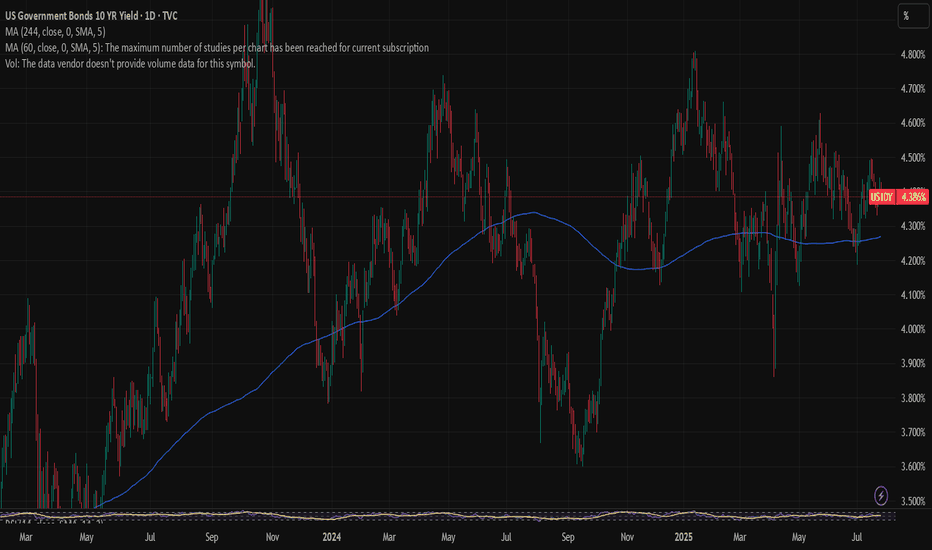

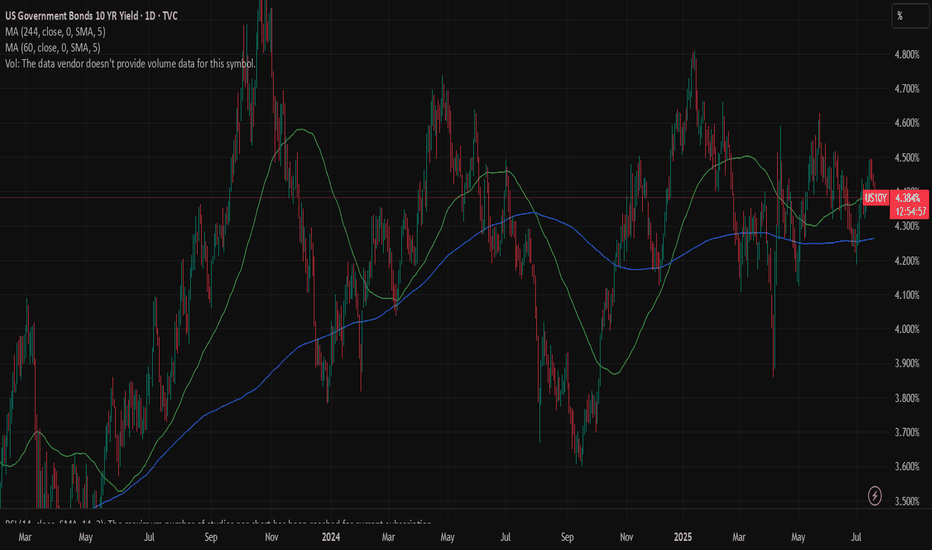

During the previous week investors were digesting the latest macro data aiming to set expectations for the forthcoming FOMC meeting, which is scheduled for Wednesday, July 30th. The 10Y Treasury yields were moving between 4,32% and 4,44%, closing the week at 4,38%. The drop in yields during the second half of the week was impacted with a trade deal between the US...

