Wick-Sniper

EssentialAll about last week you can find here: FX_IDC:XAUUSD Gold is currently seeking fresh catalysts this week. 🧐 While the economic calendar appears light for this time of year, a lack of economic data doesn't mean nothing is happening. Geopolitical events, especially tariff wars or other flashpoints, remain significant. Are there increasing signs for peace in...

FX_IDC:XAUUSD 📰 The past weeks has been a wild ride for gold prices, caught between the fiery conflict in the Middle East and a deluge of crucial economic data from the U.S. 📈 Adding to this, a detailed technical analysis provides a deeper look into gold's immediate future. **Geopolitical Drama Unfolds & Peace Prevails!** 🕊️ ceasefire negotiations....

Hello fellow traders of OANDA:XAUUSD All about last week here Since Israel's attack on Iran on Friday, June 13th, aimed at destroying all facilities for potential nuclear weapons production, the gold price initially rose to $3450. This surge lasted until Monday, June 16th, during the European session, but then began to fall from there. 📉🔻 Signs of...

Beyond the Headlines: Gold's Ascent Amidst Global Shifts & Key Technicals 🌐🚀 Everything about the last week can be found here: OANDA:XAUUSD 💰📈 We all know what's going on, I believe. Israel struck Iran 💥, and this conflict will likely take a bit before things cool down. 🥶 --- ## Geopolitical News Landscape 🌍📰 ### Israel / Iran Since June 12, Israel...

Hey fellow traders, Let's dive into the OANDA:XAUUSD outlook for the upcoming week, June 9-13, 2025. The recent price action has been a rollercoaster 🎢, and the next few days promise even more fireworks 🎇. Looking back at the 30-minute chart from May 22 to June 6, gold saw an initial consolidation, then a strong rally to multi-week highs near 3,420....

😥 The past week was complicated, and I don't want to bore you with all the political goings-on, which I hope you're already aware of. I'm a bit short on time right now, but I still wanted to share this perspective with you all. 💁♂️ It is Shoulder on Shoulder H&S everywhere! 💡 My concept of a plan: 🧗 Let's climb the Pinky way down 3289 - Actual Price 3271 -...

👁️🗨️ The strong uptrend yesterday, followed by the downtrend during the Asian session, has built a possible inverse head and shoulders pattern (30 min chart) 🤷🏼♂️. ⏫ If an uptrend follows today, the pattern will be complete. The right shoulder began around $3287, which isn't far from the current price. 👀 Keep an eye on this, as it could drop lower while still...

Last week, I published my idea for a whole week with daily updates for the first time. You can read about it here: 🎯 The target of $3348 was reached on Friday due to the announcement of new tariffs against the European Union. 💡 Here is my idea for the week from May 26-30, 2025. First things first, the Friday session last week ended with bullish momentum....

Weekly Recap – Gold Market Monday, May 12, 2025 The week began with a sharp GAP during the Asian session (starting around 1:00 AM London / 8:00 PM New York on Sunday) : Gold dropped abruptly by $60, from $3,325 to $3,266. The catalyst was a temporary easing of trade tensions between the U.S. and China, following weekend negotiations that led to a 90-day...

Gold Bullish? Sure, go ahead, but let me explain where we are and so on... 🤔 1. Newswise 📰 Tariffwar: Trade tensions between the U.S. and China have intensified following President Trump's tariff hikes. The U.S. increased tariffs on Chinese imports to 145%, while China retaliated with tariffs up to 125% on U.S. goods. Despite these escalations, both...

🟡 Gold Traders: Nothing Matters Until Wednesday! ⏳💤 Hey traders! 👋 This week, all eyes are on Wednesday... and everything before that? Mostly noise. Let me break it down for you. 👇 📊 Technical Outlook Gold is chilling above a key resistance level right now. Trendlines suggest we won’t see any major moves before Wednesday unless big news drops. 📰 🕐 Asian...

