kzatakia

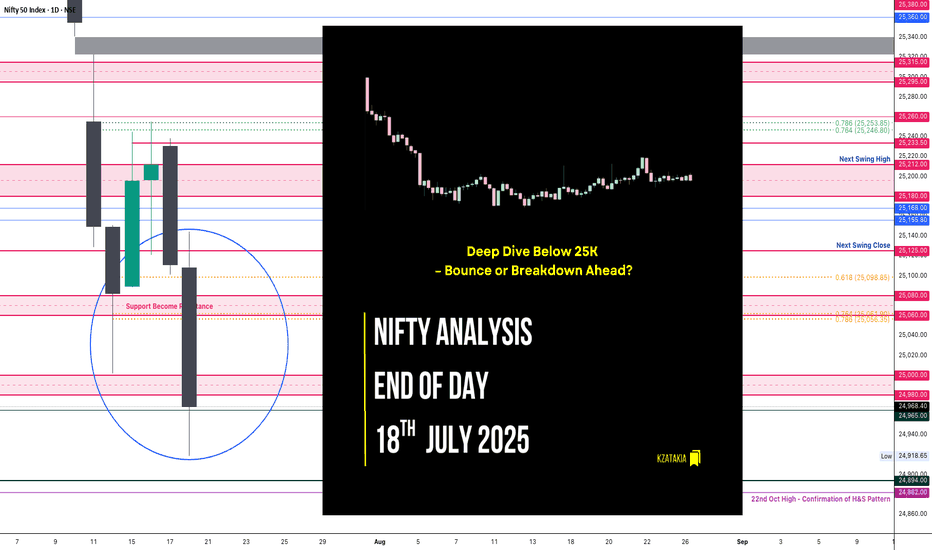

Premium🟢 Nifty Analysis EOD – July 18, 2025 – Friday 🔴 “Deep Dive Below 25K – Bounce or Breakdown Ahead?” As we discussed yesterday, a big move was on the cards — and Nifty delivered. The index started flat to negative, and from the opening tick, sellers took firm control. It sharply broke through multiple key supports: PDC, PDL, S1, the important 25,080–25,060...

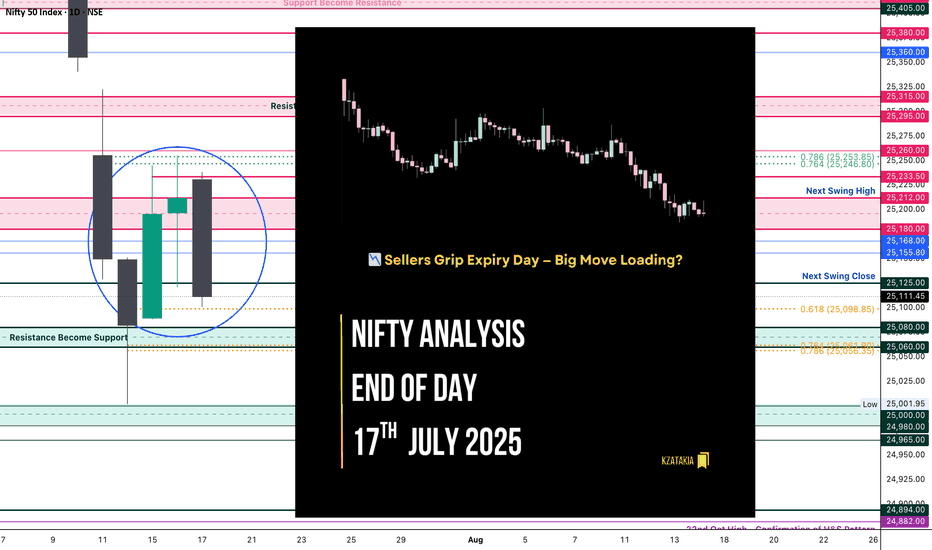

🟢 Nifty Analysis EOD – July 17, 2025 – Thursday 🔴 📉 Sellers Grip Expiry Day — Big Move Loading? Nifty started again with an OH (Open = High) formation and slipped down 94 points before 10:30 AM, marking the day’s low at 25,144. During this fall, it broke the support zone of 25,212 ~ 25,180. Although a retracement followed, it couldn’t sustain above the mean and...

