edramlan

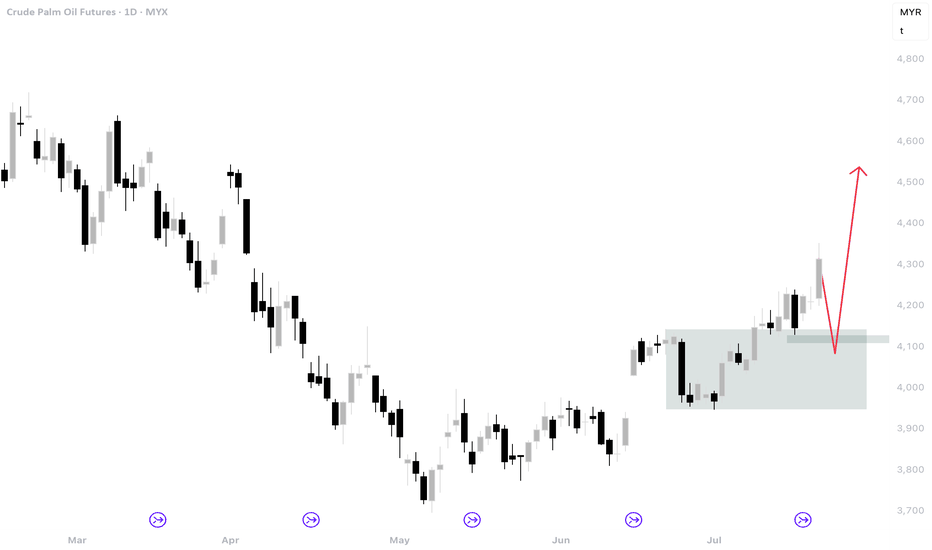

PlusIt took a very long time to reach 4300. The next target is 4500. However it won't be easy because there are a few resistance above 4300. Expecting that price might retrace a bit before continuing higher.

Looking for price to fill up the gap below 4000 and after that expecting price to go higher and target the gap at around 4300. If price stays above 4300 then price would likely going to continue bullish.

I'm expecting price to break 4000 next. If not then it will continue in consolidation mode. There is a little resistance at 4000 level but price should have enough to move higher to possible even touch 4200. Happy trading.

Price hold support steadily even though still failed to make any move higher. It seems that 3700 is a support area for now. There are two possibilities this week: #1 - We might see consolidation this week and price might move sideways. #2 - Price to retrace a bit and then make a breakout towards 4000. This would be ideal and the best scenario. Happy trading!

I think the price will continue lower next week. There is a brief retracement higher last week but the price went back lower immediately. Look at the weekly candle. A bearish key reversal that almost cancelled out the bullish reversal from the previous week. At this moment bearish is still strong therefore expecting price to go lower to test 3600 area.

There are 2 scenarios for this week: Scenario #1 - if price to close and stay above 3857 then there is possibility that it will continue going higher towards 4000 area. However this might be a limited move higher because the overall trend is still bearish. I think that the price will likely retest the 3700 and consolidate for a bit before going bullish. Scenario...

So far it is bearish until there is a significant signal that bullish is back on. If price going lower and failed to defend the previous week low then we will likely see price going lower and possibly testing the 3700 area.

A push higher on Friday clear the path towards 1560. That should be the target for next week. Depending on price action at that level, a move towards 1580 area is possible.

The index will continue higher next week. First it will take out the current high at 1515 before continuing towards 1530. However there are two ways for it to do it: Scenario1: Early of the week at market open price will straight making a move higher. This is supported by the higher closed of the weekly candle that already mitigated the bearish...

Last week price failed to make a new low but instead making a push higher. It might hint that the trend is shifting to bullish but at the current moment it is 50-50. A big bearish key reversal on Friday might indicate that bearish is not done yet. Furthermore look at the weekly candle. The upper and lower wicks are about the same length and the body is more or...

Price has gone through a few support area and it seems that it will continue lower. If price continue to close below 3960 then there is possibility that it will move to 3700 area. The case for going bullish price needs to close above 4070.

There is an argument for bullish price next week. However as it stands now the price is still in the 50-50 price action. There is not enough argument to confirm bullish movement. Meaning there is possibility also that it might go south next week. Scenario 1: If price stays above the 4000 and push higher then it will be bullish. Possibly towards 4500. Scenario 2:...

A rally today has provided a rebound for FKLI to regain the 1500 level. From the chart the lower low are not able to create a new lower low and price rebound today created a based where a move higher towards 1500 is likely. If price close above and stay above 1500 then a move towards 1600 is possible. Let's see.

