UDIS_View

PremiumMerck's remarkable growth trajectory demonstrates how a pharmaceutical leader can transform global uncertainties into strategic advantages. The company has masterfully navigated geopolitical tensions, including US-China trade disputes, by diversifying supply chains and establishing regionalized manufacturing networks. Simultaneously, Merck has capitalized on...

Kraig Biocraft Laboratories, Inc. is a leading biotechnology company that has pioneered a scalable method for producing genetically engineered spider silk. By leveraging the domesticated silkworm as a "microfactory," the company has overcome the challenges of traditional spider farming. Its proprietary gene-editing technology inserts specific spider silk protein...

The Bovespa Index, Brazil's benchmark stock market index, faces significant headwinds from an unexpected source: escalating geopolitical tensions with the United States. Recent decisions by the US administration to impose a steep 50% tariff on most Brazilian imports, citing the ongoing prosecution of former President Jair Bolsonaro, have introduced considerable...

Nissan Motor Company, once a titan of the global automotive industry, navigates a complex landscape. Recent events highlight the immediate vulnerabilities. A powerful 8.8-magnitude earthquake off Russia's Kamchatka Peninsula on July 30, 2025, triggered Pacific-wide tsunami alerts. This seismic event prompted Nissan to **suspend operations at certain domestic...

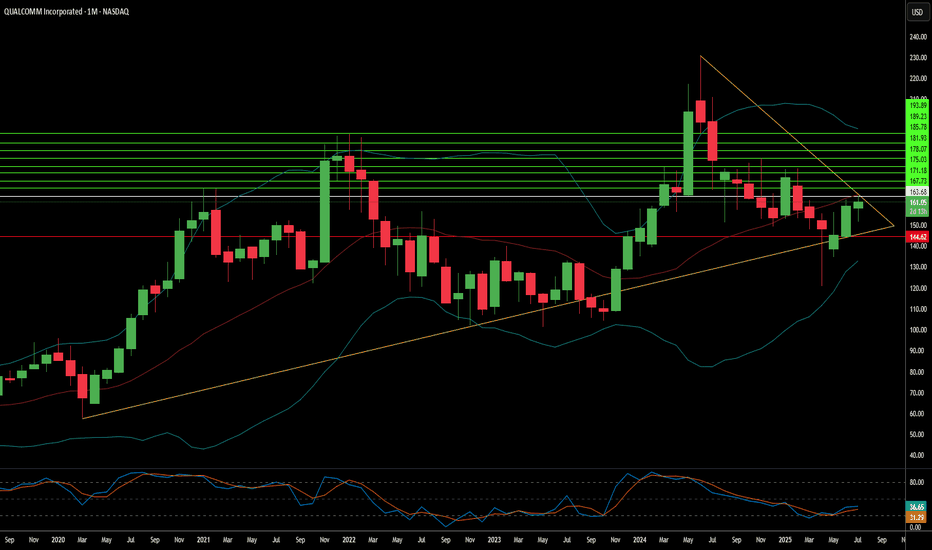

Qualcomm (NASDAQ:QCOM) navigates a dynamic landscape, demonstrating resilience despite smartphone market headwinds and geopolitical complexities. Bernstein SocGen Group recently reaffirmed its "Outperform" rating, setting a \$185.00 price target. This confidence stems from Qualcomm's robust financials, including a 16% revenue growth over the last year and strong...

Samsung Electronics is navigating a complex global landscape, marked by intense technological competition and shifting geopolitical alliances. A recent $16.5 billion deal to supply advanced chips to Tesla, confirmed by Elon Musk, signals a potential turning point. This contract, set to run until late 2033, underscores Samsung's strategic commitment to its foundry...