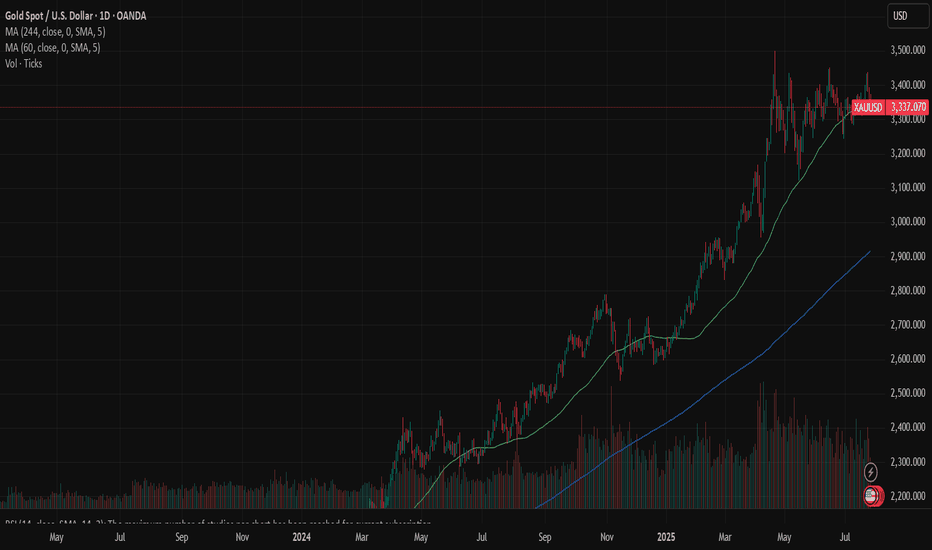

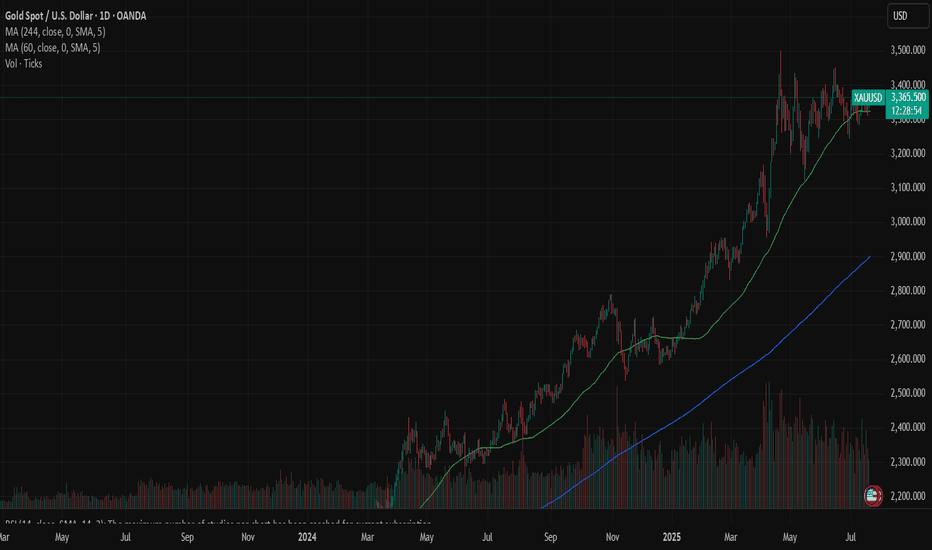

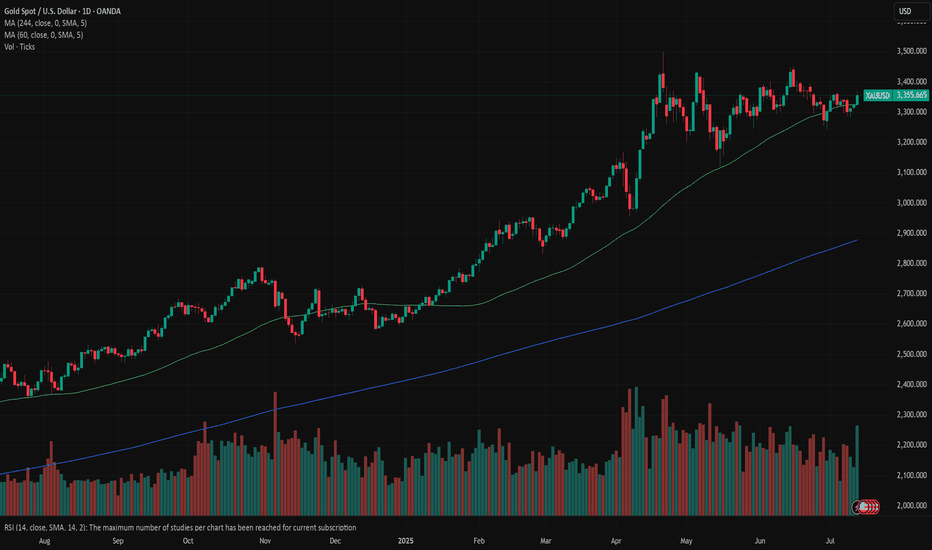

The safe-haven asset had its ups and downs during the previous week. The week started with an uptrend, where the price of gold reached its highest weekly level at $3.430, on trade tariff tensions. However, the deal made between the US and Japan, pushed the price toward lower grounds, ending the week at $3.340. In addition, Friday's drop was supported by announced...