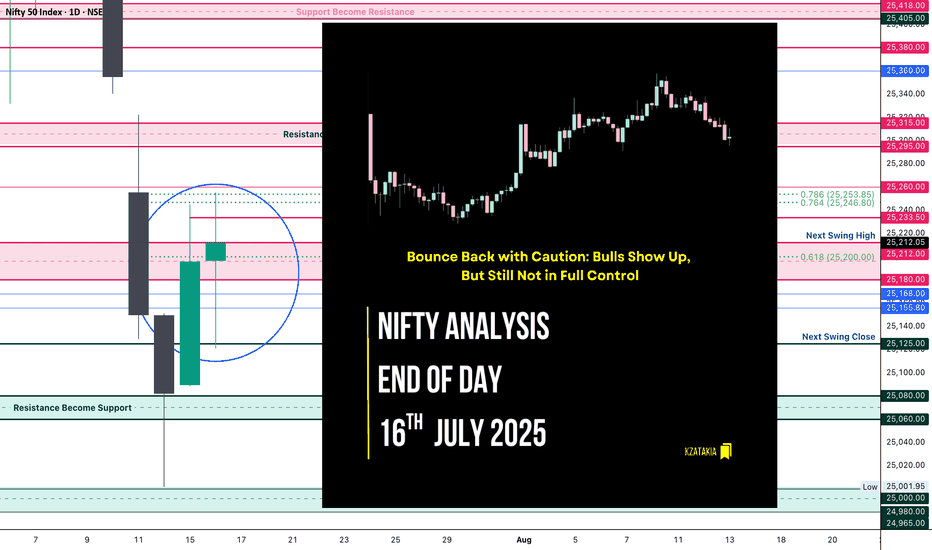

🟢 Nifty Analysis EOD – July 16, 2025 – Wednesday 🔴 "Bounce Back with Caution: Bulls Show Up, But Still Not in Full Control" Nifty started the day on a flat note, but the opening candle turned out to be the day’s high, and from there, it quickly lost 91 points, marking the day’s low at 25,121 within the first hour. The early pressure gave a bearish opening tone,...

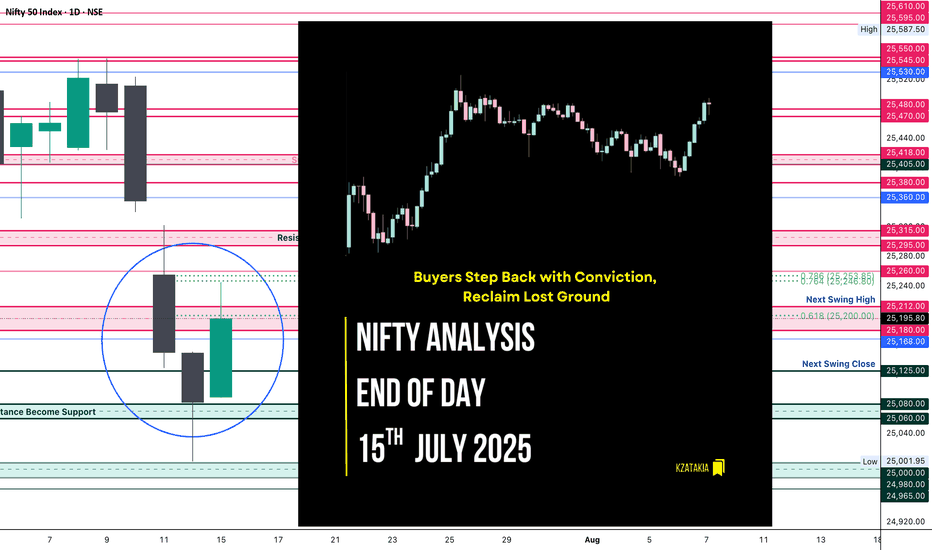

🟢 Nifty Analysis EOD – July 15, 2025 – Tuesday 🔴 "Buyers Step Back with Conviction, Reclaim Lost Ground" Nifty began the session with a flat-to-positive tone, and the first 5-minute candle confidently added 60 points, pushing the index toward 25,150 – aligning with the Previous Day High (PDH). However, the level couldn't hold on the first attempt and Nifty...

🟢 Nifty Analysis EOD – July 14, 2025 – Monday 🔴 "Broken Support, Fought Resistance – Tug of War in Play" Nifty began the day with a classic Open = High (OH) setup, instantly rejecting any bullish intent. The crucial support zone of 25,080–25,060 was taken out early, and the market went on to mark the day's low at 25,001.95, a level that quickly turned into a...

⛰️ Learning#02 : Fractals The Cleanest Clue on a Cluttered Chart If you like clean charts and smart price behaviour, Fractals are one of those tools that give subtle but powerful signals. They’re not magic. They simply reflect what price is telling you—if you’re willing to listen. Let’s unpack the concept and learn how to use Fractals like a pro. 🔍 What Is a...

