The dollar is rising because of peace talks and hopes that tariffs won’t be as bad as expected. The US stock market is looking better, but economic data is mixed. Gold’s upward movement depends on breaking $3022-25. A drop below $2095-98 could accelerate its decline.

Current Price Level: The stock is trading at PKR 32.85, Potential Trading Strategy: If the price holds above PKR 32.40, a short-term recovery toward PKR 33.68 and 35.68 . A break above PKR 35.96 may signal a strong uptrend toward PKR 37.99. Caution : breaks below PKR 30.5, it may fall to the next support at PKR 27.35 Risk-Reward Calculation: Entry Stop-Loss ...

significant increase in volume is observed indicates accumulation by institutions or major market participants. While Net volume remains negative (-8.06M), suggesting some selling pressure at higher levels. Trading Strategy: Short-Term Strategy Buy on pullback when price retraces to 7.0 - 7.2 PKR, its a better risk-reward entry for Profit target: 8.7 - 9.0...

gold spending some time around present levels before it continues higher.. At least another 3-5 business days gold needs to spend here , Last two weeks Every dip should be bought out by investors, Dips should happen in the morning hours and recovery after US session opening. A dip back towards $2,950 is required before gold continues higher. On the other hand if ...

Market Outlook : The stock has been in a downtrend, trading within a descending channel. It has been forming lower highs and lower lows, indicating bearish momentum. Currently, the price is near the lower boundary of the channel, which might act as a support level. Trading Strategy 1.28 - 1.30 PKR (First Buy Zone/temporary support) 1.20 - 1.22 PKR (Strong...

Bullish Breakout: Price has cleared a key resistance zone at 144-46 PKR, signaling an upward trend. Buying Momentum: As long as the price stays above the trendline, the bullish trend remains intact. Overbought : Currently stock at Overbought zone, A short-term pullback and consolidation is due before another rally.

Pre : PAEL has shown strong financial growth, with Q1 2024 net profit surging 1,090% YoY to PKR 444.9 million, driven by eased import restrictions and market stability. For the nine months ending September 2024, profit after tax rose 97% YoY to PKR 1.863 billion, supported by a 35% revenue increase due to higher sales volumes and price adjustments. Post : the...

Current Price: PKR 9.71 Trading Strategy: Entry Point: If the stock successfully breaks above the trendline (~PKR 10.00) with strong volume, enter a buy position. Target Price: First target PKR 12.50, second target PKR 14.00. Stop-Loss: Below the recent swing low (~PKR 8.50) to limit downside risk.

ANSWER : YES The price is approaching this trendline support, indicating a potential upward trend over time.

FCCL breaks a 8-years Long resistance. The result could be epic, it could either keep going higher or pause short-term and then blast through above the resistance. However, breakout is still in place burning some of the early buyers to explode higher without much effort.

Tariff issues remain a major factor in the market, affecting the economy globally while gold prices are fluctuating based on news updates and will continue trading under all time high zones

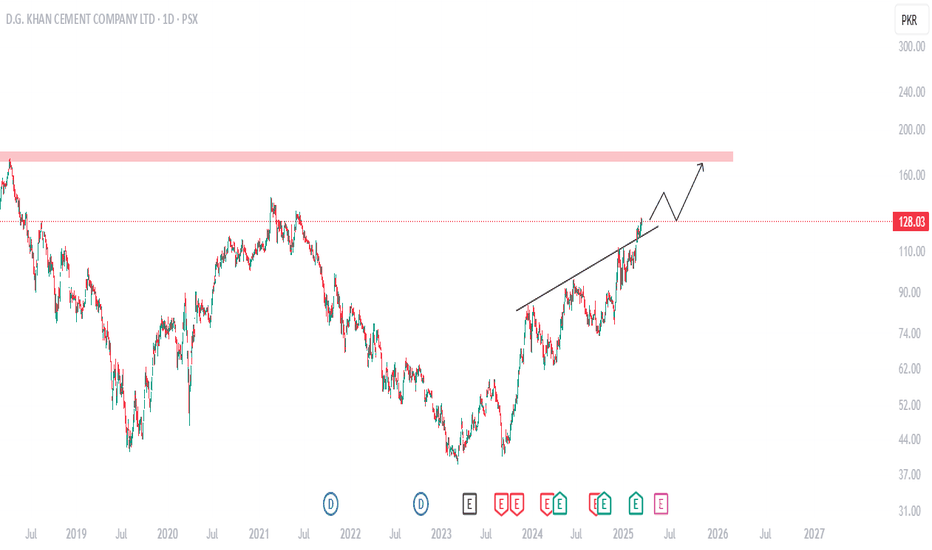

it is up against a multi-week resistance line once again, Several industry peers have already surged past key levels and Some of the producers already broke out and DGKC eventually shall follow suit. I personally expect DGKC to quadruple without much effort upon breakout to gain 40%.

Dewan motors an intraday dead cat bounce and gave it all back. This channel looks to me ready to break down any day...

The stock is in an uptrend, as seen from the ascending trendline support. Recent price action shows strong bullish momentum, with consecutive green candles pushing the price higher. A potential consolidation phase is expected before another upward move. Short-term Demand zone 33-34 PKR Strong Demand zone around 28-30 PKR,

Current Price: PKR 34.18 Entry Point: Around PKR 31 - 33, as this is a key demand zone First Target: PKR 38 (Short-term resistance level) Second Target: PKR 42 (Major resistance zone, where selling pressure might appear) Risk Consideration: If the stock fails to hold PKR 30, it may enter a further bearish phase.

Accumulation Phase: Currently The stock is consolidating in a range-bound phase, A breakout above PKR 17 could trigger bullish momentum . Demand Zone 1 : 15 Demand Zone 2 : 17

Gold is currently consolidating after an uptrend and breakdown, trading within a range between 2880 - 2930, Since from Last week Gold again resume its uptrend trajectory because sudden rising trade tensions and market uncertainties have driven investors again towards gold. with US tariffs and changing oil prices causing uncertainty, gold prices will trade at...

2025 (Sideways Market: 102,000 - 118,500) Market Behavior: Likely to move in a range-bound manner with resistance at 118,500 and support near 102,000. Strategy: Traders: Focus on short-term swing trades between support and resistance. Investors: Consider accumulating fundamentally strong stocks on dips. Stop-loss: Below 102,000 to avoid deep drawdowns. Further...