ir-rizzle

EssentialUpstart needs to stay above $112.85, and cross $128 and then $135. If it can clear $135, $142 and $150 aren't a long way off. Invalidation level is 105.58....below that level, it wave 4 would have crossed the wave 1 high invalidating this count. My final target is ~265, but that's still a long way away i believe. The above mentioned levels are the ones to...

Bull and Bear case laid out. I may do an explanation later but too lazy right now. Watch ~38 for a pivot.

I have 3 scenarios that im watching for here, 1 bullish and 2 bearish (these two are basically the same, just different paths) The bullish scenario: This is the green count which would be minor wave 4 to wave 5, of intermediate wave 1 (not shown) of primary wave 5 (in orange) This count assumes that from April 14 to June 22 was a 3 wave ABC move down to complete...

Disney is on wave 5 from the covid lows. Its sitting on 2 AVWAPs and was rejected off another AVWAP. It tested the DTL from the wave 3 high after being rejected at the AVWAP of the wave 3 highs. There's currently a volume shelf at 175-176 where it has been consolidating. All signs point to a large move up, especially with Marvel phase 4 starting up, the...

Here is a bullish and bearish count for PLTR. Please note that at this time, my bias is towards the bullish count. The main question is whether we have hit the cycle 2 bottom at 17.06 or not. If that May 11 low was the bottom, then we are within primary wave 3 of cycle 3. This would be the most bullish place where we can expect the biggest gains. If that...

A count of the full cycle since covid lows, with a pitchfork imposed on top using fib levels. This could indicate where the final top might be for apple. Being such a large part of the market, i dont see the big correction happening in the overall market until apple has reached 180-190.

Grow Generation at some really interesting levels here. Currently in wave minor C of intermediate 2 of primary 5. [ Its in the golden zone between the 618 and 786 fb levels Its about to back test the downtrend line There's a large supply zone between 40.30 and 39.50 on the volume profile Wave C is approaching the 50% extension of wave A The setup is...

Here's a fresh look at Desktop Metal after it broke previous lows and invalidated my last count (linked). It looks like we weren't finished with the primary wave 2 correction. It looks to be a 5-3-5 zigzag correction, and we're getting pretty close the the all time lows of 9.40. RSI has bottomed out here, so if we're gonna bounce, it has to be here.

Watching $CRON here to continue making higher lows needs to get above EMA's at around 8.30 to 8.50, then clear wave 1 high around 9.50 This is simply a journaling exercise to keep track of my predictions.

Here's a look at what Tesla might do in the near to mid term, over the next few weeks. Please forgive the messy chart, i know there's a lot going on here, but i wanted to show my work and the reasoning for each scenario. Bullish: The bullish scenario is that we had a primary wave 4 consisting of and ABC structure which ended on may 19 with the 545 low, and...

Just a quick look at apple to keep track of how this moves. If the count is right, we should see 175 by Dec'21/Jan'22 and 190 by Dec'22/Jan'23. I like that the pitchfork lines up well with the count too.

Just to keep track of the price movement. We may still see price more higher to 51-52 before a pull back. Start buying from 43-40

Taking a look at the LINKUSD weekly chart, we see a perfect 5 wave move in the 2020/2021 run, and wave 3 can be broken up into a sub wave pretty clearly. Now we have made a 3 wave move to the down side, and bounced off of $15...we could still drop to roughly $11 as BTC hasn't completed a 5 wave move to the down side yet, but this looks exactly like the EHTUSD...

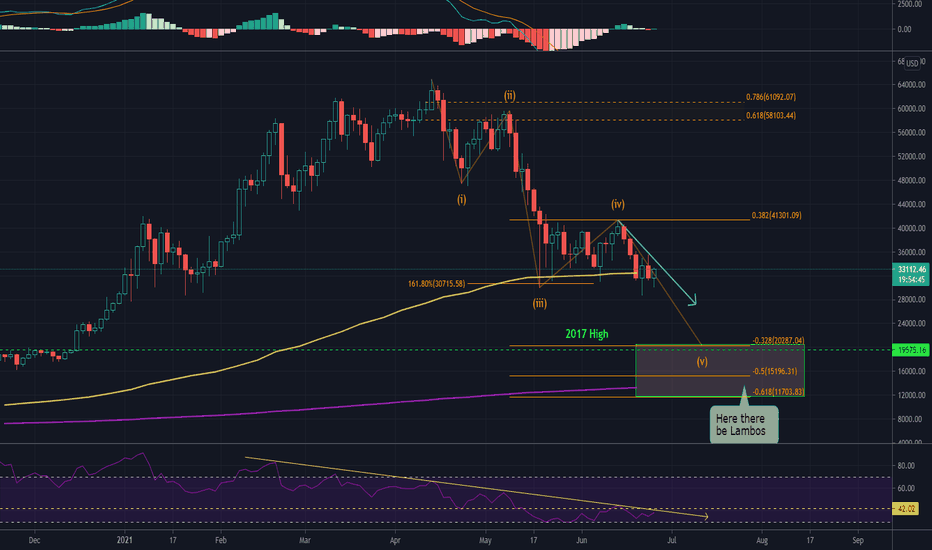

Looking at the 2D chart (its a little more robust than the weekly) BTCUSD is making an exceptionally clean 5 wave move towards the downside. Im amazed at how precisely wave 3 and wave 4 hit the 1.618 and 38.2 targets. This is algo trading, no doubt about it. The RSI has also followed a nice little downtrend since it peaked on Feb 20th at 58K. It hit the same DTL...

Here is the weekly chart for ARKW, the ARK Next Gen Internet ETF counting from inception, ARKW has completed a massive wave 3 followed by a deep wave 4 correction which means it'll have an equally powerful wave 5. Taking the equal legs target or wave 1 results in a 5th wave that does not cross the ATH, which means a true wave 5 should replicate the entire length...