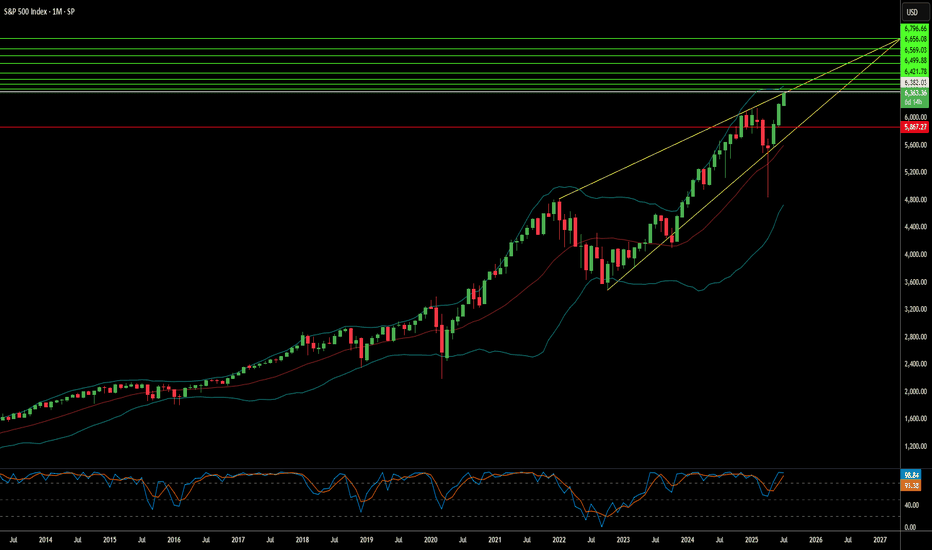

The S&P 500 recently achieved unprecedented highs, reflecting a multifaceted market surge. This remarkable performance stems primarily from a robust corporate earnings season. A significant majority of S&P 500 companies surpassed earnings expectations, indicating strong underlying financial health. The Communication Services and Information Technology sectors, in...

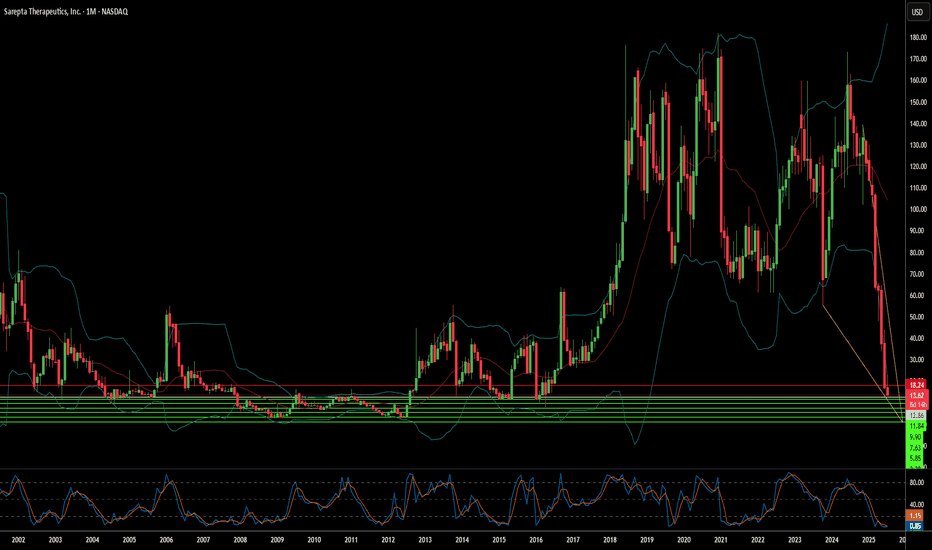

Sarepta Therapeutics (SRPT) faces significant market headwinds. The company's stock has seen a notable decline. This stems from multiple, interconnected factors. Its flagship gene therapy, ELEVIDYS, is central to these challenges. Recent patient deaths linked to similar gene technology raised safety concerns. The FDA requested a voluntary pause in Elevidys...

