With the news that the CDC is pausing J&J vaccine distribution due to blood clot issues. I'm assuming we should see it tank at the open? You're guess is as good as mine. In my opinion if we see price drop it should be a good time to buy, because everyone else is selling. The level I'm interested in is $147-$150. It is an untested point of control where...

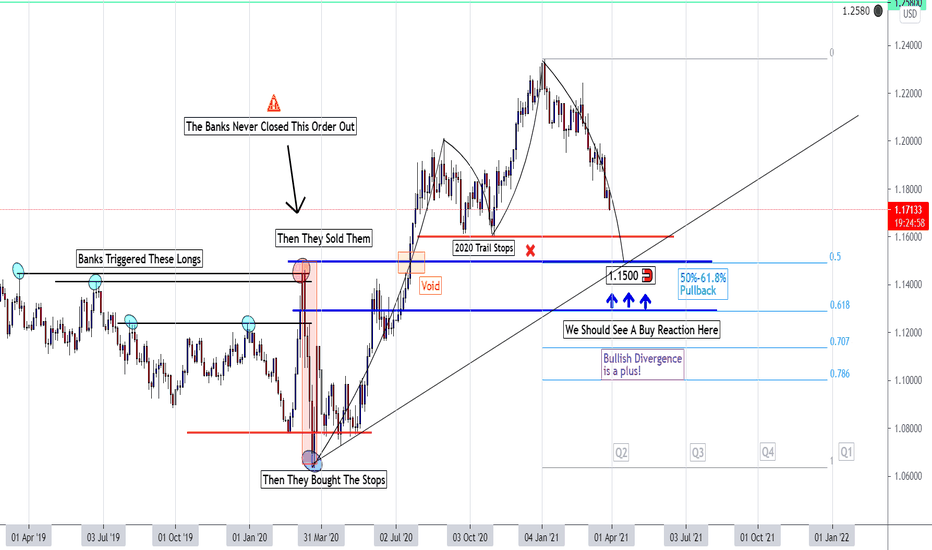

There isn't too much for me to write here. As long as price stays under 1.1840 on the daily keeping looking short. The chart explains it, read the story from left to right. Price wants liquidity, that's the name of the game. The COVID down spike from last year was a MASSIVE move to drain the sell orders out of the market. It was initiated at 1.1500 We have...

My fellow traders!...In this video I am breaking down my thoughts for gold. We may be getting the yearly low. I cover economic drivers, bigger timeframes, historic patterns, and stimulus checks. This video can help tons of traders! THIS MOVE COULD BE HUGE! My gold analysis that hit perfectly -> Gold Repeating History My gold trap move analysis setup -> ...

This isn't necessarily the cleanest setup. The analysis is based on the idea the dollar will get weaker today, but it looks indecisive overall. All Elevated Signals have fired so I'm taking the trade. The idea here is to buy a london open down move, with the thought we are bullish for london session. So right now price may be discounted, I have a very tight...

When price is ranging you want to find where liquidity is at within the range, they usually build and target those little pockets. Full analysis coming in about 5-10 minutes. I have to type it out, GBPUSD will be added shortly as well. What's going on? In my weekly prep we were anticipating a range to start the week, right now it "seems" probably. It all...

Looking for buys within this range at the moment. Things are looking like what we spoke about in this week's market prep. Ideal scenario We attack buy-side liquidity, then we see a minor sell-off from UK close to Asia Open. Right now the activity within this range looks bullish because we have a void above price and the price has been clearing the sell-side...

BTCUSD looks like it wants to test this prior high, will it hold? Will it get smashed? Just gotta wait on price. We are losing volume which means people aren't submitting requests to bid as much, this simply means lack of demand. If we get a new high but maintain this divergence and we don't have volume, it could make for a drop. I'll be adding this to the...

Here is this week's outlook and things to be mindful of: THE US AND CAD CLOCKS MOVED FORWARD ONE HOUR THIS WEEKEND! News: Tuesday: Moderate USD news Wednesday: Lots of USD news Thursday: GBP news I analyzed each currency based on their strength before the video. The way I do this is linked below in related ideas. Each arrow represents the day of the week...

Here is this week's outlook and things to be mindful of: THE US AND CAD CLOCKS MOVED FORWARD ONE HOUR THIS WEEKEND! News: Tuesday: Moderate USD news Wednesday: Lots of USD news Thursday: GBP news I analyzed each currency based on their strength before the video. The way I do this is linked below in related ideas. Each arrow represents the day of the week...

I'll break this down in a video tomorrow, A huge up move tomorrow would be amazing, Q2 could be beautiful.

People straddle the news. Looking for a spike down to trigger shorts. Then a run-up to fill the liquidity void. The black line is February's low. I'm not taking this trade. Just observing. (testing my ability to play their game)

Gotta be quick, it's mid session. Purple zones are potential buy zones, waiting for signal the take profit must remain untouched for entry, Ideally, I'd like to see asia low cleared and hit purple zone but I don't know if we'll get that.

🔵 As a forex trader, some of us stick to a pair or two, some of us trade several, and some just scan all of them for the exact setup that they trade in their strategy. Regardless, it’s a forex trader’s duty to have an awareness of how each currency is performing. If GBPJPY is going to rise, it will most likely be due to a combination of the pound gaining strength...

I am a trap move and liquidity trader, I look for them all day every day, so I don't expect this idea to align with the majority BUT Gold still looks a little sketchy to me. Based upon my rules, those weekly lows will/should get breached, whether it's this week or next week, next year I don't know. But there is liquidity sitting around $1660. What I like is the...

Here is an idea for XAUUSD today. XAUUSD is still bearish until the daily tells me otherwise. With that in mind I'm looking for short. Optimal entry should come in around 5:00am-5:30am (est), maybe even NY, I'd prefer the UK/EU lunch break. Idea: - Using an institutional zone from yesterday, we have an impulse butterfly pattern potentially completing with...

I already secured about 15 pips from GBPUSD, probably not trading for the rest of the day. We need more from price. My opinion: As tempting as it may be to start looking for some long momentum to creep into EURUSD (which is happening right now) The daily has given us no reason to go long, don't be that trader who thinks an H1 candle can reverse a daily trend....

Welcome to mindset Monday, where I will share something trading psychology-related. In this post, I will be breaking down 5 things that have helped my trading psychology over the years. Trading is not only a game of strategy, but there is a level of self-awareness involved as well. The 5 things that have helped me are basic brainwave science, limiting social...