🟢 Nifty Analysis EOD – July 11, 2025 – Friday 🔴 "Smooth Slide, Silent Pressure – Bulls on the Edge" Nifty opened with a 60-point gap-down, and despite an initial attempt to fill the gap with a 40-point bounce, the index couldn’t sustain. What followed was classic, smooth selling pressure — a slow bleed marked by 16 consecutive 5-minute candles that never broke...

🟢 Nifty Analysis EOD – July 10, 2025 – Thursday 🔴 "False Hopes, True Drop – Bears Tighten Their Grip" Nifty opened with a mild 50-point gap-up, but within the very first minute, that optimism was crushed. It dropped nearly 100 points, breaching the previous day’s low, and entered the key support zone of 25405–25418, which held briefly for about half an hour. But...

🟢 Nifty Analysis EOD – June 23, 2025 – Monday 🔴 👊 Tug of War Between Optimism and Pessimism Nifty opened with a sharp 140-point gap-down, weighed by geopolitical tensions and negative news cues. The mood was clearly pessimistic — yet, from the deep low of 24,824.85, bulls made a bold comeback. What followed was a classic textbook reversal:Price clawed back...

🟢 Nifty Analysis EOD – June 20, 2025 – Friday 🔴 🚀 Bull Run Out of the Blue 🚀 – A Masterclass in Price Action Nifty kicked off the session with a +56-point gap-up — surprising many, especially since Gift Nifty hinted flat to negative and yesterday’s close was weak. The real jolt came when, in the very first minute, price broke above the Previous Day High (PDH)...

🟢 Nifty Analysis EOD – June 19, 2025 – Thursday 🔴 📉 Bookish Spinning Top Doji – Another Day of Indecision on Expiry Nifty opened with a mild +16-point gap-up and immediately dipped to test the Previous Day Low (PDL), marking the day low at 24,738.10. A quick reversal took the index 125 points higher, reaching a high of 24,863, only to settle back into...

🟢 Nifty Analysis EOD – June 18, 2025 – Wednesday 🔴 ⚖️ Dhamakedar Start, But Indecisive Close – Weekly Expiry Caution Ahead Nifty opened with a 65-point gap-down at 24,788.35, but what followed was a power-packed bullish start — within just 25 minutes, it surged over 150 points, hitting a day high of 24,947.55. However, the euphoria didn’t last. As the...

🟢 Nifty Analysis EOD – June 17, 2025 – Tuesday 🔴 ⚠️ Resistance Rejection at 25K – Pause or Warning Sign? Yesterday’s note rightly anticipated today’s challenge near 25K — and that’s exactly how the session unfolded. Nifty opened at 24,977.85, right inside the critical resistance zone of 24,972–25,000, and formed a near O=H (Open = High) structure. The index...

🟢 Nifty Analysis EOD – June 16, 2025 – Monday 🔴 📈 Expected Follow-Through Plays Out – Bulls Eye 25K Hurdle Next Nifty opened flat-to-positive at 24,737, briefly dipped to the day’s low of 24,703.60, and then reversed smartly to touch an intraday high of 24,967.10 by 13:40. After that, the index spent the rest of the day consolidating in a narrow 40-point band...

🟢 Nifty Analysis EOD – June 13, 2025 – Friday 🔴 🕊️ Gap-Down on Geopolitical Tension – Buyers Step In at Crucial Support Nifty opened with a massive gap-down of 415 points at 24,473 triggered by overnight geopolitical tensions — testing a crucial swing low from May 22. Interestingly, the market formed an OL (Open = Low) pattern and staged a powerful 281-point...

🟢 Nifty Analysis EOD – June 12, 2025 – Thursday 🔴 📉 Range Breakout on Expiry – Bears Steal the Show As highlighted in yesterday’s note — “Watch 25,222 on the upside and 25,080 on the downside for breakout” — Thursday’s expiry session decisively broke the range to the downside, unleashing a sharp bearish move. Nifty opened strong at 25,164.45, briefly tested...

🟢 Nifty Analysis EOD – June 11, 2025 – Wednesday 🔴 ♻️ Déjà vu Day – Bulls Attempt, Bears Resist For the third consecutive session, Nifty started on a positive note with a 45-point gap-up at 25,134.15, but as has been the pattern lately, early optimism was wiped out instantly, with the index hitting the day’s low of 25,081 within the first 5 minutes. What...

🟢 Nifty Analysis EOD – June 10, 2025 – Monday 🔴 🔄 Fallback From the Top – Another Rangebound Day Nifty began the session on a bullish note with a Gap-Up of 97 points at 25,199.30, but that turned out to be both the Open and High of the day. Within the first 20 minutes, the index plunged 144 points, even breaking below the previous day’s low, signaling a swift...