forexmoneya

EssentialHello Traders, Welcome to new day we have US JOLTS high impact news today, for market sustains above 3300 psychological level if market successfully break 3280 level then it will move towards 3280 or even 3270 if market crosses 3330 level successfully then it will move towards 3345 or even 3360 All eyes on FOMC & NFP news for the week Disclaimer: Forex is Risky

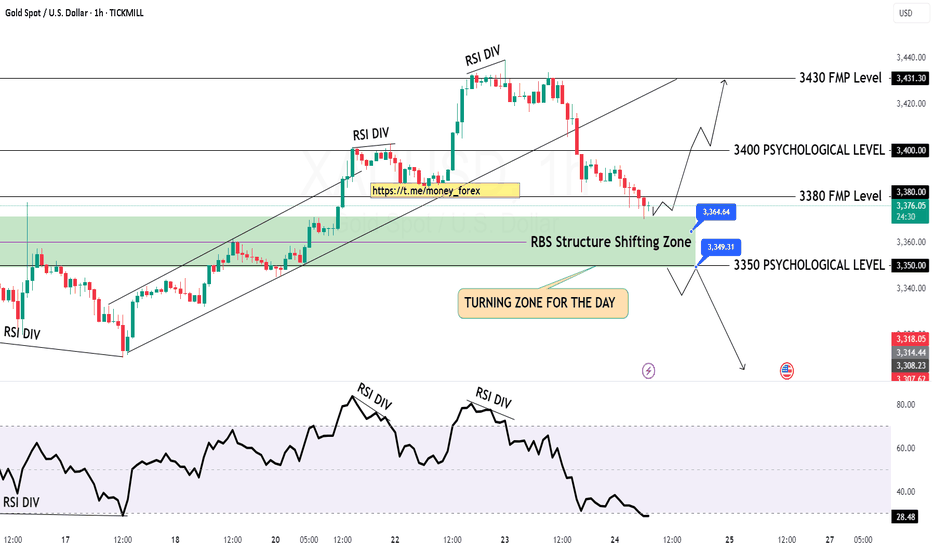

Hello Traders, we got fall yesterday on RSI DIV and right now all eyes on 3350 Psychological level breakout if market successfully breaks that level then it will move towards 3330 or even 3315 level some retracements remains pending around 3400-3412 zone GOLD will might retrace that zone before going further down Reminder: PMI's day in the market...

