kWhDealer_

PremiumA perfect storm of good news here. June 30 was the last day to redeem $BULLZ warrants. The overhang of insiders dumping shares to arbitrage warrants is gone. This happened just in time to catch the sector tailwinds from the NASDAQ:HOOD announcement of tokenized public and private assets rolling out in Europe. WeBull has integrated the NASDAQ:COIN CaaS...

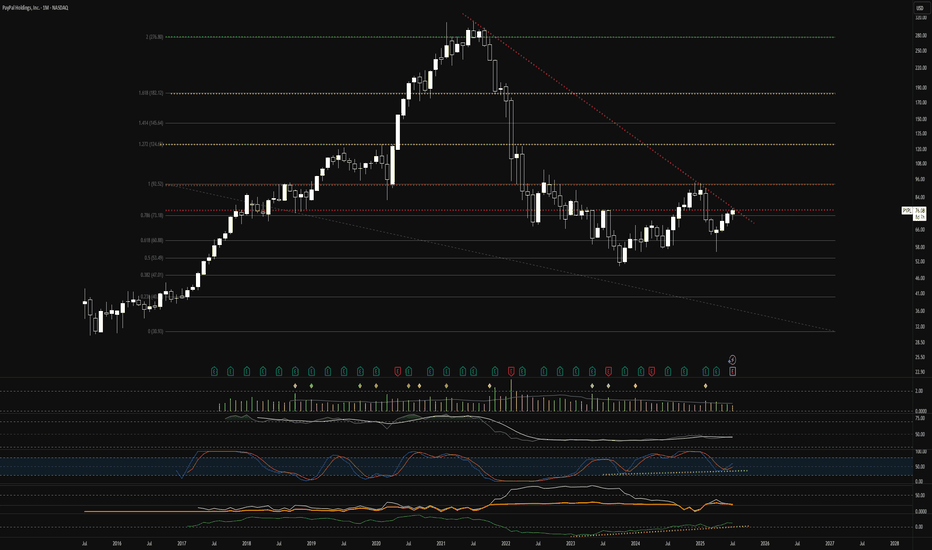

PayPal announced PayPal World at midnight so of course I woke up, queued an order, and filled at the morning bell. Huge potential here leveraging blockchain technology for real world money transfers.

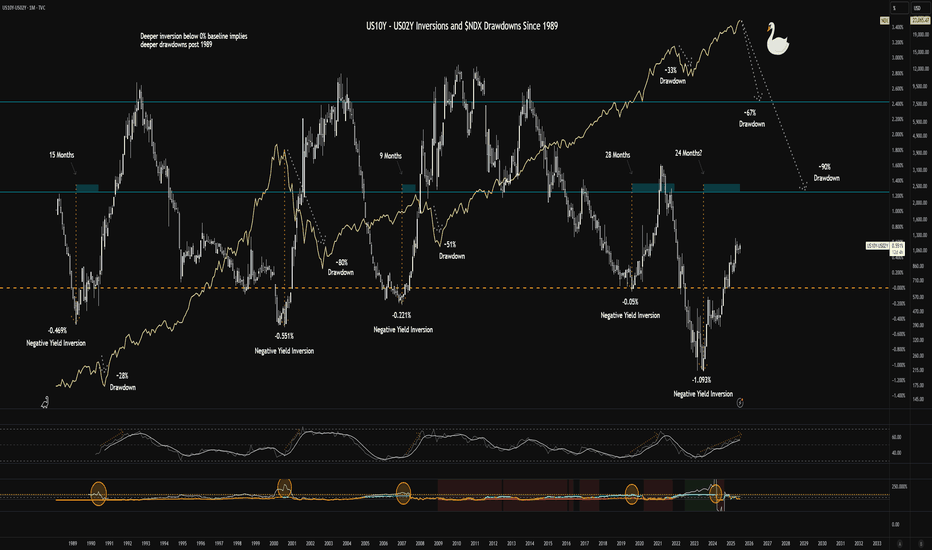

I cleaned the chart a bit for readability. The chart shows historical inversions in the TVC:US10Y and TVC:US02Y and the drawdowns in the NASDAQ:NDX that followed. The implication is that we should expect to see a >50% drawdown within 4 months. I'm not calling the "why" but only drawing parallels to historical price action following bond market...

It appears that since 1989, deeper inversions of the yield curve have led to deeper drawdowns in the $NDX. Relative strength always appears to be in a steeper move upward coupled with fuzzy signals in volatility before the drawdown. Based on the previous market crashes, anything from a 60% to 90% drawdown appears to be plausible. Currently buying long-expiry OTM...

With respect to crypto projects with real utility and valued against CRYPTOCAP:BTC , Internet Computer Protocol potentially represents huge, if less speculative, value. Watching here.

While the NASDAQ is flirting with putting a double-top in, technology companies like NASDAQ:MSFT NASDAQ:GOOGL and NASDAQ:META are increasing CapEx spend for future Ai infrastructure. Margin compression is likely to result with a smaller hit from energy costs - estimated at about 1% of revenue - as energy demand for compute continues to leap forward and...

Ratio strongly supports XRP is approaching buy zone for big gains!

HBAR bumping its head up against a % dominance in an ascending wedge. Bull flagging for a possible extension up to the 1.618 level.

Looking for a reversal in long-run sentiment here for $ETHUSD. Much more runway for the Ethereum ecosystem.

Looking for long-run sentiment to flip on $BTCUSD from here on. Let's see.

Shorts are most vulnerable to liquidations now. Sharp movement to the upside possible here. $XRP is riding the 0-line. What a ride it's been! $XRPUSD $XRPUSDSHORTS $XRPUSDLONGS

Looks like something major happens here in the next two weeks. There's a possibility that someone takes a big bet in the other direction though, like on June 21st. Last chance though - something big happens either way.

Market cap dominance is consolidating around 2% but should break upward out of its descending wedge. Looking for a strong move back to the 30% area. This could transpire because of a collapse in the current value of $BTCUSD and/or $ETHUSD due to regular market cycles or regulatory measures that may disincentivize accumulation. The simultaneous emergence of major...

Price action appears to be setting up for '04 performance. The Russell has more runway relative to the S&P and Nasdaq.

Transformational change in our infrastructure is coming. Energy storage, transfer, and usage will drive this trend. The Russell is primed to make its next push up to the 2.618 extension around 3,000. Looks like September is going to be the ramp up. I hold several names added in the reconstitution.

Every time we've touched and broken the 50MA on the weekly, we've collapsed onto the 200MA. I don't believe this time will be any different. Maintaining a $20K buy target for Bitcoin. I believe that, long-term, dominance will fall to below 20% of the total crypto market cap as underlying CBDC bridge assets absorb volume.

Daily shows price action resting on ichimoku cloud and compression underneath a curling 50MA. Expecting a touch around $16 and a bullish continuation as we head into production. Price discovery beyond October. Future blue chip in the making.

Looks more like wave III than wave I.