diegotrader9988

Iron ore has been sufffered quite alot about tariffs but for economical reasons it has changed it and the way is up

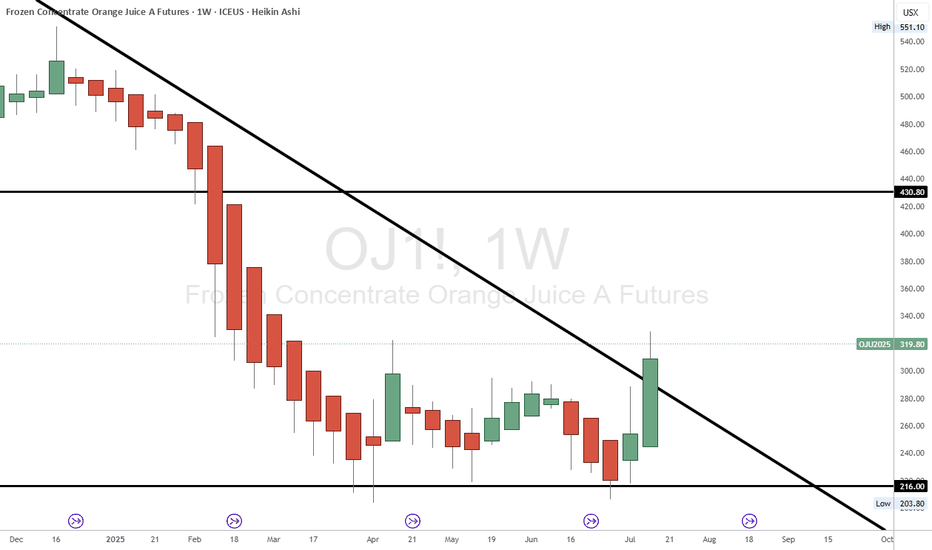

Most of orange juice consumpted in the usa is most from brazil and due to political situation and tariffs the trend for orange juice is up....

"Oil prices are expected to rise due to the ongoing war. The conflict is disrupting supply chains and creating uncertainty in the global market, pushing prices higher."

S&P 500 remains in a broader downtrend, driven by persistent economic uncertainties and inflationary pressures. Despite a recent correction, with the SPY rising approximately 2.5% from $551.23 on April 25 to $565.00 on May 9, this uptick may be temporary, as market sentiment and macroeconomic indicators suggest ongoing volatility and potential further declines

Bitcoin is currently in a downtrend, showing signs of declining value. Investors are cautious as the market faces increased selling pressure and uncertainty.

cattle prices are currently in an uptrend, showing signs of increasing value. Investors and producers are optimistic as the market experiences stronger demand and limited supply.

The Brazilian cattle market has entered a downtrend, with prices poised to test recent lows. High supply and weaker domestic demand, coupled with export challenges, are driving the decline, as meatpackers face pressure to adjust to shifting market dynamics.

The U.S.-China trade war, fueled by tariffs, is pressuring their currencies, with the U.S. dollar falling and the Chinese yuan gaining. The dollar weakens amid recession fears, while China curbs yuan appreciation. A potential currency war looms, but both nations aim to stabilize markets for now.

Bitcoin is gearing up to test its all-time highs, fueled by growing investor optimism and robust market momentum. Technical indicators and increasing institutional interest point to a potential breakout in the near term.

The Brazilian stock market is currently in an uptrend, showing signs of growth and investor confidence. Positive economic indicators and strong corporate results are driving the market higher.

Brazailian interest rate has come from a long bull market but for now things might have changed for moment its sell...

Usd brl is on track to change trend. It has risen since last year

IMOB the main index about real state in Brazil has just collapsed after Central bank raike its interest rate and guidance for more increase in the next months due to it most real state companies will suffer quite a bit cause they need quite huge amount of capital for keep the business running mainly for costs to build.

Us bonds or tlt long term bonds are undeer pressure for mpment its a sell

For quite sometime bitcoin was undê prrssure but not nwow.....longs

For some momemt bitcoin kept on pressure down now up

For quite some time iron ore has been in a bad market but due to china stimulus now we can see some support for long #vale #riotinto

Cane is getting hot here for moment its long mainly due to fire in brazil