Bitcoin dominance, a metric that calculates the cryptocurrency’s share versus other assets on the market, has been trending up since the start of October. The last time dominance was at this level was at the end of August. “Although there is positive sentiment around BTC, bull runs usually lead to a bear market in alt coins,” noted Melvis Langyintuo, a market...

Katie Stockton, an analyst at Fairlead Strategies, says bitcoin has been above the key $10,000 price point for some time, which she considers bullish. “Bitcoin has been consolidating within its uptrend since discovering support near $10,000 a month ago,” Stockton said. The last time bitcoin traded below $10,000 was on September 9.

Bitcoin’s price was as high as $10,932 on spot exchanges such as Coinbase before quickly plunging 4% within two hours to as low as $10,427. It subsequently rebounded a bit to $X as of press time. The drop coincided with the announcement crypto derivatives venue BitMEX was formally being charged by U.S. regulators for unregistered trading, among other...

Several stakeholders in the crypto market see a lack of yields coming from traditional markets as a sign cryptocurrency has a place in uncertain times. “We are moving into a period of stagflation – stagnant growth and inflation – which creates a steepening of yield curves in the fixed income world,” said Chris Thomas, head of digital assets for Swissquote Bank....

Rupert Douglas, head of institutional sales at crypto brokerage Koine, has some concerns that investors will quickly sell off crypto should traditional markets take another nosedive. “The question is: Is the selling over in equities? I don't think so, which means that risks are still to the downside for BTC,” Douglas told CoinDesk.

“So far, bitcoin dominance has largely been sliding downwards since the beginning of 2020,” said Andrew Tu, an executive at crypto quant trading firm Efficient Frontier. “It will be interesting to see if we see a short term reversion of the bitcoin dominance back upwards.” Jean Baptiste Pavageau, partner at trading firm ExoAlpha, says decentralized finance, or...

The price of bitcoin was struggling to trend upward Friday, staying in a narrow $10,200-$10,350 range to start the weekend. “Bitcoin has traded off this month with other risk assets, such that it is now short-term oversold near former resistance in the $10,055 area,” said Katie Stockton, analyst for Fairlead Strategies. “We expect the pullback to keep its hold...

Henrik Kugelberg, a Swedish over-the-counter crypto trader, points to the longer-term outlook of bitcoin versus fiat’s performance. “The macro perspective is of course that all currencies will lose value and the only hedge in the currency market the coming months is bitcoin.” Indeed, the U.S. Dollar Index, a measure of the American currency against a basket of...

“After the Sept. 2-3 drop, bitcoin has been stuck in a narrow range of $10,100 to $10,500, looking for direction,” said David Lifchitz, chief investment officer for crypto quantitative firm ExoAlpha. “Each drop below $10,000 has been furiously bought, keeping BTC above that,” he added. Over the past week, traders have come in and scooped up sub-$10,000 bitcoin,...

Rupert Douglas, head of institutional sales for crypto brokerage Koine, isn’t ruling out a further drop. “It’s tough right now to say how far BTC retraces,” he told CoinDesk. “My concern is around equities, where I believe tech is in a bubble not dissimilar to 2000,” he added. The equities markets are mixed Tuesday, with some hopeful numbers out of Asia while...

Bitcoin’s price dropped below $10,000 Friday, sliding as low as $9,894 on spot exchanges such as Coinbase. “It’s not the best look for BTC from a momentum and positive volume standpoint, to be honest,” said Constantine Kogan, partner at crypto fund of funds BitBull Capital. David Lifchitz, chief investment officer for crypto quantitative firm ExoAlpha, says...

Ether’s market cap’s share of the broader digital asset market hit a 2020 high over 14% Wednesday. Although dipping a bit Thursday, the last time ether’s share was at these levels was back in August 2018. “A large number of useful projects on the Ethereum blockchain contribute to ether dominance growth,” said Azamat Malaev, co-founder of HodlTree, a...

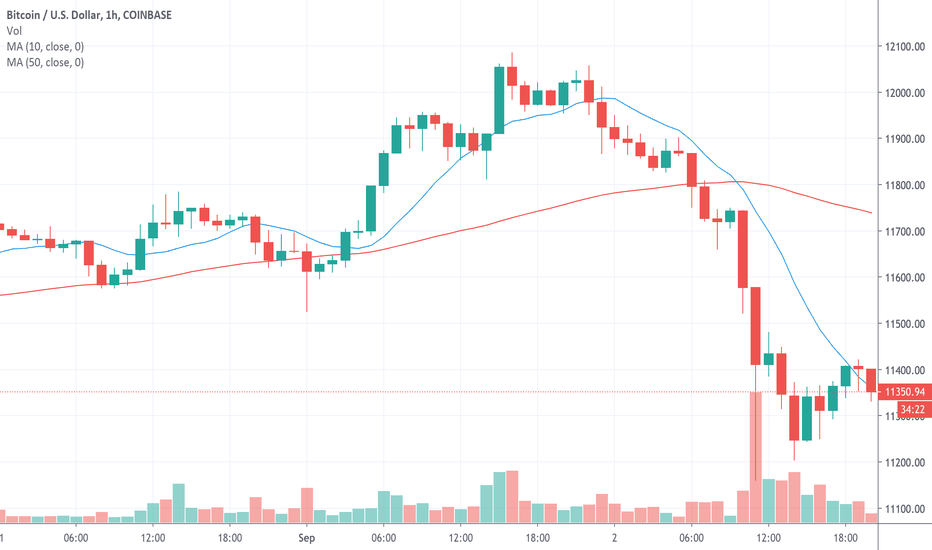

Bitcoin dropped to as low as $11,159 on spot exchanges like Coinbase Wednesday. The fall was exacerbated by long-oriented derivatives traders on exchanges like BitMEX. That platform experienced $9 million in sell liquidations in one hour as prices fell, the equivalent of a margin call in the cryptocurrency world. Alex Mascioli, head of institutional services at...

One bullish sign for crypto: The ETH/BTC trading pair, which highlights the strength of ether versus bitcoin, is trending way up Tuesday as some traders are selling BTC for ETH. "I am keeping a close eye on the ETH/BTC pair, as ETH is at a key level not seen since January 2019,” said Jason Lau, chief operating officer for cryptocurrency exchange OKcoin. “With...

The Federal Reserve’s decision to let inflation run while keeping interest rates low is helping boost crypto, Darius Sit, managing partner of QCP Capital, told CoinDesk. “The market was looking to the Powell speech to see if there’d be any hawkish indications – clear plans to end liquidity injection and cheap money,” Sit said. “There was no sign of hawkishness...

Jean Baptiste Pavageau, partner at quant trading firm ExoAlpha, says bitcoin’s recovery after gyrating $450 on Fed chair Jerome Powell’s comments Thursday continues a larger bullish cycle started earlier in the summer. “After it’s recent fake breakout above the $12,000 resistance level, bitcoin saw a short-term trend reversal in its broader bullish trend...

Jean Baptiste Pavageau, a partner at quantitative trading firm ExoAlpha, says bitcoin continues to be affected by gains in alternative cryptocurrencies, or altcoins. Indeed, one way to measure this is looking at bitcoin’s dominance, which hit a 2020 low of 60.26% in August. ”The flattishness of the bitcoin price since the beginning of August allowed the altcoin...

Over-the-counter crypto trader Henrik Kugelberg expects a bullish, if not record, fourth quarter ahead for bitcoin, even if the number of sluggish market days pile up. “I expect a slower curve but would not be surprised if we reach a $15,000 BTC in October and somewhere around $18,000-$20,000 at year end.” Kugelberg points to the uncertain economy as giving...