juanfortuno

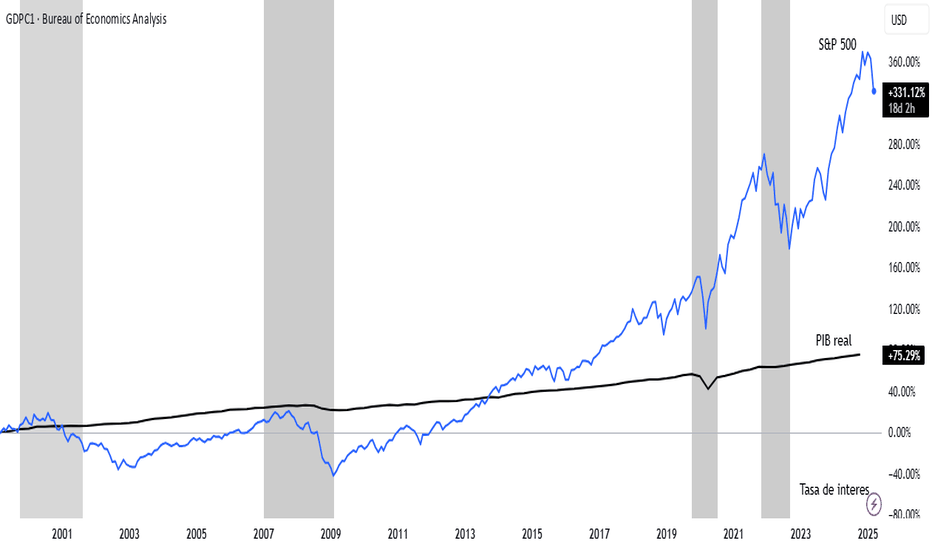

Real GDP and the S&P 500 are interconnected indicators of economic health, though they measure different aspects of the economy. Real GDP reflects the total value of goods and services produced, adjusted for inflation, and serves as a broad measure of economic growth. The S&P 500, on the other hand, represents the performance of 500 large-cap U.S. companies and is...

The inflation rate and the Federal Funds Rate are deeply interconnected, with the Federal Reserve using the latter as a primary tool to manage the former. When inflation rises above the Fed's target (typically around 2%), the Fed often increases the Federal Funds Rate to tighten monetary policy. Higher rates make borrowing more expensive, which can reduce consumer...

Real GDP and the Federal Funds Rate are closely intertwined in the context of economic policy and performance. The Federal Funds Rate, set by the Federal Reserve, is a key tool used to influence economic activity. When the Fed raises the Federal Funds Rate, borrowing costs increase for consumers and businesses, which can slow down spending, investment, and overall...

The interest rate and the S&P 500 share a complex yet significant relationship in financial markets. When interest rates rise, the cost of borrowing typically increases for companies, which can reduce their profits and, in turn, put downward pressure on S&P 500 stock prices. Additionally, higher rates make bonds and other fixed-income assets more attractive...