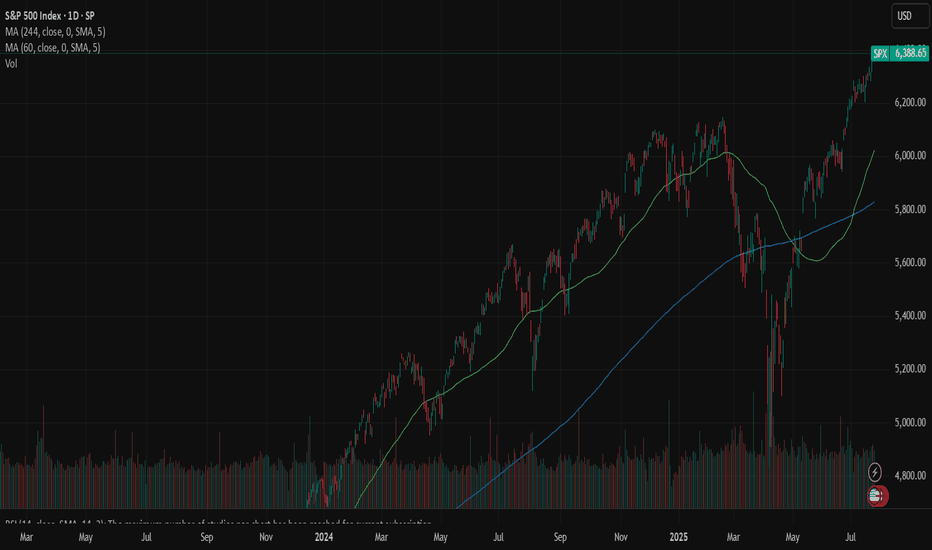

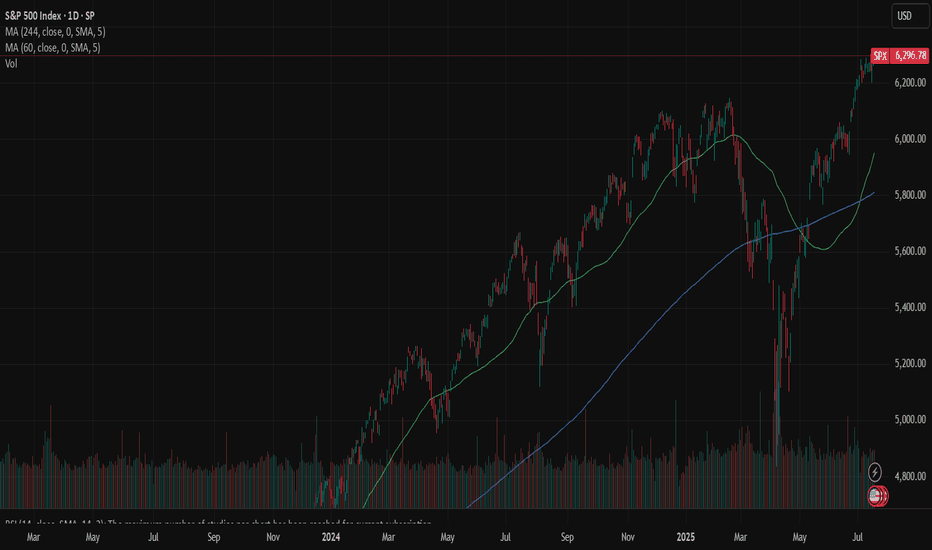

Investors' optimism continued to hold at the U.S. equity markets another week in a row. The S&P 500 posted another weekly winning streak, supported by solid earnings of companies included in the index. The index also reached another all time highest level, with Friday's level of 6.388, gaining around 1,5% for the week. Tech companies were once again main...

