All time frames are bearish on EU, looking for a setup at the 4h POI before looking for an entry short. Major News: Unemployment - Thursday

AU is bearish in the short-term until 1h timeframe shifts back to bullish to align with 4h and daily structure. We're looking for shorts in the meantime until price reaches the extreme of the swing structure. Major News: Unemployment - Thursday

EU has clean structure with Daily, 4h, and 1h bearish. 1h internal structure is bullish at the moment and we're waiting for that to break bearish before looking for any shorts. We're going to be patient and wait for internal before looking for high probability trades. Major news: China trade talks - Monday CPI - Tuesday PPI/Unemployment - Thursday

Daily is bullish, so in the future price possibly will trend up. In the meantime 4h and 1h are bearish but has reached a critical daily demand zone at the extreme of daily structure. So far 1h internal is bullish, so we are still looking for longs cautiously until structure is broken. Major news: China trade talks - Monday CPI - Tuesday PPI/Unemployment - Thursday

Eurusd has been consolidating internally, but has made a final push bearish from Friday NFP. We're looking for a short at the flip zone of the 1h POI, but if it goes past that to the extreme of the internal structure, we will be cautious and wait for a break to switch bullish. Thanks for stopping by! Major News: FOMC - Wednesday Unemployment - Thursday

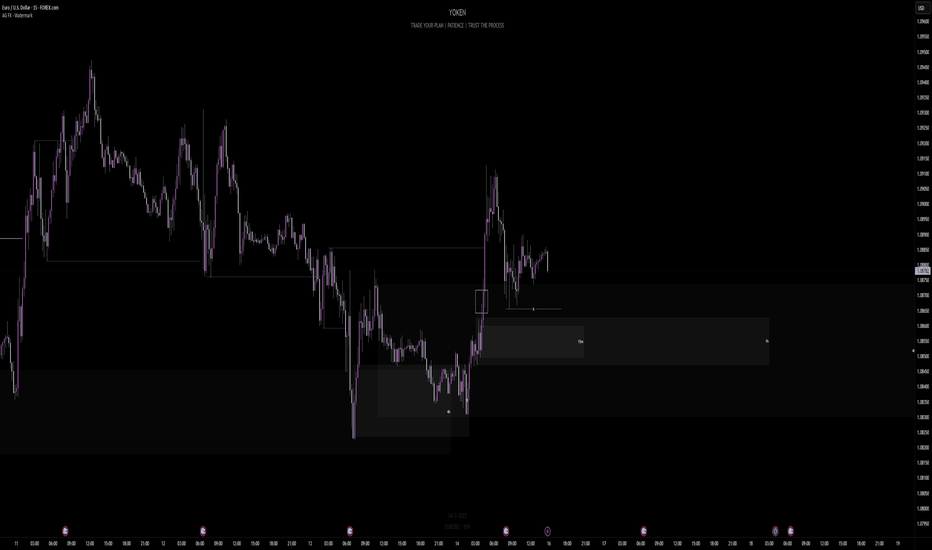

After a hellish week of consolidation, price has made its move higher (finally) and we're back to a trendy chart. My analysis the beginning of the week shows 2 POIs that I am interested in for longs, and if it breaks the level that I pointed out bearish, I will look for shorts. Thanks for tuning in! Major News: FOMC - Wed Unemployment - Thurs

EU had a crazy week of consolidation last week and it was best to stay out until structure was clearer and had a direction. My direction this week is bullish since all structure is bullish and we are starting to see that demand is in control. If it isn't, expect the lower level 4H POI to be mitigated and then continue the bull run. Major News: PMI -...

Weekly and daily candles are consecutively bullish with a V-shape recovery to the upside. Looking for longs and especially keeping an eye out for the 1H POI flip-zone that I refined in the 4H POI. Unless 1H internal structure shifts bearish, I am long ALL THE WAY! Major News: PMI - Wednesday Unemployment - Thursday Thanks for tuning in, have a great week.

