chartorscience

Looking at UUV tonight after some large volumes over the past week. In terms of context, the company wrapped up all previous business in the US last November 2020. Winton Willesee was appointed Chairman in October 2020 to push this through. For those unfamiliar, he has a history of leading RTOs (xTV to NZS) and growing small-cap companies such as CPH and...

Quick look at DDD on a Sunday afternoon. After striking a deal to take over the Adelong Gold Project from receivers in 2020, DDD has been in an upward trend. The price has settled at around $0.005 after hitting heights of $0.01 in September 2020. This coincided with a number of overbought signals , as per the MFI. The volume profile indicates that the...

Quick look at the ASX:AR9 chart. Lookback After a cup-and-handle and subsequent break-out in July, ASX:AR9 hit a high in mid-August. It has since entered a four-month downtrend (Trend 1) and is currently in a period of consolidation. Strong support was immediately found at the 0.618 fib level ($0.36) and this has held despite being tested multiple...

Quick look at ASX:IXR after a big end to last week. What has happened? After a huge run up between May 2019 and October 2019, ASX:IXR topped out at $0.015. During the ensuing months, ASX:IXR found support at the 0.5 fib resistance (Support 1) which held until COVID-19 when this level turned into resistance (Resistance 1). IXR bottomed out at the 0.786...

Quick look at EGR which is looking at a nice end to 2020. After a run-up in September following positive news, EGR dropped off and failed to break through the 0.382 fib resistance. Support has been found at $0.14 (Support 1), confirmed by WVF which strongly indicates market bottoms at this level. Trading has since pushed away from Support 1 and the...

We look at ASX:OSP after a rapid mid-year rise and subsequent fall-off. After entering the downtrend in August, ASX:OSP hit a support of $0.022 before failing to break through 0.618 fib resistance. Subsequently the previous support of $0.022 turned into resistance. New 'Support 1' of $0.018 was found which ASX:OSP has looked to have bounced off at...

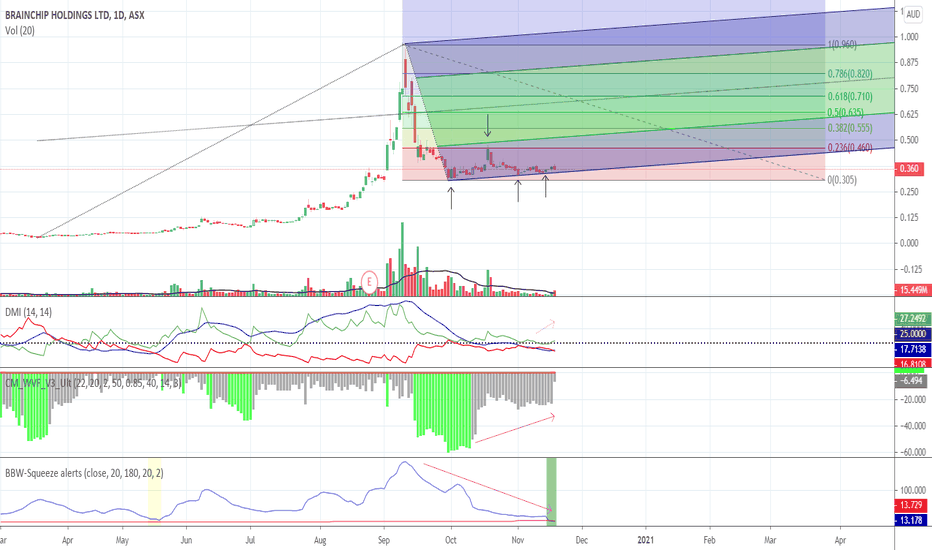

Quick technical analysis of ASX:BRN following its rapid rise and subsequent consolidation over the past two months. In summary: Indicators are showing that support has been found at ~$0.31 and the .236 fib retracement level / -0.5 schiff resistance level has been tested. As per BBW, volatility is decreasing which indicates that a breakout may be on the...

As per discussion on chart. > Schiff Pitchfork levels and Ichi Cloud show the short-term support and resistance levels for NEO > NEO has handled itself well so far, and I expect to see a slight dip before a rise above the 100 day EMA, and above the -0.5 Schiff level once again. > Look for bounce back from SUPPORT_1 and/or SUPPORT_2 before entering market.

A classic buyers vs. sellers tug-of-war is currently underway with NULS. Analysis and strategy as per chart. Symmetrical triangle pattern and current testing of Schiff Pitchfork resistance indicate a breakout (up or down) direction in the coming days. Fundamental analysis indicates a positive outbreak, given a spate of recent interest (including IBTimes...

If an external event doesn't cause additional downward pressure on the market, VEN is set to breakout in the coming days. Formation of a symmetrical triangle, a BB squeeze and a rise in the DMI+ and ADX creates a favourable scenario for VEN. Coupled with fundamental analysis (upcoming rebranding and current airdrop), positive movement is likely.

Mid-term formation of textbook cup and handle pattern (bullish continuation pattern), with current 'handle' phase indicating consolidation prior to a likely breakout. Once the current price level breaks out above the 'handle' resistance level, be quick to put your buy orders in before this intergalactic mission gets underway! Analysis Initial upward trend...

Quick analysis of XMR, which I consider to be a great option in these bearish times. This week XMR has been trending up within the channel Strong trend support (lower bound of channel) set to continue Tested resistance at 31,000 sat's twice today already. If this breaks through the price will likely spike upward In addition: Volume over past day...

After the recent spike there are a number of small signs that consolidation may occur before a further break out. - formation of an ascending triangle pattern - this pattern is often associated with a contraction in trading volume, indicating consolidation. This is evident in the recent ARK trading volume - fib extension shows that 0.618 level is currently being...

Today's rally is another small indicator that the IOTA mission to the moon is once again underway. The perennial symmetrical triangle seems to be forming, coupled with a continued decline in BB width. The 0.382 resistance has also been tested three times in the past four days. Promising signs. This is not financial advice.

following the symmetrical triangle and testing of short term support levels, we should see a moderate rise in the next 24 hours, prior to a potential trip to the moon. short term support level has been tested numerous times in last 12 hours at a minimum there is major support at $0.69 for xrp