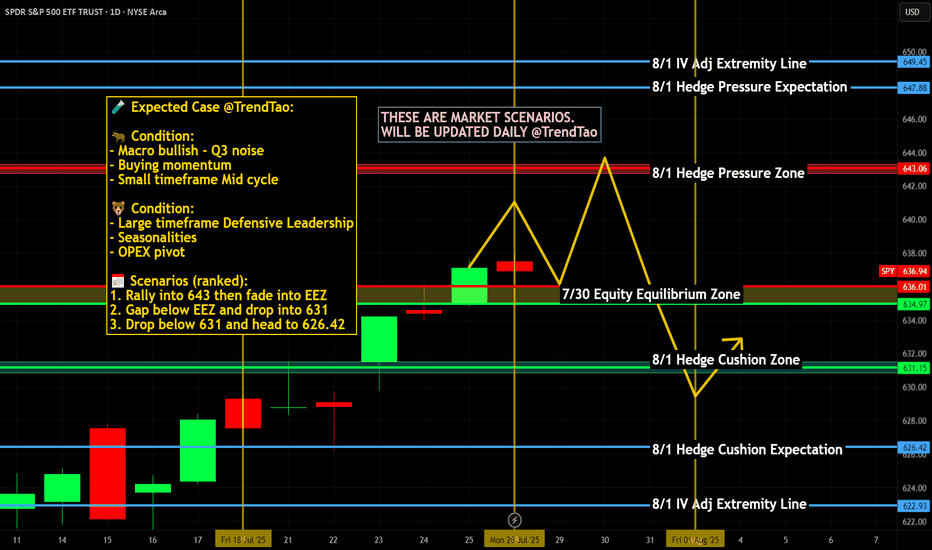

🔮 Nightly AMEX:SPY / SP:SPX Scenarios for July 31, 2025 🔮 🌍 Market-Moving News 🌍 🏦 Fed Holds Rates — Dissent Indicates Division The Federal Reserve maintained its benchmark rate at 4.25%–4.50%. Notably, two governors—Christopher Waller and Michelle Bowman—dissented in favor of a 25 bp rate cut, underscoring internal divisions amid growing political...

🔮 Nightly AMEX:SPY / SP:SPX Scenarios for July 30, 2025 🔮 🌍 Market‑Moving News 🌍 🧭 Fed Holds Steady Amid Uncertainty As the FOMC enters its July 29–30 meeting, the Fed is expected to keep rates unchanged at 4.25%–4.50%, even as one or two governors may dissent in favor of rate cuts amid mixed economic data. Recent strength in consumer spending contrasts with...

🔮 Nightly AMEX:SPY / SP:SPX Scenarios for July 29, 2025 🔮 🌍 Market‑Moving News 🌍 U.S.–EU Trade Deal Sparks Optimism The U.S. and EU signed a trade framework allowing a 15% tariff rate on most EU imports, averting harsher penalties. The S&P 500 and Nasdaq both closed at fresh record highs, supported by upbeat tech earnings sentiment—Tesla advanced on a new...

🔮 Weekly AMEX:SPY / SP:SPX Scenarios for July 28–August 1, 2025 🔮 🌍 Market‑Moving News 🌍 🏦 Fed Holds Steady, Faces Political Pressure The Federal Reserve is expected to keep rates at 4.25%–4.50% during its FOMC meeting midweek. While rates are unchanged, political pressure from President Trump continues as calls intensify for rate cuts and questions arise...

