cryptokebab

PremiumChart from end of Dec/early Jan. Idea back then was that the top is in, and we'll revisit at least 51.5 levels. IMO low will be between 41.5-32.5, with potential to reach 23s. However, it won't happen in one day and it's finally at prices i want to scale in and hold for the next weeks/months incase i'm wrong with the macro idea. I'm a buyer between 74-62,...

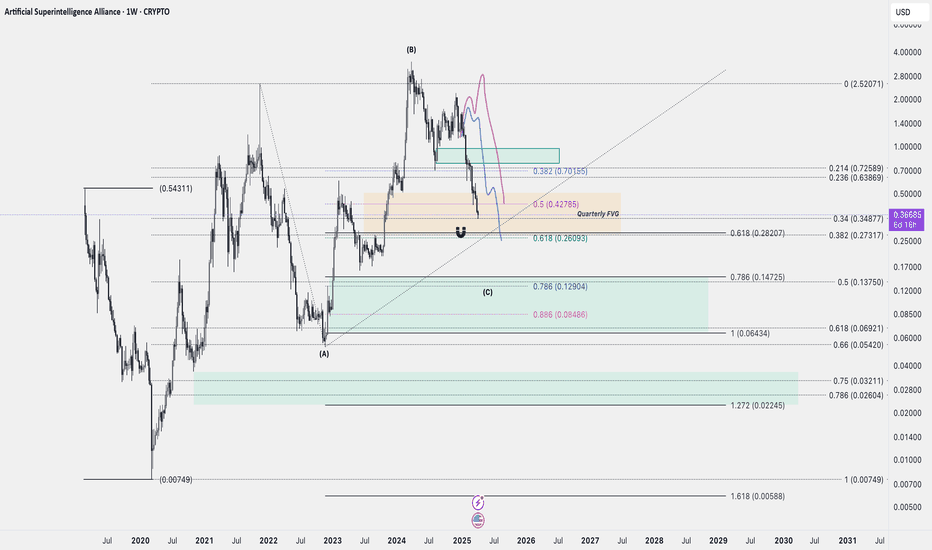

I sold every single FET I had at around 2.50s in May 24 and I've not been really interested in it since then, apart from a few short term traders. It's always been a terrible asset to trade frequently, a pain to wait for it to do its thing and then everything happens in a matter of few weeks. As if it's not enough, the merger made it even less attactive. Anyway,...

Playing the potential Wave 3 for Silver. My invalidation will be a weekly close below the highlighted demand zone.

Please check What if #1 for the context. I'm bullish for the next days, either giving us one or two more highs, followed by a dump in MTF. If things happen in this way, all we can do at that point will be playing level to level, until we have a clear picture.

What a move corn, what a move. Although it's a what if for, becomes an expectation when i see that bear div on rsi. An impulsive move like this may very well complete as diagonal, and when you see diagonals at the highs with HTF divs, you run away. If that happens to work, i'd not think for a second to buy that dip as the expection should be new highs, but i'd...

Yes, the market structure isn't really broken and it hasn't lost any major support Yes, it can go higher, a lot higher, and yes it's been one of the best performers of this cycle . Which makes it rather risky to short it. But it doesn't change the fact that it: - Failed to beat critical levels - By being one of the best performers, retail is loving it. -...

Hello friends, long time no update. I'll kept the chart clean and simple. Fail to break the levels above = orange coin goes for 49 at least, and imo 42-36 eventually. Breaking them probably takes us to 86k at least. All of these levels are confluence of fibs and volume, which gave me 15k bottom and 73k top. Trade safe.

Ok, although i'm super cautious at the current levels (and have been like that since ath) and think that we've been distributing, i don't want to be biased to the one side blindly as nothing is clear yet and bitty has been strong in this range. Here is the most bullish idea that makes sense to me (as in, going higher without any significant low). If things...

The trend has turned bearish. My swing trades will be shorts, probably until 28-21k. But I'll start buying soon to sell on the way up. IMO chances of going above 48k top is 25%, and I think you should consider yourself happy if it can reach 44k. Here are my buy levels based on fibonacci, vwaps and volume profile.

Ok, maxis can start making fun of it because 10k is shown on the chart, but I'm a trader and I trade probabilities. Even if the idea is correct, it won't get there straight and it won't get there in one month. We have three untapped yearly vwaps since 2016, both identified on the chart. I think the first one (at 28k) will come between march and july. The second...

In my last BTC idea i said it wasn't a good idea to be bearish and it turned out, indeed it wasn't. Idea here is self-explanatory but it can look more cluttered when shared so a little explanation. The whole thinking is shaped around the Nasdaq fractal and an up only scenario, which is unlikely IMO. Between the three, blue option is my favourite as it'll stop...

One of my favourite assets as it respects my strategies very well. I could be completely wrong with this one and as usual I'm playing level by level. The substructure is very difficult to outline for now, but I'm watching 4h and daily charts in the interim areas marked on the chart for potential internal trend reversals. I'm aware of the bullish scenarios, but...

I got myself some bags from the blue box, but if they're kind enough to offer the green box as well with nice bull divs, I will return the favour and sit on my hands for a few weeks/months.

DOT is another asset I trade maybe once or twice a year - I gave up trading it after the 2021 top and I saw many people got burnt trying to long it over the past few months since bitcoin's 15k bottom. I still prefer lower targets, but time is at an important place so I might be too greedy to wait for it. Still, if lower targets comes within this week and the...

Same fib play that I used to point many HTF reversals such as: I never traded CAKE and not trading now either because I prefer fresh narratives - but a good RR trade is there if you're interested.

Just a late-night brain dump. I've been trading IMX and WOO for the past 6 months almost everyday and noticed they respect my strategy in similar fashion - so i wanted to look for a correlation between their price action. To my limited FA knowledge, they don't have anything in common at all, but that doesn't matter at all. With fractals, I don't care too much...

I've been suggesting further upside on BYBIT:DYDXUSDT.P and for alts in general for a long time, but dydx has been one of assets I traded best, feel free to check the charts below for how HTF ideas played out since march/january. At the moment it's approaching to a big resistance area I highlighted before and already looks like a deviation of the range (at...

Ok, we nailed the bottom for BYBIT:DYDXUSDT.P with the HTF idea. I'll add my EW counts as a comment to keep the chart as clean as I can. PA wise, my main idea is to go a bit higher, pullback, then run towards 5$. Disclaimer: The setups given aren't the way i'll play it. I don't like using stops in areas like this where I'm confident we'll reverse eventually. I...