EUR/USD bounces off 1.1300, Dollar turns red After bottoming out near the 1.1300 region, EUR/USD now regains upside traction and advances to the 1.1370 area on the back of the ongoing knee-jerk in the US Dollar. Meanwhile, market participants continue to closely follow news surrounding the US-China trade war.

The Japanese yen is expected to strengthen by approximately 7% against the US dollar, according to Morgan Stanley. This prediction comes as a response to potential weakening economic data and the increasing likelihood of a US recession due to recent reciprocal tariff announcements. Morgan Stanley’s team, which includes Koichi Sugisaki and David Adams, suggests...

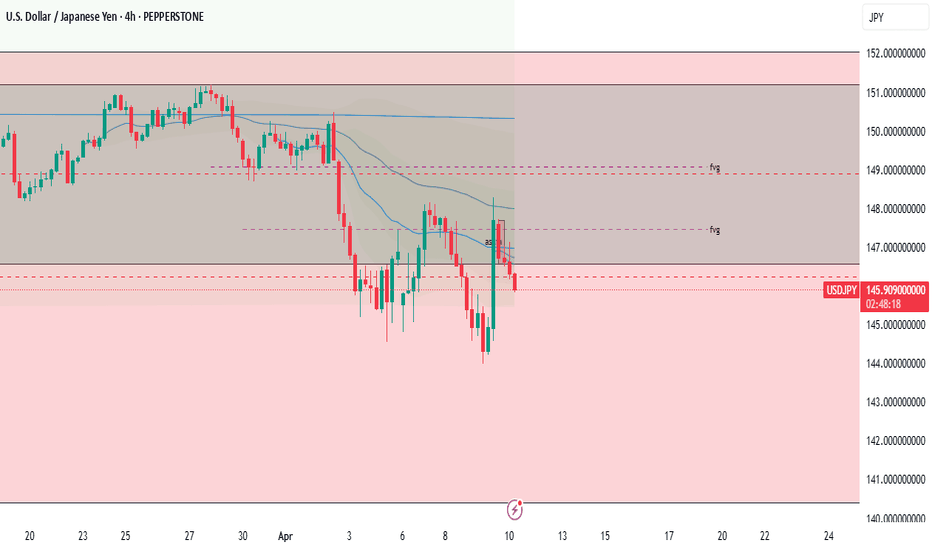

USD/JPY tumbles below 147.00, awaits US CPI for fresh impetus USD/JPY has come under intense selling presure and drops below 147.00 in the Asian session on Thursday. The US-China trade war escalation and the divergent BoJ-Fed policy expectations underpin the Japanese Yen and weigh heavily on the pair amid a renewed US Dollar downtick. US CPI awaited.

Gold clings to gains above $3,110, closes in on all-time high Gold builds on Wednesday's impressive gains and trades above $3,110 on Thursday. The broad-based selling pressure surrounding the US Dollar and retreating US bond yields on growing fears of a deepening trade war between China and the US fuel XAU/USD's rally.

USD/JPY tumbles below 147.00, awaits US CPI for fresh impetus USD/JPY has come under intense selling presure and drops below 147.00 in the Asian session on Thursday. The US-China trade war escalation and the divergent BoJ-Fed policy expectations underpin the Japanese Yen and weigh heavily on the pair amid a renewed US Dollar downtick. US CPI awaited.

EUR/USD holds gains below 1.1000 ahead of US CPI release EUR/USD is tirmimng gains while below 1.1000 in the European session on Thursday. The Euro gains on the German coalition deal and Trump's 90-day pause on reciprocal tariffs. Meanwhile, the US Dollar finds demand on profit-booknig ahead of the US CPI data release.

Gold price (XAU/USD) touches a fresh weekly top, around the $3,132-3,133 area heading into the European session as concerns about escalating US-China trade tensions continue to drive safe-haven flows. Moreover, fears that tariffs would hinder economic growth and boost inflation turn out to be another factor that benefits the precious metal's status as a hedge...

Gold extends rally to $3,050 area as safe-haven flows dominate markets Gold preserves its bullish momentum and trades near $3,050 in the second half of the day. Further escalation in the trade conflict between the US and China force markets to remain risk-averse midweek, allowing the precious metal to capitalize on safe-haven flows.

EUR/USD trades decisively higher on the day above 1.1000 on Wednesday as the US Dollar (USD) stays under persistent selling pressure on growing fears over a recession as a result of the US trade war with China. Later in the American session, the Federal Reserve will release the minutes of the March policy meeting.

EUR/USD trades decisively higher on the day above 1.1000 on Wednesday as the US Dollar (USD) stays under persistent selling pressure on growing fears over a recession as a result of the US trade war with China. Later in the American session, the Federal Reserve will release the minutes of the March policy meeting.

Gold prices are accelerating their daily decline, steadily approaching the critical $3,000 per troy ounce mark as the Greenback's rebound gains extra momentum and US yields tighten their retracement.

Central Bank Policies: The Swiss National Bank (SNB) policy decisions significantly impact the CHF. Recent SNB rate cuts are a key factor influencing the EUR/CHF pair. Conversely, the European Central Bank (ECB) policies regarding the Eurozone also have a large impact on the EUR side of the pairing.

