johnelfedforexblog

EssentialA fairly subdued start to the week kicked into life with some USD selling today. It's worth noting how much difference a week can make. Following chair Powell's press conference this time last week, I started to wonder if there would be 0 FED rate cuts for the rest of the year. Fast forward a few days and NFP data blew anything chair Powell said out of the water....

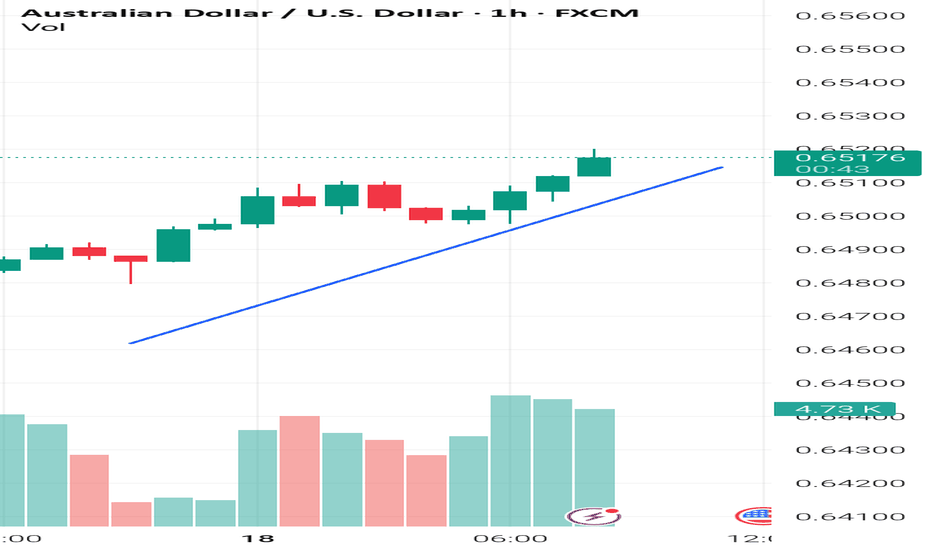

Following Friday's NFP data, calls for FED rate cuts are still in the air. And I agree with an ING article suggesting USD strength can be sold. Combined with just published 'higher than forecast' AUD service PMI data. I think AUD USD long is worth a go. It's a 12 pip stop loss with 18 pip profit target up to recent highs. The risk to the trade is Chinese...

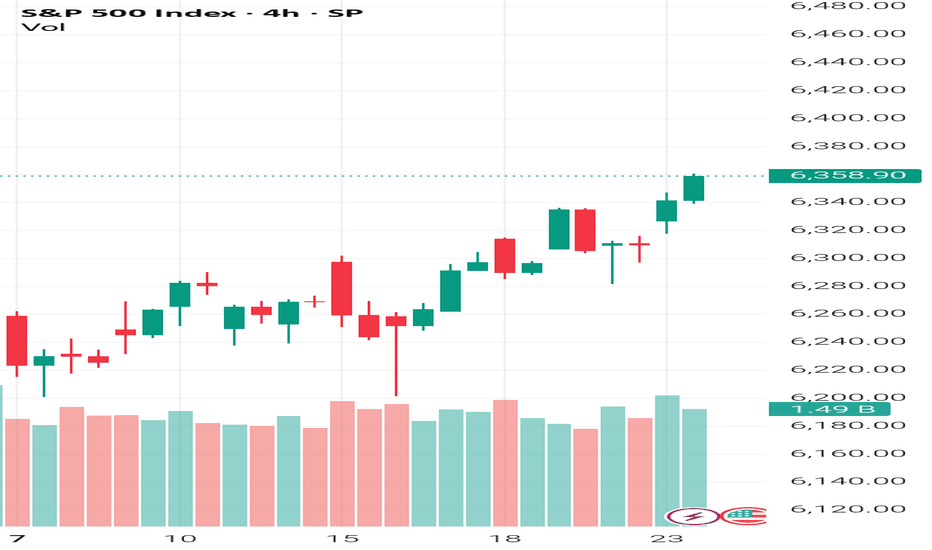

There was a lot of information to take in during the week starting Monday 28 July. A US / EUR trade deal announcement, US GDP, MICROSOFT earnings all contributed to positive market sentiment as the S&P continued to push all time highs. But in a reminder that anything can happen, a combination of NFP, AMAZON earnings and fresh TARIFF UNREST, ensured the week ended...