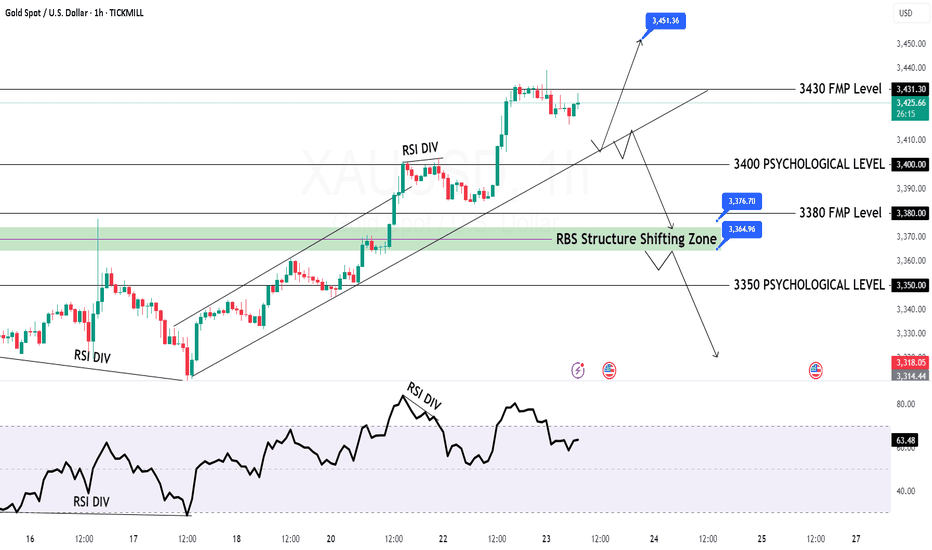

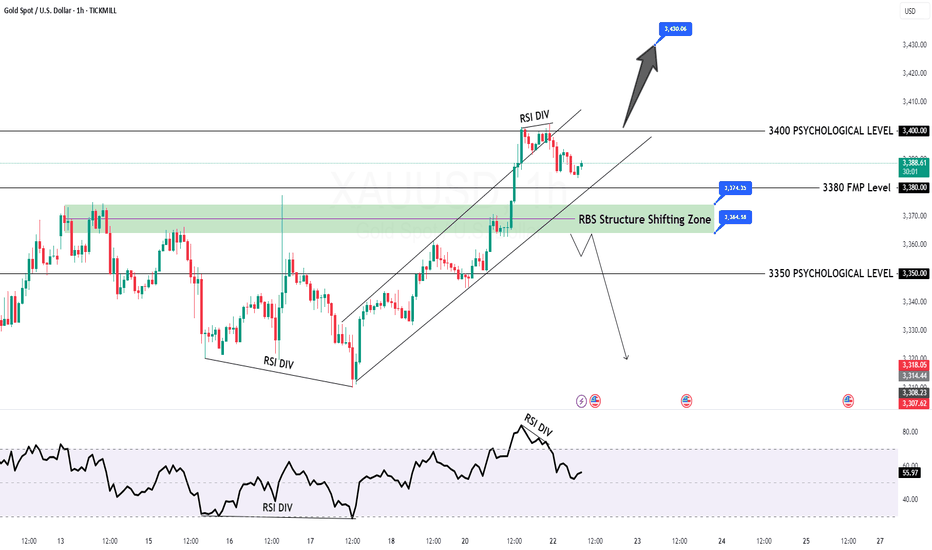

Hello Traders First of all i hope you were enjoying yesterday move with 400 Pips Reward For today we have 3400 Psychological remains in focus if market breaks below 3400 then it will move towards 3364-76 zone otherwise we are remain buyers above 3400 Level Strong Resistance zone for intraday is at 3445-3465 if market cross 3465 the it will move towards ATH...

Hello Traders, Today we have FED Chair Powell Speech ahead all eyes on 3400 Psychological Level Break for now, if market successfully breaks 3400 then it will move towards 3435 below 3400 it will move back towards 3350 level Disclaimer: Forex is Risky

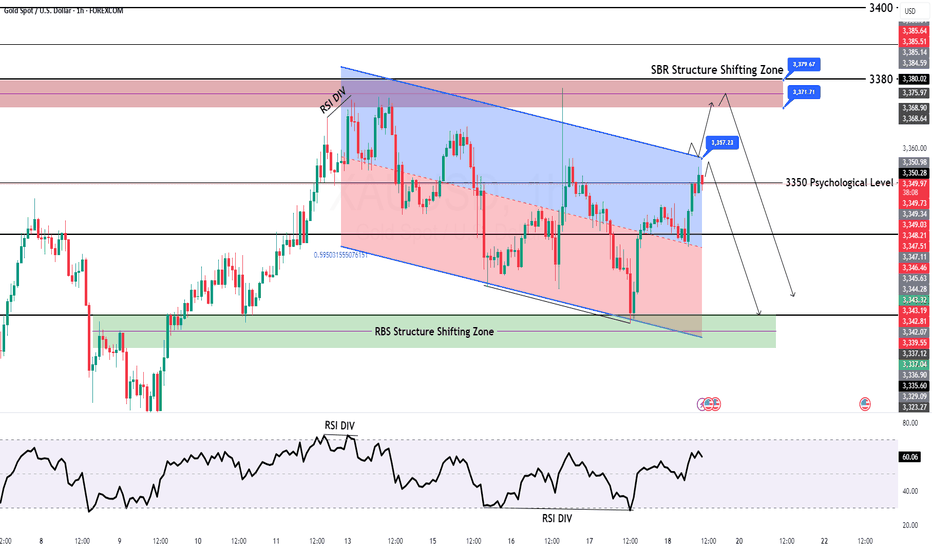

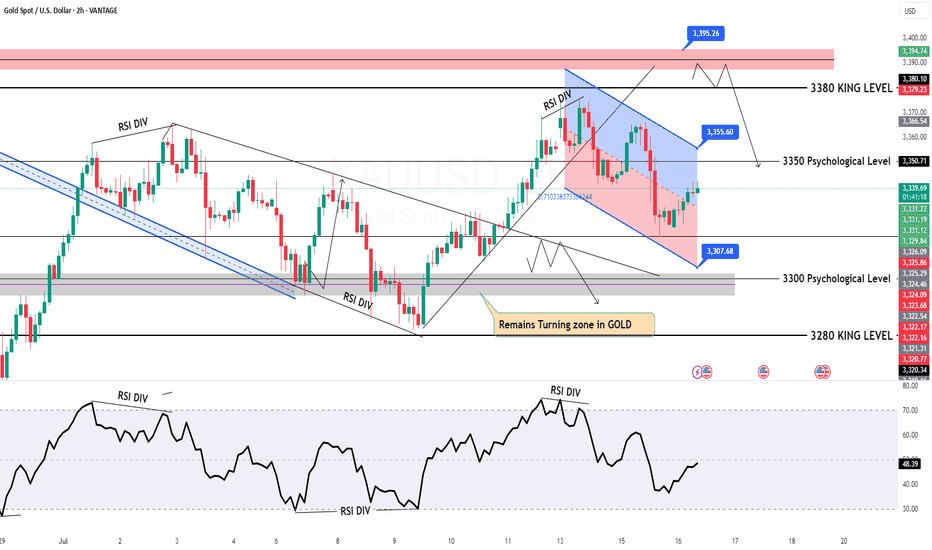

Hello Trader, Today we have closing day For now market is still in Bearish Channel range and try to sustains below 3350 Psychological Level Further only market clear breakout of 3385 level then we will be on Bullish side other we are remains bearish for now All eyes on Todays Closing Disclaimer: Forex is Risky

