Large 4 ema extension, expect a gap fill to close to the trendline

In XBI i have been playing this trend for days now. Very simple XBI like to test the 13 ema and bounce. When it is near or a little below i buy this weeks closest itm calls. I sell the position before eod. i set my stoo roughly .20 below the 13 ema on the daily. Nothing fancy here. Sometimes the easiest trades are right in front of our face. you can follow my...

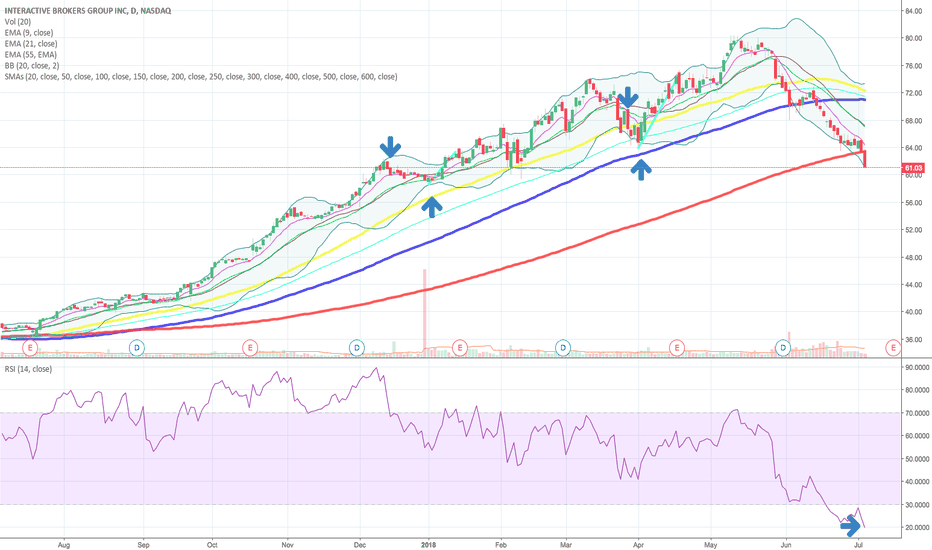

$IBKR, i have played $IBKR into the past 2 eps. It tends to sell off and then ramps up btwn 15-30 days before eps. I believe the market is giving us a good buy opportunity here into eps. With the markets being volatile that plays in favor of this stock. Traders are more active and thats how they make money. I started a position today in the July 20 65c. I...

This is a pretty simple setup. We have a triple bottom with a strong FL. I feel the r/r here is definitely worth it. The hourly chart looks nice closing above the 13ema. I bought the Aug 25c here. I will set my stop loss at 22.88. Dont forget we also have Buffet buying this stock. Normally i write a longer summary but this set up is pretty easy and visible to all.

$BA i have not entered in for a swing trade yet. I am waiting to see how tonight turns out. But drawing the short term Fibs along with a solid support line i see $355 coming fast once we get thru tomorrow. I plan to buy calls tomorrow after we see the overnight trade war reactions. follow me @breakingoptions for live trading on twitter

$IBKR looks like it is consolidating after its recent decline. With all the volatility in the market we have to assume there trading volume has increased since last quarters earnings. It also has good support at 63.33. I plan to buy calls in the morning. To see my exact entry and call following me @breakingoptions

$MNST LONG i think we at least break the 200d and start the gap fill. Obviously we would like the market with us. It broke out of its recent consolidation to the upside. There was large size bullish put selling at the August 50 strike on 6/27. I will be buying calls in the morning. you can see my exact entry ticket on twitter @breakingoptions

$OSTK, now with all that cash i think it is time $OSTK retests the recent high of $41.55 and breaks thru. Key support is at 33.30 then 31.35. I will be buying calls at open tomorrow. Will update on twitter which ones. @breakingoptions

$CAT @breakingoptions , keep this one on the radar, RSI has not been this oversold since 2014, This is all trade war noise. Stock is below every moving avg. I have a string support / gap up line at 132.01. Fib 38.2% @ 145.12, once trade war news is over this will be your go to stock. Aug 145 calls looking like a decent play

$OLED , i believe OLED is a good long here for a short term swing trade. It has reversed course on a substantial support line that dates back to feb 2017. RSI indicates that we were way oversold yesterday with a reading of around 24. Tomorrow will be a key day to see if we can break above 30 on the RSI. Also on the hourly we need to break the 55ema which is at...

$AAPL, I feel $AAPL we be effected by trade war talks more than it is showing. It has had difficulty at this RSI level in the past 3 months EXCEPT for when the Buffet news came out. On the hourly they pinned apple on the 55em with the 9ema right above sloping down. It sdid defend the 21 ema on the hourly today. I feel the real tell is if it breaks the 50d sma...

$IQ, as you can see on the hourly chart, every-time $IQ had a large green candle following a large red candle during the opening hour or closing hour, it moved up significantly. There was 1 instance i found it took towards the 2nd trading day for the move. Based on this trend and the LARGE call buying today ( July 40 over 16k, 45 over 21k, 50 over 13k), i plan...

$SPLK closed above support on the 9,21,55 EMA today in an ugly tape. It had 2 double bottoms today on the 10m and immediately got bought up. I like the chart on this name based off of its symmetrical moves. I feel the technicals line up for another leg higher. Seasonality, ( which is another factor i look at) is in our favor, The scanners i use show and 80% or...

$CMG is hold nicely on the hourly in this down market worth a shot on the weekly 475 option. I would hold overnight but exit tomorrow. Know your risk tolorerance

As we all know spring / summer is christmas for HD. By looking at 3 years Historical charts we can see home depot has an increase in share price of greater than 10% from mid June right into earnings. I am an options trader so one way i plane to capitalize on this move is a Risk Reversal Spread. I plan to sell the Aug 210/220c, while at the same time selling the...