The EUR has begun the week under pressure following the US / EUR trade deal. EUR weakness could be out down to what they call 'sell the fact', meaning buy last week's deal rumours / sell (take profit) on the announcement. Or, more likely, it could be because it appears the US has the better side of the deal. Either way, all of lat week's EUR positivity has...

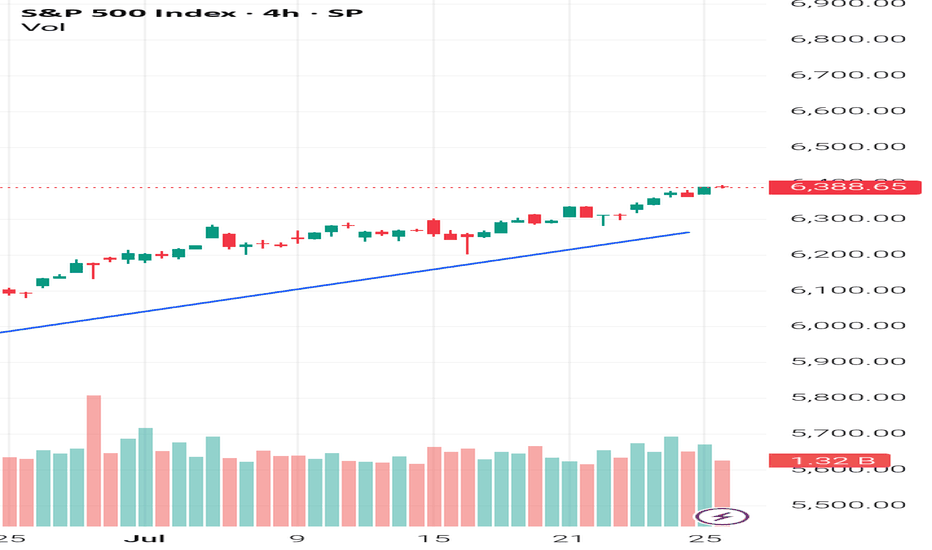

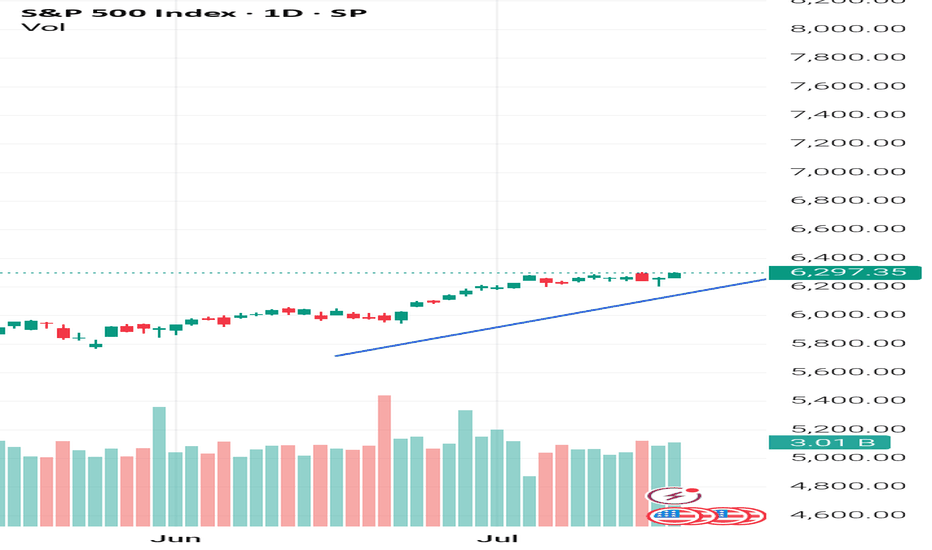

The week starting Monday 21 July was another week of positive sentiment, the S&P continues to hit all time highs and the VIX remains anchored below 17. The upbeat mood was propelled by an announcement of a tariff deal between the US and Japan. The market now thinks it's likely deals with EUROPE and CHINA will soon follow. All the while, earnings season continues...