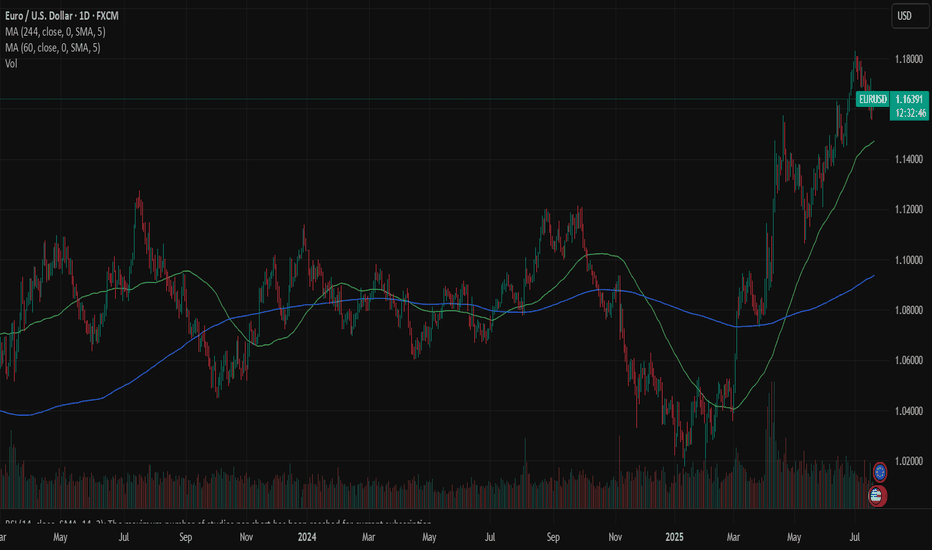

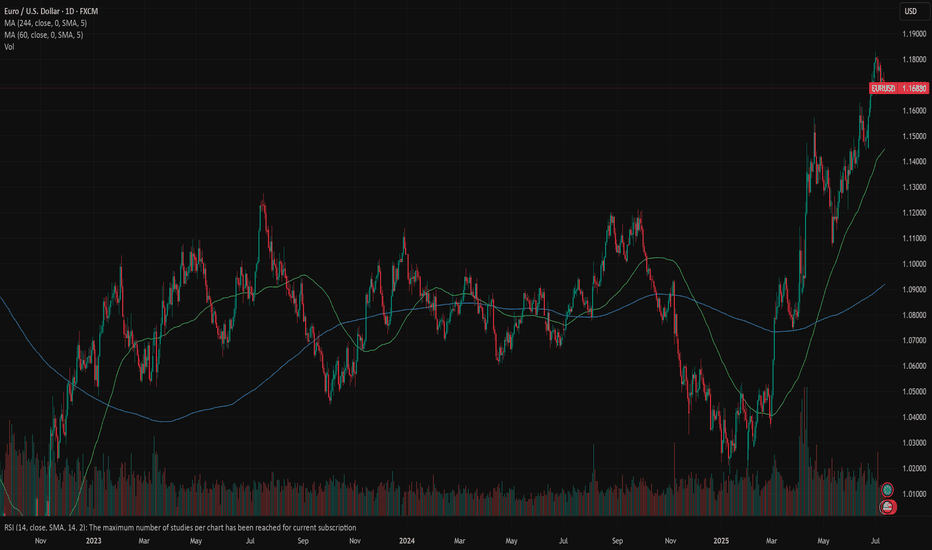

The ECB meeting was one of the major events during the previous week, when it comes to macro data. As it was widely expected, the ECB left rates unchanged, amid uncertainties related to trade tariffs with the U.S.. The ECB maintains its previous macro outlook, viewing the Euro Zone economy as resilient but facing downside risks. President Lagarde highlighted...