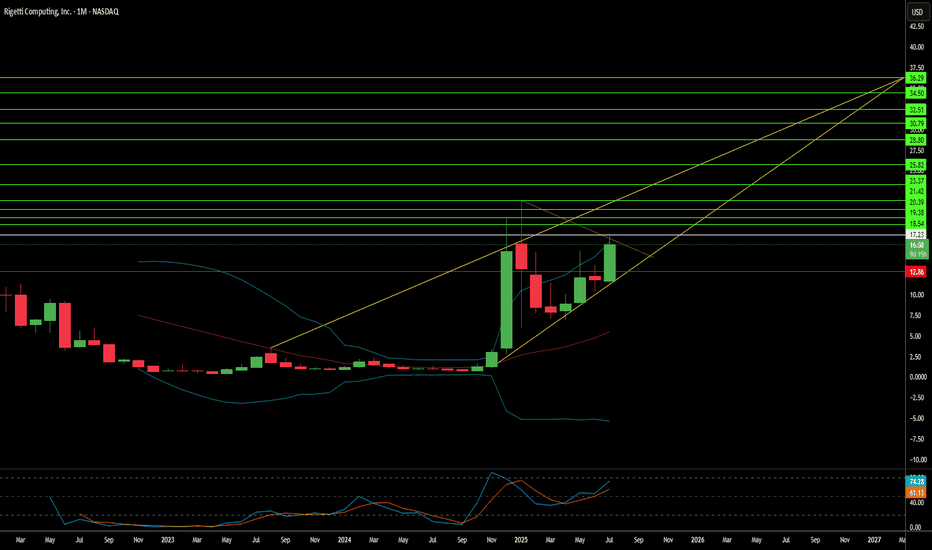

Rigetti Computing, a pioneer in quantum computing, recently commanded market attention with a significant 41% surge in its stock. This jump followed a critical technological breakthrough: achieving 99.5% median 2-qubit gate fidelity on its modular 36-qubit system. This represents a twofold reduction in error rates from previous benchmarks, a vital step toward...

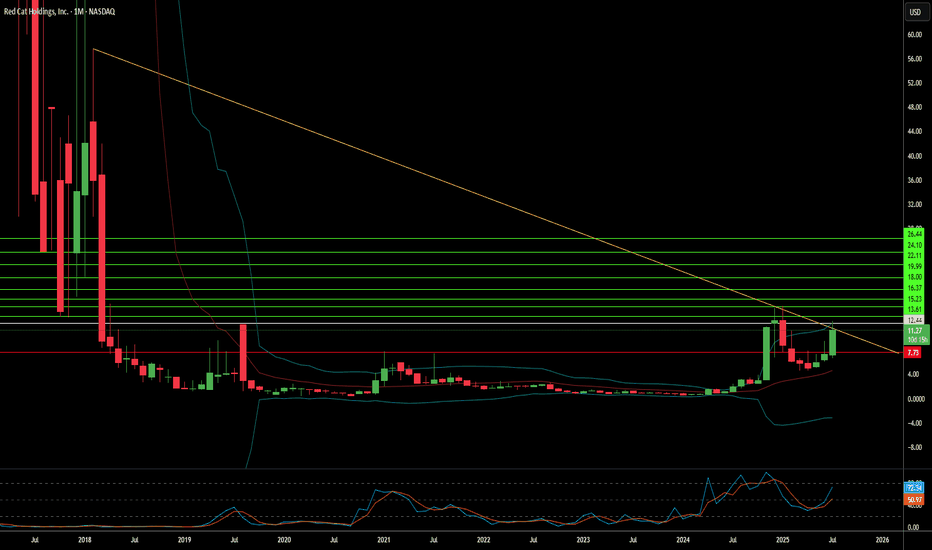

Red Cat Holdings (NASDAQ: RCAT) navigates a high-stakes segment of the burgeoning drone market. Its subsidiary, Teal Drones, specializes in rugged, military-grade uncrewed aerial systems (UAS). This niche positioning has attracted significant attention, evidenced by contracts with the U.S. Army and U.S. Customs and Border Protection. Geopolitical tensions,...

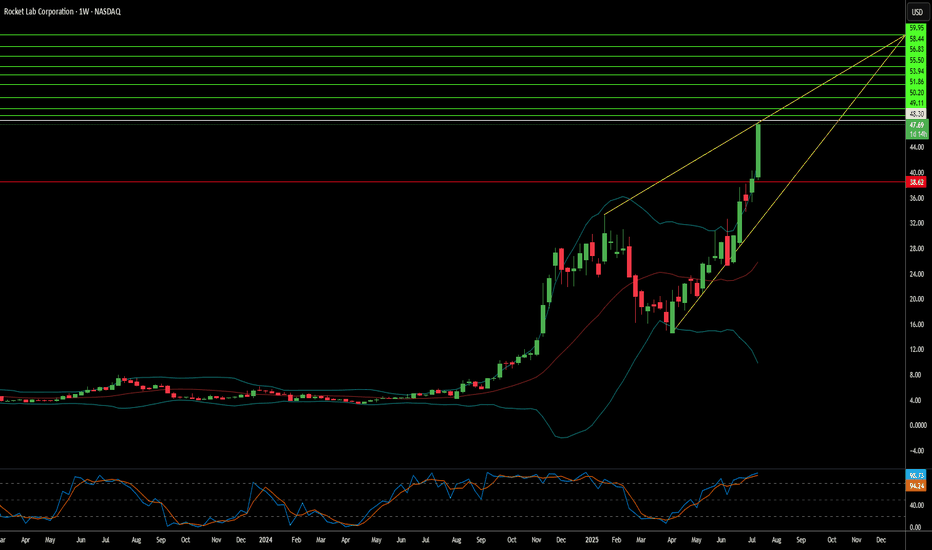

Rocket Lab (RKLB) is rapidly ascending as a pivotal force in the burgeoning commercial space industry. The company's vertically integrated model, spanning launch services, spacecraft manufacturing, and component production, distinguishes it as a comprehensive solutions provider. With key operations and launch sites in both the U.S. and New Zealand, Rocket Lab...

