I'm always looking for signs of a change in trend direction. A good indicator has always been; 1. A series of higher highs in the price-action, with 2. A corresponding series of lower highs on the RSI (for major trend changes or corrections I use the daily time-frame), 3. Ideally, three lower highs on RSI (sometimes you only get two), with the final RSI high...

Thanks for viewing, Medium and long term bullish on BTC. Just short term bearish based on the price-action. Expecting the swing low of 17,600 to remain intact, but some price weakness is inbound. Based mostly on 4hr bearish divergence - higher highs are shown as lower highs on the RSI. At a minimum it is a sign of reducing momentum (upward in this case). Drew a...

Thanks for viewing Just a simple technical analysis of the share price of FMG assuming continued correction from all time highs. Mostly just based on the Iron ore price having lost 55% from 2021 highs and still being 50% (while FMG is only down only 28%) down presently. Mapped out some support / demand and resistance / supply zones. Thinking something around...

Thanks for viewing. If you don't believe in Elliot Wave there is still hope for you - please stick around. I also use other TA. So where is BTC right now? - Multi-month price decline since late 2021, - After setting a swing low around 17,600 BTC has made a series of higher highs and higher lows that are contained within a parallel channel quite neatly, - After...

Hello, No big analysis, just trying a new trading style. Demand has turned into resistance, entered after some nice upside wick rejections and a lower high set. Targeting lower TL. I have found that while the outer channel contains price relatively well, a tighter channel seems more appropriate. This is getting into difficult territory to be short, as by my...

Thanks for viewing, While I find Elliot Wave difficult to use well in trading, I find it useful in gaining perspective on the market and brainstorming possible moves. You can see the breakout from the 1711.10 and the price channeling strongly. If wat I have labelled wave 1 and 3 are correct (wave 3 does meet an over 1:1 extension of wave 1 and I had a target of...

Too busy to explain fully. This move up from 1680 has confused me many times. For clarity I just re-checked my Elliot Wave patterns - specifically "Overlap Diagonal within Wave C". The move up from 1711.xx wasn't impulsive even though it was very steep at times.

Hello, It has been a while without posting. Still a believer in Elliot Wave, even though it can be difficult to count at times. Some general assumptions; - A normal 5 wave impulse wave is followed by three corrective waves - only really concerned with the larger scale (A)(B)(C) correction. - Wave (C) is often the same lenth as wave (A) but this isnt a rule, it...

Not a lot to analyse here, Am just watching the 1.03401 level as this swing low was set in January 2017. Should this level fail to act as strong support, I would be looking next to the 0.83-82 level possibly. However, there is some multi-decade support level at the 1.01 level not far below. Interesting to watch what happens

Thanks for viewing, This is my tentative view on the AUDUSD pairing over the rest of the year. FOREX loves to stay within a channel, this pairing is no exception. In my view the market weakness is about to steepen. What was trend-line support is now resistance. Look there are a lot of pretty colours, so I must be right. 1. There is some weakness shown by the...

Hello all, Quite the price channel over the past 2 weeks. So many touches... not a speculative channel at all. Small descending triangle forming. They tend to be bearish but can go either way. Personally I would see less resistance to the price declining than rising. But either way, an upside breakout; target 1730 and a downside breakout target 1687 Downside...

Hello, Thanks for viewing. Let me start by saying that I am a big fan of Barrick but have been looking for an entry point for some time and now am sharing my view with everyone. Purely technical analysis based on a Elliot Wave. But simple, there was a big dip, partial retracement, and I expect this present dip to be about the same size in $ terms not...

Thanks for viewing. No, not as a treatment - please don't inject uranium as a treatment (if Uranium came in a bottle it would need a warning for Americans). Competition? What I mean is that Uranium has been on a run starting from when the equity markets showed weakness - and has yet to show signs of slowing. I'm not sure what the relationship is yet, as crude,...

Thanks for viewing, Yeah yeah yeah, I'm really inviting some comments of FUD etc. Yes, the parallels between US tech in the stockmarket and the crypto market in late 2018 exist. Look I like Elon, and what he is doing. You can't question his results. I also like TESLA, but not at this price. There is no reasonable explanation for why TESLA should be so highly...

Thanks for viewing. I was attracted to Intel after seeing its low PE ratio, very good dividend coverage ratio (it only pays out 27% of its free cash flow in dividends so its profit could halve without having any effect on dividends), high profit margins. I haven't delved too deep, all I did was a wee EW 'buy-zone' based on a 1:1 wave (C) extension. Wave (C)...

This won't be a long one. - ETH has almost (within $12- reached a 1:1 extension of the fist major corrective move). - Just like in 2018/19 it has corrected more deeply than BTC. - Last time "big daddy BTC" recovered first and went on a run while ETH continued dipping. - This time maybe the same maybe different. - At least a plausible (just like in BTC) 5...

Thanks for viewing. So I may not be right of course, but this is a short-term swing strategy that could become medium-term. So if it drops lower I will choose likely prices to add to my position. The 3 wave correction (ABC) met a typical extension (sometimes it doesn't correct as much... sometimes more) of 1.618 of wave A which will mean something to a lot of...

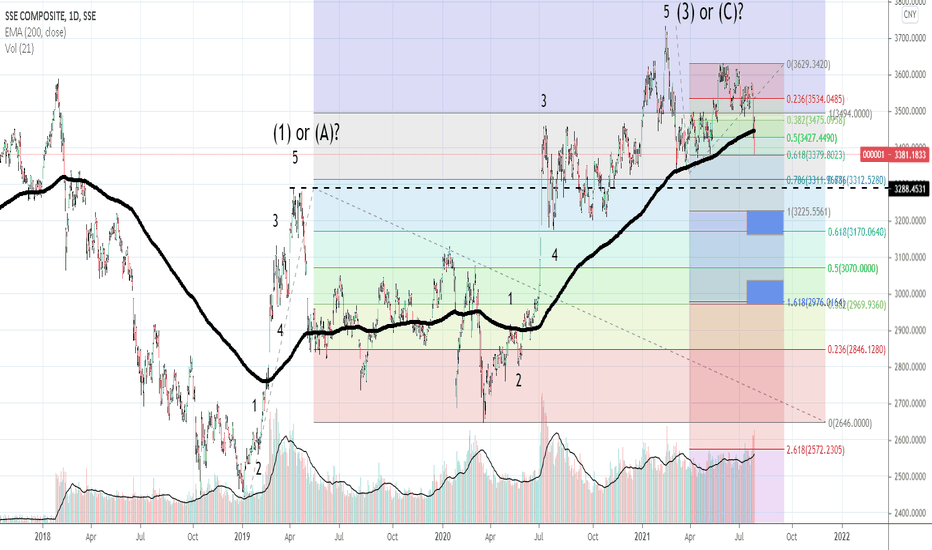

Thanks for viewing. I'm not a trader in SSE, or an investor. General bullishness since December 2018 has recently been met with some strong resistance and selling pressure. Apart from finding myself here after reading the news today, where the commentator predicted more "risk" in the market, I don' really track this index. I'm not a follower of the fundamentals...