fract

PremiumBy anchoring the triangle’s resistance line through 4 distinct highs and the support line through 2 unviolated major lows, we establish a structurally reliable formation. This repeated validation lends statistical weight to both boundaries. In this context, the resistance zone gains significance as a high-probability density region — a zone where price has...

A quick work on identification of key pattens and Mapping its intrinsic rhythm with Fibonacci Ratios. Pattern I Fib Mapping Pattern I Validation of Pattern I: Match in frequency of cycles within patterns Pattern II Validation of Pattern II: Match in frequency of cycles

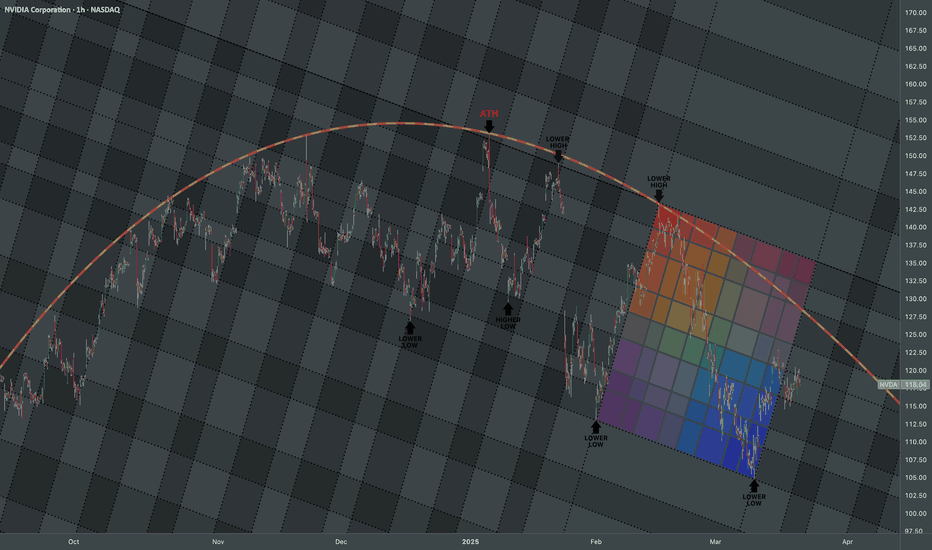

TA Nvidia demonstrated strong growth throughout 2024. However, this year, it has shown rather a poor performance. When an uptrend started to weaken, it gave off subtle signals before a full reversal happened on the horizon. One of the first clues is that the highs collectively begin to appear curved compared with initial rough growth. This reflects the loss of...

In this idea I would like to walk you through some principles which I use to find and relate historical complexities within rhyming cycles. Market Reflexivity Market reflexivity is a concept introduced by George Soros that defies the traditional TA notion of efficient markets by revealing that price movements do not merely reflect fundamentals — they actively...

In this research idea I'll test which of those two tools would be a more effective way for projecting future key levels to which price may react best. While both of them are chart-based and run on fibonacci with progression rate 0.25 showing exponential spacing between levels, there are differences: TradingView's Fibonacci Retracement (2 chart points) Levels...

Integrating another fibonacci channel into a formerly discovered interconnected structure: Direction defined by HH's: Mar '24 & Dec '24; Mapping to LL Nov '22 Price breaking over this channel is a signal of continuation of bullrun in a bigger scale (like 2016 BR). Interconnected Fractals in respect to Phi: My work revolves around understanding and...

STRUCTURAL AWARENESS This analysis seeks to provide structural insights by identifying key levels and understanding historical price patterns to anticipate the limits potential future scale of price movements. Indicators in use: I'd start with retrieving HH LH HL LL points by script I've designed based on Pivot Points to be as aware as possible of key levels...

Apple Inc has some complex cycles which we're about to breakdown to composite phases via fibonacci ratios. REGULARITIES Continuous Fractal Since start 00's, bearish trends in Apple have notably shrunk in percentage terms, painting the past two decades as a period of ever growing optimism. Many long-term cycles remain incomplete for an extended time...

The market is currently staging a short-term rally - essentially a speculative mean reversion bounce as a reaction to -55% crash from all-time high. This move appears driven largely by retail traders seizing what it perceives as a rare opportunity to accumulate an oversold "large-caps". While retail participation and opportunistic capital are supporting the...

In this idea, I’d like to share a quick recap about my unconventional approach to understanding the chaos of the market. Price movements don’t just mirror fundamentals, they also reshape them in continuity. Relating recent fluctuations to historic swings is crucial, because markets operate within a structured, evolving framework where past price proportions...

In this tutorial, we’ll explore how the Fractional Accumulation/Distribution Strategy (FADS) can help traders especially with an investment mindset manage risk and build positions systematically. While FADS doesn’t provide the fundamentals of a company which remain the trader’s responsibility, it offers a robust framework for dividing risk, managing emotions,...

Earlier identified angle that maps growth cycle. It has a strong frame of reference because: Building blocks are arranged into their Fib orbit. Direction of Cycle of Highs and Lows match To validate the angle we can extend to the left to confirm prices respected that angle. We can see it interconnects entire previous fractal cycle confirming angles...

In fractal analysis the randomness of price levels can be justified with the chart's historic HL coordinates. We'll use the old structure below as a base for further cycle breakdown. There are another two fib lines derived from angled trends, the fibs of which rhyme with chaos behind price action and cycle formation: Steep fibs determine timing of high...

Trend's Three Frames of Reference: The Fibonacci channels in the chart are constructed based on the COVID low (March 2020) and the 2023 low, with a projection that aligns with the late 2021 top as a key reference point. This approach sets the direction of the Fibonacci channels in an upward-sloping trajectory, capturing the broader bullish trend while...

After reaching all time high of $488.50 on 18 Dec '24, Tesla has been systematically dropping making lower lows. So far it made a local low at $325.10 which is -33% from ATH. One might intuitively assume that Tesla’s CEO, with significant administrative resources at his disposal, would drive the stock to outperform on a longer period. This narrative held true,...

Fibonacci interconnection between Higher Low, Higher High and series of Lower Highs and Lower Lows. The side of breakout from this narrowing formation will determine the direction of trend. The fibonacci lines derived from the structure covers the limits of breakout wave. If the price resumes its downtrend, I can only assume the market is still digesting the...

Couple of days ago the world witnessed how current U.S. president on practice could remotely deactivate rocket systems given by previous U.S. administration for Ukraine's defense. One may argue it's a reckless decision, another might say it's a "multi-dimensional chess".. Instead of diving into politics, I would like to focus why this single event alone can...

This chart presents a Fibonacci channel projection based on key swing points, including a Higher High, Higher Low, an All-Time High (ATH), and a current Lower Low. The levels of Fibonacci channel that market should abide by for the nearest future, are defined by: HL & LL - sets direction (fib 0 line); applied to ATH (fib 1 line). The derived fib ratios help to...