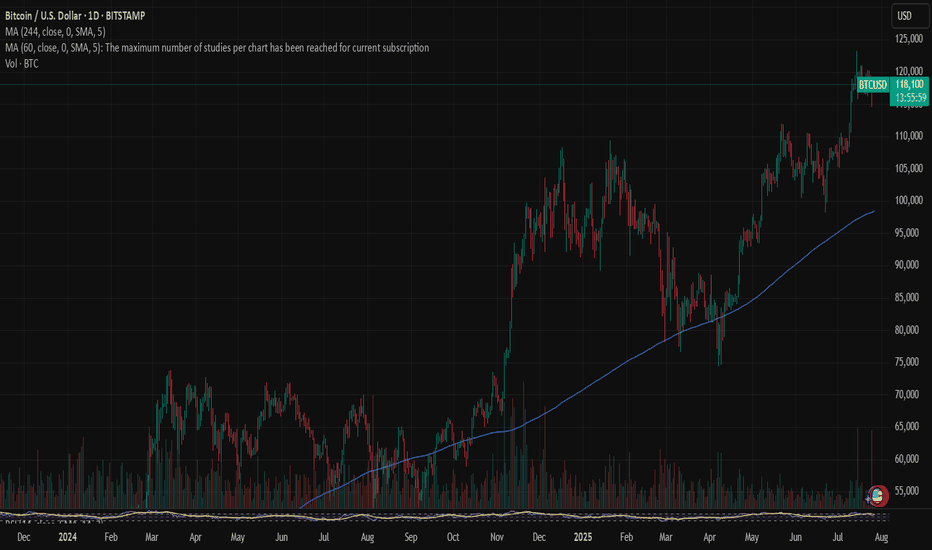

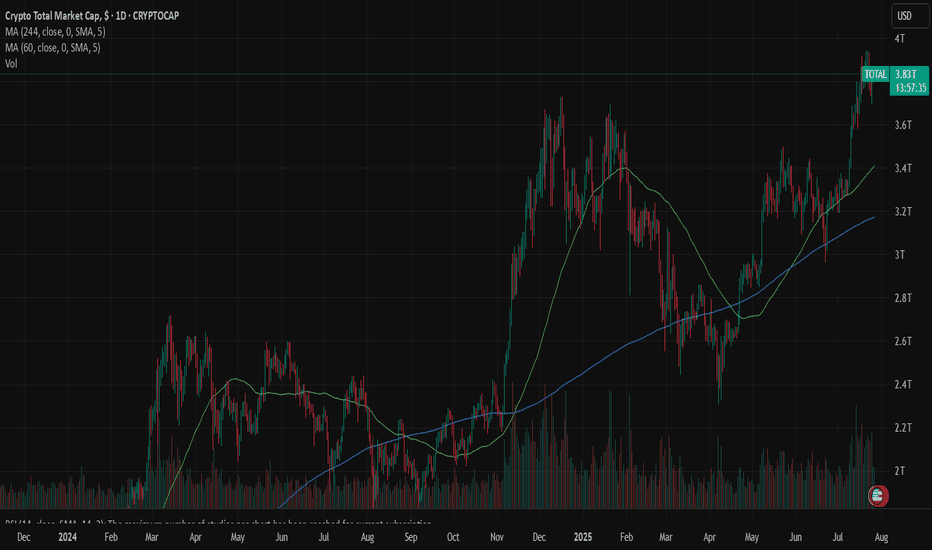

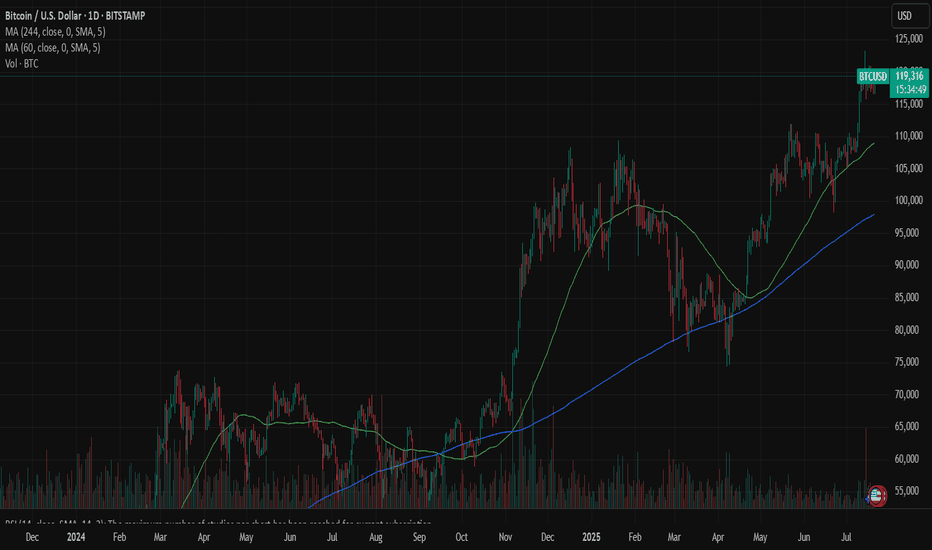

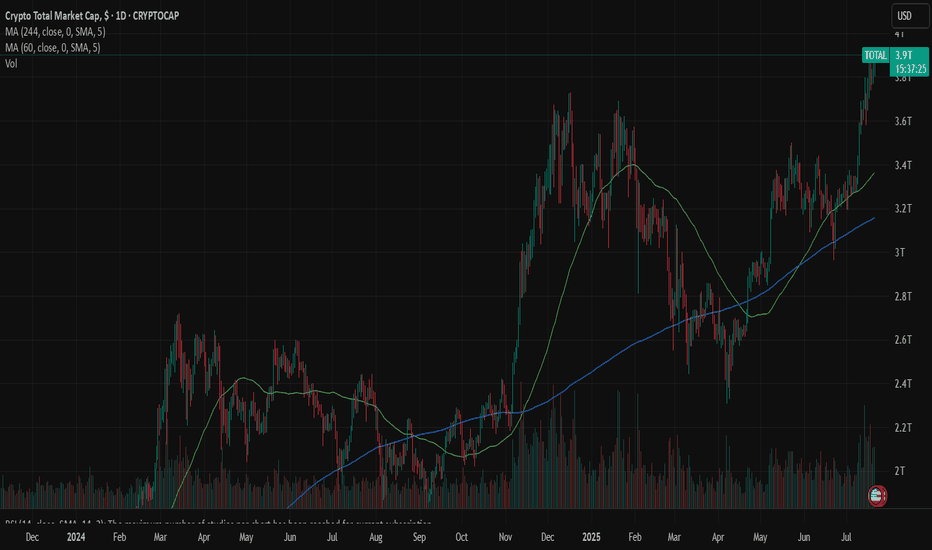

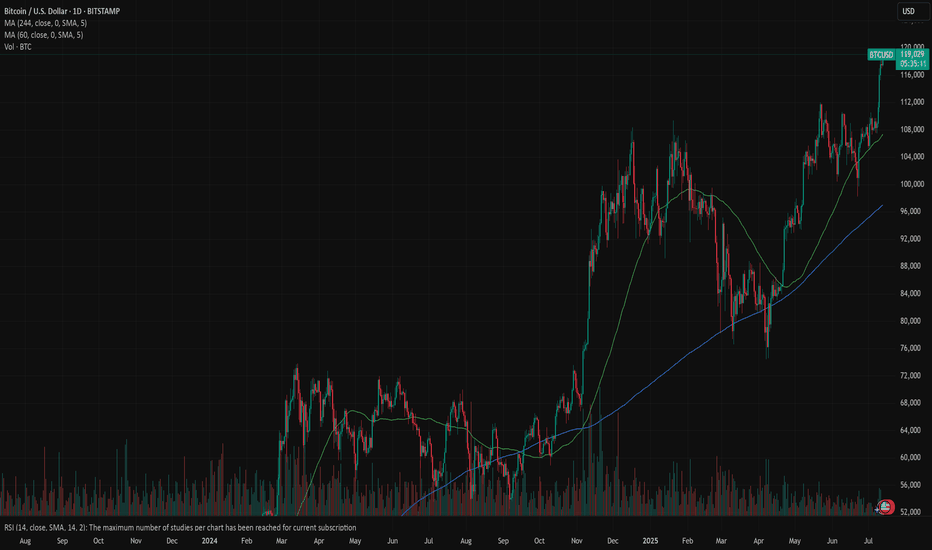

