WiseLeoTrading

PremiumWhile a BoE rate cut of 0.25% is widely anticipated today, the market's focus will be on the post-meeting guidance, which could clarify the future path of monetary policy. The decision is influenced by a weakening labor market and a significant government deficit of 51 bln USD. A dovish stance could lead to a faster pace of cuts, dampening the pound. From a...

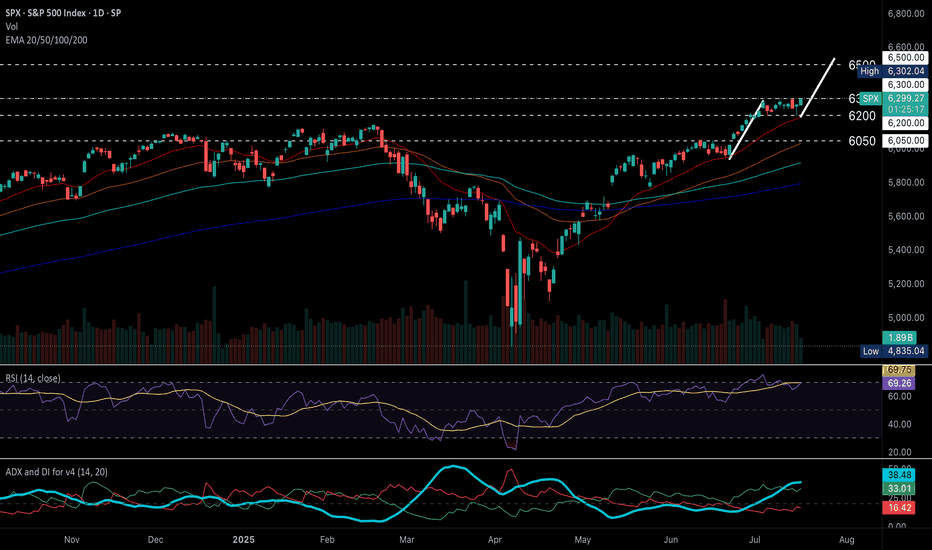

US500 Market Insight The US500 continues to demonstrate resilience amid a complex macroeconomic backdrop, trading around 6,388 at mid-session today. This represents a modest 0.40% recovery from the previous close of 6,299, signaling improving investor sentiment despite ongoing market headwinds. Fundamental Outlook: Market Resilience Amid Volatility After a...

Fundamental: Natural gas (XNGUSD) continued its decline, driven by high storage levels and surplus supply. Despite a 6.8% increase in demand for the week ending 30 Jul, the daily average supply surplus remained at 3.6 bln cubic feet, boosting underground working storage capacity to near the five-year average high. The persistent supply surplus could exert further...

Fundamental View The Federal Reserve opted to keep interest rates unchanged with a hawkish tilt at its latest policy meeting which gave the USD a boost. Meanwhile, gold’s upside remains limited due to reduced safehaven demand, a stronger USD and a de-escalation in global trade tensions. Elevated US inflation figures and robust economic performance have...

Following the July meeting, the BoJ maintained its interest rate at 0.5%, citing prevailing uncertainties from trade tariffs. Concurrently, the BoJ revised its inflation forecast upward to 2.7% YoY from 2.2%. The central bank's language on economic uncertainty has become less pessimistic, downgrading trade policy risks from "extremely high" to "high uncertainties...

