We've got some serious overhead resistance and unless something truly blows us away in earnings, the path is lower but with less volatility than recently. No new lows in April and certainly no highs.

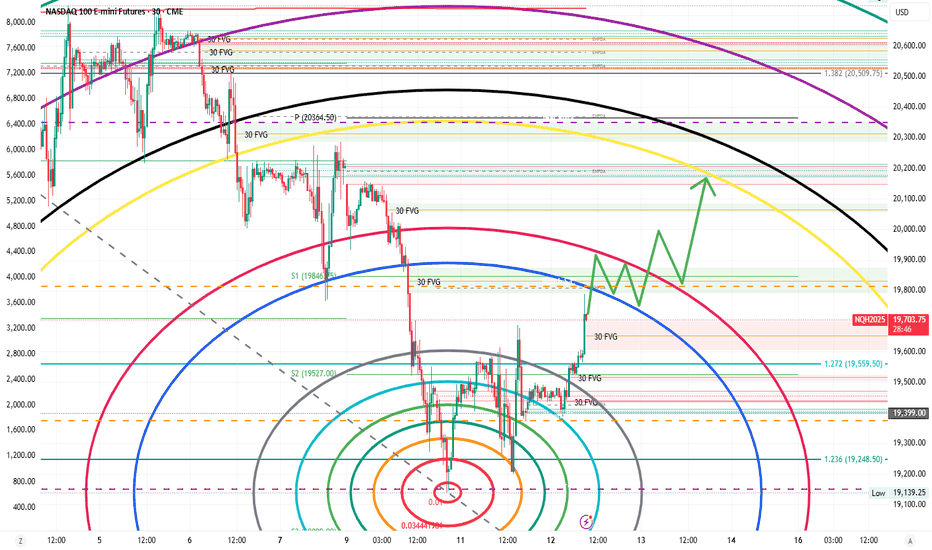

NQ has been falling one rung at a time on the Fibonacci circle from the most recent all time high. Normal behavior for a recovery would be to round the circle until the path becomes more upwards, so the path will take a while for true recovery. However with FOMC this week, I've allotted a short term good and bad path depending on the market reaction.

Prediction of price action 3/12-3/13 relief rally.

Simple charting of long distance Fibonacci circles are revealing correlations that are bringing us another rung down before the next consolidation phase and return upwards. I'm expecting that phase to find support at 80k, with potential to bounce for a very brief low around the previous ATH in 75k range.

This is based on purely charting and has nothing to do with fundamentals. The charts are showing signs of forming the next bottom in a Fibonacci circle pattern. Simply following the patterns in the charting, I probed out where it appears to fit and we end up around $165 sometime middle to end of next week. It would complete all 5 phases of the Elliott Wave and...

This is purely charting and does not pertain to earnings at all. But the charting of past highs and lows with fibonacci circles certainly appears as if we're setting up for a large leg down. After hitting the June highs, we've been bouncing between lines and using the pattern to chart the pattern - it winds up independently hitting after their earnings date of...

The entire rally since October 2022 has been based on the rapid depletion of the Fed's reverse repo. When the RR drains rapidly, the money flows directly into the stock market. When the RR gains, it precurses a drop in the stock market. At each pivot point the stock market has followed suit. We just had the most recent pivot on March 15th through today adding...

The entire rally since October 2022 has been based on the rapid depletion of the Fed's reverse repo. When the RR drains rapidly, the money flows directly into the stock market. When the RR gains, it precurses a drop in the stock market. At each pivot point the stock market has followed suit. We just had the most recent pivot on March 15th through today adding...

Based on the chart analysis - our two options both result in the same location. If we are bullish on rates, then rates will increase and see heavy resistance on the upper side. On the same right, if we drop lower, we will see heavy resistance there as well. My expectation is that rates are the same for the immediate future.

Fibonnaci Circles, which represent areas in which resistances are likely to occur reverberate through time. The fib circle from the low of 2020 to the high of 2021 - and high of 2021 to low of 2022 show that our current price in the $620s is at a double resistance from both. This could result in a halt to the rise and likely a slow grind lower from here. It could...

The 10yr has taken a break in the past couple days off it's highs. This is normal but and happens regularly in the relentless overall path upwards in rates. The Fed has made all the signals that they are blind to the supply and demand issues of treasuries and willing to allow the market to do what it will as long as it results in less inflation. Chairman Powell in...

Oil has been patient for the past week or so and is in line for a bounce back to recent highs at around $90-92 over the next week or so. I am expecting some resistance and then a quick drop based on the Fibonacci circle drawn on recent most recent high and lows. The price is currently at the bottom of the circle which encounters the most resistance and there is a...

Gann Fan bottom which originates from the March 2020 lows will provide a support for falling further. Additionally the Fibonacci Circle's bottom provides support, with the 200 day sitting there as well. There's a lot of reason to expect a bounce here temporarily. I don't think it'll last since the macro environment is not improving much. An additional fall to the...

GLD had a nice pop this week, but overall trend and positioning remains downside. Expecting a drift lower toward 175's put support before bouncing after 9/22 expiration toward 180+ into mid-October expiration. Follows the Gann Fan perfectly.

This 2/1 Gann Fan line has been in existence since 1981 and is about to be tested. For those that don't use gann fans - the 2/1 line is typically associated with a large pop. The 10 yr is already on a tear and this could result in a very fast pop to 5% in the coming weeks.

Resistances are forming in NASDAQ:NVDA shown in the Gann Fan and Fib Circles. Looking for a pullback through the end of October / Range bound in this 450-500 range. Look for a November through earnings push higher to new highs.

No resistance in the near term two weeks leading into the Fed Meeting, we should continue to rise into the Gann Fan resistance line as shown. But we are nearing a resistance of a Fibonacci Circle which should provide resistance to drop. Along with the potentially 0% chance of a September rate hike, this could the next drop.

NFLX has a significant amount of options GEX showing 380 in October, I expect the stock to continue it's downturn, perhaps with some fluctuation through October.