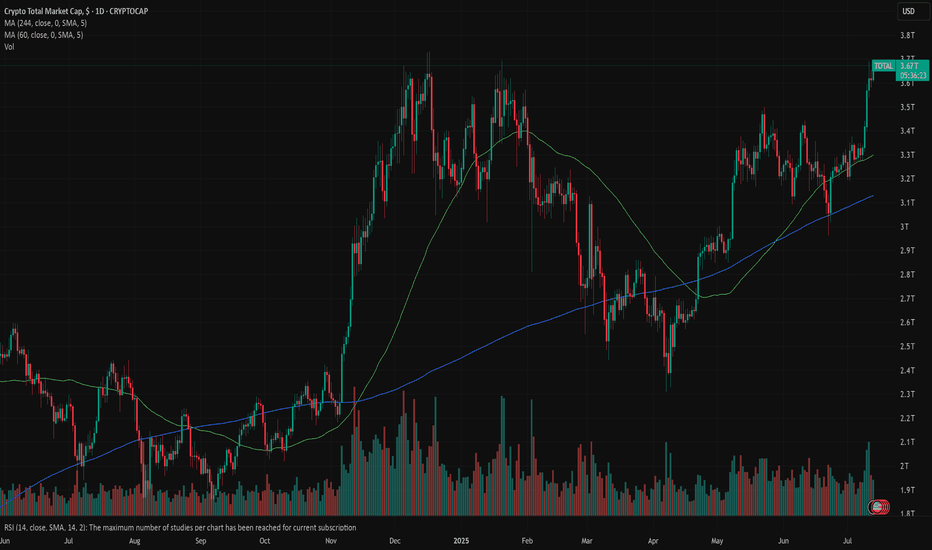

The optimism that held the market sentiment after the adoption of the Genius Act on July 17th, slowly faded during the previous week. As it was expected, traders were closing their positions in order to book profits, spiking the liquidations of positions. The price of BTC reached the lowest weekly level at $114,8K at Friday's trading session, however, it was only...