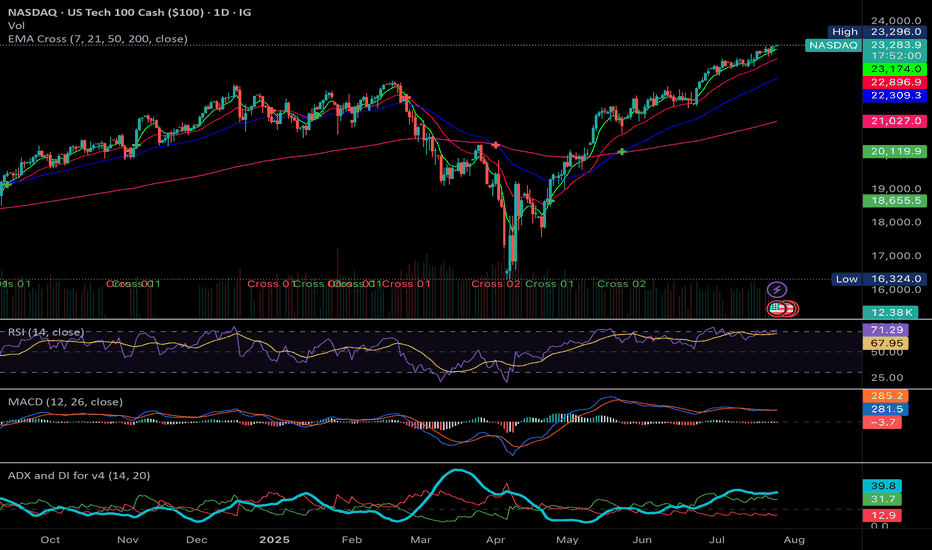

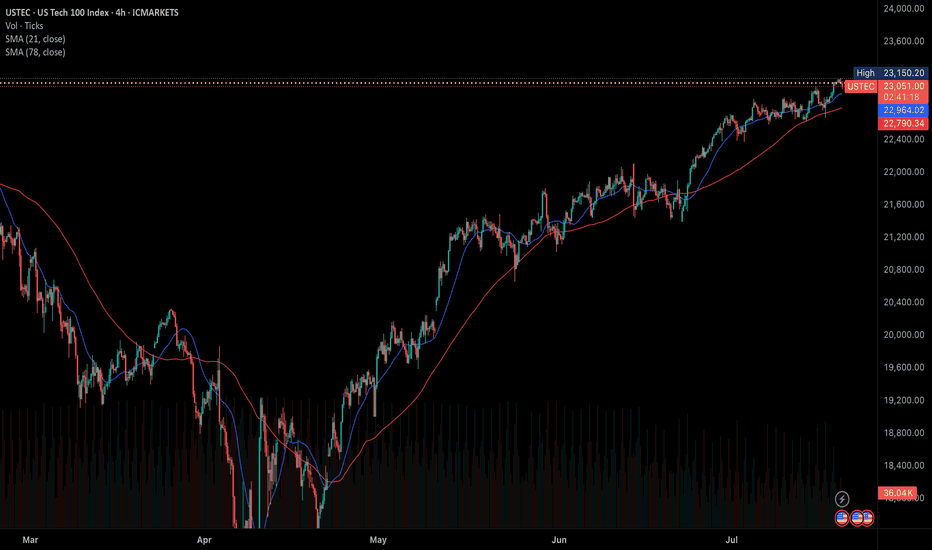

Fundamental: USTEC (NASDAQ100) continues its strength, propelled by robust Alphabet (GOOG) earnings that buoyed technology companies. Cloud services recorded the largest growth at 32% YoY, primarily driven by AI. Concurrently, the company plans to allocate $85 bln to capital expenditure in 2025 for AI, an increase from $75 bln, signaling continued surging demand...

The US July Michigan Consumer Sentiment Index increased to 61.8 from 60.7, while the 12-month inflation expectation decreased to 3.6% from 4% in the previous month. This suggests an easing of inflation concerns and improved consumption optimism. This data, coupled with recent stronger Retail Sales figures, continues to support expectations for robust US economic...

S&P 500 (US500) maintains strong bullish momentum. Technical Outlook S&P 500 (US500) holds a strong bullish structure, continuing to print higher highs and higher lows above diverging EMAs, signaling sustained upward momentum. RSI has eased from overbought levels, now hovering below 70, while price consolidates sideways near recent highs, a typical pause...

Fundamental view: Total US natural gas consumption rose 0.8% to 75.1 Bcf/d. Power sector demand increased 1.0% to 43.8 Bcf/d, driven by higher temperatures and increased air conditioning use. While total supply averaged 112.5 Bcf/d, down 0.6% from the previous week. Dry production decreased 0.6% to 106.2 Bcf/d. Net imports from Canada fell 1.4% to 6.3 Bcf/d. Rig...

Fundamental US500 is pushing higher as the US 2nd quarter earnings season gains momentum under President Trump's second administration amidst tariffs. Big tech earnings will have a significant impact on the index price action. Technical Bullish momentum is gaining as the uptrend remains strong. The RSI is approaching the overbought region however a break above...

Tesla Q2 2025 Delivery fell, but could it rebound in 2H? Key Figures Q2 2025 Deliveries: 384,122 vehicles Year-over-Year Change: Down approximately 13–14% from Q2 2024 Wall Street Expectations: Around 385,000–387,000 vehicles Production vs. Deliveries: 410,244 vehicles produced, indicating a build-up in inventory Fundamental analyst Sales Decline:...

Fundamental Oil prices remain under pressure. Volatility is expected to remain elevated as traders digest inventory data, watch for geopolitical shifts, and anticipate the upcoming OPEC+ meeting on July 6, where supply policy could change. Technical Technical indicators remain strongly bearish with RSI favouring further downside below pivot level 65.53...