elevatedinvestor

The chart does majority of the talking here, there isn't too much I feel I have to write. Both assets are following similar pricing models that we have seen in the markets before. What do you think Bitcoin is going to do?

I'm currently watching EURJPY for a potential long setup. Price is showing signs of bullish structure, and there’s a clean upside target sitting at 164.20, where equal highs rest on the weekly chart. That level also ends in a .20—an institutional number often used for stop placement—which adds confluence that price may be drawn toward it. Why I'm Bullish The...

📈 Weekly Forex Recap – Market Reactions & Lessons (Apr 7–11) Last week there were about +320 pips of reaction potential (excluding Gold, which I was completely off on). There were multiple opportunities to capture solid intraday or swing setups. 3 out of 6 weekly targets were hit. 5 out of 6 trend biases were either accurate or neutral —meaning no major...

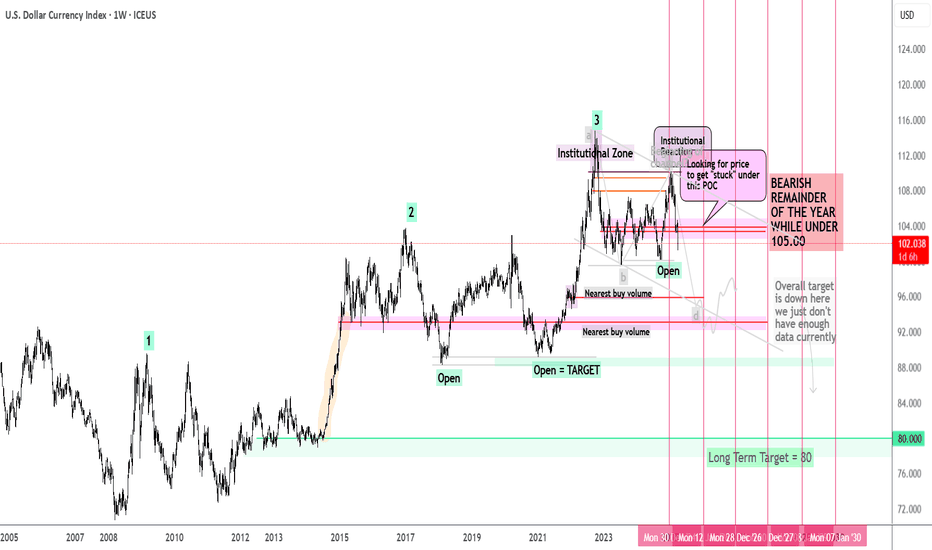

This is a pure technical walkthrough of the U.S. Dollar Index—no fluff, no indicators, no fundamentals. Just market structure, smart money, and liquidity concepts. Back on January 14th , I posted about a potential 20%+ drop in the DXY — you can view it here . This video builds on that thesis and walks you through the full technical story from 1986 to today...

I haven't posted on here in a minute but the NAS is looking weak, along with the SP and DOW, but mainly the SP and NAS. The next two weeks are critical to the remainder of the year. If we breach the 2024 high and close below it in January, I anticipate more lows. If we breach above it, and can hold above it through mid-February, we're probably looking at another...

Looking for a long entry, limit order set.... Here is my logic from left to right: we have an short term "double top" forming inside a higher time frame up trend, I'm looking for a run on the stops of traders going short. We found support at a bullish liquidity pocket (bottom red spot) = Bullish sign Price completed a bullish harmonic (that grey double...

Trade entered. Entry rules met. Confluences: ✅ Bearish overall bias ✅ Bearish demand zone ✅ Bearish impulse crab pattern ✅ Bearish divergence ✅ Bearish break of structure ✅ Entering London close zone ✅ Price is in entry zone ✅ Required risk:reward met ⭐ I shared this watch zone in my weekly forex outlook this week, you can subscribe by clicking the link in my bio.

Entry rules met. Confluences: ✅ Bearish overall bias ✅ Bearish demand zone ✅ Bearish ABCD extension pattern ✅ Bearish divergence ✅ Bearish break of structure ✅ Entering London close zone ✅ Price is in entry zone ✅ Required risk:reward met ⭐ I shared this watch zone in my weekly forex outlook, you can subscribe by clinking the link in my bio.

Trade entered. Entry rules met. Confluences: ✅ Bearish overall bias ✅ Bearish demand zone ✅ Bearish ABCD extension pattern ✅ Bearish divergence ✅ Bearish break of structure ✅ Entering London close zone ✅ Price is in entry zone ✅ Required risk:reward met ⭐ I shared this watch zone in my weekly forex outlook this week, you can subscribe by clicking the link in my bio.

Trade entered. I used the 5 min for entry but Tradingview doesn't let me post it on a small time frame. We should find out if this is a winner or loser during the rest of US/UK overlap. I personally think price wants to drop more, but my strategy says to buy, so I'm listening to the strategy, plus there is a nice risk to reward for this trade. Confluences: ✅...

This is a rough yearly outlook for the DXY. I will be updating this as the year goes on (I'll update this idea monthly as I check it). Right now there is TONS of sell side liquidity open on the DXY, and price may want to attack it. It's important to monitor its behavior around the 110-112 mark. I'm bearish on this index overall (1-4 year outlook), but it could...

Trade entered. Confluences: ✅ Bullish overall bias ✅ Bulllish demand zone ✅ Bullish crab on 15 min chart, bullish impulse crab on H4 ✅ Bullish divergence in price reversal zone ✅ Buillish break of structure ✅ Entering London close zone ✅ Break of structure confirmed ✅ Required risk:reward met

Waiting for order fill. Must come between 10am-12:30pm ET today. Confluences: ✅ Bullish overall bias ✅ Bulllish demand zone ✅ Bullish crab on 15 min chart, bullish impulse crab on H4 ✅ Bullish divergence in price reversal zone ✅ Buillish break of structure ✅ Entering London close zone ✅ Break of structure confirmed ✅ Required risk:reward met

The most important thing to reflect on each week is NOT your profit and loss balance. Instead, reflect on these three questions: - Did I follow my core habits for success? - Am I ready to let my attachments from last week go? - Am I focusing on this current moment, or a destination I'm trying to reach? I won't put a whole lot of words here. It's all in the...

Waiting for entry trigger. Must come between 10am-12pm ET today. Confluences: ✅ Bullish overall bias ✅ Bulllish demand zone ✅ Bullish bat pattern ✅ Bullish divergence in price reversal zone ✅ Buillish break of structure ✅ Entering London close zone ✅ Break of structure confirmed ✅ Required risk:reward met

Trade entered. Entry rules met. Confluences: ✅ Bullish overall bias ✅ Bulllish demand zone ✅ Bullish impulse butterfly pattern ✅ Bullish divergence ✅ Buillish break of structure ✅ Entering London close zone ✅ Price is in entry zone ✅ Required risk:reward met

Looking for a short entry to trigger between 10am and 12pm ET today. Probably not going to get it, price looks like it wants to melt for the CB Consumer Confidence release at 10am. We'll see.

In this video I share 8 ways to optimize your Tradingview for improve your performance. Most people focus on strategy, but that is only a piece of successful trading. What I would argue is even more important....is your ability to execute. Better execution is a result of - repetition, clarity, understanding The things in this video will help you with...