Last week in the news Trade tariff (un)certainties shaped market sentiment during the previous week. The US-Japan trade deal was settled which brought some relaxation among investors. The US equities continued with a positive trend, with the S & P 500 reaching fresh all time highest level, ending the week at 6.388. On the same ground the price of gold turned a...

The US inflation and jobs data shaped investors sentiment during the previous week, where 10Y US Treasury yields eased as of the end of the week. The US inflation remains relatively steady and in line with expectations, with 0,3% increase in June or 2,7% y/y. The producers price Index was holding at 0% in June, while the University of Michigan inflation...

Gold was traded relatively flat during the previous week, moving within a range of $3.370 and $3.313. The safe-haven asset was holding relatively steady on eased geopolitical and economic tensions. The US Dollar gained a bit last week on better than expected inflation and jobs data posted during the week. Analysts are in agreement that current concerns related to...

The US equity markets remained relatively resilient this week, despite ongoing concerns about trade policy developments. After last week’s slight retreat from its all-time high, the S&P 500 resumed its upward momentum early in the week, continuing to hover near record levels. The index reached a new highest level of 6,315 on Friday before pulling back slightly,...

The focus of the previous week was on US inflation figures. Posted data showed relatively stable figures for June, as inflation was standing at 0,3% for the month and 2,7% on a yearly basis. Both figures were in line with market expectations. Core inflation remained elevated and reached 0,2% for June and 2,9% y/y. At the same time, core inflation was by 0,1pp...

The U.S. House passed the Genius Act on July 17, following Senate approval in June. The bill sets comprehensive federal standards for stablecoins, clearing the way for banks and fintechs to issue them under clear reserve and audit rules. This represents a new milestone for the crypto market, and its leading coin - BTC. During the week, BTC managed to hold steady...

Last week in the news Resilient inflation and the jobs market in the US supported further investors sentiment, bringing equities to higher grounds. The new all time highest level was reached by the S&P 500, which is closing the week at 6.296. The US Dollar gained in value during the week, however, the price of gold remained relatively flat, closing it at $3.349....

During the previous week there has not been important US macro data scheduled for a release, however, news regarding tariffs has been the ones which shaped investors sentiment and also, US bond yields. It was indeed a no-clear-direction trading week when it comes to 10Y Treasury benchmark yields. The week started with a strong move to the upside, from 4,32% up to...

The market optimism holds, but comments related to tariffs are still bringing some unrest among investors. Although this unrest is currently not as strong as in April this year, still, some investors prefer to keep part of their funds in the safe-haven assets. News regarding trade tariffs during the previous week include 35% tariffs on imports from Canada, 50%...

Previous week was another optimistic week on financial markets. Regarding the approaching deadline for a delay in the application of trade tariffs set by the US Administration, which came due on July 9th, the market did not show much of a concern. The green trend line of the S&P 500 continued during the week, where the index managed to reach another new all time...

This week was calm when it comes to currently important US macro data. The most important event was related to the release of the FOMC meeting minutes from the June session. There was no new information revealed in the Minutes, which has not already been communicated with the public. The Fed is aimed to maintain flexibility around future rate cuts. They will most...

Crypto enthusiasts are celebrating the latest achievement of BTC. The coin managed to reach another all time highest level during the previous week, at the level of $118,5K. Although BTC was struggling during the previous period to sustain the higher grounds, testing on several occasions the resistance level at $108K, the buying orders prevailed on Wednesday,...

Last week in the news Previous week was short in US macro news, however, news regarding trade tariffs were the ones that shaped market sentiment at Friday's trading session. The optimism on the US equity markets still holds, regardless of a short correction on Friday. The S&P 500 reached another all time highest level, ending the week at 6.259. Gold was once...