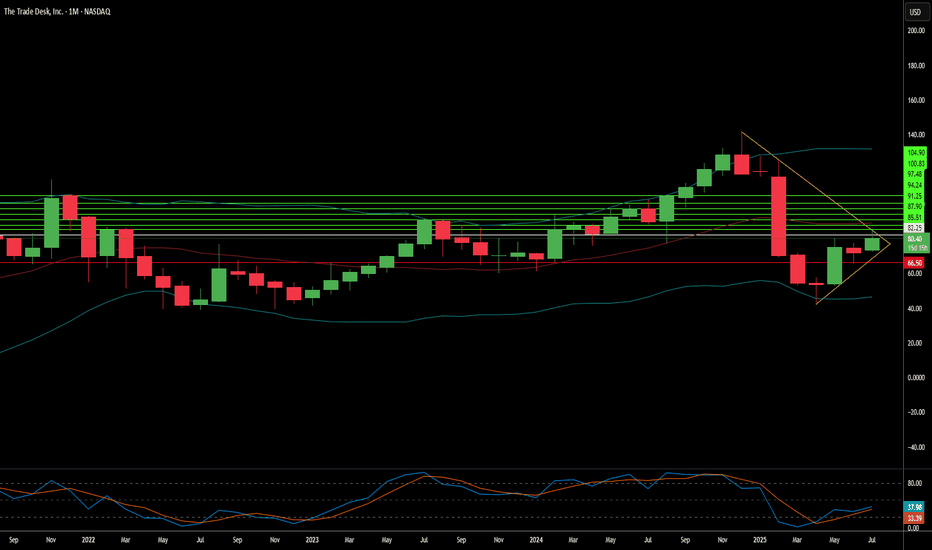

The Trade Desk (TTD) recently experienced a significant stock surge. This rise stems from both immediate market catalysts and robust underlying business fundamentals. A primary driver was its inclusion in the prestigious S&P 500 index, replacing Ansys Inc. This move, effective July 18, immediately triggered mandated buying from index funds and ETFs. Such inclusion...

GE Aerospace's remarkable rise reflects a confluence of strategic maneuvers and favorable market dynamics. The company maintains a dominant position in the commercial and military aircraft engine markets, powering over 60% of the global narrowbody fleet through its CFM International joint venture and proprietary platforms. This market leadership, coupled with...

The IBEX 35, Spain's benchmark equity index, navigates a complex landscape. Despite encouraging macroeconomic indicators, including robust GDP growth and declining unemployment, underlying vulnerabilities persist. Political instability forms a significant headwind. A fragmented parliament, ongoing corruption scandals, and the specter of early elections create an...

MP Materials has experienced a significant market revaluation, with its stock surging over 50% following a pivotal public-private partnership with the U.S. Department of Defense (DoD). This multi-billion-dollar agreement, which includes a $400 million equity investment, substantial additional funding, and a $150 million loan, aims to rapidly establish a robust,...

The price of orange juice is surging, impacting consumers and the broader economy. This increase stems from a complex interplay of geopolitical tensions, macroeconomic pressures, and severe environmental challenges. Understanding these multifaceted drivers reveals a volatile global commodity market. Investors and consumers must recognize the interconnected factors...

Ondas Holdings (NASDAQ: ONDS) is carving a distinct path in the evolving defense technology landscape, strategically positioning itself amid escalating global tensions and the modernization of warfare. The company’s rise stems from a synergistic approach, combining innovative autonomous drone and private wireless network solutions with shrewd financial maneuvers....

Orgenesis Inc. (OTCQX: ORGS) champions a revolutionary approach to cell and gene therapy (CGT) manufacturing. The company focuses on decentralizing production, moving away from traditional, centralized facilities. This strategy, centered on their POCare Platform, aims to drastically improve accessibility and affordability of life-saving advanced therapies. Their...