AUD/USD has ereased earlier gains to edge lower below 0.6300 in the Asian session on Monday. Trump's tariff concerns outweigh mixed Chinese NBS March PMI data, Australia's hot private inflation data and broad US Dollar weakness, exerting downward pressure on the pair as risk-aversion intensifies.

The CHF/CAD pair tells the trader how many Canadian Dollar (the quote currency) are needed to purchase one Franc Swiss (the base currency). These two economies are quite intensely linked because Canada is an important producer of gold while Switzerland is a great importer of that same commodity - a quart part of the overall commodities imported by Switzerland is...

Gold price rallies over 0.7% and ekes out a fresh all-time high at $3,086. Markets are heading into safe-haven Gold while Equities and Cryptocurrencies drop. Gold traders are now targeting $3,100 in the near term. Gold price (XAU/USD) is printing another record performance this Friday, hitting $3,086 as the new all-time high for now and trading around $3,077 at...

GBP/USD retests the 1.2870 zone, or two-week lows The Greenback's upside impulse is now gathering extra steam and motivates GBP/USD to recede to the area of new two-week troughs around 1.2870.

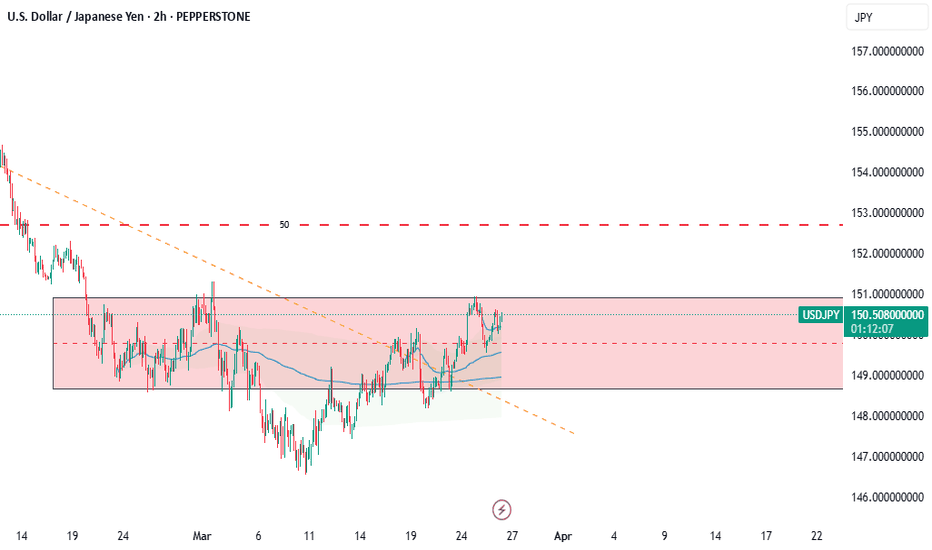

USD/JPY rebounds toward 150.50 on risk recovery USD/JPY is bouncing back toward 150.50 in Wednesday's Asian session. The pair reverses US President Trump's fresh tariff threats and hawkish BoJ commentary-led drop, tracking the rebound in risk sentiment and the US Dollar. All eyes stay on US tariffs, data and Fedspeak.

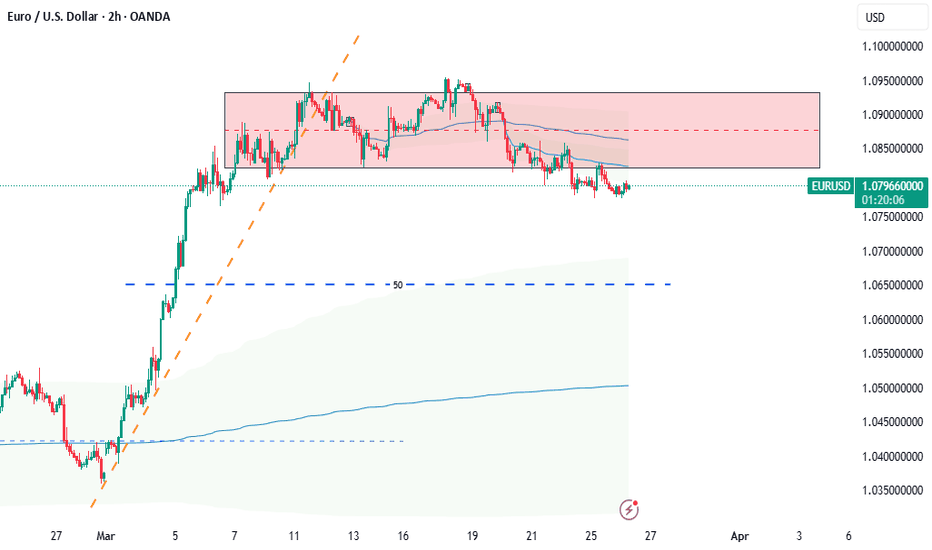

EUR/USD wavers near 1.0800, US data eyed EUR/USD trades sideway near 1.0800 in Wednesday's European trading hours as the US Dollar struggles amid the latest tariff threats by US President Trump. Dovish ECB commentary limits the pair's upside ahead of US data and Fedspeak.