Hello Traders, welcome to new Trading day Today we have some high impact news of USD, Currently market is still in tight range and we still need breakout of 3300 Psychological for downside clearly For upside market must need to close above 3380-90 zone for further upwards continuation currently we are also keep an eyes on WAR Fundamental news Disclaimer:...

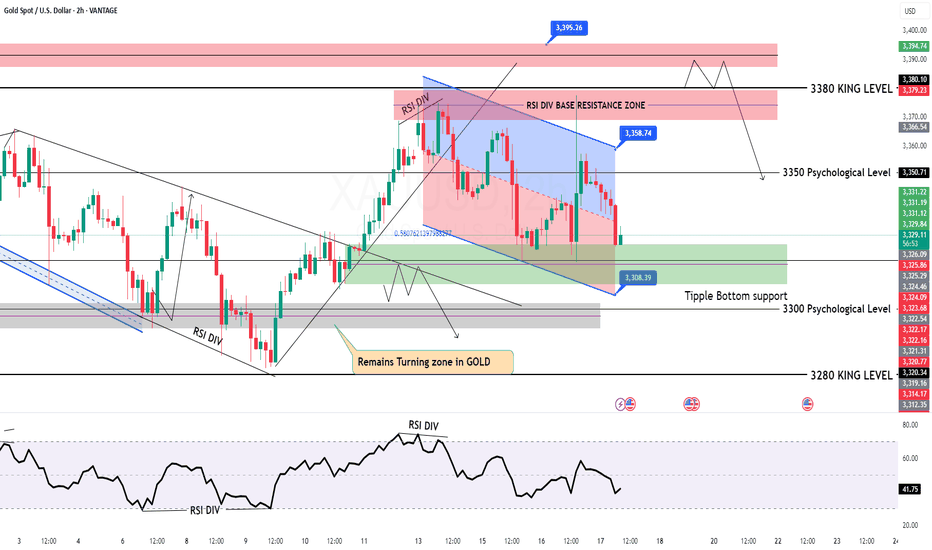

Hello Traders, Today we have major news is US PPI, currently market is in tight range between 3360 to 3310 all eyes on 3360 level breakout for the day for further upward continuation Only break below 3315 market will goes further downside Currently we also have Bearish channel in H2 TF Disclaimer: Forex is Risky

Hello Traders, Welcome to the US CPI Day, as you can see that market is in tight range for now and all eyes on the breakout for now Only clear breakout of 3380 we will consider market will be bullish towards 3400 & 3425 If markets sustains below 3335 it will move towards 3305 or even 3285 All eyes on US CPI Disclaimer: Forex is Risky

Hello Traders, we have no major news today, But Tariff News remains agendas for now All eyes on 3380-3400 zone breakout for further upside, only below 3350 GOLD will move towards 3330 level with continuation of 3310 level Disclaimer: Forex is Risky

Hello Traders Today we have weekly closing & all eyes on weekly closing initially 2nd 3350 Psychological level remains watchable if GOLD break 3360 level successfully today then it will move towards 3390 else we have remains selling opportunities from TOP below 3360 level market will move towards 3315 Disclaimer: Forex is Risky