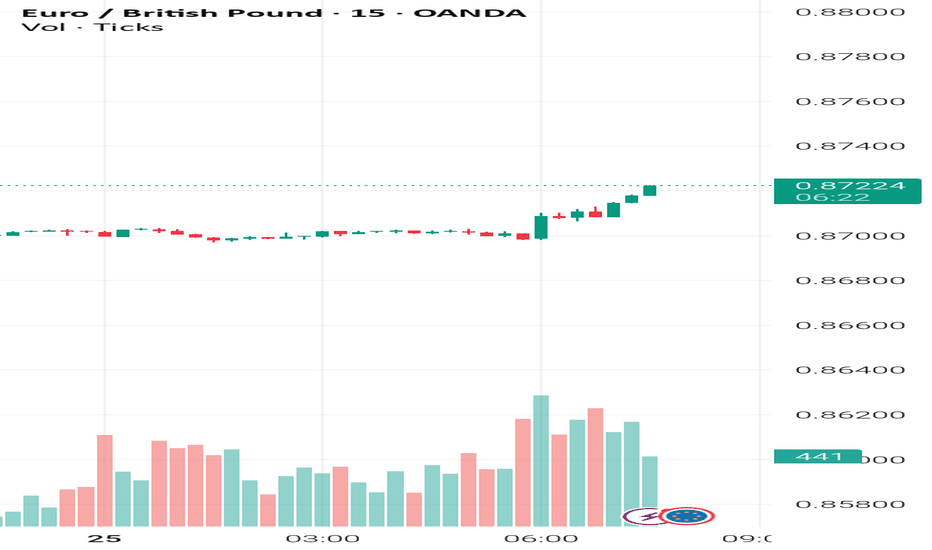

EUR GBP long 'relative fundamental' trade, based on the fairly 'hawkish' ECB and also today's and yesterday's 'soft' UK data. Entry 0.8712 The risk to the trade is the fact the stop loss is not behind a solid 'upswing of note'. But this is the only moment I have to potentially trade today and I think it's worth a go. I do think a 'risk on' trade is also viable...

The ECB is on the agenda today. I don't envision a particularly volatile event, although a continuation of the 'limited further cuts narrative' should see the EUR supported, particularly given growing thoughts of a US / EUR trade deal. All in all, with the S&P still climbing, I continue to hold the view that 'risk on' trades are viable, especially since the...

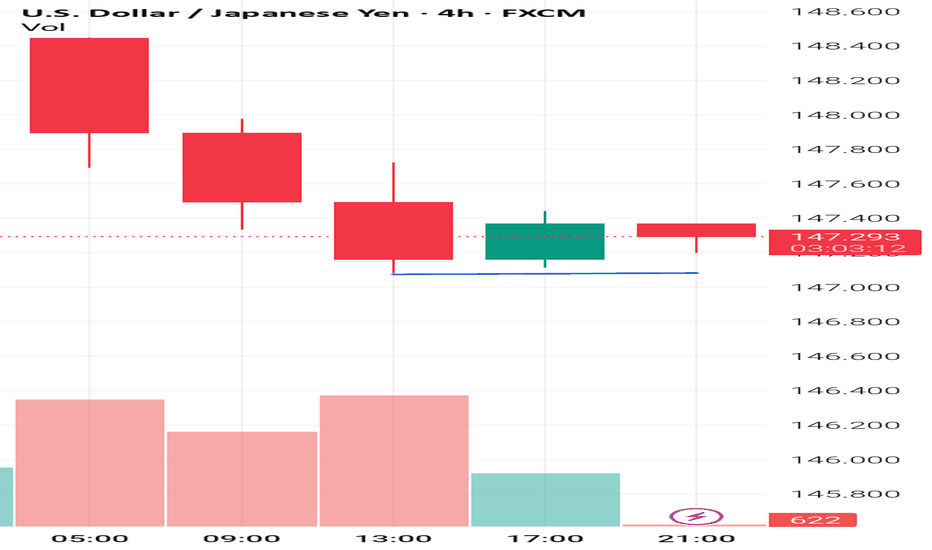

The outcome of the Japanese election has created JPY strength. If you placed a short term JPY long based on the election, I would find it difficult to argue. But, personally, I think any JPY strength will be short lived. Essentially due to uncertainty creating a likelihood of a slower pace of BOJ rate hikes (If at all). Meaning, JPY short trades back on the table...

The S&P and NASDAQ once again hit all time highs during the week starting Monday 14 July. Which is a sign of confidence despite the ongoing external threats (tariffs / Middle East). I've noticed the current earnings season wasn't approached with as much trepidation as recent earnings seasons have been. Of course, that could come crashing down as companies continue...

