It is not a secret that Europe’s defence landscape has shifted dramatically to a pace unseen since the Cold War. In 2022, Central and Western Europe’s combined military outlays reached $345 billion, surpassing 1989 levels as the Cold War ended1. Where there is a commonly cited “peace dividend”, this is the era reaping the rearmament rewards. Even traditionally...

Many said it could not be done and would never happen. But the European defence industry is undergoing a paradigm shift. The geopolitical landscape has shifted dramatically, and delayed action is no longer an option. With rising global instability and the return of President Trump to the White House, European leaders must act decisively to ensure security,...

While developed economies have shifted to easing policies, opening the way for a broadening of the market away from technology mega stocks, the economic outlook remains uncertain. The violent reaction to DeepSeek’s launch early in the year clearly highlights the nervousness of markets and their ultra concentration. In the first few weeks of the year, the Trump...

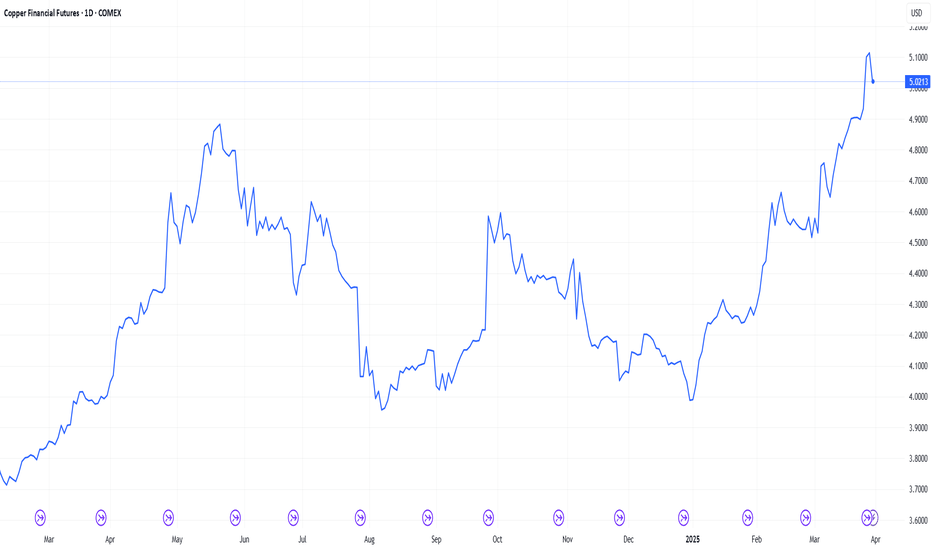

Copper’s COMEX price hit a new high on 26th March making the red metal red hot right now. The first three months of 2025 have seen industrial metals make noticeable gains with the Bloomberg Industrial Metals Subindex up 10.55% year to date1. Copper’s gains, however, stand out for numerous reasons. Tariffs The additional premium of COMEX prices over the London...

I recently created a website, but soon after launching it, I noticed it wasn’t appearing in Google searches. While researching how to fix this, I received an email with step-by-step instructions on what to do. Nothing about it seemed suspicious—not even the sender’s address. But when I used artificial intelligence (AI) to verify its authenticity, it was flagged as...

Arabica coffee prices have experienced unprecedented volatility, with futures surpassing $4.30 per pound on February 10, marking the 13th consecutive record-setting session1. This surge is attributed to a confluence of climatic challenges, speculative trading activities, and inherent agricultural cycles. Speculative trading and market volatility The recent...

We are about a month into the Chinese Year of the Snake. The preceding Year of the Dragon (10 February 2024 to 28 January 2025) brought significant momentum to the asset class with broad commodities rising 10%, precious metals rising 36%, industrial metals rising 12%, and even energy and agriculture mustering a late gain (close to 2% each)1. However, the Year of...

“The decision here is the most powerful symbol of the rebirth of nuclear power as a clean and reliable energy resource,” – Constellation Energy CEO Joe Dominguez, September 2024. The decision in the quote above refers to the deal Microsoft has struck with Constellation Energy, the operator of the Three Mile Island nuclear plant, to restart operations and power...

The race to bolster European defence capabilities is well underway. Since the invasion of Ukraine, European leaders have intensified calls for increased defence spending. The continent, long reliant on US security guarantees, is now facing a critical inflection point. Recent moves by the US administration to engage with Russia without consulting its European...

The United States (U.S.) is no longer just a bitcoin holder – it may be laying the groundwork for a national crypto reserve. Is this the moment bitcoin goes fully mainstream? Strategic bitcoin accumulation? Recent estimates suggest that the U.S. government is sitting on 200,000+ bitcoins – over $13 billion worth – mostly seized from criminal operators such as...

Japanese equities ended 2023 on a high note. Japan’s post pandemic re-opening, accommodative monetary stance, high equity risk premiums and improving corporate governance reforms were important tailwinds for Japanese equities in 2023. Over the last 12 months Japan has benefited from global investor inflows who are diversifying their investments in Asia, with...

India shined as one of the best performing markets globally in 2023 despite high global inflation, rising interest rates, and unstable geopolitics. The Sensex and Nifty, two widely followed benchmarks for the Indian markets, grew 19.57% and 21.11% respectively in US Dollar (USD) terms1. India’s economy displayed strong local retail demand, moderate inflation,...

After a long journey, the first spot bitcoin exchange-traded funds (ETFs) were approved in the United States of America. This is the latest step on the path to bitcoin, and digital assets more generally, becoming mainstream. To help clarify how this chain of events unfolded, and where the story could go next, this is an edited summary of a discussion with Ryan...

Cocoa was the best performing commodity in 2023, recording a price increase of 64%1. Cocoa prices have continued to rally in 2024 crossing the threshold of US$5000 Metric Ton (MT) on 2 February 2024. The last time cocoa prices rose to this magnitude was in 1977 when it reached US$5379MT. A similar situation prevailed back then, adverse weather conditions led to...

This week financial markets were dominated by central banks policy decisions. While the Federal Reserve (Fed) and Bank of England (BOE) kept rates on hold, the policy board of the Bank of Japan (BOJ) decided to further increase the flexibility in its yield curve control policy. The BOJ previously set a strict cap of 1.0% for the 10-year Japanese Government Bond...

2023 has been a tough year for stock pickers. The gap between equity factor styles has been vast over H1. Growth, riskier in nature, posted the best performance up 24% year-to-date (YTD) followed closely behind by quality up 20% YTD1. The excitement around artificial intelligence (AI) reached a fever pitch in H1 2023, supporting growth-oriented technology stocks....

As London Metals Exchange Week 2023 wraps up, we summarise some of the key observations for the state of the base metals in 2023 and what are likely to drivers for the markets going into 2024. Better than the macro data would indicate Despite the challenging macroeconomic backdrop especially in China, metal demand is holding up fairly well. Demand indicators...

Asset allocation is ultimately about balancing returns with risks. While it is relatively easy to reduce risk in a portfolio, it is harder to do so without diminishing its return potential. Diversification, that is, adding uncorrelated assets to the portfolio, is one of the main tools available to investors to lower such risk, but it often comes at the cost of...