💰 Gold on the Move – Bearish or Bullish? 🤔 Hey traders! 👋 On the 1H chart, Gold was chillin’ on a trendline starting from $3386 on Wed, Apr 23, climbing up till $3353 on Mon, Apr 28 📈. But then... it changed direction! 😬 Starting Wed, Apr 30, we saw a shift to a lower trendline at $3319, and today it’s trying to climb above $3300 🔄. 📉 Bearish vibes? We're...

Recently, the expected Head and Shoulders pattern seems to be delayed — and possibly invalidated — as buyers successfully defended the line at $3,287, pushing the price up to $3,319 on Friday. As a result, a new bullish setup has emerged. On the 1-hour chart, an XABCD harmonic pattern has clearly formed, offering two upside targets: Target 1: $3,367 Target...

OANDA:XAUUSD 📉 Watching closely: Possible Head and Shoulders formation developing on the 4H and 1H charts As of April 24, 2025, Gold (XAU/USD) is forming a potential Head and Shoulders pattern on the shorter timeframes (4H and 1H), which could indicate a reversal setup. While multiple scenarios are still in play, the price action around the $3368 level...

📊 Summary of Recent 4 Trading Days During the ongoing US-China trade war, President Trump has ramped up his public criticism of Federal Reserve Chair Jerome Powell. Though he lacks the authority to remove Powell directly it seems, Trump's frustration with the Fed’s independent policy direction has led to an apparent institutional power struggle. This conflict...

The gold price has had a pretty crazy six days, jumping from 3,014 USD on April 9, 2025, to 3,357 USD on April 17 – that’s a solid 11%+ gain. So, what’s going on now? Is the gold rally over, or could we see even more upside? Let’s break it down. 🔥 What’s driving the gold price? The big reason behind the recent surge is the trade war between the US and China....

OANDA:XAUUSD Gold has been heavily influenced by recent developments in the trade war. A 90-day pause on tariffs (excluding China) and the exemption of smartphones and computers from tariffs were announced on friday. These headlines may temporarily calm markets and give stocks room to rise — which typically puts pressure on gold. If Dollar is rising again,...

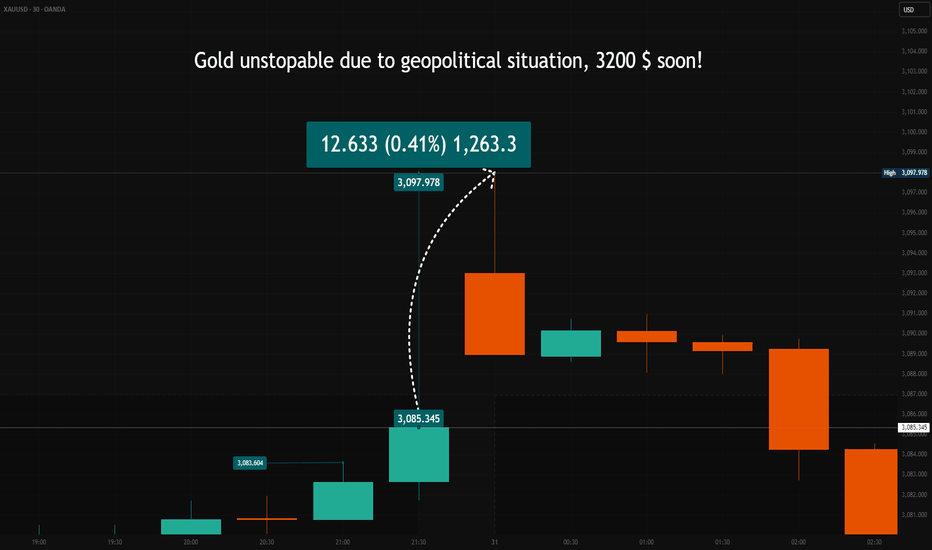

The late Friday session on March 28, 2025, ended with a strong rally in gold, as multiple price candles attempted to push higher. By 10 PM CET, gold had settled at $3,085.345, reflecting significant bullish momentum. As the market reopened on Monday, the gold price gapped up by approximately +$12.5 , opening at $3,097.978 . This type of price gap typically...