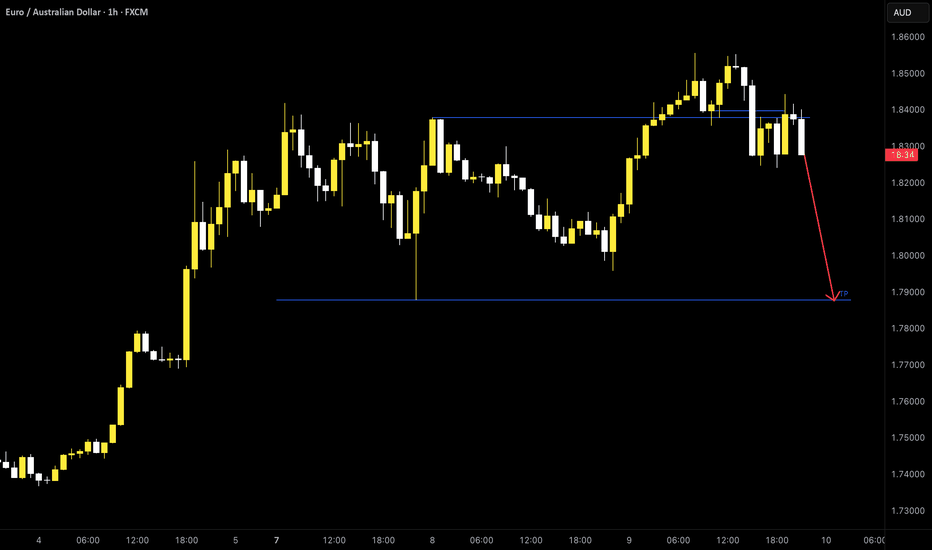

Looking for opportunity to short the pair. Expecting retracement 1.7870 area.

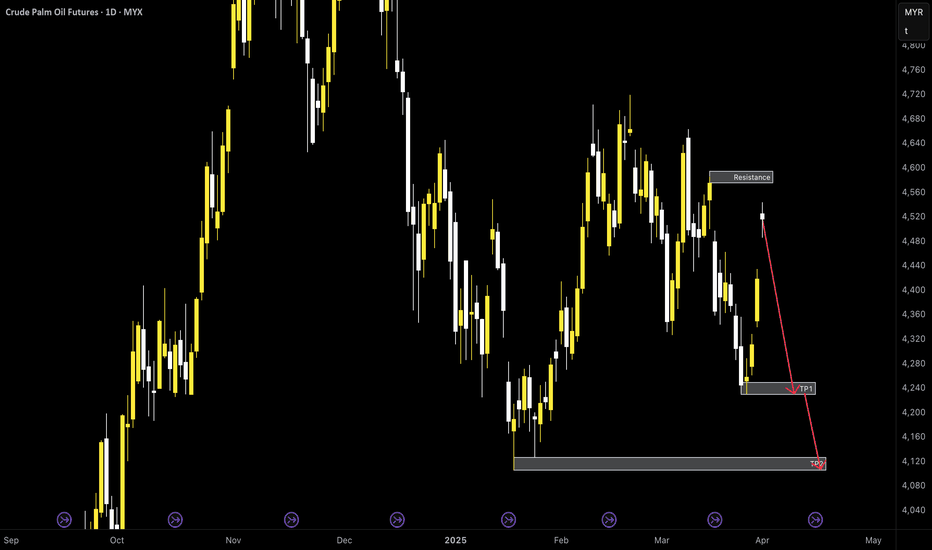

Price went higher today and this might be only a retracement before going lower again. For the remaining of the week, price might consolidate a bit before having any momentum to continue lower. If it indeed going lower, price will up the gaps before targeting TP1. Depending on price action TP2 is a possibility. For price to fully go bullish, a close above 6600 is required.

Looks like the price is going lower and it is bearish. Hopefully next week it could have enough momentum to continuously pushing lower and take out the support area towards 4200. Depending on price action, price would probably going much lower to 4000 where a much stronger support is expected. The only way for price to continue higher is to close above the 4500.

Price move higher as expected. It is now at resistance level. Scenario 1: Price break through and close above 4638 - Price will likely going forward to TP2. Scenario 2: Price help up at resistance and make retracement towards 4560 to 4550 area. If the area holds then it will continue higher towards TP1 and eventually TP2. This is the best scenario since price will...

I think the FKLI is bearish right now. It might tested the 1500 level. The momentum lower is strong and we will reach 1500 very soon. From there on it will be depending on the price action on whether 1500 will hold or break lower.