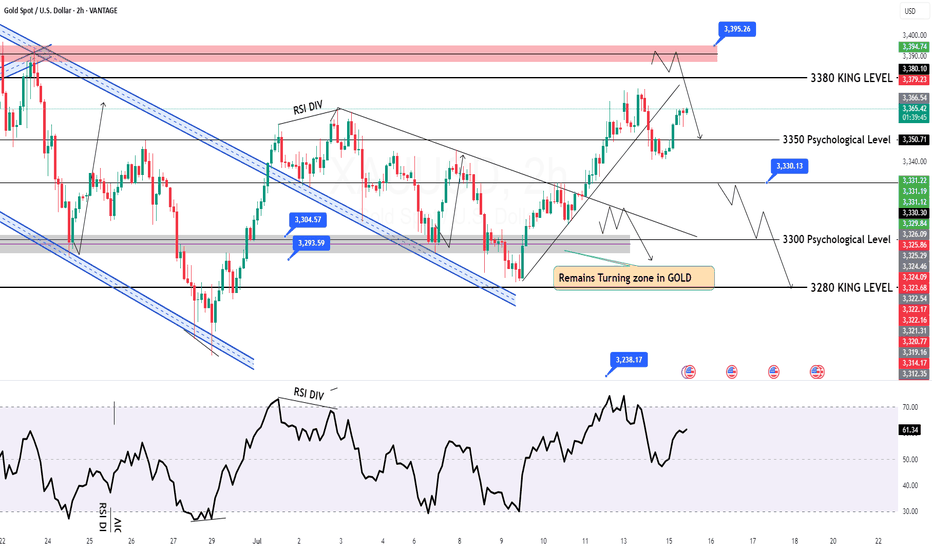

Hello Traders, as you can see that GOLD is stuck in tight range between 3300-3330 all eyes on clear breakout for now further only market will break clearly 3345 level then we will consider market will move further advance below 3300 GOLD will move towards 3250 Scalping Range 3300 - 3330 for the short time period Disclaimer: Forex is Risky

Hello Traders as you can see that we have strong resistance on 3310 level only break above that level will consider bullish move Below 3300 Psychological level market remains Bearish and move towards 3245 level FOMC Meeting minutes dues today Disclaimer: Forex is Risky

Hello Traders Gold is still in a range between 3300 - 3350 Psychological level, all eyes on breakout of both mentioned psychological levels for now Intraday Strong support zone is located 3290-3300 Intraday Strong Resistance zone is located 3350-3360 US TARIFF WAR remains agenda for now Disclaimer: Forex is Risky

Welcome to the new week traders as we have FOMC meeting minutes report due this week so firs market is fell down from 3350 Psychological level now is testing 3300 psychological level all eyes on breakout of 3300 level for now if market breaks 3300 level then it will move towards 3280 then 3350 only clear breakout of 3335 will clear path for towards 3368...

As you can see that GOLD is still in consolidation range above 3300 Psychological Level Currently prices are still standing @ 3340 nearby Psychological Level, only if market breaks 3368 clearly then it will consider Bullish other below 3368 market still in Bearish Move Reminder: Today is US Bank Holiday Disclaimer: Forex is Risky

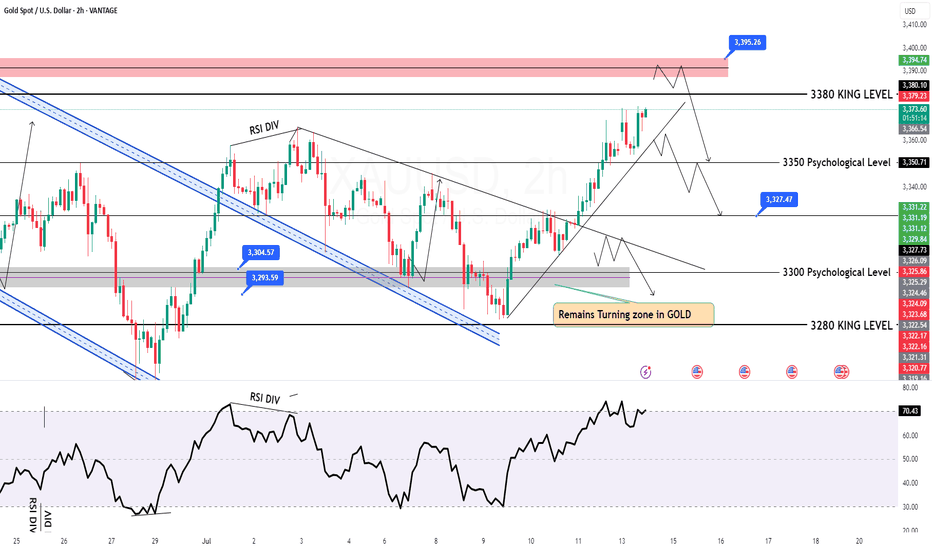

Hello Traders, Main event of is day NFP and all eyes on 3400 Psychological for now, right now market sustains around 3350 Psychological level for downward move GOLD still need to break 3324 level in order to go further down above 3324 LEVEL GOLD is still remains Bullish Remember: It's NFP day Disclaimer: Forex is Risky

Hello Traders, Today all eyes on breakout of 3360-70 zone in order to GOLD go for further advance below this zone all eyes are remains on 3318 level if market successfully maintain 3330 level then will go down further towards 3300 Psychological Level after passing 3318 NFP main event of the day which is held by tomorrow Disclaimer: Forex is Risky

Hello Traders, As you can see that there are some solid in the market since morning, right now market is sustains below 3300 Psychological Level and move towards 3270-75 key support zone and then at 3350 Monthly candlestick closing also due today only if market breaks 3305 successfully today then GOLD will move towards 3335 Disclaimer: Forex is Risky