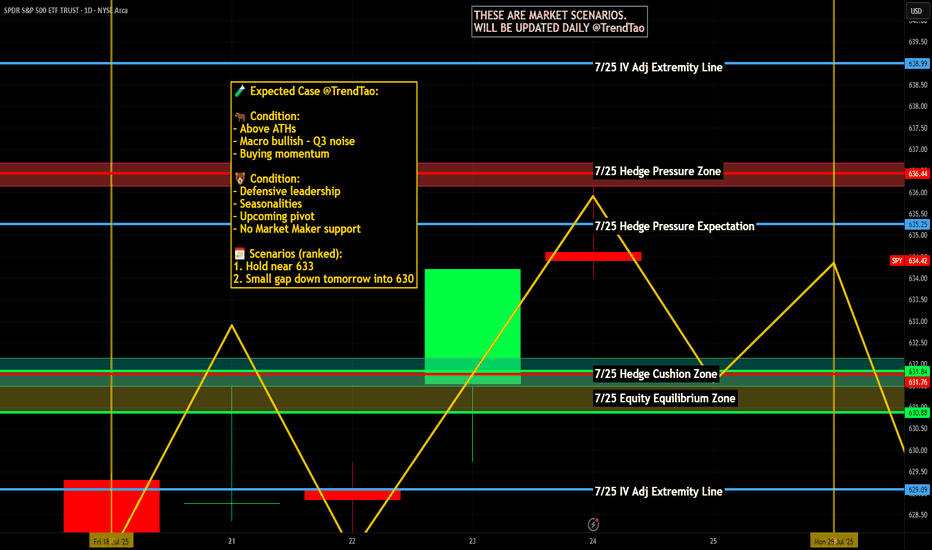

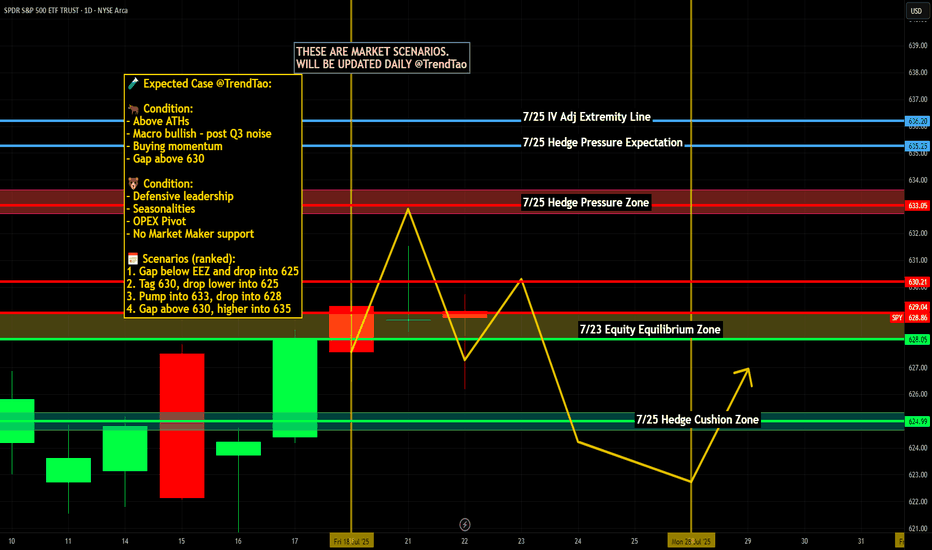

🔮 Nightly AMEX:SPY / CBOE:SPX Scenarios for July 25, 2025 🔮 🌍 Market‑Moving News 🌍 🏔️ Copper Market Flashpoint Following President Trump’s announcement of steep copper tariffs (15–50% range), U.S. copper futures surged, then sharply reversed. Inventory arbitrage between CME and LME markets surged, distorting pricing dynamics and triggering concern over metal...

