NYSE:MOH is looking at a bullish continuation after the stock saw a break above the falling wedge formation, confirming the upside continuation over the longer-term period. Strong bullish break above 340.00 further confirms the upside. Long-term MACD is looking at a strong long-term bullish momentum after the MACD/signal line is rising and histogram is...

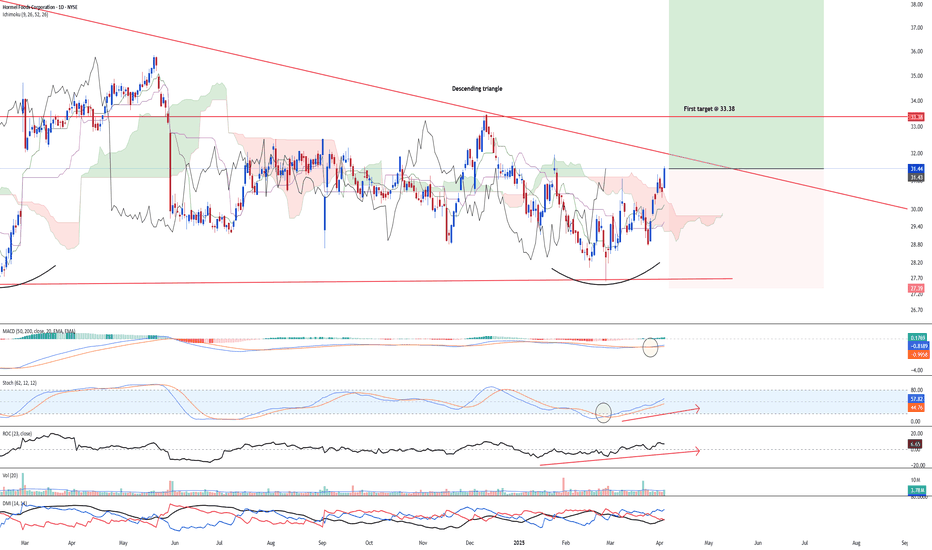

NYSE:HRL has formed a large descending triangle and a potential double bottom formation. Given the upside momentum, there is a strong chance of HRL trending higher after breaking above the descending triangle. Long-term MACD is looking at a strong long-term bullish momentum after the MACD/signal line is rising and histogram is positive. Stochastic has been...

NYSE:DG has confirmed its rounding bottom reversal and it has also broken above the downtrend line which started since March 2024. Furthermore, the breakout was supported by strong bullish candle and high volume, above the 20-period average. With the strong momentum, the stock may move to filled up the large bearish gap between 94-120 range. Long-term MACD is...

TSE:7951 is looking at a potential reversal after the stock formed an inverted head and shoulder formation. Furthermore, the stock has broken above the bearish gap down zone, indicating renewed buying pressure. Hence, we believe that the stock is likely to edge up higher after long-term MACD momentum is showing signs of return. Weekly chart shows a larger...

The DJIA is looking at a crossroad and based on Wyckoff schematics, the index is looking at a possible distribution BUT the current price action is tilting towards a re-accumulation phase as the SOW (Sign of weakness) is not in yet. We think that the rebound is likely to happen TODAY. However, we would want to see a break above 43,100 resistance to confirmed the...

NYSE:F Ford is looking at a possible resumption of upside after the stock broke above the downward sloping line of the descending triangle. Furthermore, the stock has 1.) Clear closure above the bearish gap with strong bearish candle 2.) Inverted head and shoulder is in the picture. Ichimoku is showing early signs of a bullish reversal. Long-term MACD is...

TWSE:2303 Micro Electronics is looking at an early bottoming out reversal after price action broke above the downtrend line and today was edging up higher with steady flow of volume. Furthermore, Ichimoku shows steady uptrend and is a strong reversal. Momentum from long, mid and short-term are looking at a bullish momentum in unison. Long-term uptrend from the...

TPEX:6488 Globalwafers is looking at a possible bullish rebound after price action shows strong upside. All momentum indicators are back to the upside and is likely looking at a strong momentum going forward.

TSE:6141 DMG Mori is looking at a strong bullish upside after the stock has seen a strong reversal at the base of the channel. Looking at the weekly chart, the stock has been on a steady uptrend since 2013 and stock recent price action on the weekly chart also sees DMG being supported above the 200-EMA. 14-week period RSI saw rising momentum when the lows are...

XETR:BAYN Bayer is looking at a possible rebound after the stock rose strongly and attempting to break above the bearish gap seen. Ichimoku is showing a strong bullish signal and we believe near-term should see further upside. Long-term MACD is back to the positive. Stochastic confirms the bullish momentum and has yet to see overbought signal yet. 23-period...

NYSE:CL is looking at a potential rebound to the upside after the stock actually broke above the falling wedge and has filled and trade beyond the bearish gap highlighted in the chart. Ichimoku is showing a clear bullish signal as the leading Span A and B will likely perform a crossover (Bullish twist). The stock also closed above the resistance turned support...

NYSE:HSY Hershey is looking at a potential bottoming out after showing strong bullish breakaway gap on 6th Feb 2025, first sign of a strong bottom rebound. Furthermore, the stock has formed a v-shaped bottom pattern and recent bullish candle has closes above the ichimoku's cloud, making the latest sign of a strong bullish confirmation based on ichimoku signal....

NYSE:CRM is looking at a potential strong bullish continuation after the stock has broken out of the bullish flag with a huge bullish bar with the support of a spike in volume. Furthermore, the stock has been in an uptrend channel since Dec 2022 and it is likely to continue higher. Hence, we are adding on to a buy position on CRM with near-term target price of...

NYSE:TRV Travellers is looking at a continued upside after a mild correction at 27 Nov 24. The double top fails to conclude a 1:1 move and rebounded heavily. Currently, the stock rose above all ichimoku indicators and the stochastic plus the ROC is showing signs of rising bullish momentum. Hence, we are looking at a buy to US$300.00 on a longer-term basis

NASDAQ:NVDA is looking at a potential rebound after completing its 3-wave structure as prices saw a sustained rebound at 117 region, which coincide with the 138.2% Fib expansion level of wave A-B. Right now, upside seems to be an corrective upside and may hit 135-148 region before hitting a resistance.

TWSE:2344 Winbon is strong and strong from the bottom. Ichimoku shows three bullish golden cross and the strong run up from 12th Feb is supported by the spike in volume. Long-term MACD has turned bullish, supporting the strong run up in long-term momentum. Stochastic oscillator has confirmed its oversold crossover and is starting to turn bullish. DMI...

MYX:LHI has completed its short-term bearish correction after breaking strongly above the overhead resistance. Short-term bullish momentum is confirmed after 23-period ROC rose sharply above the zero line and formed a bullish divergence. To add on, the stock's major uptrend remain intact since 2022 Oct. Initiate a buy at 0.630 or limit buy at 0.545

TSE:6677 SK electronics is looking at a possible continuation after 1.) It gapped up from immediate bottom and broke out of the falling wedge on good earnings. To add on, the stock's bullish momentum is back after long-term MACD rose from the bottom after it has perfromed a crossover. Histogram is positive. Stochastic confirmed the oversold crossover and...