ZhengQian

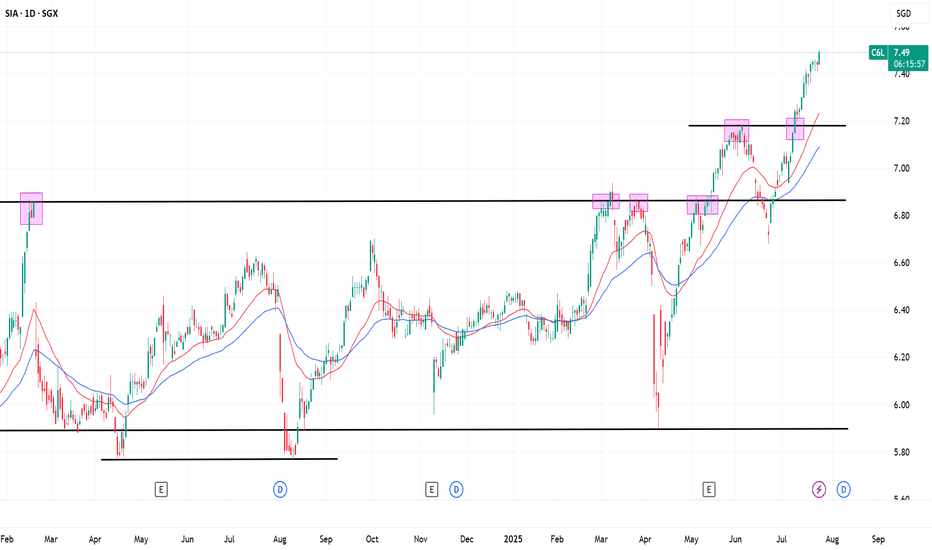

Broke past the key 7.20 resistance after twice rejections. Now SIA is heading toward the next target at 7.84 no major resistance in sight.

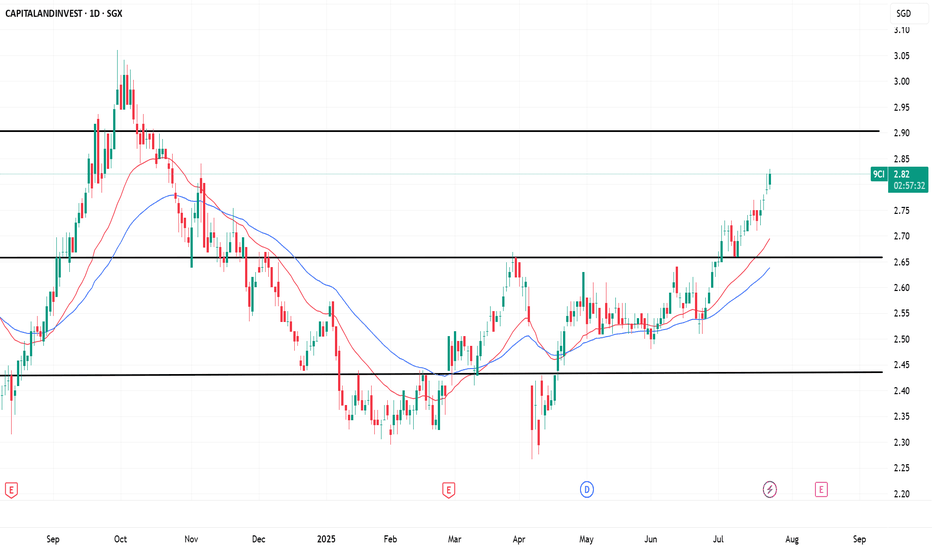

Price is approaching key resistance near SGD 2.90, following a strong bullish breakout above the 2.66 support zone. A successful breakout could open the door for further upside.

American Express (AXP) just broke above its previous all-time high, pushing into uncharted territory with strong bullish momentum.

Visa is rebounding after a sharp drop triggered by the announcement of the Genius Act, now approaching the 362 zone — a key resistance level from previous highs. Let’s see how it plays out.

Price is approaching a previous high near the $319–$320 level, where it faced strong resistance earlier this year. Watching closely to see if it breaks out or forms a double top reversal.

Starbucks (SBUX) has just broken above the key resistance level around $89.50, which previously acted as a strong support-turned-resistance zone.

SATS, a former superstar, seems to be making a comeback this year. The pandemic and WFS acquisition raised many doubts about management, but the latest excellent quarterly results and dividend distribution show that the company is coming back stronger. The recent contract renewal with SIA and the acquisition of Menzies World Cargo (Amsterdam) to expand EU market...

Visa is one of the greatest companies, with a solid business model and a profit margin of 50%. The stock has hit resistance at $362 and is currently testing that level. If the share price breaks above it, we could see a continued uptrend to new highs. However, if it fails to break out, a pullback might be expected.

Singapore Airlines (SIA) is testing a key resistance at $6.86 as it gears up to announce its full-year results on 15 May. The drop in oil prices could give the company a boost with better margins. If it breaks above $6.86, we might see more upside. But if it fails, a short-term dip over the next 7 trading days is likely — could be a good chance to re-enter after...

SGD 6.86 is a key resistance level for SIA. A successful breakout could see it turn into support. Failure to break above this level suggests continued short-term downside.

Mapletree Pan Asia is finally lifting from the support line at SGD 1.18. The REITs sector is typically seen as a defensive play during periods of weak market sentiment. The decline in Singapore’s interest rates and growing expectations of a Fed rate cut are driving its recovery. Despite a 5.96% dividend yield, concerns remain as net property income continues to...

Ping An Insurance's price is rising along with the Hang Seng Index, and the recent Chinese government meeting has introduced policies that benefit insurance companies. Let's see how it goes!

The Straits Times Index has been reaching new highs in recent months, driven by the rise of the top three banks—DBS, UOB, and OCBC. OCBC, which also the owner of Great Eastern insurance group, has seen its share price surge nearly 40% year-over-year. The ex-dividend date for its SGD 0.57 dividend is set for April 25, 2025, offering a dividend yield of...

One of the top 10 Chinese tech companies listed on the HK Stock Exchange, JD.com’s share price appears to be breaking out from its previous consolidation zone as bullish sentiment continues in the tech sector.

Pico Far East, a Singapore-based event management company listed on the HKSE, specializes in exhibitions, events, and brand activation services. With robust financial results, the company offers an attractive dividend yield of nearly 6%. Its share price is now traded at a 52-week high.

The recent introduction of Deepseek has driven a surge in HKSE tech company share prices. SenseTime, a leading AI company in China specializing in facial recognition and automation, is among the beneficiaries of this rally, supported by strong government backing and increasing global AI adoption. The chart displays a bullish candlestick pattern, signaling...

Concord Energy, headquartered in Singapore, is a Chinese power generation company operating in mainland China, Australia, New Zealand, Spain, Italy, the USA, and Canada. With global energy consumption on the rise, particularly in China and the USA, increasing electricity demand driven by data centers and AI computations is expected to benefit power generation...

Synergy House, a furniture player headquartered in Setia Alam, appears to have formed a Cup and Handle pattern on its technical chart. The company stands out despite the overall underperformance of the industrial products sector. Furniture exporters, including Synergy House, are expected to benefit from a stronger USD. Besides, the company has implemented AI...