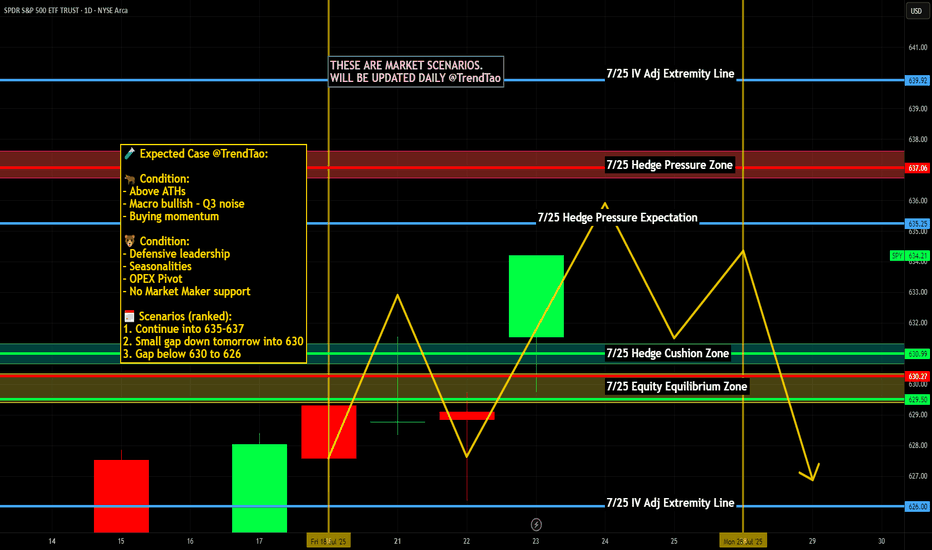

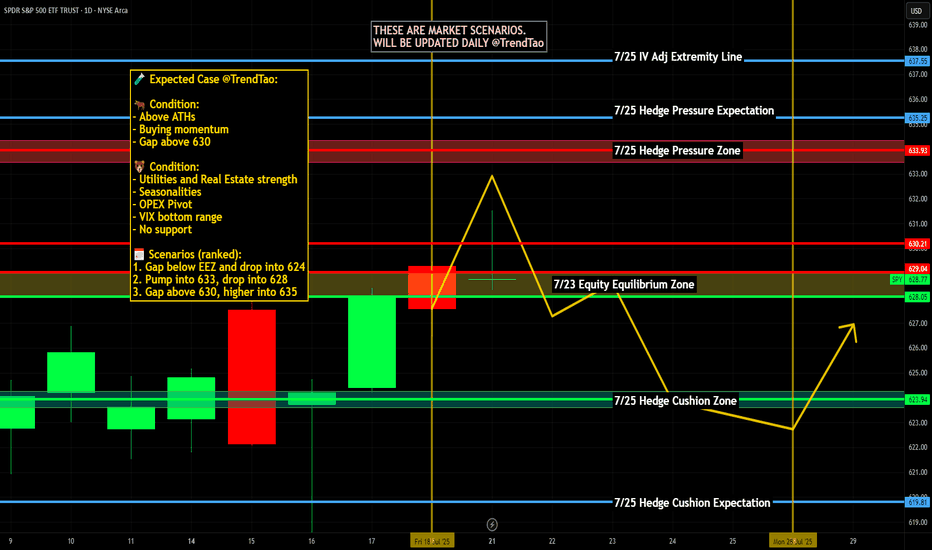

🔮 Nightly AMEX:SPY / SP:SPX Scenarios for July 24, 2025 🔮 🌍 Market-Moving News 🌍 🤝 U.S.–EU & U.S.–Japan Trade Optimism Lifts Sentiment The S&P 500 and Nasdaq hit record-high closes on July 23, fueled by optimism over a potential U.S.–EU trade deal mirroring the U.S.–Japan framework, with the EU-set tariff on autos potentially halved to 15% 💵 Dollar Retreats,...

