Ethereum will be reaching 2808$ in coming days before month May is closed. ETH almost reached main liquidity zone for this rally and also 200MA. As soon this level is done - expect another market crash in June. Next crash will be super fast and most of altcoins will drop even lower. Target for ETH in month of June is between 1100$ and 1300$. After this crash we...

Finally main goal for correction since december has been reached! ETH hit 1550$. For more detailed idea check this one On 3D timeframe you can see that StochRSI is trending UP, means momentum is building for next move UP. RSI may finish to form a bullish divergence in coming days. Also price hit liquidity zone since oct. 2023. This level has to show us...

DyDx chart is looking good. On 3D timeframe StochRSI is high - good momentum is building up RSI started to make higher low Price is testing 21MA and should break it soon Also bullish divergence on RSI 1st impulse could be to 4-6$ region with huge correction afterwards. Later in summer probably will see rise to 17$+

Link has finished its bullmarket in december 2024. There is strong bearish RSI divergence on 1-2W timeframe. At the moment price is holding at support so short-term could see a bounce to 25$. Later crash below trend line and retest of this trend line at other side during altseason. Bear market targets are between 2$ and 5$

Back in december i was posting this idea, indicating bitcoin TOP There is 12y RSI trend line on 2W time frame. After each RSI touch of this yellow line approx. in 400-680 days new bear market bottom formed. Next bottom should be around Q1 2026 jan-feb-march.

ETH cycle is similar to 2018-2021 There were 4 movements around Gaussian Channel. At the movement №4 price dropped back under the Channel. Since November 2024 after Tripple top formed on ETH it was clear to me that ETH is going to visit 1500$ region. However don't think that when movement number 4 is complete then we will have another year of bullishness. Since...

Found this interesting AI token that has nice structure. In the short-term most likely it will fall to 0.04-0.05$. As those levels are reached price could rise to 0.4-0.5$ which is 500-800% possible profits. I think 4-5 cents could be reached at the end of january and in early february it will start to go up.

After VGX filed bancrupcy in 2022 new team in charge of VGX right now and new opportunity. RSI has strong bullish divergence on 1W timeframe. Since 2017 VGX formed massive falling wedge. 1st thing VGX must reclaim is level 50 on RSI - strong resistance that held price in a downtrend since 2022. Target 1 could be 0.618 fib lvl which is 10k% higher. Target 2...

VARA has brutal downside for 120 days in a row RSI has finally reached its lowest point since 2023 since its launch on Coinbase Now its getting ready to recover. Main target for this year is 0.11$ which is at 0.786 fib lvl. Since project has strong fundamentals it could reach even 1$+ in a long term RSI and SRSI may be reversing right now.

ORAI has formed a massive bull flag with a fakeout under the bottom trend line. SRSI is trending higher means momentum is building for upside. RSI is forming bullish divergence and we can see how its slowly curving to the upside 1st target will be to reclaim 15$ 2nd target - 46-55$ 3rd target - if we are lucky it could go as high as 140+$

SRSI is trending higher RSI have bullish divergence and formed inverse H&S Next leg up could bring price to 0.886 fib lvl

After nice movement in december Algo formed massive bull flag pattern and looks like price is reversing. RSI formed double top and dropped to 30 where it found support. RSI has started to move up, creating higher lows. StochRSI is moving up - momemtum is building up. Targets for next leg up are between 0.94$ and 1.4$ (400-600%)

ETH/USD chart looks very bullish at first glance but if you look closer then you might find some bearishness in the short-term ETH formed double TOP in the spring time and since then it was in down trend. Current up move for me seems like just retest of July high. In the upcoming alt-season ETH will lead the market but before that it may drop much lower into...

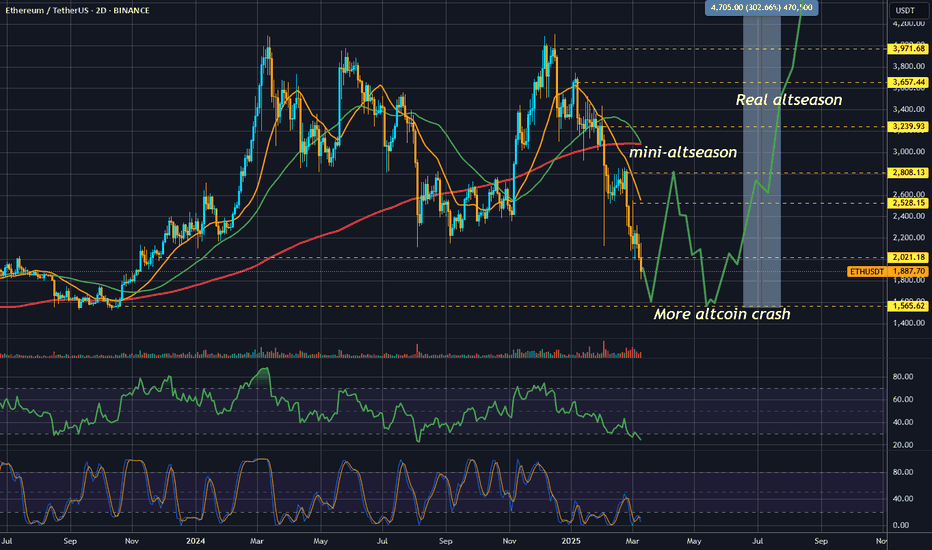

Finally ETH is getting to 1500$ as i was writing back in nov-dec For ETH 1500$ will be the bottom and in the next 3-5 weeks most likely we will see mini-altseason. After that we should expect some more down side for most of altcoins but ETH likely to retest 1500$ and form double bottom. As this move is complete, real altseason will begin and ETH goes to 5-6k...

In december i posted this chart indicating BTC TOP and possible new bear market bottom price We may see some bullish momentum in spring-summer time but this will be last impulses on BTC Next bear market bottom should be around 25-30k in Q1 2026 Why this range? There are two things: trend line that goes at the bottoms and huge liquidity zone which formed in...

Solana has super nice bullrun in 2023-24 but all good things comes to an end. I will talk about long-term targets and not about short-term movements. StochRSI formed bearish divergence on 1M timeframe. It continues to move down. Price formed double top (clearly see if you change chart to line chart) Price touched 2021 bullrun highs. It took all liquidity at this...

PLU is a low cap token which formed double bottom formation and bullish divergence on 3D and lower timeframes. Targets for this token starting from 1000% to 3000%

Back in december i created an idea pointing out at double top on ETH. SInce then triple top has formed and still in play. Even if we see some rise in price in the short-term expect more down side in coming weeks December post: Main target is around 1500$ and this will be great entry point to get 300%