All structure is bullish so our bias remains bullish until the MTF (1H) breaks bearish. I have a bullish daily bias that is looking for the Daily supply level above this local high. Major News: Unemployment Claims - Thursday

Daily bias is bullish, prior week ended bullish with a V shape recovery showing that bulls are in control. As always our MTF internal structure dictates our immediate bias (bullish) and until it breaks, we're continuing our longs. Price is reaching an important level at the extreme of the HTF supply level so once price gets there, it's good to see what happens...

Last week ended bullish for the pair, but there is a correction occuring at the moment so we will follow the MTF internal structure (bearish) until it reaches the daily and 4h POI to look for bullish price action. Internal MTF structure is always king and we will need that to shift before looking for longs. Major news: Inflation - Thursday Thanks for stopping...

Last week was clearly bearish leading to all time frames being bearish. Starting the week with a high probability POI to look for entry models from to take shorts to the next daily demand level. Impactful news: Inflation 4/10 Thanks for stopping by and goodluck traders!

EURUSD has healthy price action with the MTF switching to bullish, once MTF aligns with the daily, we're definitely good to go on longs. For now waiting for price action to show us that it wants to move higher. Major news: NFP Friday Thanks for coming, goodluck this week with your trades!

Weekly analysis this week, price has been congesting and tightening the last 2 weeks, expecting hopefully a good move this week to breakout of consolidation. Starting the week with a bearish bias. Major News: NFP Friday Thanks for stopping by, have a great trading week!

Weekly analysis of EU, my analysis shows bearish signals and where I am looking to trade from. The chart looks very healthy for a daily retracement with the medium time frames aligning to it. Only volatile news this week for me to watch out for is: Unemployment Claims - Thursday Let me know your thoughts, analysis, or what you'd like to see! Thanks for...

Analysis of my main pair AUDUSD, last week resulted in the bears taking over and my analysis explains why my bias is bearish going into the new week. Not much volatile news except for Unemployment Claims on Thursday. Let me know what you guys think, your analysis, and if you want to see anything else! Goodluck this week traders, let's kill it.

First video publish, testing out my recording but also giving my insights for the week ahead. The candle color looks a bit off but hopefully it can be fixed for the next publish. Pardon the background noise in the first few seconds of the video. Let me know how the quality and your thoughts/analysis as well! Happy trading and have a great week traders, let's win.

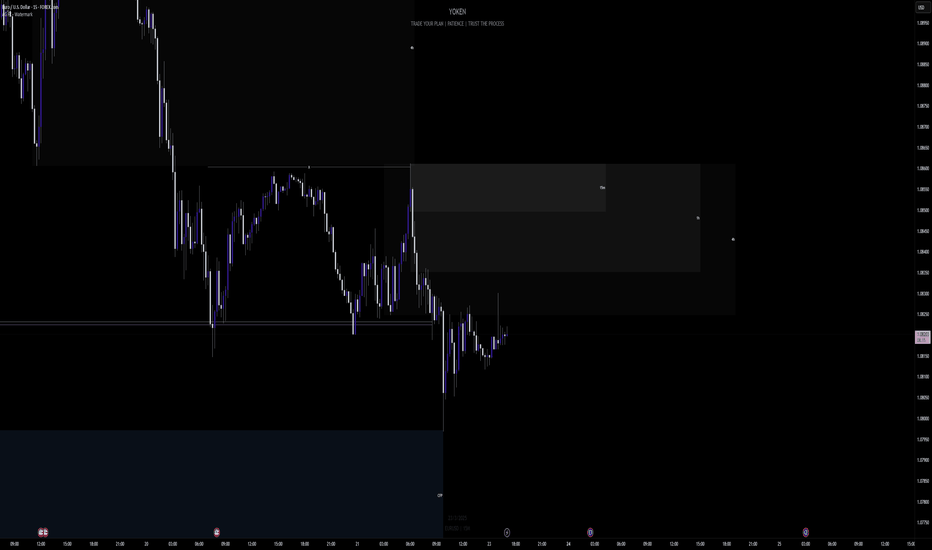

Smart money trading is the method I use. It utilizes market structure, liquidity, and supply/demand zones. From my image you can see the steps before a long setup possibly in NY session tomorrow. Liquidity was taken and momentum has went for the upside, looking for a long setup at my 7th step.