With the S&P pushing new highs, the VIX below 17 and recent dovish comments from WALLER. I feel the stage could be set for a positive end to the week. The WALLER comments having moved the needle towards USD weakness into the weekend. I've left the JPY alone due to potentially strange movent ahead of weekend elections. The trade is a 20 pip stop loss with a 25...

Despite all the recent tariff concerns, inflation concerns and Middle East worries. The S&P continues to push all tine highs. And 'risk surprises' not withstanding, is likely to do so. Backed up by a solid start to ratings season, especially from Netflix. In the currency space, that should mean the JPY remains weak. And I'm cutoutting recent JPY strength due to...

A day that looked like it was drifting into a 'summer lull' kind of day, suddenly had bouts of volatility when the TRUMP / POWELL SAGA re-emerged. Which is making it difficult to hold an opinion at the moment. If the president wins the battle and the FED cut rates more than expected, the USD (should) weaken. If Mr Powell (and the FED board) remain steadfast and...

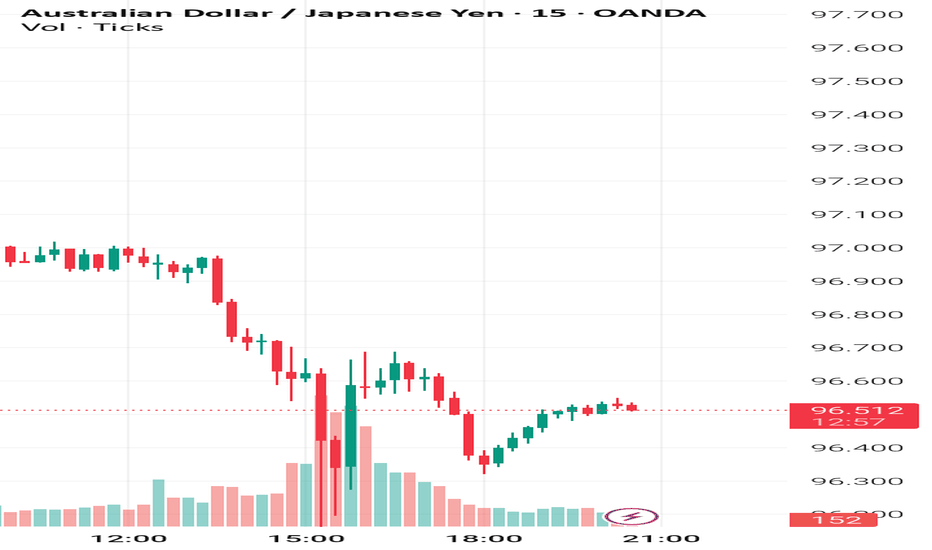

The market appears to like the month on month below forecast US CPI data. The JPY is currently the weakest, I've therefore entered a straightforward 'risk on' AUD JPY catalyst trade. It's a 20 pip stop loss with 30 pip profit target. The risk to the trade is if the market changes its mind, or simply negative sentiment at the US open.

Despite a little bit of tariff noise, nothing has fundamentally altered my view that 'risk on' trades are viable, particularly short JPY. Although (with the exception of the strong USD, we've seen fairly lackluster movement today). Which I suspect can be put down to the market waiting for Tuesdays US CPI data. I would also attribute today's USD strength to...

The week starting Monday 7 was a fairly sanguine week. With limited US data on the agenda, all eyes were on commentary surrounding the July 9 tariff deadline. Ultimately, any tariff concerns were be brushed aside when a 'fresh deadline' of August 2 was announced. Any attempts at fresh escalation following the announcement were met with ambiguity, as the market...

Entry 95.71 Nothing has happened to alter my 'risk in bias'. A, I've been waiting for a 'nice but of support' to place a stop loss behind. And I'm comfortable with the 1hr swings that have formed. It's a 20 pip stop loss with 30 pip profit target. The risk to the trade is a fresh bout of negative sentiment

It's a week bereft of major US data. In the main it'll be up to the 'risk environment' to determine proceedings (which currently means tariff headlines). But we do have the RBA and RBNZ rate decisions to potentially create opportunities. First up, during Tuesday's Asian session is the RBA, a central bank with a preference for high interest rates...

84.72 20 pip stop loss, 25 pip profit target The AUD started the week under pressure as the US president singled out the BRICS nations tariffs. (The AUD falling in sympathy with china). It has since been telegraphed that in general, tariff negotiations are going well, the market is expecting good news. And any 'risk off' moves are reversing. Arguably, any...