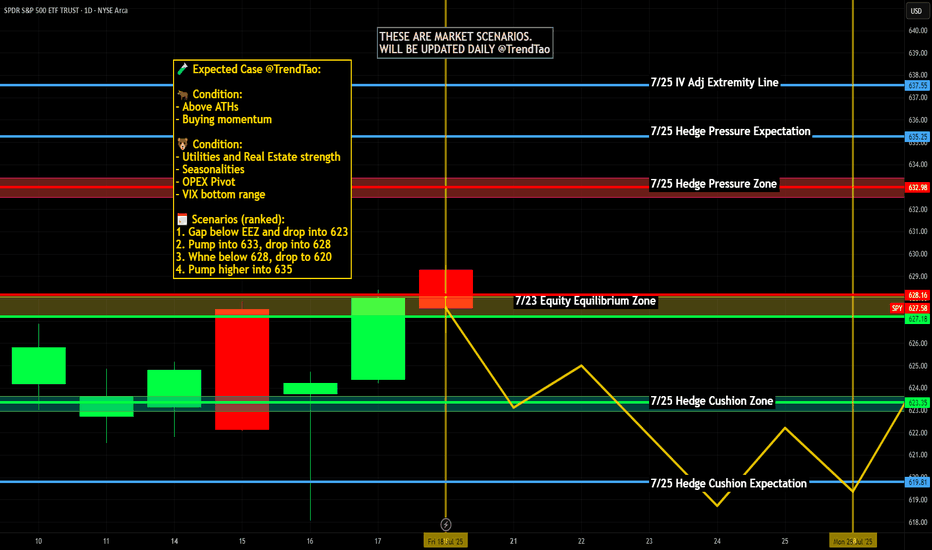

🔮 Nightly AMEX:SPY / SP:SPX Scenarios for July 23, 2025 🔮 🌍 Market-Moving News 🌍 📈 Morgan Stanley Stays Bullish Morgan Stanley reaffirmed its optimistic view, forecasting the S&P 500 will reach 7,200 by mid‑2026. They cited strong earnings and anticipated rate cuts as key drivers, though warned of risks from rising Treasury yields and tariff-related cost...

🔮 Nightly AMEX:SPY / SP:SPX Scenarios for July 22, 2025 🔮 🌍 Market-Moving News 🌍 🚀 Tech & EV Stocks in Focus Ahead of Earnings Futures were quiet ahead of Tuesday’s open, but key movers included Astera Labs (+19%), Alphabet (+2.7%), Netflix +2%, and Robinhood –4.9% after being passed over for the S&P 500. Investors are positioning ahead of major tech and EV...

🔮 Weekly AMEX:SPY / SP:SPX Scenarios for July 21–25, 2025 🔮 🌍 Market-Moving News 🌍 🏦 Fed Chair Powell Speaks — Markets Key Into Tone Federal Reserve Chair Jay Powell’s Jackson Hole speech is the week’s centerpiece. Markets will be closely listening for clues on inflation strategy, rate-cut timing, and sensitivity to geopolitical inflation drivers like...

🔮 Nightly AMEX:SPY / SP:SPX Scenarios for July 19, 2025 🔮 🌍 Market-Moving News 🌍 🏢 U.S. Corp Buybacks Set to Propel Stocks Citadel Securities expects U.S. companies to repurchase roughly $1 trillion of stock in 2025. With the blackout period ending in August, buybacks—historically strong in July, the stock market’s best month—could bolster valuations ⚖️ Fed...

🔮 Nightly AMEX:SPY / SP:SPX Scenarios for July 17, 2025 🔮 🌍 Market-Moving News 🌍 🇮🇳 India–U.S. Inflation Divergence Dampens Dollar India’s June retail inflation tumbled to a six-year low, while U.S. CPI hit its fastest pace since February—driven by tariff effects. This divergence is weakening the U.S. dollar against the rupee, pushing down dollar‑rupee...

