kmacalin2025

With the recent sell off to $158 from earnings, looking for a recovery to the upside for a potential trade.

Strong horizontal trend on FE and significantly undervalued. Possible 70% return on FE.

KBAL is significantly undervalued and presents a possible 50% return.

FNKO is significantly undervalued with a strong possibility of a 100% return.

Strong horizontal pattern on CIEN with a possible 30% return.

Strong upward trend on WKHS with a possible 60% Return.

Possible 10% return on DPZ with a strong upward trend.

Strong upward trend on DKNG with a possible return of 40%.

Strong horizontal trend on AYX with a possible 40% return.

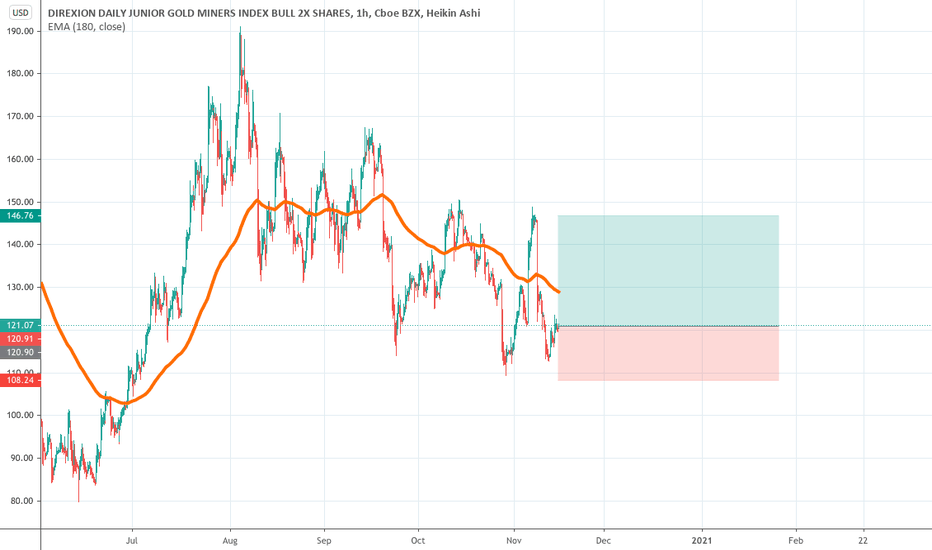

Strong horizontal pattern on JNUG with a possible 20% return.

Strong Horizontal trend on INTC with a possible 25%+ return.

Great dip buy opportunity on AGQ as this etf has been on a strong upward trend and recently experienced a correction. Closed above the 180 day EMA. Look for a reversal for a possible 13% return.

TQQQ has been on a strong upward trend follow the 180 day EMA. Last week had a significant drop but closed above the 180 day EMA. Great possible buy opportunity for a potential 20% return.

CVNA has been on a strong upward trend for the past couple months and presents a great dip buy opportunity for a possible 35%+ return.

WYNN has been on a steady horizontal trend for the past couple months. Reaching a strong support, WYNN shows a great dip buy opportunity for a potential 45% return

FB is currently an undervalued stock with a great dip buy opportunity for a potential 15%+ return.

FISV offers a great dip buy opportunity for a minimum 10% return. FISV has been on a strong upward trend for the past several years and will continue on this trend because of solid fundamentals.

Great dip buy opportunity on MCD for potential 15%+ return. Should be easy return as MCD is finding consolidation.