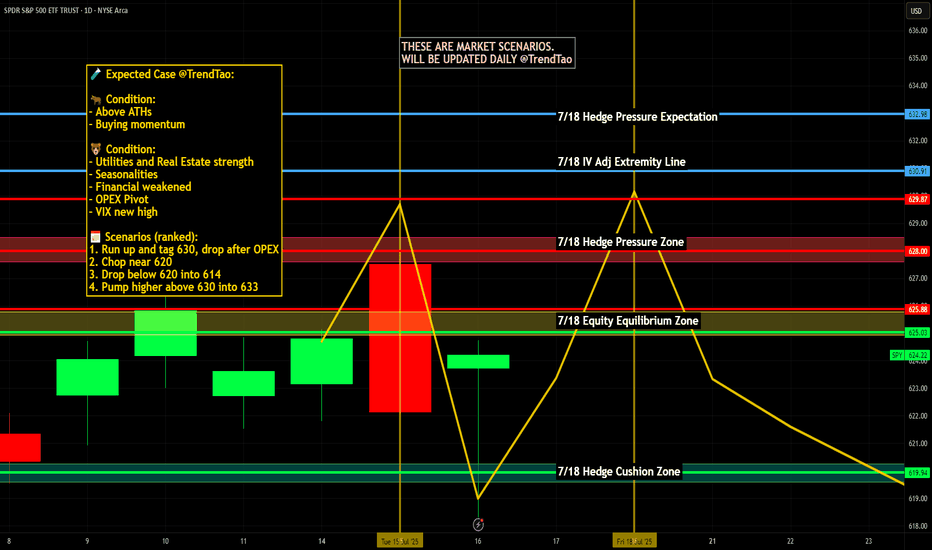

🔮 Nightly AMEX:SPY / SP:SPX Scenarios for July 16, 2025 🔮 🌍 Market-Moving News 🌍 📈 Record Bullish Sentiment Signals Rotation Bank of America reports the most bullish fund-manager sentiment since February. With 81% expecting one or two Fed rate cuts this year, the group sees a rotation strategy replacing outright selling, with investors tipping toward sector...

🔮 Nightly AMEX:SPY / SP:SPX Scenarios for July 15, 2025 🔮 🌍 Market-Moving News 🌍 📦 Dow Futures Dip on New Tariff Announcements President Trump announced new 30% tariffs on EU and Mexico, with additional duties on Japan, South Korea, Malaysia, Kazakhstan, South Africa, Laos, and Myanmar starting August 1. Dow, S&P, and Nasdaq futures each slipped ~0.3% as...

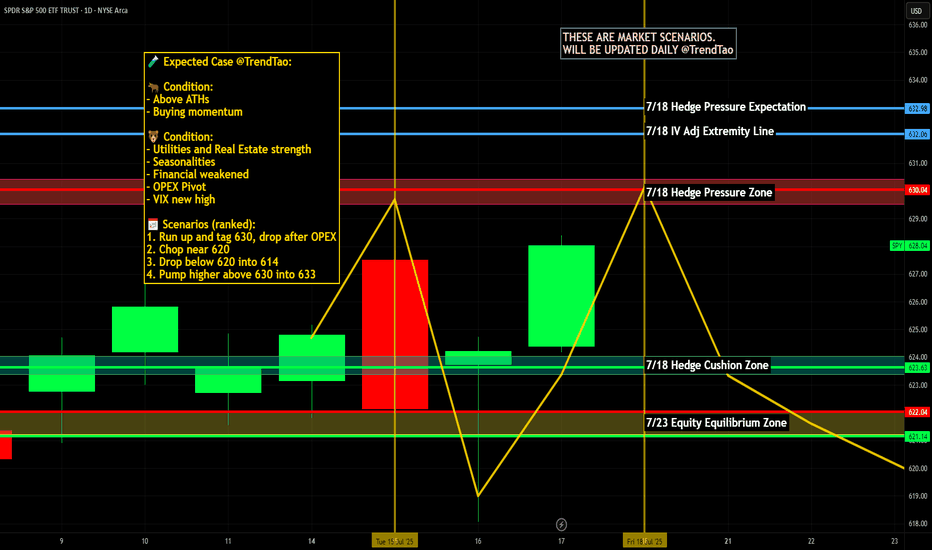

🔮 Weekly AMEX:SPY / SP:SPX Scenarios for July 14–18, 2025 🔮 🌍 Market-Moving News 🌍 ⚖️ Powell Faces ‘Epic’ Trade‑Inflation Dilemma Former Fed economists warn Chair Powell is navigating nearly unprecedented terrain: tariffs are pushing up prices even as the labor market cools. Striking a balance between inflation control and growth support remains a formidable...